Introduction

Amazon.com is one of the largest e-commerce companies in the world, operating in around 20 countries. Jeff Bezos founded it on 5 July 1994; initially, it was an online marketplace for books, and later, the company has included many other products in its seller list. On 15 May 1997, Amazon issued its IPO at $18 per share, trading under the NASDAQ stock exchange with the symbol AMZN. Amazon has many subsidiary companies, including Zoox, Kuiper System, Amazon Lab126, Amazon Web Service, and many more.

Why Should You Know About Amazon Stock?

As the world is getting digitalized, it is crucial for us to know the latest trends so that we can get benefit from those trends. And it is critical in this uncertain world to build savings, protect money from inflation and taxes, and maximize income from investment, so Amazon stock could be the best option to secure your future. Moreover, Covid-19 has transformed all the business models worldwide and compelled businesses to do online trading. So, most companies use the online marketplace to sell and buy their products rather than develop their websites, and among them, most of these companies have chosen Amazon for their businesses. Along with these, it ranked as the top U.S. e-commerce market having a share of 36.9 % of the U.S. market, followed by Walmart (5.3%) and eBay (4.7%).

Companies Having Shared in Amazon

Many companies across the world have shared on Amazon. However, the following three companies have the highest numbers of shares on Amazon:

Advisor Group Inc.

Advisor Group Inc. is a brokerage company that provides financial services like asset management, investment advisory, and other services. Moreover, it has one of the world's largest networks of independent wealth management firms. According to the report, Advisor Group holds 7.1% of Amazon shares which becomes 35.4 million shares in numbers.

Vanguard Group Inc.

Vanguard Group Inc. is a mutual fund and ETF management company having $6.2 trillion under management (AUM) on 31 January 2020. It holds 33.0 million shares of Amazon or 6.6% of outstanding shares.

BlackRock Inc.

BlackRock Inc. is a mutual fund and ETF management company having $6.47 trillion in assets under management (AUM). It is considered one of the most prominent asset managers in the world. The firm owns 27.0 million shares of Amazon, which becomes 5.4% of all outstanding shares.

Why Should You Invest in Amazon Stock?

There are many reasons to invest in amazon however following are some solid reasons to invest in it:

- As the online shopping trend is getting popular all around the world, so, Amazon is getting benefits from this global shift.

- Amazon Web Service (AWS) provides a cloud computing platform for the company to perform its tasks. Companies like Netflix, Twitch, LinkedIn, Facebook, BBC, ESPN, Etc., use AWS services to run their operations. As its revenue is growing above 30%, and profit is up to 57%, so it means that it has a high potential to grow.

- Amazon has many subsidiary companies; if even one company has downfalls, the growth of other companies will compensate for this downfall. So, there is very little chance of bearing the loss.

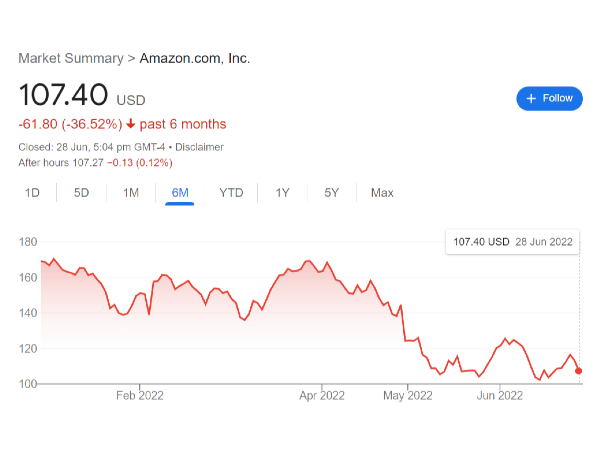

- The more compelling and attractive reason to buy Amazon stock, it is cheaper than in years. The company has been in a market sell-off, so the stock price is down from its highs.

- According to the Bank of America survey, 58% of online shoppers start their search on Amazon, and 25% start their search on Google. Finally, 58% of those shoppers, 76% to 100%, do their shopping on Amazon. It shows that Amazon's customers are loyal, and there is a high probability of increasing these numbers.

- In addition, Amazon prime member revenue is growing at a special rate, and according to Bank of America, 75% of current prime members are not likely to cancel their membership. Most importantly, 24% of these members have the intention to spend more on Amazon.

- According to the report, Amazon is working with 12 luxury brands to develop a platform for luxury retail items, and it will be a separate section of Amazon, where retailers will be allowed to customize the style and layout of their items. According to the report, it will be a significant category for Amazon to tap.

- Ecommerce is still in its initial stage of growth with a market share of 19.1% of total retail sales compared to traditional sales. And it is forecasted that eCommerce will still grow in the future. It is also a fact that eCommerce has captured 50% of the U.S. retail market, and the trend indicates flourishing and growing in magnitude in the future.

- Among the top 50 financial analysts of Wall Street, 48 forecast to growth of Amazon stock or recommend buying; however, the remaining two give Amazon Stock a "hold" rating.

- The final reason to buy Amazon stock is its highly qualified staff who have years of experience in business and know how to tackle the hindrance and flourish the business.

For more stocks information click the link below

https://www.stockbossup.com/main/myProfile

Introduction

Amazon.com is one of the largest e-commerce companies in the world, operating in around 20 countries. Jeff Bezos founded it on 5 July 1994; initially, it was an online marketplace for books, and later, the company has included many other products in its seller list. On 15 May 1997, Amazon issued its IPO at $18 per share, trading under the NASDAQ stock exchange with the symbol AMZN. Amazon has many subsidiary companies, including Zoox, Kuiper System, Amazon Lab126, Amazon Web Service, and many more.

Why Should You Know About Amazon Stock?

As the world is getting digitalized, it is crucial for us to know the latest trends so that we can get benefit from those trends. And it is critical in this uncertain world to build savings, protect money from inflation and taxes, and maximize income from investment, so Amazon stock could be the best option to secure your future. Moreover, Covid-19 has transformed all the business models worldwide and compelled businesses to do online trading. So, most companies use the online marketplace to sell and buy their products rather than develop their websites, and among them, most of these companies have chosen Amazon for their businesses. Along with these, it ranked as the top U.S. e-commerce market having a share of 36.9 % of the U.S. market, followed by Walmart (5.3%) and eBay (4.7%).

Companies Having Shared in Amazon

Many companies across the world have shared on Amazon. However, the following three companies have the highest numbers of shares on Amazon:

Advisor Group Inc.

Advisor Group Inc. is a brokerage company that provides financial services like asset management, investment advisory, and other services. Moreover, it has one of the world's largest networks of independent wealth management firms. According to the report, Advisor Group holds 7.1% of Amazon shares which becomes 35.4 million shares in numbers.

Vanguard Group Inc.

Vanguard Group Inc. is a mutual fund and ETF management company having $6.2 trillion under management (AUM) on 31 January 2020. It holds 33.0 million shares of Amazon or 6.6% of outstanding shares.

BlackRock Inc.

BlackRock Inc. is a mutual fund and ETF management company having $6.47 trillion in assets under management (AUM). It is considered one of the most prominent asset managers in the world. The firm owns 27.0 million shares of Amazon, which becomes 5.4% of all outstanding shares.

Why Should You Invest in Amazon Stock?

There are many reasons to invest in amazon however following are some solid reasons to invest in it:

For more stocks information click the link below https://www.stockbossup.com/main/myProfile