Is Boot Barn (BOOT) a Buy?

Boot Barn Holdings (BOOT) is considered a BUY up to a price of $73.20. The company has performed well over the pandemic even though it’s in retail. This is likely due to its work boot business, which makes up nearly half of their business.

Boot Barn has a strong leadership team that has proven they can grow the company post-IPO. The company doesn’t have much analyst coverage which may make it an investment opportunity that isn’t well known on Wall Street.

Check out the companion video to this article here:

https://youtu.be/q4IDUAbLEqI

Screener Methodology to Find Boot Barn (BOOT)

I decided I'd look at Boot Barn holdings because I got inspired after watching one of the Bull Sessions. The Bull Session discussed a small company list and Ken Kavula and Mark Robertson were talking about emerging companies. Mark was proud of the fact that they were able to find an old issue for five or ten bucks of Hoover’s Handbook of Emerging Companies. So, I looked at all the companies– all 600 companies - to find out which ones my investment clubs have researched over the last couple years.

Learn More: Hoover’s Handbook of Emerging Companies

I zeroed in on about six stocks. I was looking for a strong core score and PEG ratio. I then eliminated some of the stocks for the following reasons.

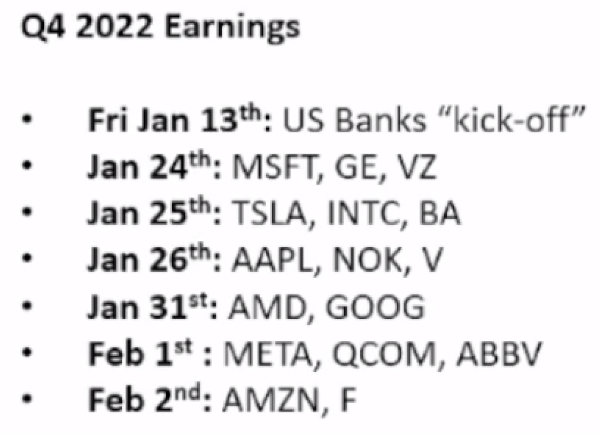

Evercore (EVR) - I like Evercore as an investment. It's a boutique Investment bank but you can likely wait before investing in it.

CoStar Group (CSGP) – I like CoStar Group but I think it’s currently too expensive

Ollie’s Bargain outlet (OLLI) – This recently had a downturn and it may be good to get back into the stock in the future.

East West Bankcorp (EWBC) - I really wanted to do East West Bank Corporation but Mark told me I can't analyze a bank unless I got Ken’s approval! It’s unfair for anyone to do a bank without the express a written approval of Ken Kavula, even though I own it and I've done very well with it.

Read More: Ken Kavula’s analysis of Western Alliance Bank

- Fleetcor (FLT) – Already analyzed in another Investor Round Table session.

So, I decided I'd look at Boot Barn even though it has a PAR (projected annual return) that's high. I think that's one of the things that made the Bulls Session take it off their small company list.

About Boot Barn Holdings (BOOT)

- S&P Small Cap 600 (Joined April 2019)

- Medium Sales Size of $1.59 Billion

- Sector: Consumer Cyclical

- Industry: Apparel Retail

- Head Quarters: Irvine, Ca

- Founded in 1978

- Initial Public Offering on October, 2014

- Sells western and work-related footwear through retail stores and e-commerce

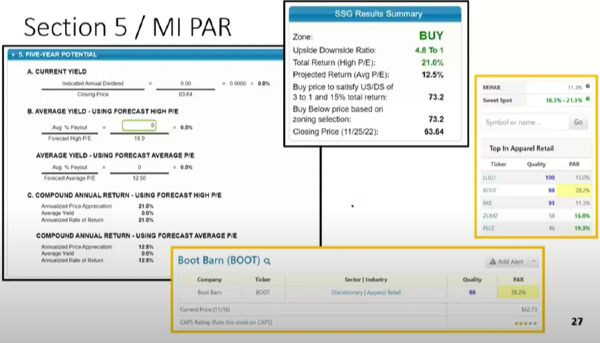

- Manifest Investing quality rating of 88, projected average return of 28.2%, sales growth of 15.6%, and a Core Score of 197 as of November, 2022.

- Morningstar Financial Health Grade: C (on average)

- Limited Analyst Coverage

Boot Barn’s Product Assortment

About 49% of sales is boots. The company sells other apparel like hats, but their core competency is in boots for workwear. I initially thought that they were just a bunch of cowboy boots but because they sell work boots, they were considered an essential business and were able to stay open during the pandemic. So, if you look at your stock selection guide, you're not going to see that retail dip that so many companies had. They are really trying to keep sales in-store rather than trying to move to e-commerce, which is against the grain when compared to most retail stores.

Sales Growth Areas

New customers generate about half of their revenue growth. The median age of their customers is dropping since the IPO. And they're really getting a healthy growth in the Hispanic consumer market. All these trends seem like real positives to me.

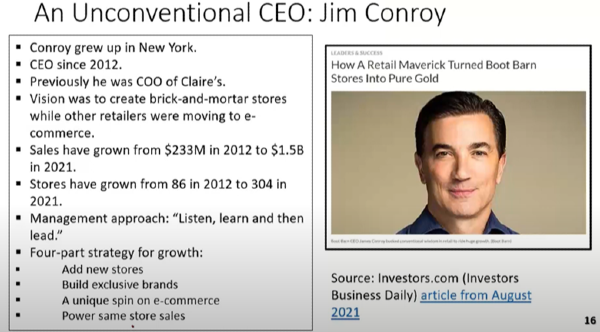

Boot Barn’s Unconventional CEO: Jim Conroy

The CEO, Jim Conroy, seems very straightforward. I like these Investor Business Daily articles when they feature a CEO you get a really good feel for them.

So, Jim Conroy is the one who initiated the IPO. Since the IPO, they've grown sales from $230 million to $1.5 billion. They grew same store sales, they added new stores, and built exclusive Brands. Boot Barn has a different spin on their e-commerce as they really want to power same store sales.

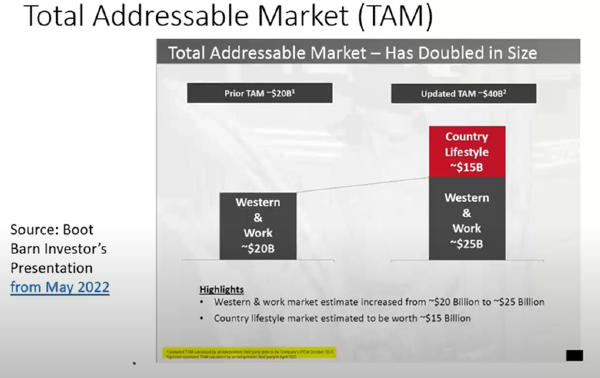

Total Addressable Market

Sometimes these estimates are a little bit fudged. Companies try to make their total addressable markets (TAM) look good even though they may be exaggerated. Even if you think their $40 Billion TAM is high, Boot Barn still has a lot of room to grow. Boot Barn is not just cowboy boots; their work boots are a strong component of this total market. And work boots are accessories for workers whose jobs are never going to go overseas.

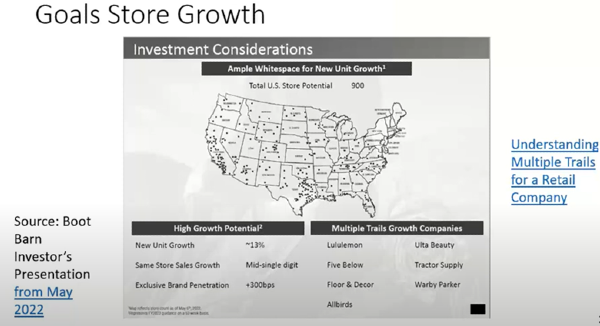

Boot Barn Store Growth

Boot Barn thinks unit growth will be about 13% and same store sales will be in the mid-single digits. This multi-trail concept in retail is a new way of doing marketing. Other companies, like Lululemon and Tractor Supply, aren’t competitors but they all have the same approach in terms of how to be able to reach their customers.

These companies rely on e-commerce while still being a brick-and-mortar company. There are many popular brands that have buildings in our neighborhood like Five Below, Floor and Décor, and Tractor Supply.

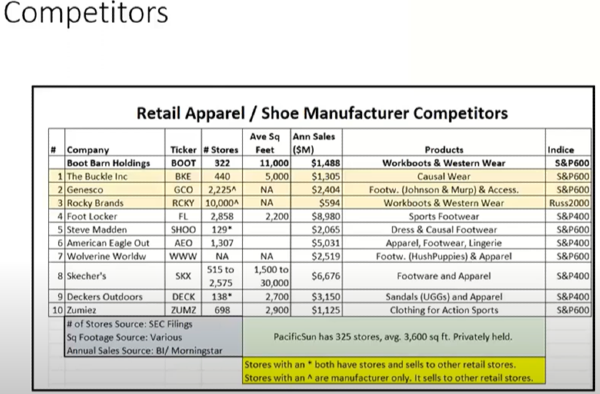

Boot Barn’s Competitors

Boot Barn’s square footage is significantly larger than their competitors like The Buckle Inc. Some of their competitors actually send their stuff out to other people as well. For example, Johnson and Murphy doesn't have a Johnson and Murphy's store chain. They just send their merchandise to other franchises. Boot Barn is a much larger store by size than their competitors except for Sketchers.

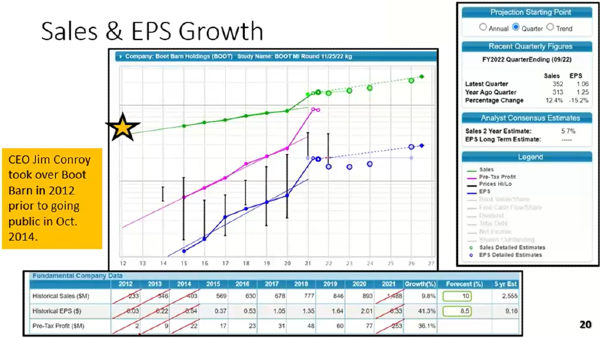

BOOT Sales and EPS Growth

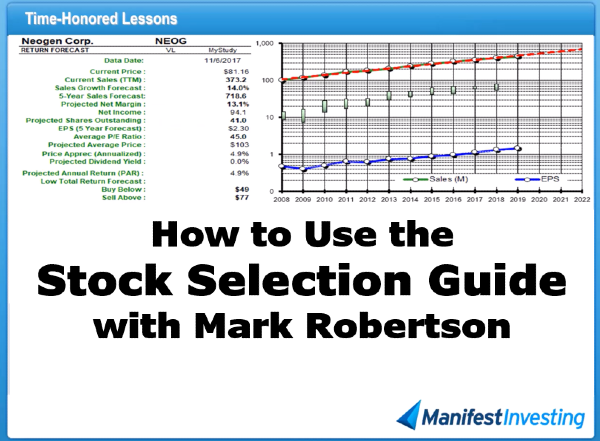

Looking at the Stock Selection Guide (SSG), first note that we marked the SSG where new management came on board. This is a technique George Nicholson liked to do. He would mark on the SSG when new management came on board. So, I marked where this new CEO, Jim Conroy, came in.

Looking at the Stock Selection Guide (SSG), first note that we marked the SSG where new management came on board. This is a technique George Nicholson liked to do. He would mark on the SSG when new management came on board. So, I marked where this new CEO, Jim Conroy, came in.

Looking at sales, I think a 10% to 12% growth would be really easy for them to hit. These numbers are likely cautious, and I probably could have been more bullish.

Read More: How to Analyze Stocks Using a Stock Selection Guide

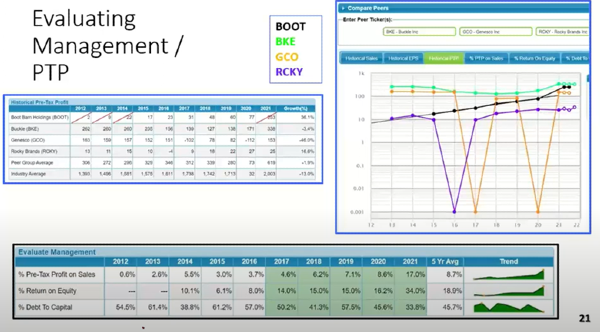

Evaluating Boot Barn’s Management

Not too often you can see a retail company that has positive pre-tax profit, return on equity, and well managed debt to capital for 5 straight years. If you look at the percent return on equity, it jumps in 2020 from 16% to 34%. On top of that, debt to capital falls from 61% in 2015 to 33.8% in 2021. How many retail companies can you think of that ended up paring down their debt during the pandemic while also increasing their pre-tax profit?

Not too often you can see a retail company that has positive pre-tax profit, return on equity, and well managed debt to capital for 5 straight years. If you look at the percent return on equity, it jumps in 2020 from 16% to 34%. On top of that, debt to capital falls from 61% in 2015 to 33.8% in 2021. How many retail companies can you think of that ended up paring down their debt during the pandemic while also increasing their pre-tax profit?

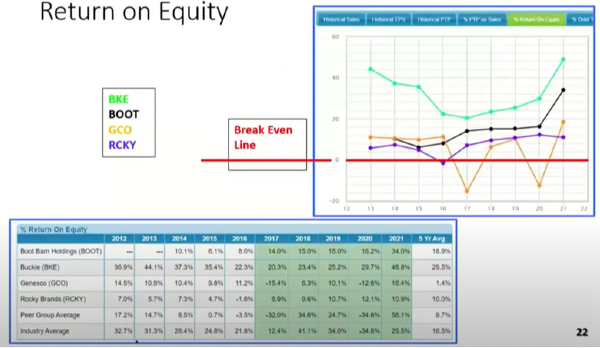

Return on Equity

While Boot Barn’s competitors like Rocky Brands (RCKY) and Genesco (GCO) bounce around between having equity or not, it looks like it's really between Buckle (BKE) and Boot Barn (BOOT). Boot Barn had a strong 2021 with a 34% return on equity.

While Boot Barn’s competitors like Rocky Brands (RCKY) and Genesco (GCO) bounce around between having equity or not, it looks like it's really between Buckle (BKE) and Boot Barn (BOOT). Boot Barn had a strong 2021 with a 34% return on equity.

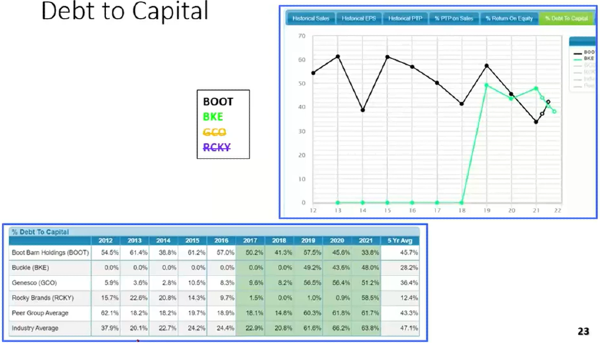

Debt to Capital

Buckle (BKE) had no debt leading up into the pandemic, but as of 2021 now has a higher debt to capital percentage than Boot Barn.

One note is that accounting rules around long-term debt changed in 2019 so that restaurants and retailers like Buckle and Boot Barn had to add their uncapitalized leases in as debt.

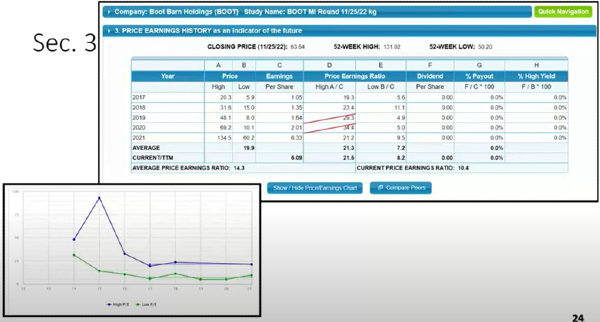

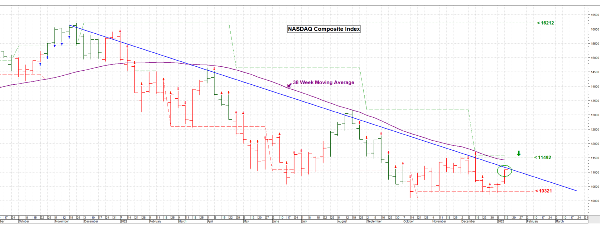

Boot Barn has a really low price in terms of its P/E ratio, so it's right where the lows are which is a great time to jump in if you think it's a good company.

Read More: How to Interpret the Price to Earnings Ratio

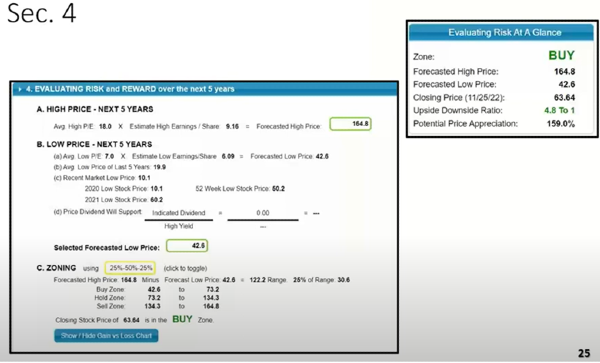

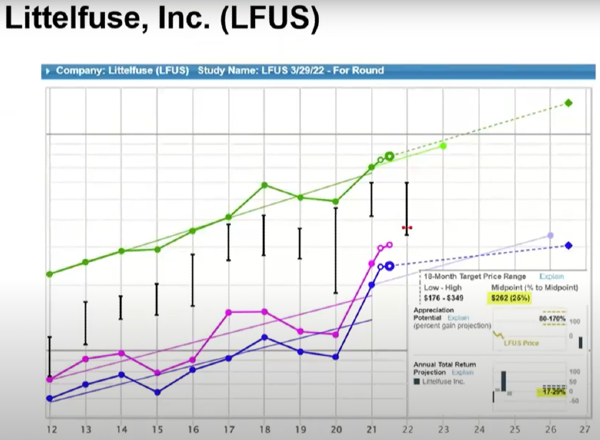

Here's where I come up with our high and low prices. I am setting a high P/E ratio of 18 and that gets me to a price of $164. I'm getting a low P/E ratio at 7 which I think is pretty reasonable on the downside. That's about a third off their current price. With retail companies I feel comfortable lowering my estimates because of the cyclical nature of the industry. For that reason, I dropped my lower P/E ratio to the point where I could get a number that was somewhere around a third less than where the current price is at. Otherwise, I'd get an unbelievable upside-downside ratio that is really too good to be true.

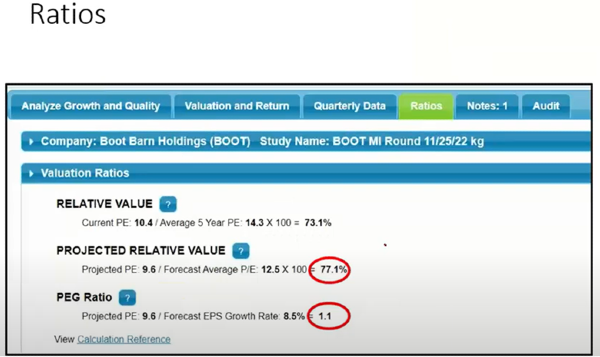

Financial Ratios

I use the projected relative value and the PEG ratio as a test. A PEG ratio of 1.1 and projected relative value of 77.1% may be a little bit optimistic but not too bad. You’ll likely see similar ratios across the industry.

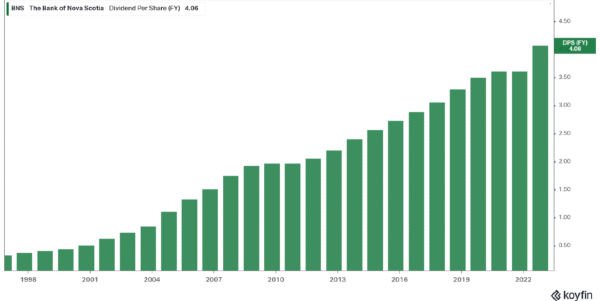

Boot Barn’s MI PAR

For this analysis, the MI PAR is 28.2 which is obviously too good to be true. I think the range on this one is somewhere between 12.5 and 21 between the projected average return and the high return. It doesn't pay a dividend so your rate of return will have to come from both P/E expansion and by earnings growth.

Cautions about investing in Boot Barn

Some concerns about Boot Barn:

- It's not a core stock, the Manifest Investing Core Score is 197

- Its financial health per Morning Star is a C rating

- It doesn't have much analyst coverage

- Retail stores can be really fickle among their target audience

- BOOT is a store centric operation in the internet age

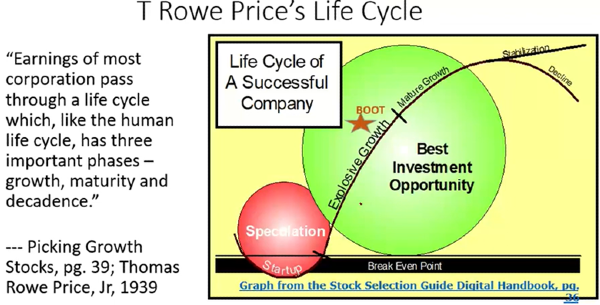

Taking the T Rowe Price life cycle that's in the handbook, I think Boot Barn still has some explosive growth but I think it's sort of right in the middle of the company lifecycle and starting to mature. I don't think it's mature growth, but I think they have a plan to grow their stores. The number of stores could go up into the 800 to 900 range.

Conclusions About BOOT

- Medium sized steady growth company

- Company is well-managed

- Company is “on sale”. Current P/E ratio is 10.4. Five-year average P/E ratio is 14.3

- The stock’s U/D ratio is 4.8:1. TR is 21% and PA is 12.5%

- The company is a BUY up to a price of $73.20

About Kevin Gillogly and “Digging into the BI”

Check out their YouTube channel here:

https://www.youtube.com/@DiggingIntoBI

I'm Kevin Gillogly and I am the director of the DC BetterInvesting™ regional chapter. We’ve started a joint program with the Maryland chapter in the DC Regional chapter similar to the “The Investing Round Table”. On the first Monday of the month, we look at the latest issue of BetterInvesting™ and dig into the magazine, we look at the two featured stocks: the undervalued stock featured in the stock to study section and then two other stocks using BetterInvesting™ tools. We use the BetterInvesting™ heat map for example or it could be from here at the round table.

Our club just celebrated two years in October 2022 last month. Our club is free and open to the public. You can find us on the DC Regional chapter under local events and you can also find us on YouTube under “Digging into the BI”. You can also find us on our Facebook page which is the DC Regional chapter. There are links in all of those to our registration. You don't have to be a BetterInvesting™ member to visit. We do two of our stocks in CoreSSG to help out beginners and two in CoreSSG plus.

Check out the companion video to this article here:

https://youtu.be/q4IDUAbLEqI

Is Boot Barn (BOOT) a Buy?

Boot Barn Holdings (BOOT) is considered a BUY up to a price of $73.20. The company has performed well over the pandemic even though it’s in retail. This is likely due to its work boot business, which makes up nearly half of their business. Boot Barn has a strong leadership team that has proven they can grow the company post-IPO. The company doesn’t have much analyst coverage which may make it an investment opportunity that isn’t well known on Wall Street.

Check out the companion video to this article here: https://youtu.be/q4IDUAbLEqI

Screener Methodology to Find Boot Barn (BOOT)

I decided I'd look at Boot Barn holdings because I got inspired after watching one of the Bull Sessions. The Bull Session discussed a small company list and Ken Kavula and Mark Robertson were talking about emerging companies. Mark was proud of the fact that they were able to find an old issue for five or ten bucks of Hoover’s Handbook of Emerging Companies. So, I looked at all the companies– all 600 companies - to find out which ones my investment clubs have researched over the last couple years.

I zeroed in on about six stocks. I was looking for a strong core score and PEG ratio. I then eliminated some of the stocks for the following reasons.

Evercore (EVR) - I like Evercore as an investment. It's a boutique Investment bank but you can likely wait before investing in it.

CoStar Group (CSGP) – I like CoStar Group but I think it’s currently too expensive

Ollie’s Bargain outlet (OLLI) – This recently had a downturn and it may be good to get back into the stock in the future.

East West Bankcorp (EWBC) - I really wanted to do East West Bank Corporation but Mark told me I can't analyze a bank unless I got Ken’s approval! It’s unfair for anyone to do a bank without the express a written approval of Ken Kavula, even though I own it and I've done very well with it.

About Boot Barn Holdings (BOOT)

Boot Barn’s Product Assortment

About 49% of sales is boots. The company sells other apparel like hats, but their core competency is in boots for workwear. I initially thought that they were just a bunch of cowboy boots but because they sell work boots, they were considered an essential business and were able to stay open during the pandemic. So, if you look at your stock selection guide, you're not going to see that retail dip that so many companies had. They are really trying to keep sales in-store rather than trying to move to e-commerce, which is against the grain when compared to most retail stores.

Sales Growth Areas

New customers generate about half of their revenue growth. The median age of their customers is dropping since the IPO. And they're really getting a healthy growth in the Hispanic consumer market. All these trends seem like real positives to me.

Boot Barn’s Unconventional CEO: Jim Conroy

The CEO, Jim Conroy, seems very straightforward. I like these Investor Business Daily articles when they feature a CEO you get a really good feel for them. So, Jim Conroy is the one who initiated the IPO. Since the IPO, they've grown sales from $230 million to $1.5 billion. They grew same store sales, they added new stores, and built exclusive Brands. Boot Barn has a different spin on their e-commerce as they really want to power same store sales.

Total Addressable Market

Sometimes these estimates are a little bit fudged. Companies try to make their total addressable markets (TAM) look good even though they may be exaggerated. Even if you think their $40 Billion TAM is high, Boot Barn still has a lot of room to grow. Boot Barn is not just cowboy boots; their work boots are a strong component of this total market. And work boots are accessories for workers whose jobs are never going to go overseas.

Boot Barn Store Growth

Source: Investor Presentation

Boot Barn thinks unit growth will be about 13% and same store sales will be in the mid-single digits. This multi-trail concept in retail is a new way of doing marketing. Other companies, like Lululemon and Tractor Supply, aren’t competitors but they all have the same approach in terms of how to be able to reach their customers.

These companies rely on e-commerce while still being a brick-and-mortar company. There are many popular brands that have buildings in our neighborhood like Five Below, Floor and Décor, and Tractor Supply.

Boot Barn’s Competitors

Boot Barn’s square footage is significantly larger than their competitors like The Buckle Inc. Some of their competitors actually send their stuff out to other people as well. For example, Johnson and Murphy doesn't have a Johnson and Murphy's store chain. They just send their merchandise to other franchises. Boot Barn is a much larger store by size than their competitors except for Sketchers.

BOOT Sales and EPS Growth

Looking at sales, I think a 10% to 12% growth would be really easy for them to hit. These numbers are likely cautious, and I probably could have been more bullish.

Evaluating Boot Barn’s Management

Return on Equity

Debt to Capital

Buckle (BKE) had no debt leading up into the pandemic, but as of 2021 now has a higher debt to capital percentage than Boot Barn.

One note is that accounting rules around long-term debt changed in 2019 so that restaurants and retailers like Buckle and Boot Barn had to add their uncapitalized leases in as debt.

Boot Barn has a really low price in terms of its P/E ratio, so it's right where the lows are which is a great time to jump in if you think it's a good company.

Here's where I come up with our high and low prices. I am setting a high P/E ratio of 18 and that gets me to a price of $164. I'm getting a low P/E ratio at 7 which I think is pretty reasonable on the downside. That's about a third off their current price. With retail companies I feel comfortable lowering my estimates because of the cyclical nature of the industry. For that reason, I dropped my lower P/E ratio to the point where I could get a number that was somewhere around a third less than where the current price is at. Otherwise, I'd get an unbelievable upside-downside ratio that is really too good to be true.

Financial Ratios

I use the projected relative value and the PEG ratio as a test. A PEG ratio of 1.1 and projected relative value of 77.1% may be a little bit optimistic but not too bad. You’ll likely see similar ratios across the industry.

Boot Barn’s MI PAR

For this analysis, the MI PAR is 28.2 which is obviously too good to be true. I think the range on this one is somewhere between 12.5 and 21 between the projected average return and the high return. It doesn't pay a dividend so your rate of return will have to come from both P/E expansion and by earnings growth.

Cautions about investing in Boot Barn

Some concerns about Boot Barn:

Taking the T Rowe Price life cycle that's in the handbook, I think Boot Barn still has some explosive growth but I think it's sort of right in the middle of the company lifecycle and starting to mature. I don't think it's mature growth, but I think they have a plan to grow their stores. The number of stores could go up into the 800 to 900 range.

Conclusions About BOOT

About Kevin Gillogly and “Digging into the BI”

Check out their YouTube channel here:

https://www.youtube.com/@DiggingIntoBI

I'm Kevin Gillogly and I am the director of the DC BetterInvesting™ regional chapter. We’ve started a joint program with the Maryland chapter in the DC Regional chapter similar to the “The Investing Round Table”. On the first Monday of the month, we look at the latest issue of BetterInvesting™ and dig into the magazine, we look at the two featured stocks: the undervalued stock featured in the stock to study section and then two other stocks using BetterInvesting™ tools. We use the BetterInvesting™ heat map for example or it could be from here at the round table.

Our club just celebrated two years in October 2022 last month. Our club is free and open to the public. You can find us on the DC Regional chapter under local events and you can also find us on YouTube under “Digging into the BI”. You can also find us on our Facebook page which is the DC Regional chapter. There are links in all of those to our registration. You don't have to be a BetterInvesting™ member to visit. We do two of our stocks in CoreSSG to help out beginners and two in CoreSSG plus.

Check out the companion video to this article here: https://youtu.be/q4IDUAbLEqI