Which Copper Stocks Are Best? A Comprehensive Investment Guide

| Company |

Copper Output (Metric Tons) |

Symbol |

| BHP Group |

Significant global production |

BHP |

| Freeport-McMoRan |

~362,874 metric tons |

FCX |

| Rio Tinto |

Large-scale copper operations |

RIO |

| Teck Resources |

Expanding copper production |

TECK |

| Southern Copper |

Latin American copper leader |

SCCO |

| Taseko Mines |

Mid-tier producer with growth plans |

TGB |

| Ero Copper |

Focused on high-grade assets |

ERO |

| Ivanhoe Mines |

Developing large-scale projects |

IVPAF |

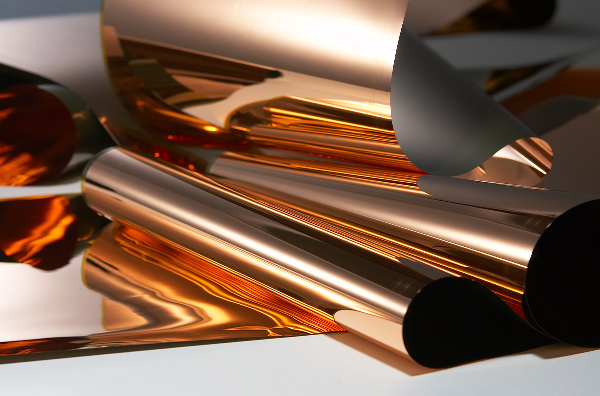

Alright, let's talk copper! Now, copper is everywhere—it's in your phone, your car, and even the wiring in your house. This metal is the backbone of modern infrastructure, and with the global push toward electrification and renewable energy, demand is only going up. That’s why copper stocks are catching the attention of investors. Companies mining and refining copper stand to benefit from rising prices, driven by supply constraints and increasing industrial use. But here’s the kicker—copper prices don’t just move on demand alone. Factors like geopolitical tensions, mining regulations, and even macroeconomic trends play a role in shaping the market. So, if you’re looking at copper stocks, understanding these dynamics is key to making smart investment decisions.

2. The Growing Demand for Copper

Copper isn’t just a metal—it’s the unsung hero of the modern world. Think about it: every time you flip a light switch, charge your phone, or drive an EV, copper is working behind the scenes to make it all happen. And here’s the kicker—demand is about to go through the roof. With the global push for electrification and renewable energy, copper is becoming one of the most essential materials out there. Wind turbines? Packed with copper wiring. Solar panels? Same deal. And don’t even get me started on EVs—those things need four times more copper than traditional cars.

But there’s a problem… Supply isn’t keeping up. Copper mines take years (sometimes decades) to ramp up production, and we’re looking at potential shortages post-2025. That’s a perfect setup for rising prices, making copper stocks a seriously intriguing play. If you’re looking to invest, now’s the time to start paying attention—because when supply crunches hit, the companies holding the biggest copper reserves could see some major gains.

3. Key Factors to Consider When Investing in Copper Stocks

Alright, let’s break this down. When it comes to copper stocks, mining costs and production efficiency are make-or-break factors. The best miners aren’t just pulling copper out of the ground—they’re doing it cheaply and efficiently. Lower costs mean higher profit margins, and that’s what keeps investors happy. But here’s the thing: mining isn’t just about digging. It’s about logistics, labor, and energy costs, all of which can fluctuate wildly. Companies with streamlined operations, modern extraction techniques, and access to high-grade deposits tend to outperform. If a miner is stuck with outdated equipment or inefficient processes, their margins shrink fast. And in a market where copper prices swing like a pendulum, efficiency is everything.

Now, let’s talk geopolitical risks and ESG considerations — because copper mining isn’t just about numbers, it’s about where and how the metal is produced. Some of the biggest copper reserves are in politically unstable regions, where sudden regulatory changes or resource nationalism can shake up the industry. Then there’s the ESG factor—investors are paying closer attention to sustainability, and companies that ignore environmental concerns could face serious backlash. Mines that pollute or fail to meet ethical labor standards risk losing investor confidence. On the flip side, firms embracing green production methods and responsible sourcing are positioning themselves as long-term winners. And let’s not forget dividends—some copper stocks offer solid payouts, making them attractive for income-focused investors. But dividend stability depends on financial health, so companies with strong balance sheets and consistent cash flow are the ones to watch.

4. Top Copper Stocks to Watch in 2025

Alright, let’s break down the top copper stocks to watch in 2025—because if you’re looking for exposure to this essential metal, these companies are leading the charge.

BHP Group (NYSE: BHP)

BHP isn’t just big—it’s massive. This global mining powerhouse has its hands in everything from iron ore to coal, but copper is a key part of its portfolio. With operations in South America and Australia, BHP benefits from scale, efficiency, and deep reserves. The company is actively expanding its copper production, betting big on the metal’s future demand. Plus, its diversified business model helps cushion against market volatility, making it a solid long-term play.

Freeport-McMoRan (NYSE: FCX)

If you’re looking for a pure copper play, Freeport-McMoRan is one of the best bets. This U.S.-based miner owns the legendary Grasberg mine in Indonesia—one of the largest copper deposits in the world. Freeport has been ramping up production while keeping costs in check, which is crucial in a market where margins matter. With strong cash flow and a focus on shareholder returns, FCX remains a favorite among copper investors.

Rio Tinto Group (NYSE: RIO)

Rio Tinto is a diversified mining giant, but don’t overlook its copper assets. The company has significant exposure to copper through its operations in Mongolia, the U.S., and South America. What sets Rio apart is its commitment to sustainable mining—it’s investing heavily in ESG initiatives, which could make it a preferred choice for environmentally conscious investors. Plus, its strong balance sheet and dividend payouts make it a reliable pick.

Teck Resources (NYSE: TECK)

Teck Resources is a Canadian miner that’s been steadily increasing its copper output. The company has been shifting focus toward copper, recognizing its growing importance in electrification and renewables. With expansion projects in Chile and Canada, Teck is positioning itself as a rising force in the copper market. Investors looking for a growth-oriented copper stock should keep an eye on this one.

Southern Copper (NYSE: SCCO)

Southern Copper is a Latin American copper powerhouse, with massive reserves in Peru and Mexico. The company boasts some of the lowest production costs in the industry, which gives it a competitive edge when copper prices fluctuate. SCCO is also known for its strong dividend payouts, making it an attractive option for income-focused investors. With copper demand set to rise, Southern Copper’s efficient operations and strategic positioning make it a compelling pick.

These stocks offer a mix of stability, growth potential, and dividend opportunities—so whether you’re looking for a long-term hold or a high-growth play, there’s something here for every investor.

5. Emerging Copper Stocks with High Growth Potential

Alright, let’s dive into these emerging copper players—because sometimes the best opportunities aren’t the biggest names.

Taseko Mines (NYSE: TGB)

Taseko is a mid-tier copper producer with serious expansion plans. Its flagship Gibraltar mine in British Columbia is one of Canada’s largest open-pit copper mines, and the company is actively developing the Florence Copper Project in Arizona, which could significantly boost production Taseko Mines. What makes Taseko interesting is its focus on low-cost, in-situ recovery technology, which could make Florence one of the most efficient copper operations in North America. While the stock has seen volatility, its long-term growth potential is tied to successful execution of its expansion strategy.

Ero Copper (NYSE: ERO)

Ero Copper is all about high-grade copper assets. Operating primarily in Brazil, the company has built a reputation for efficient, low-cost production Taseko Mines. What sets Ero apart is its focus on exploration and resource expansion—it’s constantly working to increase reserves and improve operational efficiency. Investors looking for a copper miner with strong fundamentals and a commitment to growth should keep an eye on ERO. Plus, its exposure to Brazil’s rich copper deposits gives it an edge in securing long-term supply.

Ivanhoe Mines (OTC: IVPAF)

Ivanhoe Mines is a high-risk, high-reward play in the copper space. The company is developing large-scale copper projects, including the massive Kamoa-Kakula mine in the Democratic Republic of Congo Taseko Mines Ltd. This project is one of the highest-grade copper discoveries in recent history, and Ivanhoe is ramping up production aggressively. However, geopolitical risks in the region remain a concern. If Ivanhoe can navigate regulatory challenges and maintain steady output, it has the potential to become a major force in global copper supply.

Risks and Challenges in Copper Investing

Copper prices swing like a wrecking ball—one moment soaring, the next crashing. Supply chain chaos, geopolitical flare-ups, and regulatory red tape can turn a promising investment into a headache overnight. Mines in politically unstable regions? Risky. Environmental scrutiny? Growing. If a company isn’t adapting, it’s falling behind.

Conclusion

Copper is the metal of the future, but picking the right stocks takes strategy. Established giants offer stability, while emerging players bring high-risk, high-reward potential. The key? Diversification. Keep an eye on supply trends, ESG shifts, and macroeconomic forces—because when copper surges, the right investments could pay off big.

Which Copper Stocks Are Best? A Comprehensive Investment Guide

Source: mining.com

Alright, let's talk copper! Now, copper is everywhere—it's in your phone, your car, and even the wiring in your house. This metal is the backbone of modern infrastructure, and with the global push toward electrification and renewable energy, demand is only going up. That’s why copper stocks are catching the attention of investors. Companies mining and refining copper stand to benefit from rising prices, driven by supply constraints and increasing industrial use. But here’s the kicker—copper prices don’t just move on demand alone. Factors like geopolitical tensions, mining regulations, and even macroeconomic trends play a role in shaping the market. So, if you’re looking at copper stocks, understanding these dynamics is key to making smart investment decisions.

2. The Growing Demand for Copper

Copper isn’t just a metal—it’s the unsung hero of the modern world. Think about it: every time you flip a light switch, charge your phone, or drive an EV, copper is working behind the scenes to make it all happen. And here’s the kicker—demand is about to go through the roof. With the global push for electrification and renewable energy, copper is becoming one of the most essential materials out there. Wind turbines? Packed with copper wiring. Solar panels? Same deal. And don’t even get me started on EVs—those things need four times more copper than traditional cars.

But there’s a problem… Supply isn’t keeping up. Copper mines take years (sometimes decades) to ramp up production, and we’re looking at potential shortages post-2025. That’s a perfect setup for rising prices, making copper stocks a seriously intriguing play. If you’re looking to invest, now’s the time to start paying attention—because when supply crunches hit, the companies holding the biggest copper reserves could see some major gains.

3. Key Factors to Consider When Investing in Copper Stocks

Alright, let’s break this down. When it comes to copper stocks, mining costs and production efficiency are make-or-break factors. The best miners aren’t just pulling copper out of the ground—they’re doing it cheaply and efficiently. Lower costs mean higher profit margins, and that’s what keeps investors happy. But here’s the thing: mining isn’t just about digging. It’s about logistics, labor, and energy costs, all of which can fluctuate wildly. Companies with streamlined operations, modern extraction techniques, and access to high-grade deposits tend to outperform. If a miner is stuck with outdated equipment or inefficient processes, their margins shrink fast. And in a market where copper prices swing like a pendulum, efficiency is everything.

Now, let’s talk geopolitical risks and ESG considerations — because copper mining isn’t just about numbers, it’s about where and how the metal is produced. Some of the biggest copper reserves are in politically unstable regions, where sudden regulatory changes or resource nationalism can shake up the industry. Then there’s the ESG factor—investors are paying closer attention to sustainability, and companies that ignore environmental concerns could face serious backlash. Mines that pollute or fail to meet ethical labor standards risk losing investor confidence. On the flip side, firms embracing green production methods and responsible sourcing are positioning themselves as long-term winners. And let’s not forget dividends—some copper stocks offer solid payouts, making them attractive for income-focused investors. But dividend stability depends on financial health, so companies with strong balance sheets and consistent cash flow are the ones to watch.

4. Top Copper Stocks to Watch in 2025

Alright, let’s break down the top copper stocks to watch in 2025—because if you’re looking for exposure to this essential metal, these companies are leading the charge.

BHP Group (NYSE: BHP)

BHP isn’t just big—it’s massive. This global mining powerhouse has its hands in everything from iron ore to coal, but copper is a key part of its portfolio. With operations in South America and Australia, BHP benefits from scale, efficiency, and deep reserves. The company is actively expanding its copper production, betting big on the metal’s future demand. Plus, its diversified business model helps cushion against market volatility, making it a solid long-term play.

Freeport-McMoRan (NYSE: FCX)

If you’re looking for a pure copper play, Freeport-McMoRan is one of the best bets. This U.S.-based miner owns the legendary Grasberg mine in Indonesia—one of the largest copper deposits in the world. Freeport has been ramping up production while keeping costs in check, which is crucial in a market where margins matter. With strong cash flow and a focus on shareholder returns, FCX remains a favorite among copper investors.

Rio Tinto Group (NYSE: RIO)

Rio Tinto is a diversified mining giant, but don’t overlook its copper assets. The company has significant exposure to copper through its operations in Mongolia, the U.S., and South America. What sets Rio apart is its commitment to sustainable mining—it’s investing heavily in ESG initiatives, which could make it a preferred choice for environmentally conscious investors. Plus, its strong balance sheet and dividend payouts make it a reliable pick.

Teck Resources (NYSE: TECK)

Teck Resources is a Canadian miner that’s been steadily increasing its copper output. The company has been shifting focus toward copper, recognizing its growing importance in electrification and renewables. With expansion projects in Chile and Canada, Teck is positioning itself as a rising force in the copper market. Investors looking for a growth-oriented copper stock should keep an eye on this one.

Southern Copper (NYSE: SCCO)

Southern Copper is a Latin American copper powerhouse, with massive reserves in Peru and Mexico. The company boasts some of the lowest production costs in the industry, which gives it a competitive edge when copper prices fluctuate. SCCO is also known for its strong dividend payouts, making it an attractive option for income-focused investors. With copper demand set to rise, Southern Copper’s efficient operations and strategic positioning make it a compelling pick.

These stocks offer a mix of stability, growth potential, and dividend opportunities—so whether you’re looking for a long-term hold or a high-growth play, there’s something here for every investor.

5. Emerging Copper Stocks with High Growth Potential

Alright, let’s dive into these emerging copper players—because sometimes the best opportunities aren’t the biggest names.

Taseko Mines (NYSE: TGB)

Taseko is a mid-tier copper producer with serious expansion plans. Its flagship Gibraltar mine in British Columbia is one of Canada’s largest open-pit copper mines, and the company is actively developing the Florence Copper Project in Arizona, which could significantly boost production Taseko Mines. What makes Taseko interesting is its focus on low-cost, in-situ recovery technology, which could make Florence one of the most efficient copper operations in North America. While the stock has seen volatility, its long-term growth potential is tied to successful execution of its expansion strategy.

Ero Copper (NYSE: ERO)

Ero Copper is all about high-grade copper assets. Operating primarily in Brazil, the company has built a reputation for efficient, low-cost production Taseko Mines. What sets Ero apart is its focus on exploration and resource expansion—it’s constantly working to increase reserves and improve operational efficiency. Investors looking for a copper miner with strong fundamentals and a commitment to growth should keep an eye on ERO. Plus, its exposure to Brazil’s rich copper deposits gives it an edge in securing long-term supply.

Ivanhoe Mines (OTC: IVPAF)

Ivanhoe Mines is a high-risk, high-reward play in the copper space. The company is developing large-scale copper projects, including the massive Kamoa-Kakula mine in the Democratic Republic of Congo Taseko Mines Ltd. This project is one of the highest-grade copper discoveries in recent history, and Ivanhoe is ramping up production aggressively. However, geopolitical risks in the region remain a concern. If Ivanhoe can navigate regulatory challenges and maintain steady output, it has the potential to become a major force in global copper supply.

Risks and Challenges in Copper Investing

Copper prices swing like a wrecking ball—one moment soaring, the next crashing. Supply chain chaos, geopolitical flare-ups, and regulatory red tape can turn a promising investment into a headache overnight. Mines in politically unstable regions? Risky. Environmental scrutiny? Growing. If a company isn’t adapting, it’s falling behind.

Conclusion

Copper is the metal of the future, but picking the right stocks takes strategy. Established giants offer stability, while emerging players bring high-risk, high-reward potential. The key? Diversification. Keep an eye on supply trends, ESG shifts, and macroeconomic forces—because when copper surges, the right investments could pay off big.