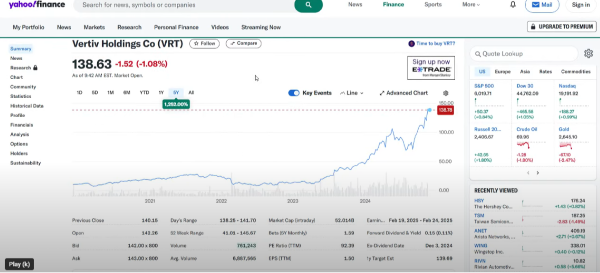

Verve's Phenomenal Stock Performance

Over the last five years, Verve has been one of the best-performing stocks, with an impressive increase of 1,250%. Such a performance is nothing short of extraordinary, and much of this growth has been recent. For instance, in just one year, the stock surged by 24%.

Many might attribute this incredible rise solely to market hype, but there is more to the story. The expectation that Verve's stock will continue to perform well is not surprising. A significant part of this success comes from the company’s ability to dramatically increase its margins and profitability. Furthermore, Verve's revenue has also shown substantial growth.

Analyzing PE Ratios and Earnings Growth

Examining Verve's Price-to-Earnings (PE) ratio provides more insight. Currently, the PE ratio stands at a high level of 94, which aligns with the company’s substantial stock growth. When a stock increases by 1,250%, it’s natural for the PE ratio to be elevated. However, this high PE ratio is justified by Verve's underlying growth metrics. Between 2022 and 2023, Verve increased its earnings per share by an impressive 234%, further driving its profitability.

The Bottom Line

Verve's remarkable stock performance is backed by solid fundamentals, including significant growth in margins, profitability, and revenue. These factors contribute to the high PE ratio, reflecting the company’s robust financial health and growth potential. As Verve continues to innovate and expand, its stock performance will likely remain strong.

Impressive Earnings Growth

Verve's earnings per share (EPS) surged by 234%, followed by an additional 51.8%. Over the last two years, this translates to an impressive near-500% increase in profitability. In 2023 alone, Verve's profitability exceeded expectations, supported by substantial revenue growth. Year-over-year, revenue saw increments of 14%, 21%, and another 14%. Consistently maintaining such profitability for five years is bound to yield significant returns, even if it doesn't reach the astronomical 1,250% growth. These figures indicate an exceptionally strong financial performance.

Revenue and Cash Flow Highlights

Verve’s consistent revenue growth has been complemented by an increase in cash flow, driven by effective profit billing and revenue management. Their focus on data center operations has played a pivotal role in their success. The importance of efficient infrastructure in data centers cannot be overstated, as inefficient setups can lead to significant financial losses.

The Vital Role of Data Centers

Data centers are critical to modern computing needs. As someone who works in a data center, I can attest to the challenges posed by poor infrastructure. The company I work for went bankrupt due to bad infrastructure, costing us substantial amounts of money. It's crucial to understand that data centers involve more than just racks; they encompass electrical equipment and other essential components. Efficiency in these areas is key.

Future of Data Centers

Data centers are undeniably the future, with increasing demand for computing power driven by technological advancements and AI. Even in the absence of AI, the need for computing resources will continue to grow, supporting various businesses' operations. Verve’s involvement in this industry positions them well for continued success.

Dividend Considerations

While there is a dividend associated with Verve's stock, it is minimal. Investors should primarily focus on growth potential rather than dividends. Recent evaluations, such as those from Schwab, suggest that Verve’s stock will continue to outperform the average stock over the next year. After such a remarkable run-up, some moderation in growth is expected. However, the company’s strong fundamentals and industry positioning make it a promising investment.

Warning One: High Expectations and Realistic Growth

If you anticipate Verve's stock to surge another 1,250% over the next five years, it is technically possible but unlikely. The substantial growth experienced thus far has been driven by significant improvements in margins and profitability, which become increasingly difficult to sustain. While revenue growth of 20-30% could continue to propel the stock, reaching the same exponential growth will be challenging. Investors might fare better with a company currently positioned for such dramatic growth rather than one that has already experienced it. Nevertheless, Verve remains a strong long-term hold, though it may not replicate its past 500% growth over the next two years.

Warning Two: Portfolio Diversification and High PE Ratios

Many investors interested in Verve either own the stock or are heavily invested in companies with similar high PE ratios. While there is nothing inherently wrong with owning stocks with high PE levels, it is risky to concentrate most of your portfolio in just a few high PE stocks. During economic downturns or recessions, these stocks are often hit hardest, with significant capital outflows. Although some high PE stocks can perform well during tough times and recover strongly, diversification is crucial to mitigate risks. Owning a mix of stocks with varying PE ratios can provide more stability and protect against potential market volatility.

The Importance of Diversification

Diversifying your investment portfolio is essential for long-term success. While high PE stocks like Verve can deliver impressive returns, they also come with higher risks during market downturns. Balancing your portfolio with stocks that have lower PE ratios and more stable performance can help weather economic uncertainties and reduce potential losses.

Diversification and Stock Performance

I own a mix of stocks that don't always generate constant profits. Some of these include dividend-paying stocks and utility stocks, which I often cover on this channel. Diversification is key for me, but ultimately, you're in control of your own investments. It's important to note that high-growth businesses come with risks. If a high-growth company slows down significantly, you might see its stock drop dramatically, especially during a recession.

PE Ratios and Stock Valuations

Let's examine where the PE ratio has been. Currently, the PE ratio is at 79, up from 93. The forward PE is slightly lower, possibly due to calculation methods. While a high PE ratio might seem concerning, it's not unusual for fast-growing stocks. In this context, the current valuation isn't outrageous. Although the stock isn't cheap, its impressive growth justifies the higher PE ratio.

Analyst Recommendations

Interestingly, all 16 analysts recommend either a buy or strong buy for this stock. This is the first time I've seen unanimous buy recommendations on this channel, after covering around 100 videos. It’s a testament to the stock's potential and performance.

Closing Thoughts

Verve's remarkable stock performance has been driven by significant improvements in margins, profitability, and revenue growth. However, investors should temper their expectations for future growth and prioritize portfolio diversification to manage risks. By maintaining a balanced mix of investments, you can achieve strong returns while protecting your assets during market fluctuations.

https://youtu.be/SSfWcByLx_I?si=3jkFC4xohZg0XSsz

Verve's Phenomenal Stock Performance

Over the last five years, Verve has been one of the best-performing stocks, with an impressive increase of 1,250%. Such a performance is nothing short of extraordinary, and much of this growth has been recent. For instance, in just one year, the stock surged by 24%. Many might attribute this incredible rise solely to market hype, but there is more to the story. The expectation that Verve's stock will continue to perform well is not surprising. A significant part of this success comes from the company’s ability to dramatically increase its margins and profitability. Furthermore, Verve's revenue has also shown substantial growth.

Analyzing PE Ratios and Earnings Growth

Examining Verve's Price-to-Earnings (PE) ratio provides more insight. Currently, the PE ratio stands at a high level of 94, which aligns with the company’s substantial stock growth. When a stock increases by 1,250%, it’s natural for the PE ratio to be elevated. However, this high PE ratio is justified by Verve's underlying growth metrics. Between 2022 and 2023, Verve increased its earnings per share by an impressive 234%, further driving its profitability.

The Bottom Line

Verve's remarkable stock performance is backed by solid fundamentals, including significant growth in margins, profitability, and revenue. These factors contribute to the high PE ratio, reflecting the company’s robust financial health and growth potential. As Verve continues to innovate and expand, its stock performance will likely remain strong.

Impressive Earnings Growth

Verve's earnings per share (EPS) surged by 234%, followed by an additional 51.8%. Over the last two years, this translates to an impressive near-500% increase in profitability. In 2023 alone, Verve's profitability exceeded expectations, supported by substantial revenue growth. Year-over-year, revenue saw increments of 14%, 21%, and another 14%. Consistently maintaining such profitability for five years is bound to yield significant returns, even if it doesn't reach the astronomical 1,250% growth. These figures indicate an exceptionally strong financial performance.

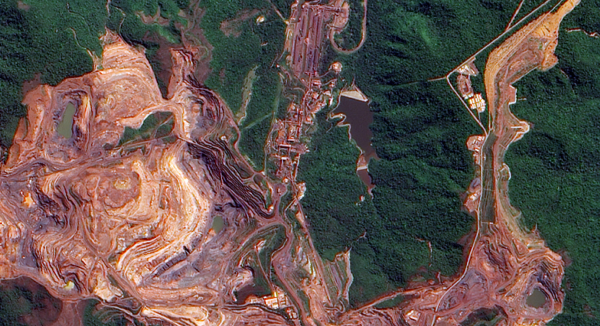

Revenue and Cash Flow Highlights

Verve’s consistent revenue growth has been complemented by an increase in cash flow, driven by effective profit billing and revenue management. Their focus on data center operations has played a pivotal role in their success. The importance of efficient infrastructure in data centers cannot be overstated, as inefficient setups can lead to significant financial losses.

The Vital Role of Data Centers

Data centers are critical to modern computing needs. As someone who works in a data center, I can attest to the challenges posed by poor infrastructure. The company I work for went bankrupt due to bad infrastructure, costing us substantial amounts of money. It's crucial to understand that data centers involve more than just racks; they encompass electrical equipment and other essential components. Efficiency in these areas is key.

Future of Data Centers

Data centers are undeniably the future, with increasing demand for computing power driven by technological advancements and AI. Even in the absence of AI, the need for computing resources will continue to grow, supporting various businesses' operations. Verve’s involvement in this industry positions them well for continued success.

Dividend Considerations

While there is a dividend associated with Verve's stock, it is minimal. Investors should primarily focus on growth potential rather than dividends. Recent evaluations, such as those from Schwab, suggest that Verve’s stock will continue to outperform the average stock over the next year. After such a remarkable run-up, some moderation in growth is expected. However, the company’s strong fundamentals and industry positioning make it a promising investment.

Warning One: High Expectations and Realistic Growth

If you anticipate Verve's stock to surge another 1,250% over the next five years, it is technically possible but unlikely. The substantial growth experienced thus far has been driven by significant improvements in margins and profitability, which become increasingly difficult to sustain. While revenue growth of 20-30% could continue to propel the stock, reaching the same exponential growth will be challenging. Investors might fare better with a company currently positioned for such dramatic growth rather than one that has already experienced it. Nevertheless, Verve remains a strong long-term hold, though it may not replicate its past 500% growth over the next two years.

Warning Two: Portfolio Diversification and High PE Ratios

Many investors interested in Verve either own the stock or are heavily invested in companies with similar high PE ratios. While there is nothing inherently wrong with owning stocks with high PE levels, it is risky to concentrate most of your portfolio in just a few high PE stocks. During economic downturns or recessions, these stocks are often hit hardest, with significant capital outflows. Although some high PE stocks can perform well during tough times and recover strongly, diversification is crucial to mitigate risks. Owning a mix of stocks with varying PE ratios can provide more stability and protect against potential market volatility.

The Importance of Diversification

Diversifying your investment portfolio is essential for long-term success. While high PE stocks like Verve can deliver impressive returns, they also come with higher risks during market downturns. Balancing your portfolio with stocks that have lower PE ratios and more stable performance can help weather economic uncertainties and reduce potential losses.

Diversification and Stock Performance

I own a mix of stocks that don't always generate constant profits. Some of these include dividend-paying stocks and utility stocks, which I often cover on this channel. Diversification is key for me, but ultimately, you're in control of your own investments. It's important to note that high-growth businesses come with risks. If a high-growth company slows down significantly, you might see its stock drop dramatically, especially during a recession.

PE Ratios and Stock Valuations

Let's examine where the PE ratio has been. Currently, the PE ratio is at 79, up from 93. The forward PE is slightly lower, possibly due to calculation methods. While a high PE ratio might seem concerning, it's not unusual for fast-growing stocks. In this context, the current valuation isn't outrageous. Although the stock isn't cheap, its impressive growth justifies the higher PE ratio.

Analyst Recommendations

Interestingly, all 16 analysts recommend either a buy or strong buy for this stock. This is the first time I've seen unanimous buy recommendations on this channel, after covering around 100 videos. It’s a testament to the stock's potential and performance.

Closing Thoughts

Verve's remarkable stock performance has been driven by significant improvements in margins, profitability, and revenue growth. However, investors should temper their expectations for future growth and prioritize portfolio diversification to manage risks. By maintaining a balanced mix of investments, you can achieve strong returns while protecting your assets during market fluctuations.

https://youtu.be/SSfWcByLx_I?si=3jkFC4xohZg0XSsz