AES - AES Stock Forecast, Price & News

AES Corporation (AES) is a big company that makes and delivers electricity to lots of places around the world. They also work on finding new ways to make energy using things like wind and sun power. They help to make sure people have electricity to use in their homes and businesses. The company's stock trades on the New York Stock Exchange (NYSE) under the ticker symbol "AES."

Sometimes, people can buy a little piece of AES Corporation called a "stock". The price of a AES electric stock can change a lot! It depends on how much it costs to make electricity, what the government says to do, and how the world's money is doing. In the last 5 years, the price of AES stock has been between $7.00 and $30.00 per share.

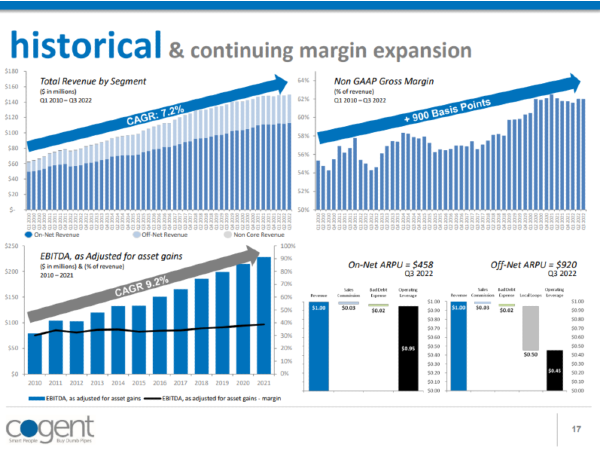

AES Corporation (AES) stock has seen a surge in value in recent weeks. The global energy company's stock price has risen by 12% since the beginning of the year, with a current trading price of $25.62 per share. AES operates in 14 countries worldwide and has a diverse portfolio of energy assets, including wind, solar, and thermal power plants. The company has also recently announced plans to invest in battery storage technology, which is expected to drive growth in the coming years. AES's financials also look promising, with a revenue growth of 9.2% and a net income of $644 million in the last quarter of 2022. Investors are optimistic about AES's future prospects and the potential for further stock price appreciation.

Read More: Top Utility Stocks

AES stock forecast 2023-2025 (Earning Growth Forecast)

The projected annual earnings growth rate of AES, listed on NYSE, is not expected to surpass the estimated earnings growth rate of 58.39% for the US Utilities - Diversified industry. Moreover, AES's projected earnings growth rate of N/A is also not expected to exceed the average forecast earnings growth rate of 26.89% for the US market.

Some grown-ups who know a lot about money think that in the year 2023, AES Corporation might make around $1,183,819,572! But some of these people think it could be a little less, like $1,177,131,326, or a little more, like $1,190,507,818. In the year 2024, they think AES might make around $1,304,208,003. Some think it might be a little less, like $1,290,831,511, and some think it might be a little more, like $1,317,584,495.

Looking ahead to 2025, AES is projected to earn $1,437,972,927, and this forecasted amount is consistent among all estimates from different Wall Street analysts.

It should be noted that AES's earnings in 2023 are expected to be in the negative, with a value of -$546,000,000. However, the forecasts from Wall Street analysts indicate a positive trend in AES's earnings in the subsequent years, with an expected increase in earnings each year from 2023 to 2025.

AES stock EPS Forecast 2023-2025

The current earnings per share (EPS) of AES (NYSE: AES) stands at -$0.82. According to analysts' estimates, the average EPS for AES is predicted to reach $1.77 in 2023, with the lowest EPS projection at $1.76 and the highest EPS projection at $1.78. Likewise, analysts project that the average EPS for AES will be $1.95 in 2024, with the lowest EPS projection at $1.93 and the highest EPS projection at $1.97. Finally, in 2025, AES's EPS is anticipated to reach $2.15, with a minimum projection of $2.15 and a maximum projection of $2.15.

Is AES a good stock to buy or sell

AES stock is a strong buy. Because it is a company that makes and delivers energy to lots of different countries. They use different ways to make energy, like wind, sun, water, and heat. Because they work in lots of different places and use different ways to make energy, it might be easier for them if something happens in one place or with one way of making energy. They are also working on making energy in ways that are good for the Earth, like using renewable energy sources. This could help them grow even more because lots of people want to use energy that is good for the Earth.

AES stock - Frequently Asked Questions

How can I buy AES stock?

To purchase AES stock, you need to open a brokerage account with a reputable online broker, deposit funds into the account, and then place an order to buy AES shares through the broker's trading platform. The process is relatively straightforward, but it's important to do your research and assess your risk tolerance before making any investment decisions.

Is AES stock a good investment?

If someone wants to invest money and be a part of the energy industry, they might think about buying AES stock. This could be a good idea because AES Corporation works in lots of different places and uses different ways to make energy, like using wind or solar power. They also try to make energy in ways that are good for the Earth. But, investing always comes with a risk, and the company and the world's money can change and affect the price of the stock. So, before someone decides to buy AES stock, they should talk to someone who knows a lot about money and do some research to make sure it's a good idea.

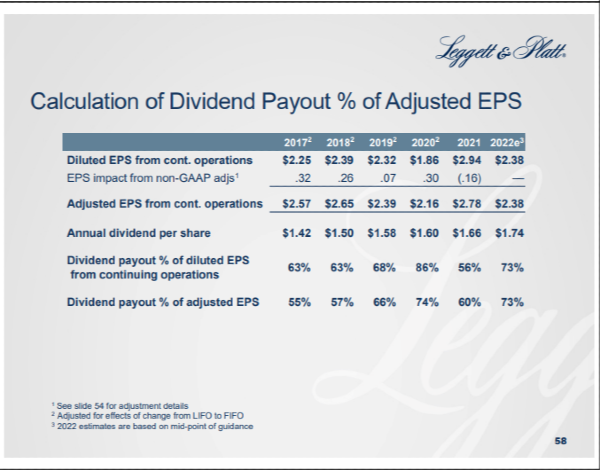

Does AES pay dividends?

AES gives some of its profits to the people who own a part of the company, which are called shareholders. But, how much and how often they get this money can change depending on how well the company is doing and what the people in charge decide. This money is called a "dividend." Some people might like buying AES stock because they could get money from the dividend and also make more money if the stock price goes up. But, it's important to know that just because something happened in the past doesn't mean it will always happen in the future.

Is Duke energy part of AES?

No, Duke Energy is not part of AES Corporation. Duke Energy is a separate publicly traded company that operates in the energy sector.

Duke Energy is a utility company that provides electricity and gas services to customers in the United States. The company operates in six states in the Southeast and Midwest regions of the country, serving over 7 million customers. Duke Energy is headquartered in Charlotte, North Carolina, and trades on the New York Stock Exchange under the ticker symbol DUK.

Where does AES get its electricity?

As a global power company, AES generates electricity from a variety of sources including natural gas, coal, oil, wind, solar, and hydroelectric power.

AES operates power plants in multiple countries around the world, and the sources of electricity used by the company may vary depending on local regulations, availability of resources, and other factors.

In recent years, AES has been increasing its focus on renewable energy sources such as wind and solar power. The company has set a goal to reduce its carbon intensity by 70% by 2030, and to achieve net-zero carbon emissions from its electricity generation by 2040. AES is investing in renewable energy projects and energy storage solutions to help achieve these goals.

Overall, AES sources its electricity from a variety of sources depending on local conditions and the company's strategic priorities.

AES - AES Stock Forecast, Price & News

AES Corporation (AES) is a big company that makes and delivers electricity to lots of places around the world. They also work on finding new ways to make energy using things like wind and sun power. They help to make sure people have electricity to use in their homes and businesses. The company's stock trades on the New York Stock Exchange (NYSE) under the ticker symbol "AES."

Sometimes, people can buy a little piece of AES Corporation called a "stock". The price of a AES electric stock can change a lot! It depends on how much it costs to make electricity, what the government says to do, and how the world's money is doing. In the last 5 years, the price of AES stock has been between $7.00 and $30.00 per share.

AES Corporation (AES) stock has seen a surge in value in recent weeks. The global energy company's stock price has risen by 12% since the beginning of the year, with a current trading price of $25.62 per share. AES operates in 14 countries worldwide and has a diverse portfolio of energy assets, including wind, solar, and thermal power plants. The company has also recently announced plans to invest in battery storage technology, which is expected to drive growth in the coming years. AES's financials also look promising, with a revenue growth of 9.2% and a net income of $644 million in the last quarter of 2022. Investors are optimistic about AES's future prospects and the potential for further stock price appreciation.

Read More: Top Utility Stocks

AES stock forecast 2023-2025 (Earning Growth Forecast)

The projected annual earnings growth rate of AES, listed on NYSE, is not expected to surpass the estimated earnings growth rate of 58.39% for the US Utilities - Diversified industry. Moreover, AES's projected earnings growth rate of N/A is also not expected to exceed the average forecast earnings growth rate of 26.89% for the US market.

Some grown-ups who know a lot about money think that in the year 2023, AES Corporation might make around $1,183,819,572! But some of these people think it could be a little less, like $1,177,131,326, or a little more, like $1,190,507,818. In the year 2024, they think AES might make around $1,304,208,003. Some think it might be a little less, like $1,290,831,511, and some think it might be a little more, like $1,317,584,495.

Looking ahead to 2025, AES is projected to earn $1,437,972,927, and this forecasted amount is consistent among all estimates from different Wall Street analysts.

It should be noted that AES's earnings in 2023 are expected to be in the negative, with a value of -$546,000,000. However, the forecasts from Wall Street analysts indicate a positive trend in AES's earnings in the subsequent years, with an expected increase in earnings each year from 2023 to 2025.

AES stock EPS Forecast 2023-2025

The current earnings per share (EPS) of AES (NYSE: AES) stands at -$0.82. According to analysts' estimates, the average EPS for AES is predicted to reach $1.77 in 2023, with the lowest EPS projection at $1.76 and the highest EPS projection at $1.78. Likewise, analysts project that the average EPS for AES will be $1.95 in 2024, with the lowest EPS projection at $1.93 and the highest EPS projection at $1.97. Finally, in 2025, AES's EPS is anticipated to reach $2.15, with a minimum projection of $2.15 and a maximum projection of $2.15.

Is AES a good stock to buy or sell

AES stock is a strong buy. Because it is a company that makes and delivers energy to lots of different countries. They use different ways to make energy, like wind, sun, water, and heat. Because they work in lots of different places and use different ways to make energy, it might be easier for them if something happens in one place or with one way of making energy. They are also working on making energy in ways that are good for the Earth, like using renewable energy sources. This could help them grow even more because lots of people want to use energy that is good for the Earth.

AES stock - Frequently Asked Questions

How can I buy AES stock?

To purchase AES stock, you need to open a brokerage account with a reputable online broker, deposit funds into the account, and then place an order to buy AES shares through the broker's trading platform. The process is relatively straightforward, but it's important to do your research and assess your risk tolerance before making any investment decisions.

Is AES stock a good investment?

If someone wants to invest money and be a part of the energy industry, they might think about buying AES stock. This could be a good idea because AES Corporation works in lots of different places and uses different ways to make energy, like using wind or solar power. They also try to make energy in ways that are good for the Earth. But, investing always comes with a risk, and the company and the world's money can change and affect the price of the stock. So, before someone decides to buy AES stock, they should talk to someone who knows a lot about money and do some research to make sure it's a good idea.

Does AES pay dividends?

AES gives some of its profits to the people who own a part of the company, which are called shareholders. But, how much and how often they get this money can change depending on how well the company is doing and what the people in charge decide. This money is called a "dividend." Some people might like buying AES stock because they could get money from the dividend and also make more money if the stock price goes up. But, it's important to know that just because something happened in the past doesn't mean it will always happen in the future.

Is Duke energy part of AES?

No, Duke Energy is not part of AES Corporation. Duke Energy is a separate publicly traded company that operates in the energy sector.

Duke Energy is a utility company that provides electricity and gas services to customers in the United States. The company operates in six states in the Southeast and Midwest regions of the country, serving over 7 million customers. Duke Energy is headquartered in Charlotte, North Carolina, and trades on the New York Stock Exchange under the ticker symbol DUK.

Where does AES get its electricity?

As a global power company, AES generates electricity from a variety of sources including natural gas, coal, oil, wind, solar, and hydroelectric power.

AES operates power plants in multiple countries around the world, and the sources of electricity used by the company may vary depending on local regulations, availability of resources, and other factors.

In recent years, AES has been increasing its focus on renewable energy sources such as wind and solar power. The company has set a goal to reduce its carbon intensity by 70% by 2030, and to achieve net-zero carbon emissions from its electricity generation by 2040. AES is investing in renewable energy projects and energy storage solutions to help achieve these goals.

Overall, AES sources its electricity from a variety of sources depending on local conditions and the company's strategic priorities.