Published January 5th, 2023 by Jonathan Weber

Enbridge Inc. (ENB) is a Canadian energy infrastructure company that offers a high dividend yield of more than 6% at current prices. While its valuation is not the lowest in the midstream space, the valuation is still reasonable and justified by Enbridge’s higher-than-average quality.

It is one of the high-yield stocks in our database.

We have created a spreadsheet of stocks (and closely related REITs and MLPs, etc.) with dividend yields of 5% or more.

You can download your free full list of all securities with 5%+ yields (along with important financial metrics such as dividend yield and payout ratio) by clicking on the link below:

Click here to instantly download your free high dividend stocks spreadsheet now, along with important investing metrics.

In this article, we will analyze the prospects of Enbridge.

Business Overview

Enbridge was founded in 1949 and is headquartered in Calgary, Canada. The company is an energy midstream and infrastructure player that operates with a focus on moving oil and gas from production areas to end markets. Enbridge also has a smaller, but growing renewable energy business on top of that.

Enbridge has exhibited healthy business growth in recent years. Cash flow-per-share has risen during every year of the last decade, except for 2017, when cash flow-per-share declined by around 15% versus the previous year. 2022 was a strong year for the company, as Enbridge posted a new cash flow-per-share high of $3.91, and the company’s management forecasts that 2023 will be even stronger.

During the most recent quarter, Enbridge saw its results improve once again on a year-over-year basis. Revenues improved, partially due to higher commodity prices, partially due to higher rates on fee-based contracts, and partially due to higher transportation volumes. The fact that Enbridge placed new projects into service over the last year helped boost its transportation volumes.

On the back of the company’s revenue growth, Enbridge was able to grow its EBITDA by 15% during the third quarter, to CAD$3.8 billion. Growth in USD was less pronounced due to currency rate changes, however. Enbridge’s distributable cash flow (DCF) rose by 10% on a per share basis during the quarter, rising to US$0.89 for the period.

Management has forecasted that distributable cash flows will come in around CAD$5.20 to CAD$5.50 per share in fiscal 2022 (the year has ended, but Q4 results have not been announced yet). That’s equal to around US$4.00 per share, which would be a new record and up by 2% to 3% versus 2021, which is a solid performance when we consider that a weakening Canadian Dollar was a headwind for Enbridge.

Growth Prospects

Enbridge is not active in a high-growth industry, but that has not stopped the company from delivering compelling and reliable earnings and cash flow growth in the past.

Going forward, there are several factors that should help Enbridge in growing its cash flow-per-share meaningfully. First, the company will benefit from rate increases on existing assets. Some of the company’s contracts with customers for which it moves and stores energy commodities are CPI-linked, which results in automatic revenue growth over the years.

Other contracts are not CPI-linked, but Enbridge can negotiate higher rates over time. In the current energy crisis, many of Enbridge’s customers are highly profitable, which will make it easier for Enbridge to negotiate higher fees for moving oil and similar products.

Enbridge will also benefit from its healthy growth spending. Enbridge has been investing billions of dollars in new assets for years, and it plans to do the same going forward. This includes expansion projects at existing pipelines, the buildout of new storage terminals and export facilities, and also investments in renewable assets such as offshore windparks. Since these investments have worked out well in the past, it seems likely that Enbridge will be able to deliver healthy business growth in the coming years as well by working through its growth backlog.

Last but not least, Enbridge can use some of its surplus cash flows for debt reduction and/or share repurchases. Those measures should have a positive impact on its cash flow-per-share, either via lower interest expenses thanks to debt reduction, or through a declining share count that results in a larger portion of company-wide cash flows for each remaining share.

Competitive Advantages

The energy midstream industry has very high barriers to entry. Building out new pipelines via greenfield projects costs billions of dollars, which means that this industry is not easily disrupted by new market entrants.

Increasing regulation has also resulted in extremely complicated and time-consuming processes when it comes to getting the required approvals for a new pipeline project. Some analysts believe that it is more or less impssible to build an entirely new major pipeline in North America today. That makes Enbridge’s vast asset footprint highly valuable and safe from competition.

Expanding existing pipes is easier and can pay off for Enbridge, but that’s not an option for would-be competitors that don’t have the same pipeline footprint compared to Enbridge.

Enbridge’s large size, healthy balance sheet, and strong track record also result in cost of capital advantages for the company, which makes it even harder for other companies to disrupt Enbridge.

Dividend Analysis

Enbridge started to make dividend payments decades ago. At current prices, Enbridge offers a dividend yield of 6.7% to its owners.

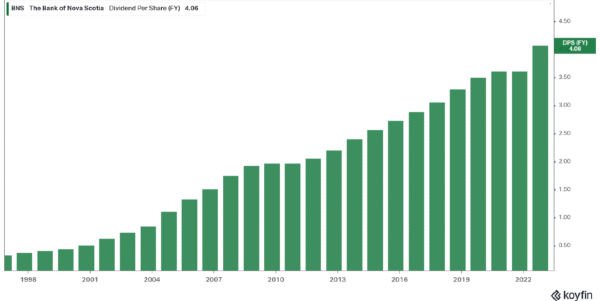

While commodity markets, including oil and natural gas markets, can be highly volatile, Enbridge is relatively insulated from those market movements, as most of its contracts are fee-based. That’s why Enbridge has been able to grow its dividend for an impressive 27 years in a row, despite several oil market crashes over that time frame.

Enbridge’s dividend growth averaged 6% over the last five years, and even more over the last decade. While there is no guarantee that Enbridge’s dividend growth will be at a similar level going forward, we believe that there is a high likelihood of mid-single digit dividend growth, as cash flow per share should continue to climb due to the aforementioned growth drivers.

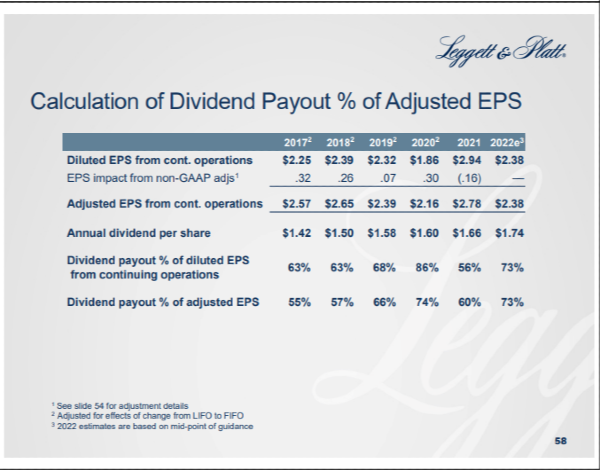

Based on distributable cash flow estimates for 2022, Enbridge currently has a dividend payout ratio of 68%. That’s not especially low, but not overly high either, considering Enbridge is an energy midstream company. The dividend payout ratio has risen marginally over the last five years, as it stood at 66% in 2017.

Between a solid and relatively constant dividend coverage ratio, the non-cyclical nature of Enbridge’s business, and the strong dividend growth track record, we believe that Enbridge’s dividend should be safe for the foreseeable future.

Final Thoughts

Enbridge’s shares have pulled back over the last couple of months, which has made its dividend yield rise to a pretty attractive level of 6.7%. That’s a high dividend yield, and we believe that investors can expect further dividend growth in the coming years as well.

Enbridge is valued at around 10x this year’s expected distributable cash flows right now. While some other midstream names are trading at even lower valuations, Enbridge stands out among its peers due to its scale, geographical diversification, and compelling track record. Its valuation is not the lowest in the peer group, but still attractive on an absolute basis, as shares offer a cash flow yield of roughly 10% at current levels.

Given a solid dividend payout ratio of 68% and a healthy balance sheet, the dividend of Enbridge can be considered safe for the foreseeable future. While Enbridge is not a high-growth company, it is highly likely that the company will deliver some cash flow and dividend growth in the future. Overall, that makes Enbridge look like a compelling income investment.

If you are interested in finding more high-quality dividend growth stocks suitable for long-term investment, the following Sure Dividend databases will be useful:

Thanks for reading this article. Please send any feedback, corrections, or questions to support@suredividend.com.

Image by drpepperscott230 from Pixabay

Published January 5th, 2023 by Jonathan Weber

Enbridge Inc. (ENB) is a Canadian energy infrastructure company that offers a high dividend yield of more than 6% at current prices. While its valuation is not the lowest in the midstream space, the valuation is still reasonable and justified by Enbridge’s higher-than-average quality.

It is one of the high-yield stocks in our database.

We have created a spreadsheet of stocks (and closely related REITs and MLPs, etc.) with dividend yields of 5% or more. You can download your free full list of all securities with 5%+ yields (along with important financial metrics such as dividend yield and payout ratio) by clicking on the link below:

Click here to instantly download your free high dividend stocks spreadsheet now, along with important investing metrics.

In this article, we will analyze the prospects of Enbridge.

Business Overview

Enbridge was founded in 1949 and is headquartered in Calgary, Canada. The company is an energy midstream and infrastructure player that operates with a focus on moving oil and gas from production areas to end markets. Enbridge also has a smaller, but growing renewable energy business on top of that.

Enbridge has exhibited healthy business growth in recent years. Cash flow-per-share has risen during every year of the last decade, except for 2017, when cash flow-per-share declined by around 15% versus the previous year. 2022 was a strong year for the company, as Enbridge posted a new cash flow-per-share high of $3.91, and the company’s management forecasts that 2023 will be even stronger.

During the most recent quarter, Enbridge saw its results improve once again on a year-over-year basis. Revenues improved, partially due to higher commodity prices, partially due to higher rates on fee-based contracts, and partially due to higher transportation volumes. The fact that Enbridge placed new projects into service over the last year helped boost its transportation volumes.

On the back of the company’s revenue growth, Enbridge was able to grow its EBITDA by 15% during the third quarter, to CAD$3.8 billion. Growth in USD was less pronounced due to currency rate changes, however. Enbridge’s distributable cash flow (DCF) rose by 10% on a per share basis during the quarter, rising to US$0.89 for the period.

Management has forecasted that distributable cash flows will come in around CAD$5.20 to CAD$5.50 per share in fiscal 2022 (the year has ended, but Q4 results have not been announced yet). That’s equal to around US$4.00 per share, which would be a new record and up by 2% to 3% versus 2021, which is a solid performance when we consider that a weakening Canadian Dollar was a headwind for Enbridge.

Growth Prospects

Enbridge is not active in a high-growth industry, but that has not stopped the company from delivering compelling and reliable earnings and cash flow growth in the past.

Going forward, there are several factors that should help Enbridge in growing its cash flow-per-share meaningfully. First, the company will benefit from rate increases on existing assets. Some of the company’s contracts with customers for which it moves and stores energy commodities are CPI-linked, which results in automatic revenue growth over the years.

Other contracts are not CPI-linked, but Enbridge can negotiate higher rates over time. In the current energy crisis, many of Enbridge’s customers are highly profitable, which will make it easier for Enbridge to negotiate higher fees for moving oil and similar products.

Enbridge will also benefit from its healthy growth spending. Enbridge has been investing billions of dollars in new assets for years, and it plans to do the same going forward. This includes expansion projects at existing pipelines, the buildout of new storage terminals and export facilities, and also investments in renewable assets such as offshore windparks. Since these investments have worked out well in the past, it seems likely that Enbridge will be able to deliver healthy business growth in the coming years as well by working through its growth backlog.

Last but not least, Enbridge can use some of its surplus cash flows for debt reduction and/or share repurchases. Those measures should have a positive impact on its cash flow-per-share, either via lower interest expenses thanks to debt reduction, or through a declining share count that results in a larger portion of company-wide cash flows for each remaining share.

Competitive Advantages

The energy midstream industry has very high barriers to entry. Building out new pipelines via greenfield projects costs billions of dollars, which means that this industry is not easily disrupted by new market entrants.

Increasing regulation has also resulted in extremely complicated and time-consuming processes when it comes to getting the required approvals for a new pipeline project. Some analysts believe that it is more or less impssible to build an entirely new major pipeline in North America today. That makes Enbridge’s vast asset footprint highly valuable and safe from competition.

Expanding existing pipes is easier and can pay off for Enbridge, but that’s not an option for would-be competitors that don’t have the same pipeline footprint compared to Enbridge.

Enbridge’s large size, healthy balance sheet, and strong track record also result in cost of capital advantages for the company, which makes it even harder for other companies to disrupt Enbridge.

Dividend Analysis

Enbridge started to make dividend payments decades ago. At current prices, Enbridge offers a dividend yield of 6.7% to its owners. While commodity markets, including oil and natural gas markets, can be highly volatile, Enbridge is relatively insulated from those market movements, as most of its contracts are fee-based. That’s why Enbridge has been able to grow its dividend for an impressive 27 years in a row, despite several oil market crashes over that time frame.

Enbridge’s dividend growth averaged 6% over the last five years, and even more over the last decade. While there is no guarantee that Enbridge’s dividend growth will be at a similar level going forward, we believe that there is a high likelihood of mid-single digit dividend growth, as cash flow per share should continue to climb due to the aforementioned growth drivers.

Based on distributable cash flow estimates for 2022, Enbridge currently has a dividend payout ratio of 68%. That’s not especially low, but not overly high either, considering Enbridge is an energy midstream company. The dividend payout ratio has risen marginally over the last five years, as it stood at 66% in 2017.

Between a solid and relatively constant dividend coverage ratio, the non-cyclical nature of Enbridge’s business, and the strong dividend growth track record, we believe that Enbridge’s dividend should be safe for the foreseeable future.

Final Thoughts

Enbridge’s shares have pulled back over the last couple of months, which has made its dividend yield rise to a pretty attractive level of 6.7%. That’s a high dividend yield, and we believe that investors can expect further dividend growth in the coming years as well.

Enbridge is valued at around 10x this year’s expected distributable cash flows right now. While some other midstream names are trading at even lower valuations, Enbridge stands out among its peers due to its scale, geographical diversification, and compelling track record. Its valuation is not the lowest in the peer group, but still attractive on an absolute basis, as shares offer a cash flow yield of roughly 10% at current levels.

Given a solid dividend payout ratio of 68% and a healthy balance sheet, the dividend of Enbridge can be considered safe for the foreseeable future. While Enbridge is not a high-growth company, it is highly likely that the company will deliver some cash flow and dividend growth in the future. Overall, that makes Enbridge look like a compelling income investment.

If you are interested in finding more high-quality dividend growth stocks suitable for long-term investment, the following Sure Dividend databases will be useful:

The 20 Highest Yielding Dividend Aristocrats

The Dividend Kings List is even more exclusive than the Dividend Aristocrats. It is comprised of 48 stocks

with 50+ years of consecutive dividend increases.

The 20 Highest Yielding Dividend Kings

The Dividend Achievers List: a group of stocks with 10+ years of consecutive dividend increases.

The Dividend Champions List: stocks that have increased their dividends for 25+ consecutive years. Note: Not all Dividend Champions are Dividend Aristocrats because Dividend Aristocrats have additional requirements like being in The S&P 500.

The Dividend Contenders List: 10-24 consecutive years of dividend increases.

The Dividend Challengers List: 5-9 consecutive years of dividend increases.

The Monthly Dividend Stocks List: contains stocks that pay dividends each month, for 12 payments per year.

The 20 Highest Yielding Monthly Dividend Stocks The major domestic stock market indices are another solid resource for finding investment ideas. Sure Dividend compiles the following stock market databases and updates them regularly:

The Complete List of Russell 2000 Stocks

The Complete List of NASDAQ-100 Stocks

Thanks for reading this article. Please send any feedback, corrections, or questions to support@suredividend.com.

Originally Posted in Sure Dividend