Will Nike Stock Recover?

Nike is an American multinational corporation that designs, develops, manufactures and markets footwear, apparel, equipment and services worldwide.

Nike is the world’s largest supplier of athletic shoes and apparel. It operates in Europe, Africa, Middle East, North America, Greater China, Asia pacific and Latin America.

Stock analysts have low earnings expectations for Nike, just two weeks ahead of its Q1 2023 report expected to be released on 29/09/2022. It is easy to understand their position, as Nike stock has plummeted over the year, owing to macro and supply chain headwinds.

Consumers have been experiencing increased inflationary pressure, which has led to weak consumer spending especially in China, one of Nike’s largest markets, at 20%. Additionally, consumers have been trading down from the brand significantly

With the high inflation rates, majority of Nike consumers have been unable to adapt, unlike the more resilient high-end consumers. However, most of the headwinds are short-term concerns, which may not affect the bigger picture of Nike’s growth trajectory.

Increased easing of near-term headwinds

In the last month, port congestion conditions and supply chain visibility has improved. We should note that the record high rate hikes amid high inflation had a significant effect on consumers demand. This is the main factor that led to an ease in the supply chain level.

Inflation has been on the rise due to pressure in the global goods industry. The good news is that this may soon be off the way. However, the bad news is that it may be a little too late as the consumers demand for discretionary goods is on a downhill trend. This is a contributing factor to a recession risk.

Conditions may look soon look up, as China is emerging from post-covid effects and supply chain disruptions. The revenue decline by 19.2% YoY in Nike quarter 4, 2022 earnings was mainly caused by the China consumer and supply woes.

Earlier last month, Alibaba produced a positive earnings commentary, indicating that it expects an upward trajectory in revenue growth through 2023. This is great news for Nike, given its long-term strategy in the China market. Nike is set to benefit from the recovery of China’s consumer appetite.

Why conditions should soon improve for Nike

We cannot overemphasize the important role of Nike’s strong leadership in steering the company towards recovery and growth. According to management, Nike is continually investing to establish itself as a market leader, a move that will ultimately cause pullbacks from competitors.

With a futuristic strategy at hand, we expect an increase in market share for Nike that will lead to increased revenue.

As we expect Nike’s revenue growth to improve, it will bring along operating leverage gains for the company. Nike has a consumer-led digital transformation that is expected to increase growth and value in the long-term.

Currently, its digital business brings in over $10 billion in revenue, 24% of the company’s total revenue. Nike commits to accelerate direct consumer connections, to improve consumer experience. By embracing latest tech trends such as apps in their operations to reach a wider audience, Nike is set to remain in demand in the long-term.

Nike latest statistics

The current projection for Q1 2023 earnings report is $0.89 per share and price target of $136.42. Nike has a debt-to-equity ratio of 0.58, current ratio of 2.63, P/E ratio 29.51 and beta of 1.03. Its market cap stands at $174.06 billion.

In insider trading, Nike CFO Matthew Friend made a stock sale worth $469,445. He sold 4,139 shares on the 3rd of August. After the sale, the CFO now directly owns 56,539 shares of Nike stock, with a current value of $6,412,653.

Recently, Nike announced a quarterly dividend to be paid on 3rd of October. On 6th September, investors of record received a dividend of $0.305 per share. Nike’s dividend yield is 1.10%.

Final Thought

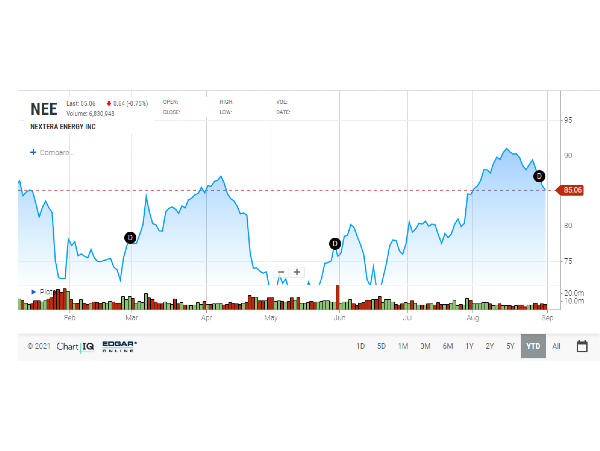

In June/July, Nike retracted to its 50-month moving average, attracting long-term dip buyers. The long-term bottom in the consumer discretionary ETF is an advantage for Nike. Its valuation is attractive, since it last traded at a free cash flow yield of over 4%, compared to an all-time average of 3.4%.

Although Nike’s performance has been far from satisfactory, improved consumer and supply chain conditions in China will help to narrow the gap. This would mean that the short-term challenges faced by Nike in the past seven months could soon be forgotten.

Additionally, it is highly likely that the market has priced the headwinds, which are not expected to worsen. With an attractive valuation and price action, Nike is on the way to fully recover and make profits.

Nike has a good earnings record and its shares have awarded investors overtime. Additionally, it is a market leader in apparel and with its innovation; it is set to remain at the top of the game. As a long-term investor, don’t expect Nike stock to gain overnight. Expect that the company’s strong earnings will increase the stock value as it has proven to do in the past.

Will Nike Stock Recover?

Nike is an American multinational corporation that designs, develops, manufactures and markets footwear, apparel, equipment and services worldwide.

Nike is the world’s largest supplier of athletic shoes and apparel. It operates in Europe, Africa, Middle East, North America, Greater China, Asia pacific and Latin America.

Stock analysts have low earnings expectations for Nike, just two weeks ahead of its Q1 2023 report expected to be released on 29/09/2022. It is easy to understand their position, as Nike stock has plummeted over the year, owing to macro and supply chain headwinds.

Consumers have been experiencing increased inflationary pressure, which has led to weak consumer spending especially in China, one of Nike’s largest markets, at 20%. Additionally, consumers have been trading down from the brand significantly

With the high inflation rates, majority of Nike consumers have been unable to adapt, unlike the more resilient high-end consumers. However, most of the headwinds are short-term concerns, which may not affect the bigger picture of Nike’s growth trajectory.

Increased easing of near-term headwinds

In the last month, port congestion conditions and supply chain visibility has improved. We should note that the record high rate hikes amid high inflation had a significant effect on consumers demand. This is the main factor that led to an ease in the supply chain level.

Inflation has been on the rise due to pressure in the global goods industry. The good news is that this may soon be off the way. However, the bad news is that it may be a little too late as the consumers demand for discretionary goods is on a downhill trend. This is a contributing factor to a recession risk.

Conditions may look soon look up, as China is emerging from post-covid effects and supply chain disruptions. The revenue decline by 19.2% YoY in Nike quarter 4, 2022 earnings was mainly caused by the China consumer and supply woes.

Earlier last month, Alibaba produced a positive earnings commentary, indicating that it expects an upward trajectory in revenue growth through 2023. This is great news for Nike, given its long-term strategy in the China market. Nike is set to benefit from the recovery of China’s consumer appetite.

Why conditions should soon improve for Nike

We cannot overemphasize the important role of Nike’s strong leadership in steering the company towards recovery and growth. According to management, Nike is continually investing to establish itself as a market leader, a move that will ultimately cause pullbacks from competitors.

With a futuristic strategy at hand, we expect an increase in market share for Nike that will lead to increased revenue. As we expect Nike’s revenue growth to improve, it will bring along operating leverage gains for the company. Nike has a consumer-led digital transformation that is expected to increase growth and value in the long-term.

Currently, its digital business brings in over $10 billion in revenue, 24% of the company’s total revenue. Nike commits to accelerate direct consumer connections, to improve consumer experience. By embracing latest tech trends such as apps in their operations to reach a wider audience, Nike is set to remain in demand in the long-term.

Nike latest statistics

The current projection for Q1 2023 earnings report is $0.89 per share and price target of $136.42. Nike has a debt-to-equity ratio of 0.58, current ratio of 2.63, P/E ratio 29.51 and beta of 1.03. Its market cap stands at $174.06 billion.

In insider trading, Nike CFO Matthew Friend made a stock sale worth $469,445. He sold 4,139 shares on the 3rd of August. After the sale, the CFO now directly owns 56,539 shares of Nike stock, with a current value of $6,412,653.

Recently, Nike announced a quarterly dividend to be paid on 3rd of October. On 6th September, investors of record received a dividend of $0.305 per share. Nike’s dividend yield is 1.10%.

Final Thought

In June/July, Nike retracted to its 50-month moving average, attracting long-term dip buyers. The long-term bottom in the consumer discretionary ETF is an advantage for Nike. Its valuation is attractive, since it last traded at a free cash flow yield of over 4%, compared to an all-time average of 3.4%.

Although Nike’s performance has been far from satisfactory, improved consumer and supply chain conditions in China will help to narrow the gap. This would mean that the short-term challenges faced by Nike in the past seven months could soon be forgotten.

Additionally, it is highly likely that the market has priced the headwinds, which are not expected to worsen. With an attractive valuation and price action, Nike is on the way to fully recover and make profits.

Nike has a good earnings record and its shares have awarded investors overtime. Additionally, it is a market leader in apparel and with its innovation; it is set to remain at the top of the game. As a long-term investor, don’t expect Nike stock to gain overnight. Expect that the company’s strong earnings will increase the stock value as it has proven to do in the past.