Bank of America Stock Price Today is just at the lowest level. It is the best time to invest in this second largest bank in America. Many investors might be hunting the high-value stocks to make high returns even when the pessimism prevails.

When inflation is getting out of control and the Fed is adopting aggressive interest hike policies to cool down the overheated economy, the Bank of America manages to surprise many in the stock market.

In this case, many consumer-oriented stocks are causing a recession-like situation. But, the banks are profiting from these high rates of interest rates.

Read Also: Should You Buy Tesla Stock? Will Meta Stock Go Up? and Is BBY A Buy or Sell? Is Best Buy still the Best Buy For Investors?

So, invest in these banks. You can become a partner in their earnings and get a good slice of their earnings and revenues in the form of dividends during this challenging economic situation.

Besides, you can take advantage of the lowest price of this stock by buying this high-value stock at the dip and enjoy returns when the economy recovers again.

Also check the Sempra Energy Stock Analysis, SRE Stock Forecast, NRG Energy Stock and Microsoft (MSFT)

Bank of America Profile

Based in North Carolina, Bank of America was established in 1998 by merging Banks America and NationsBank in 1998.

Following JP Morgan, this second-largest financial institution in the United States has also become in the limelight for many lawsuits and controversies.

Primarily, the world's fourth largest bank provides services in the domain of commercial banking, wealth management and investment banking.

Read Also: IS VISA STOCK A BUY? WHY & WHY NOT? and Why is Apple Dividend So Low?

Bank of America is a publicly traded company offering a spectrum of financial services. It is traded with the ticker symbol of BAC on the NYSE. It is also a significant component of S& P 100 and S & P 500.

Serving globally, this financial institution assists its clients through its 4600 retail financial centers and 16 200 ATMs in the United States. Online mobile banking has made customer service more convenient, efficient and secure.

Bank of America Stock Price Today

Bank of America's share price is at the nearest of its the lowest level. The current share price is 33.76 USD.

This price is closest to the 52-week lowest price, 29.67 USD. The highest 52-week price went as high as 50.11 USD.

If we look at the competitors of the BAC, we can observe that the price of this bank share is still higher comparatively, and it fell by 27.61% this year.

The share price of J.P Morgan Chase & Co has also fallen sharply by 29.03%. On the other hand, the share price of Wells Fargo has fallen only by 14.90%.

Although the prices of shares are going down but the financial position witnessed solid results.

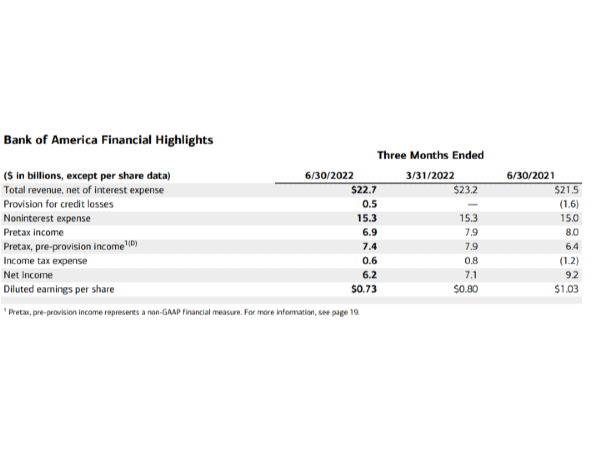

Last week, BAC published their second-quarter earnings, and they just made headlines due to their dropped profits and surging revenues at the same time. A sharp fall of 32% in the profits was attributed to the regulatory matters of BAC.

On the other hand, the revenues climbed up to 5.6% due to the resilient consumer spending and deposit balances.

Distributing $2.7 billion back to shareholders, the BAC reported earnings per share of $0.78 against the expectations of $0.75, slightly beating the market expectations.

What caused the revenues to grow in such pessimism when consumers buy fewer home mortgages and get fewer car loans due to the higher interest costs?

Check out: Why is Dominion Energy Stock Dropping? Is it Still Safe to Invest?

Surprisingly, the higher interest rates spiked up the BAC's revenues due to the higher bank deposits and the loan growth.

BAC appreciates the consumers with higher credit scores. It helps reduce the risk of defaults and maintains a solid loan growth.

The CFO, Alastair Borthwick, appeared optimistic last week about the third quarter earnings and expected the revenue to climb by 900 million or $ 1 billion due to the wide net interest differential and the loan surge.

Besides, you can check the high-dividend paying stocks like

Edison International Stock, a stock to hold in recession and NextEra Energy Stock (NEE)

The bottom Line

The future outlook is that the earnings are expected to boost by $4 billion in the upcoming two quarters due to the financial health of BAC.

The low default rate and higher credit scores of consumers helped the bank stay resilient during a pessimist market condition.

With the development of solid policies after the 2008 crisis, Bank of America designed policies to avoid any future financial crunch by extending loans to financially strong consumers.

So, it is essential to look at the solid financial position of this diversified financial institution and take advantage of this bullish stock in a pessimist market condition.

Read Also: What Happened to Netflix Stock? 'Stranger Things' About the Netflix Stock Drop in 2022 and Goog Earnings in the Second Quarter 2022

Bank of America Stock Price Today is just at the lowest level. It is the best time to invest in this second largest bank in America. Many investors might be hunting the high-value stocks to make high returns even when the pessimism prevails.

When inflation is getting out of control and the Fed is adopting aggressive interest hike policies to cool down the overheated economy, the Bank of America manages to surprise many in the stock market.

In this case, many consumer-oriented stocks are causing a recession-like situation. But, the banks are profiting from these high rates of interest rates.

Read Also: Should You Buy Tesla Stock? Will Meta Stock Go Up? and Is BBY A Buy or Sell? Is Best Buy still the Best Buy For Investors?

So, invest in these banks. You can become a partner in their earnings and get a good slice of their earnings and revenues in the form of dividends during this challenging economic situation.

Besides, you can take advantage of the lowest price of this stock by buying this high-value stock at the dip and enjoy returns when the economy recovers again.

Also check the Sempra Energy Stock Analysis, SRE Stock Forecast, NRG Energy Stock and Microsoft (MSFT)

Bank of America Profile

Based in North Carolina, Bank of America was established in 1998 by merging Banks America and NationsBank in 1998.

Following JP Morgan, this second-largest financial institution in the United States has also become in the limelight for many lawsuits and controversies.

Primarily, the world's fourth largest bank provides services in the domain of commercial banking, wealth management and investment banking.

Read Also: IS VISA STOCK A BUY? WHY & WHY NOT? and Why is Apple Dividend So Low?

Bank of America is a publicly traded company offering a spectrum of financial services. It is traded with the ticker symbol of BAC on the NYSE. It is also a significant component of S& P 100 and S & P 500.

Serving globally, this financial institution assists its clients through its 4600 retail financial centers and 16 200 ATMs in the United States. Online mobile banking has made customer service more convenient, efficient and secure.

Bank of America Stock Price Today

Bank of America's share price is at the nearest of its the lowest level. The current share price is 33.76 USD.

This price is closest to the 52-week lowest price, 29.67 USD. The highest 52-week price went as high as 50.11 USD.

If we look at the competitors of the BAC, we can observe that the price of this bank share is still higher comparatively, and it fell by 27.61% this year.

The share price of J.P Morgan Chase & Co has also fallen sharply by 29.03%. On the other hand, the share price of Wells Fargo has fallen only by 14.90%.

Although the prices of shares are going down but the financial position witnessed solid results.

Last week, BAC published their second-quarter earnings, and they just made headlines due to their dropped profits and surging revenues at the same time. A sharp fall of 32% in the profits was attributed to the regulatory matters of BAC.

On the other hand, the revenues climbed up to 5.6% due to the resilient consumer spending and deposit balances.

Distributing $2.7 billion back to shareholders, the BAC reported earnings per share of $0.78 against the expectations of $0.75, slightly beating the market expectations.

What caused the revenues to grow in such pessimism when consumers buy fewer home mortgages and get fewer car loans due to the higher interest costs?

Check out: Why is Dominion Energy Stock Dropping? Is it Still Safe to Invest?

Surprisingly, the higher interest rates spiked up the BAC's revenues due to the higher bank deposits and the loan growth.

BAC appreciates the consumers with higher credit scores. It helps reduce the risk of defaults and maintains a solid loan growth.

The CFO, Alastair Borthwick, appeared optimistic last week about the third quarter earnings and expected the revenue to climb by 900 million or $ 1 billion due to the wide net interest differential and the loan surge.

Besides, you can check the high-dividend paying stocks like Edison International Stock, a stock to hold in recession and NextEra Energy Stock (NEE)

The bottom Line

The future outlook is that the earnings are expected to boost by $4 billion in the upcoming two quarters due to the financial health of BAC.

The low default rate and higher credit scores of consumers helped the bank stay resilient during a pessimist market condition.

With the development of solid policies after the 2008 crisis, Bank of America designed policies to avoid any future financial crunch by extending loans to financially strong consumers.

So, it is essential to look at the solid financial position of this diversified financial institution and take advantage of this bullish stock in a pessimist market condition.

Read Also: What Happened to Netflix Stock? 'Stranger Things' About the Netflix Stock Drop in 2022 and Goog Earnings in the Second Quarter 2022