Sound investments

don't happen alone

Find your crew, build teams, compete in VS MODE, and identify investment trends in our evergrowing investment ecosystem. You aren't on an island anymore, and our community is here to help you make informed decisions in a complex world.

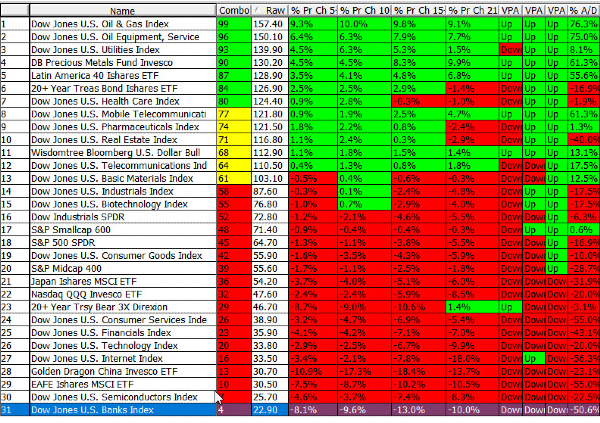

March 4, 2022 – I’m still waiting for a better indication that we are not headed lower. The simple definition is a “higher High & a higher Low” of price swings. So far we remain in a “lower High and a lower Low”. Some indicators are a little more positive but the news is uncertain and the market and its investors don’t like uncertainty, hence we’re still in a range.

The weight of Ukraine the effects on the Western economies and overall inflation fears are the major factors overshadowing great job numbers and very low unemployment. Right now it’s “all about” energy, commodities (metals & grains), consumer staples and utilities. That’s where I’m at with the rest in Cash.

The Short Term Sector Strength table is shown above

Is this a good time to “bottom fish”? Only if you are willing to take that risk and accept a possible drawdown. Likely the market will click lower to take out resting stops before it rockets higher . . . that’s just the way that it works. I’d wait and then react quickly, but Tech is on sale now. I prefer to spend time doing research at times like this and not try to “push on a rope” trying to pick a bottom in an environment that is unstable. But, “To each, their own”. Have a good week and pray for the people of Ukraine. They did not deserve this ! ….. Tom ….

I/we have no positions in any asset mentioned, and no plans to initiate any positions for the next 7 days