The year of 2023 has already started in turbulent mode. The S&P 500 is up almost 4%, as inflation appears to have cooled on earlier reports. However, I think the economy is being overlooked, as I predict we are still in for a rude awakening.

Given the rise of the stock market this year, so far, this makes it more fun to find undervalued, dividend growth stocks to buy. Today, I wanted to cover United Parcel Service (UPS) to see if they can deliver dividends in 2023!

United Parcel Service (UPS)

At over $150 Billion in market capitalization, UPS is a global leader in the shipping and logistics business. We all know them from the brown trucks and uniforms the employee wears; as well as seeing them roar up and down your streets during the holiday time frames.

Did you know that UPS is on the path to generate almost $100 billion in revenue from 2022? They made $73.3 billion through 9 months and I predict the 4th quarter will be between $24 billion and $27 billion, pushing them closer to the $100 billion mark.

Costs, like everyone else, are up, but so are revenues. In fact, They made $4 billion more in revenue through 9 months than in 2021’s first 9 months. Net income, though is slightly down due to far less investment income in 2022 vs 2021, i.e. the stock market drop, as the amount is $3.3 billion lower. than 2021.

Net income is still $8 billion on that revenue, equating to a profit margin well over 10%. Therefore, I still love UPS’ business model, the value they bring to their customer base and their ability to weather inflation successfully.

The stock is still down 12% in the last 52 weeks. Therefore, they are down by ~2% more than the broad S&P 500 / stock market, which is down just over 9%.

During this potential recession and rising inflation, I do want to see what UPS balance sheet looks like. You want to look for liquidity – higher cash reserves, a strong ability to pay current debts and a declining long-term debt balance. Having these types of metrics would allow most companies to remain flexible to change business plans in a difficult economy.

UPS definitely fits the bill. As of September 30, 2022, UPS had $11 billion of cash and equivalents, up from prior year. Not only that, their current obligations represent only $17.7 billion against $24.6 billion of current assets. This represents a current ratio of 1.4x, well over the 1x that I strive to see.

Long-term debt is something you need to watch out for. If companies are adding long-term debt to their balance sheet in this higher-interest rate environment, then this puts a strangle on cash flow as they have to use revenues/receipts generated to pay off high interest rate debt. UPS does not need to worry about that. UPS long-term debt is declining, actually, and is down $2 billion or 10% from September of 2021. They are heading in the right direction, say the least.

Therefore, with strong financial performance, a growing top line and a fairly clean and liquid balance sheet, is UPS a great dividend growth stock? Is it time to buy UPS stock in 2023? Okay, now let’s dive in to what you are here for – the dividend stock metrics through – the Dividend Diplomat Stock Screener baby!

UPS dividend stock metrics

UPS, you are going through the Dividend Diplomat Stock Screener! Here, we focus on 3 main dividend stock metrics:

1.) Price to Earnings Ratio (P/E): We look for the price to earnings ratio < the S&P 500 and the competition.

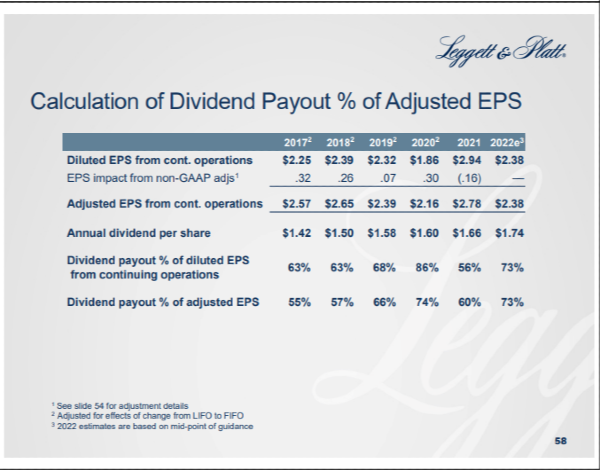

2.) Dividend Payout Ratio: The preferred dividend payout ratio is < 60%. In fact, we believe the perfect payout ratio is between 40% and 60%.

3.) Dividend Growth Rate: Given we are dividend investing on our way to financial freedom, as we believe dividend income is the best source of passive income, we look at the 5 year dividend growth rate. In addition, we review how many years the company has increased their dividend.

1.) P/E Ratio: Analysts are expecting earnings over $12 for 2023. This shows UPS has a P/E ratio of 14.6x earnings, which is a sign of undervaluation against the market as a whole.

2.) Dividend Payout Ratio: They pay a solid $1.52 dividend per share, per quarter. UPS has a payout ratio in our perfect payout ratio sweet spot, right at 50%. UPS, therefore, invests 50% of earnings back into the company and sends out the other 50% to their shareholders, by way of dividends. Safety in the dividend and UPS can continue to grow their payout.

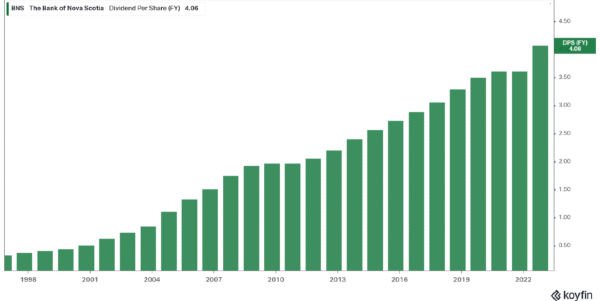

3.) Dividend Growth Rate: 13 years going strong for UPS! Look at the chart below, slow and steady, but then the big pop in 2022 thanks to the almost 50% increase. UPS has increased their dividend at a conservative 6%+ clip, I’ll take it.

Lastly, we’ll take a look at the dividend yield. As an investor, you want to know how much owning this dividend stock pays you now! The yield for UPS is at 3.41%. Not the highest yielding dividend stock, given the current market, but a fairly decent kickback to shareholders.

is UPS Stock a Stock to buy now?

Now that we’ve gone through the metrics, is UPS a stock to buy for the dividend stock portfolio?

I love UPS stock (UPS). In fact, I like them a lot at < $175 per share. That’s where I’ll be looking for them to add more to my dividend stock portfolio. I would not mind owning 100 shares of this mega cap stock. My current share count is 63, so I have a ways to go.

If you head over to our YouTube channel, you’ll find other undervalued dividend growth stocks that are higher on my list for stocks to buy now!

How about you? Do you own UPS stock? Are you finding it hard to find an undervalued stock, as the stock market has been showing green in 2023? Share your comments and feedback below!

As always, thanks for stopping by, good luck and happy investing!

-Lanny

The year of 2023 has already started in turbulent mode. The S&P 500 is up almost 4%, as inflation appears to have cooled on earlier reports. However, I think the economy is being overlooked, as I predict we are still in for a rude awakening.

Given the rise of the stock market this year, so far, this makes it more fun to find undervalued, dividend growth stocks to buy. Today, I wanted to cover United Parcel Service (UPS) to see if they can deliver dividends in 2023!

United Parcel Service (UPS)

At over $150 Billion in market capitalization, UPS is a global leader in the shipping and logistics business. We all know them from the brown trucks and uniforms the employee wears; as well as seeing them roar up and down your streets during the holiday time frames.

Did you know that UPS is on the path to generate almost $100 billion in revenue from 2022? They made $73.3 billion through 9 months and I predict the 4th quarter will be between $24 billion and $27 billion, pushing them closer to the $100 billion mark.

Costs, like everyone else, are up, but so are revenues. In fact, They made $4 billion more in revenue through 9 months than in 2021’s first 9 months. Net income, though is slightly down due to far less investment income in 2022 vs 2021, i.e. the stock market drop, as the amount is $3.3 billion lower. than 2021.

Net income is still $8 billion on that revenue, equating to a profit margin well over 10%. Therefore, I still love UPS’ business model, the value they bring to their customer base and their ability to weather inflation successfully.

The stock is still down 12% in the last 52 weeks. Therefore, they are down by ~2% more than the broad S&P 500 / stock market, which is down just over 9%.

During this potential recession and rising inflation, I do want to see what UPS balance sheet looks like. You want to look for liquidity – higher cash reserves, a strong ability to pay current debts and a declining long-term debt balance. Having these types of metrics would allow most companies to remain flexible to change business plans in a difficult economy.

UPS definitely fits the bill. As of September 30, 2022, UPS had $11 billion of cash and equivalents, up from prior year. Not only that, their current obligations represent only $17.7 billion against $24.6 billion of current assets. This represents a current ratio of 1.4x, well over the 1x that I strive to see.

Long-term debt is something you need to watch out for. If companies are adding long-term debt to their balance sheet in this higher-interest rate environment, then this puts a strangle on cash flow as they have to use revenues/receipts generated to pay off high interest rate debt. UPS does not need to worry about that. UPS long-term debt is declining, actually, and is down $2 billion or 10% from September of 2021. They are heading in the right direction, say the least.

Therefore, with strong financial performance, a growing top line and a fairly clean and liquid balance sheet, is UPS a great dividend growth stock? Is it time to buy UPS stock in 2023? Okay, now let’s dive in to what you are here for – the dividend stock metrics through – the Dividend Diplomat Stock Screener baby!

UPS dividend stock metrics

UPS, you are going through the Dividend Diplomat Stock Screener! Here, we focus on 3 main dividend stock metrics:

1.) Price to Earnings Ratio (P/E): We look for the price to earnings ratio < the S&P 500 and the competition.

2.) Dividend Payout Ratio: The preferred dividend payout ratio is < 60%. In fact, we believe the perfect payout ratio is between 40% and 60%.

3.) Dividend Growth Rate: Given we are dividend investing on our way to financial freedom, as we believe dividend income is the best source of passive income, we look at the 5 year dividend growth rate. In addition, we review how many years the company has increased their dividend.

1.) P/E Ratio: Analysts are expecting earnings over $12 for 2023. This shows UPS has a P/E ratio of 14.6x earnings, which is a sign of undervaluation against the market as a whole.

2.) Dividend Payout Ratio: They pay a solid $1.52 dividend per share, per quarter. UPS has a payout ratio in our perfect payout ratio sweet spot, right at 50%. UPS, therefore, invests 50% of earnings back into the company and sends out the other 50% to their shareholders, by way of dividends. Safety in the dividend and UPS can continue to grow their payout.

3.) Dividend Growth Rate: 13 years going strong for UPS! Look at the chart below, slow and steady, but then the big pop in 2022 thanks to the almost 50% increase. UPS has increased their dividend at a conservative 6%+ clip, I’ll take it.

Lastly, we’ll take a look at the dividend yield. As an investor, you want to know how much owning this dividend stock pays you now! The yield for UPS is at 3.41%. Not the highest yielding dividend stock, given the current market, but a fairly decent kickback to shareholders.

is UPS Stock a Stock to buy now?

Now that we’ve gone through the metrics, is UPS a stock to buy for the dividend stock portfolio?

I love UPS stock (UPS). In fact, I like them a lot at < $175 per share. That’s where I’ll be looking for them to add more to my dividend stock portfolio. I would not mind owning 100 shares of this mega cap stock. My current share count is 63, so I have a ways to go.

If you head over to our YouTube channel, you’ll find other undervalued dividend growth stocks that are higher on my list for stocks to buy now!

How about you? Do you own UPS stock? Are you finding it hard to find an undervalued stock, as the stock market has been showing green in 2023? Share your comments and feedback below!

As always, thanks for stopping by, good luck and happy investing!

-Lanny

Originally Posted in Dividend Diplomats