The bear market in 2022 has provided opportunities to buy solid companies at a discount. Fears about a recession and rising interest rates have punished equities. Although painful for existing buy-and-hold shareholders, investors can take this opportunity to add to holdings or start new positions. We seek beaten-down dividend growers suitable for income investors.

Some investors are taking this opportunity to purchase growth stocks, but many people are already overweight these stocks. Additionally, those seeking income must look elsewhere; stocks like Amazon and Google do not pay dividends yet.

Consequently, we screened for stocks in a bear market territory with a yield of more than 3.5%, a payout ratio of less than 65%, and increased the dividend for 10+ years. We further narrowed the list by requiring a price-to-earnings ratio of less than 18X.

Below, we discuss 3 beaten-down dividend growers for income investors.

Affiliate

If you are interested in investing in stocks that pay dividends I recommend signing up for the Sure Dividend Newsletter* . It is a good value and one of the best dividend stock newsletters available. There is a 7-day free trial and grace period so it is risk free. The service provides top 10 stock picks each month with discussion of advantages, valuation, and risks. I highly recommend them and use their insights for my own stock research.

3 Beaten-Down Dividend Growers for Income Investors

Whirlpool (WHR)

Whirlpool was founded in 1911. It is one of the largest appliance designers and manufacturers in the world. Whirlpool sells washing machines, dryers, refrigerators, ice makers, ovens, cooktops, microwaves, ranges, garbage disposals, etc. The leading brands are Whirlpool, Maytag, Hotpoint, KitchenAid, JennAir, Amana, Affresh, Speed Queen, etc.

Whirlpool has grown organically and through acquisitions acting as a consolidator in the industry. Today, some of its main competitors are AB Electrolux of Sweden, Haier of China, LG of South Korea, and Bosch-Siemens of Germany.

The company had revenue of $21,547 million in the last 12 months, with gross margins in the high teens and operating margins of about 10%. Whirlpool is sensitive to the economic cycle, particularly the housing market. Many of its products are bought for new homes, during a sale of an older home, and for renovations. Hence, Whirlpool’s stock price is sensitive to higher interest rates and lower home sales.

Whirlpool has one of the highest dividend yields of the Dividend Contenders at ~4.2%, more than triple the average of the S&P 500 Index. The company has increased the dividend for 12 consecutive years. The growth rate has been ~6.9% in the past five years and ~10.9% in the trailing ten years. The forward payout ratio is low at around 24%, indicating it is safe and pointing to future increases.

Whirlpool’s stock price has declined by nearly 28% year-to-date (YTD), lowering the PE ratio to about 6.9X, below the 5-year and 10-year range. As a result, investors are getting a market leader with a 4%+ yield and low valuation.

T. Rowe Price (TROW)

The second of the beaten-down dividend growers is T. Rowe Price (TROW), a primary player in retirement plans in the US. The company is known for its active mutual funds, mainly its stock and target date funds. The firm is one of the few that people can invest in for asset managers. Many others are not publicly traded or have been acquired in a consolidating industry. In addition, T. Rowe Price offers mutual funds to retail and institutional investors and sub-advisor services to other managers.

Total revenue was about $7,672 in 2021 and $7,708 million in the past twelve months. T. Rowe Price’s revenue and thus earnings depend on its fees because the company earns a percentage of assets under management (AUM). At the end of June 2022, the asset manager had about $1.31 trillion in AUM, down from the high earlier in the year due to market action and net outflows.

T. Rowe Price is a popular Dividend Champion and Dividend Aristocrat because of its 36 annual dividend increases. The firm has sustained a double-digit dividend increase rate with the trailing 10-year growth rate at about 13.3% and the 5-year growth rate at around 14.9%. Furthermore, the dividend is safe with a payout ratio of roughly 34%. Importantly, T. Rowe Price did not cut or suspend its dividend during the dot-com crash or the sub-prime mortgage crisis because it usually maintains a net cash position on the balance sheet.

The stock price is down nearly 38% YTD because of fears of the bear market. Consequently, the valuation has fallen to about 13X after accounting for lower earnings estimates. This value is below the range in the past five years and ten years. Hence, investors are getting an undervalued stock yielding more than 4%.

Walgreens Boots Alliance (WBA)

Walgreens Boots Alliance (WBA), a pharmacy retailer founded in 1901 is the third of the beaten-down dividend growers. The company operates globally in nine countries through the Walgreens, Duane Reade, Boots, Benavides, and Ahumada brands. Walgreens has nearly 9,000 stores in the US and 4,000+ stores internationally. Walgreens sells prescription and over-the-counter drugs and beauty, health, personal care, and food products.

Total revenue was $134,516 million in the last twelve months through the US Pharmacy, US Prescriptions, US Retail, International, and Walgreens Health businesses. The retailer grows organically by selling more items from its stores. Walgreens also expands by adding stores to its network. However, both growth avenues are relatively mature. VillageMD, Shields Health Solutions, and Walgreens Health Corners are the recent growth initiatives.

Walgreens is a long-time dividend growth stock. It has paid an increasing dividend for 47 years, making the company a Dividend Aristocrat and Dividend Champion. The lack of growth and difficulty executing after the merger with Boots caused the dividend yield to rise to ~4.86%. However, the payout ratio is still relatively conservative at ~36%. The dividend growth rate has been ~5.2% in the past 5-years and ~9% in the past decade but is slowing.

That said, Walgreens is trading at a PE ratio of about 7.76X, below the 5-year and 10-year average. As a result, investors are getting a high-yield stock at a bargain valuation.

Thanks for reading 3 Beaten-Down Dividend Growers for Income Investors.

A version of this post by Dividend Power originally appeared in Investor Place and was republished with permission.

*This post contains affiliate links meaning that I earn a commission for any purchases that you make at the Affiliates website through these links. This will not incur additional costs for you. Please read my disclosure for more information.

The bear market in 2022 has provided opportunities to buy solid companies at a discount. Fears about a recession and rising interest rates have punished equities. Although painful for existing buy-and-hold shareholders, investors can take this opportunity to add to holdings or start new positions. We seek beaten-down dividend growers suitable for income investors.

Some investors are taking this opportunity to purchase growth stocks, but many people are already overweight these stocks. Additionally, those seeking income must look elsewhere; stocks like Amazon and Google do not pay dividends yet.

Consequently, we screened for stocks in a bear market territory with a yield of more than 3.5%, a payout ratio of less than 65%, and increased the dividend for 10+ years. We further narrowed the list by requiring a price-to-earnings ratio of less than 18X.

Below, we discuss 3 beaten-down dividend growers for income investors.

Affiliate

If you are interested in investing in stocks that pay dividends I recommend signing up for the Sure Dividend Newsletter* . It is a good value and one of the best dividend stock newsletters available. There is a 7-day free trial and grace period so it is risk free. The service provides top 10 stock picks each month with discussion of advantages, valuation, and risks. I highly recommend them and use their insights for my own stock research.

3 Beaten-Down Dividend Growers for Income Investors

Whirlpool (WHR)

Whirlpool was founded in 1911. It is one of the largest appliance designers and manufacturers in the world. Whirlpool sells washing machines, dryers, refrigerators, ice makers, ovens, cooktops, microwaves, ranges, garbage disposals, etc. The leading brands are Whirlpool, Maytag, Hotpoint, KitchenAid, JennAir, Amana, Affresh, Speed Queen, etc.

Whirlpool has grown organically and through acquisitions acting as a consolidator in the industry. Today, some of its main competitors are AB Electrolux of Sweden, Haier of China, LG of South Korea, and Bosch-Siemens of Germany.

The company had revenue of $21,547 million in the last 12 months, with gross margins in the high teens and operating margins of about 10%. Whirlpool is sensitive to the economic cycle, particularly the housing market. Many of its products are bought for new homes, during a sale of an older home, and for renovations. Hence, Whirlpool’s stock price is sensitive to higher interest rates and lower home sales.

Whirlpool has one of the highest dividend yields of the Dividend Contenders at ~4.2%, more than triple the average of the S&P 500 Index. The company has increased the dividend for 12 consecutive years. The growth rate has been ~6.9% in the past five years and ~10.9% in the trailing ten years. The forward payout ratio is low at around 24%, indicating it is safe and pointing to future increases.

Whirlpool’s stock price has declined by nearly 28% year-to-date (YTD), lowering the PE ratio to about 6.9X, below the 5-year and 10-year range. As a result, investors are getting a market leader with a 4%+ yield and low valuation.

Source: Portfolio Insight*

T. Rowe Price (TROW)

The second of the beaten-down dividend growers is T. Rowe Price (TROW), a primary player in retirement plans in the US. The company is known for its active mutual funds, mainly its stock and target date funds. The firm is one of the few that people can invest in for asset managers. Many others are not publicly traded or have been acquired in a consolidating industry. In addition, T. Rowe Price offers mutual funds to retail and institutional investors and sub-advisor services to other managers.

Total revenue was about $7,672 in 2021 and $7,708 million in the past twelve months. T. Rowe Price’s revenue and thus earnings depend on its fees because the company earns a percentage of assets under management (AUM). At the end of June 2022, the asset manager had about $1.31 trillion in AUM, down from the high earlier in the year due to market action and net outflows.

T. Rowe Price is a popular Dividend Champion and Dividend Aristocrat because of its 36 annual dividend increases. The firm has sustained a double-digit dividend increase rate with the trailing 10-year growth rate at about 13.3% and the 5-year growth rate at around 14.9%. Furthermore, the dividend is safe with a payout ratio of roughly 34%. Importantly, T. Rowe Price did not cut or suspend its dividend during the dot-com crash or the sub-prime mortgage crisis because it usually maintains a net cash position on the balance sheet.

The stock price is down nearly 38% YTD because of fears of the bear market. Consequently, the valuation has fallen to about 13X after accounting for lower earnings estimates. This value is below the range in the past five years and ten years. Hence, investors are getting an undervalued stock yielding more than 4%.

Source: Portfolio Insight*

Walgreens Boots Alliance (WBA)

Walgreens Boots Alliance (WBA), a pharmacy retailer founded in 1901 is the third of the beaten-down dividend growers. The company operates globally in nine countries through the Walgreens, Duane Reade, Boots, Benavides, and Ahumada brands. Walgreens has nearly 9,000 stores in the US and 4,000+ stores internationally. Walgreens sells prescription and over-the-counter drugs and beauty, health, personal care, and food products.

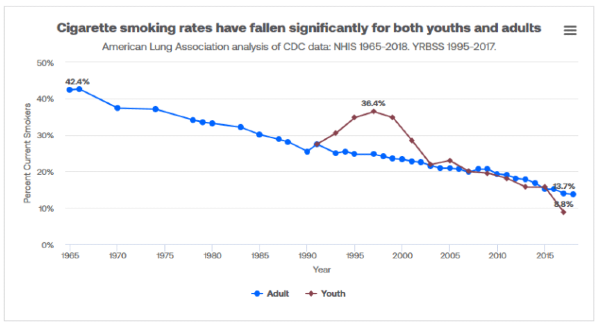

Total revenue was $134,516 million in the last twelve months through the US Pharmacy, US Prescriptions, US Retail, International, and Walgreens Health businesses. The retailer grows organically by selling more items from its stores. Walgreens also expands by adding stores to its network. However, both growth avenues are relatively mature. VillageMD, Shields Health Solutions, and Walgreens Health Corners are the recent growth initiatives.

Walgreens is a long-time dividend growth stock. It has paid an increasing dividend for 47 years, making the company a Dividend Aristocrat and Dividend Champion. The lack of growth and difficulty executing after the merger with Boots caused the dividend yield to rise to ~4.86%. However, the payout ratio is still relatively conservative at ~36%. The dividend growth rate has been ~5.2% in the past 5-years and ~9% in the past decade but is slowing.

That said, Walgreens is trading at a PE ratio of about 7.76X, below the 5-year and 10-year average. As a result, investors are getting a high-yield stock at a bargain valuation.

Source: Portfolio Insight*

Thanks for reading 3 Beaten-Down Dividend Growers for Income Investors.

A version of this post by Dividend Power originally appeared in Investor Place and was republished with permission.

*This post contains affiliate links meaning that I earn a commission for any purchases that you make at the Affiliates website through these links. This will not incur additional costs for you. Please read my disclosure for more information.

Originally Posted on dividendpower.org