Chimp Investor is ranked #3 of 90 by Blog Overview and #10 of 100 by FeedSpot in their relevant categories. If you enjoy reading this blog, please post a review on Wealth Tender.

A reminder about what empirical research tells us about business cycle phases and asset class returns

My entire approach to asset allocation is based on cycles. Cycles are patterns and thus by definition contain predictabilities - what goes up, comes down, goes up etc. Predictabilities in financial markets are opportunities to outperform.

While some real world examples of cycles are virtually pure pattern - the Earth's orbit around the sun, for example - cycles in economies can contain substantial noise. Noise in financial markets can be even greater.

One of the best known cycles in economic systems is the business - or economic - cycle, which, at its simplest, contains an expansion phase and a contraction phase. Other systems are based on three or four phases - the phases in the latter system being expansion, peak, recession, and recovery.

The phases in the four phase model can be defined in terms of two parameters: the level of economic activity and the direction of travel. Thus the expansion phase is when the level of economic activity is high and moving higher; peak is high but moving lower; recession is low and moving lower; recovery is low but moving higher.

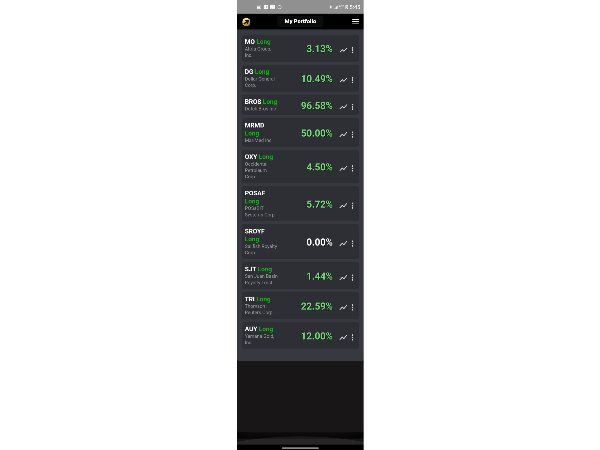

van Vliet and Blitz (2009) used an empirical approach to investigate whether there was distinct asset class performance during each phase in the four phase model. Sure enough, there was (see chart).

Chart: Asset class excess returns versus economic/business cycle phase

It is important to remember that things in the real world are not nearly as neat as suggested in the chart. The business cycle itself is noisy - phases can be interrupted by exogenous shocks, economies can move back and forth between two phases before progressing etc. Also, the asset class returns during each phase, although clearly showing a pattern in the chart, are averages. There would have been cycles when the returns in each phase did not follow the patterns in the average cycle. In other words, the research and the chart should not be read as gospel but as a guide.

In terms of where in the cycle we are at the moment, I would argue that we entered peak phase in the second quarter of this year. Why? Because bonds started to perform well, having since mid-2021 been performing poorly - the latter being symptomatic of the expansion phase.

However, the current cycle is particularly complicated because although we have weakening growth, we also have persistently high inflation - a situation called stagflation. While central banks would not want to tighten monetary policy in the face of growth that is clearly weakening, they may have to continue to do so because of the high inflation. If this is the case, the peak phase may be longer than usual as central banks work harder and longer to dampen inflationary pressures. In which case the short-term outlook for equities is still dim.

The views expressed in this communication are those of Peter Elston at the time of writing and are subject to change without notice. They do not constitute investment advice and whilst all reasonable efforts have been used to ensure the accuracy of the information contained in this communication, the reliability, completeness or accuracy of the content cannot be guaranteed. This communication provides information for professional use only and should not be relied upon by retail investors as the sole basis for investment.

Chimp Investor is ranked #3 of 90 by Blog Overview and #10 of 100 by FeedSpot in their relevant categories. If you enjoy reading this blog, please post a review on Wealth Tender.

A reminder about what empirical research tells us about business cycle phases and asset class returns

My entire approach to asset allocation is based on cycles. Cycles are patterns and thus by definition contain predictabilities - what goes up, comes down, goes up etc. Predictabilities in financial markets are opportunities to outperform.

While some real world examples of cycles are virtually pure pattern - the Earth's orbit around the sun, for example - cycles in economies can contain substantial noise. Noise in financial markets can be even greater.

One of the best known cycles in economic systems is the business - or economic - cycle, which, at its simplest, contains an expansion phase and a contraction phase. Other systems are based on three or four phases - the phases in the latter system being expansion, peak, recession, and recovery.

The phases in the four phase model can be defined in terms of two parameters: the level of economic activity and the direction of travel. Thus the expansion phase is when the level of economic activity is high and moving higher; peak is high but moving lower; recession is low and moving lower; recovery is low but moving higher.

van Vliet and Blitz (2009) used an empirical approach to investigate whether there was distinct asset class performance during each phase in the four phase model. Sure enough, there was (see chart).

Chart: Asset class excess returns versus economic/business cycle phase

It is important to remember that things in the real world are not nearly as neat as suggested in the chart. The business cycle itself is noisy - phases can be interrupted by exogenous shocks, economies can move back and forth between two phases before progressing etc. Also, the asset class returns during each phase, although clearly showing a pattern in the chart, are averages. There would have been cycles when the returns in each phase did not follow the patterns in the average cycle. In other words, the research and the chart should not be read as gospel but as a guide.

In terms of where in the cycle we are at the moment, I would argue that we entered peak phase in the second quarter of this year. Why? Because bonds started to perform well, having since mid-2021 been performing poorly - the latter being symptomatic of the expansion phase.

However, the current cycle is particularly complicated because although we have weakening growth, we also have persistently high inflation - a situation called stagflation. While central banks would not want to tighten monetary policy in the face of growth that is clearly weakening, they may have to continue to do so because of the high inflation. If this is the case, the peak phase may be longer than usual as central banks work harder and longer to dampen inflationary pressures. In which case the short-term outlook for equities is still dim.

The views expressed in this communication are those of Peter Elston at the time of writing and are subject to change without notice. They do not constitute investment advice and whilst all reasonable efforts have been used to ensure the accuracy of the information contained in this communication, the reliability, completeness or accuracy of the content cannot be guaranteed. This communication provides information for professional use only and should not be relied upon by retail investors as the sole basis for investment.

Originally posted on CHIMP INVESTOR