AXP a Buy? Key Takeaways

- American Express is a good long term buy.

- But buyer beware! Technology companies are trying to take market share.

- AXP has proven to be a strong dividend growth stock.

- AXP stock movement is influenced by the consumer discretionary and technology sector.

Welcome to a guide to every stock on the market. Today we’re looking at American Express, stock symbol AXP.

American Express is a financial company but its price movement can be affected by macroeconomic pressures that would typically affect consumer discretionary and technology stocks.

American Express can grow like a technology stock because it executes billions of financial transactions through its payment network. However, unlike its competitors Visa and Mastercard, American Express is used heavily for luxury expenses like travel and entertainment. This makes American Express vulnerable in recessions as people stop buying these kinds of luxury goods.

AXP is also a dividend growth stock. The company has regularly increased its dividend for the past decade. Even though the dividend yield is relatively low, AXP is quietly an attractive dividend stock thanks to its continued price and dividend growth.

How to Invest in American Express

American Express is not a “set it and forget it” stock. If American Express stops growing its payment network, you need to stop what you’re doing and check out its competitors. In particular, check out what’s going on with Apple card and other tech company payment networks. If they start to make headways, it may be time to take a break from AXP.

Now, there is a chance the tech companies won’t succeed in this.

First off, unlike with Amazon crushing brick and mortar retail stores, American Express is a technology company as well. They are already focused on fast, safe, and reliable electronic transactions. Merchants don’t have real pressures right now to adopt new credit cards.

Second off, unlike Amazon with retail, Apple’s core business isn’t financial transactions. Apple’s core business is computer hardware. The tech companies will need to focus their efforts to break into the payment networks business. Here, Apple has an edge as they could in theory make all iPhone transactions Apple Card transactions. But this cut throat tactic could backfire because of our final point.

Apple already works with the major credit card companies on Apple Pay. If Apple ostracizes the major credit card companies, they may pull out of Apple Pay.

These concerns were raised by analysts on the last earnings call.

Their question (paraphrased) was:

“What is the competitive risk from large tech companies?”

This was the response (also paraphrased):

“Tech companies have been involved in the financial space for a decade. We partnered with Amazon and Apple Pay. We also partner with Fintechs and startups. It’s not just the banks that are competitors, it’s the big tech companies. The way to compete is to give your customers what they want and develop better value propositions. They help us raise our game, but we are not naïve enough to think no one is coming after us. We’re paranoid. We are constantly adding value to our products. We challenge the team to constantly provide better value propositions. Offer the best services and products and make sure our customers are happy.“

So warning...

The reality is that this answer really did answer the analyst's question. And that's okay. The truth is that they may not know the answer. So they gave a generic answer instead. I'll never forget years ago when analysts comfronted Bed Bath & Beyond about their plan to compete with Amazon. They wanted to do an "omnichannel" strategy.

And now in 2023, they're bankrupt.

There is no clear cut answer here. Hence, if you invest in AXP, you need to watch the credit card industry carefully.

Hot take over...

So assuming American Express can keep its moat, its a long term hold. It has grown consistently for the last decade, and its future is bright thanks to strong growth with Gen Z and millennials.

American Express should be bought using dollar cost averaging; however, if American Express falls below its intrinsic value, plan on increasing the amount you invest during this time.

American Express likely hovers above its intrinsic value thanks to its consistent growth and name recognition. But when the economy gets hit, American Express will tank. Increase your accumulation during these times.

American Express is a buy so long as it continues to grow its payment network. With strong growth internationally and with younger consumers, continued growth looks likely for the next two years.

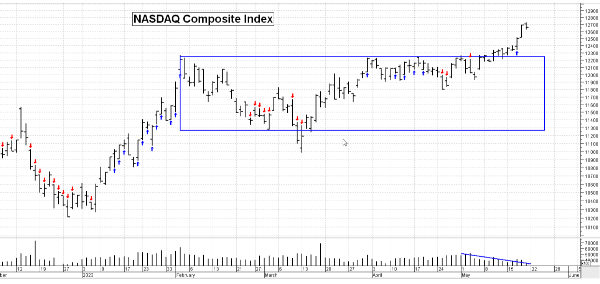

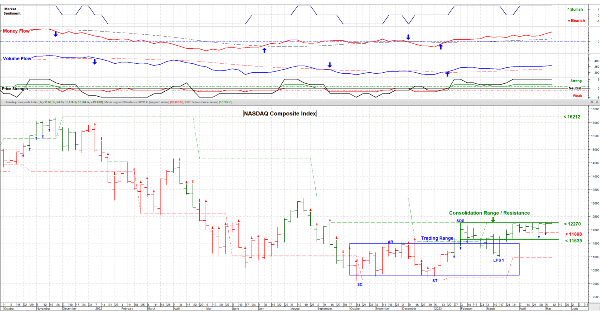

But is American Express a Buy Right Now?

In Q2 2023, at a price of $161.34, AXP is currently a buy. We calculated its fair-market value to be $176.52, and to be under-valued at $158.86. Fair warning, if something spooks the markets, AXP will crash to as low as $110 before bouncing back. Accumulate more if this happens.

For example, A hint of a real recession will send AXP falling back to its intrinsic value, just like it did during the 2008 financial crisis, the 2015 market sell-off, and the 2020 Covid pandemic. However, AXP is resilient and historically had upwards momentum after these falls.

Since AXP keeps growing its dividend, it may be good to start dollar cost averaging now at a smaller amount and then investing more if it crashes to the $110 range.

Happy Investing!

Watch More! Is American Express a Buy?

https://youtu.be/sMCVVTDXPQw

I/we have a position in an asset mentioned

AXP a Buy? Key Takeaways

Welcome to a guide to every stock on the market. Today we’re looking at American Express, stock symbol AXP.

American Express is a financial company but its price movement can be affected by macroeconomic pressures that would typically affect consumer discretionary and technology stocks.

American Express can grow like a technology stock because it executes billions of financial transactions through its payment network. However, unlike its competitors Visa and Mastercard, American Express is used heavily for luxury expenses like travel and entertainment. This makes American Express vulnerable in recessions as people stop buying these kinds of luxury goods.

AXP is also a dividend growth stock. The company has regularly increased its dividend for the past decade. Even though the dividend yield is relatively low, AXP is quietly an attractive dividend stock thanks to its continued price and dividend growth.

How to Invest in American Express

American Express is not a “set it and forget it” stock. If American Express stops growing its payment network, you need to stop what you’re doing and check out its competitors. In particular, check out what’s going on with Apple card and other tech company payment networks. If they start to make headways, it may be time to take a break from AXP.

Now, there is a chance the tech companies won’t succeed in this.

First off, unlike with Amazon crushing brick and mortar retail stores, American Express is a technology company as well. They are already focused on fast, safe, and reliable electronic transactions. Merchants don’t have real pressures right now to adopt new credit cards.

Second off, unlike Amazon with retail, Apple’s core business isn’t financial transactions. Apple’s core business is computer hardware. The tech companies will need to focus their efforts to break into the payment networks business. Here, Apple has an edge as they could in theory make all iPhone transactions Apple Card transactions. But this cut throat tactic could backfire because of our final point.

Apple already works with the major credit card companies on Apple Pay. If Apple ostracizes the major credit card companies, they may pull out of Apple Pay.

These concerns were raised by analysts on the last earnings call.

Their question (paraphrased) was:

This was the response (also paraphrased):

So warning...

The reality is that this answer really did answer the analyst's question. And that's okay. The truth is that they may not know the answer. So they gave a generic answer instead. I'll never forget years ago when analysts comfronted Bed Bath & Beyond about their plan to compete with Amazon. They wanted to do an "omnichannel" strategy.

And now in 2023, they're bankrupt.

There is no clear cut answer here. Hence, if you invest in AXP, you need to watch the credit card industry carefully.

Hot take over...

So assuming American Express can keep its moat, its a long term hold. It has grown consistently for the last decade, and its future is bright thanks to strong growth with Gen Z and millennials.

American Express should be bought using dollar cost averaging; however, if American Express falls below its intrinsic value, plan on increasing the amount you invest during this time.

American Express likely hovers above its intrinsic value thanks to its consistent growth and name recognition. But when the economy gets hit, American Express will tank. Increase your accumulation during these times. American Express is a buy so long as it continues to grow its payment network. With strong growth internationally and with younger consumers, continued growth looks likely for the next two years.

But is American Express a Buy Right Now?

In Q2 2023, at a price of $161.34, AXP is currently a buy. We calculated its fair-market value to be $176.52, and to be under-valued at $158.86. Fair warning, if something spooks the markets, AXP will crash to as low as $110 before bouncing back. Accumulate more if this happens.

For example, A hint of a real recession will send AXP falling back to its intrinsic value, just like it did during the 2008 financial crisis, the 2015 market sell-off, and the 2020 Covid pandemic. However, AXP is resilient and historically had upwards momentum after these falls.

Since AXP keeps growing its dividend, it may be good to start dollar cost averaging now at a smaller amount and then investing more if it crashes to the $110 range.

Happy Investing!

Watch More! Is American Express a Buy?

https://youtu.be/sMCVVTDXPQw

I/we have a position in an asset mentioned