Sound investments

don't happen alone

Find your crew, build teams, compete in VS MODE, and identify investment trends in our evergrowing investment ecosystem. You aren't on an island anymore, and our community is here to help you make informed decisions in a complex world.

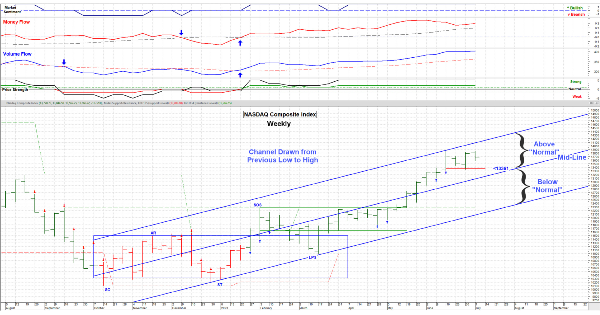

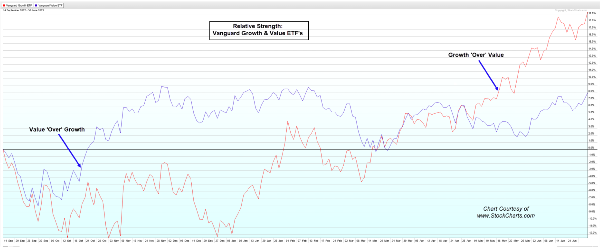

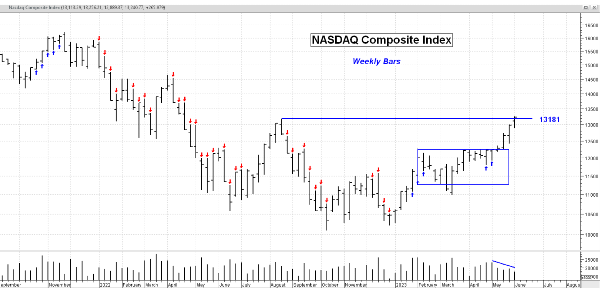

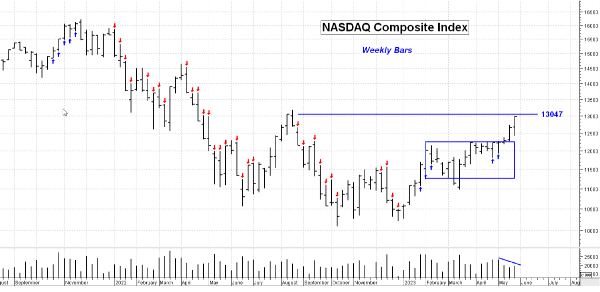

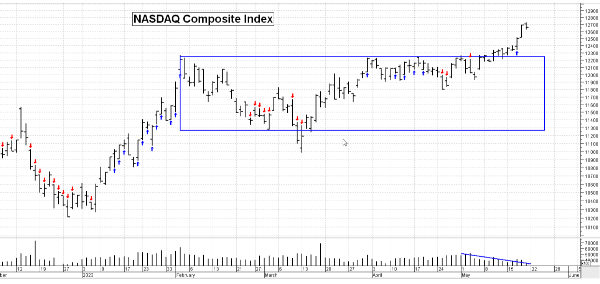

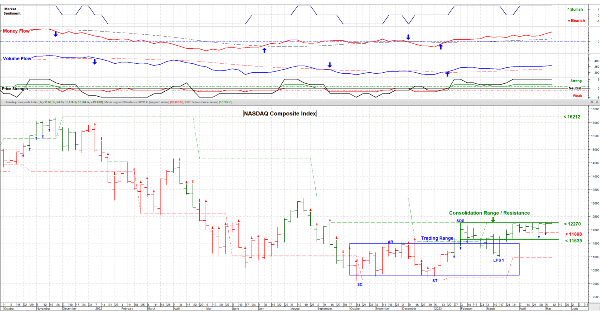

July 14, 2023 - “Markets can remain irrational longer than you can remain solvent”. Quote -John Maynard Keynes, 1923. ‘Yes, the market is “Overbought”, but it still can go higher.’ Quote – Me, 2023. Last week I attempted to show my rational for this expensive market using standard statistical analysis, and while ‘valid’, the market doesn’t have to behave logically. After all, we’re dealing with humans here.

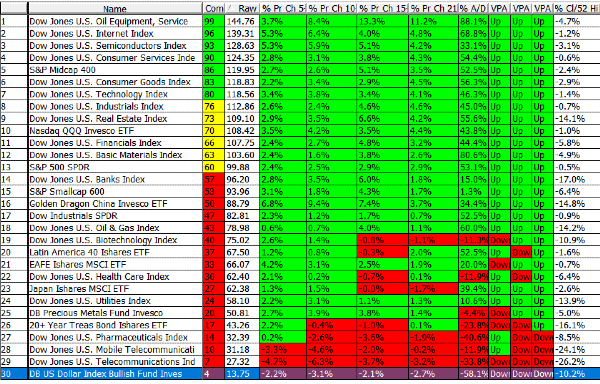

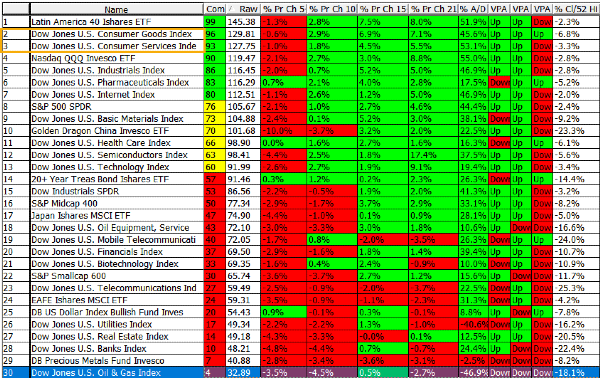

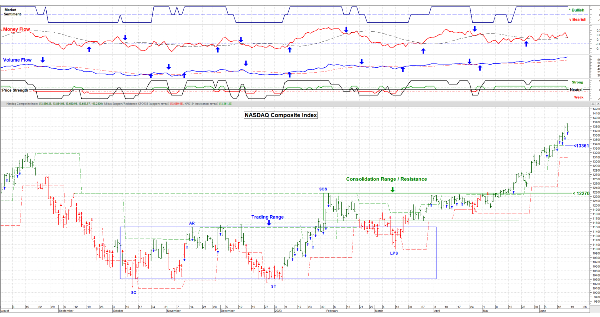

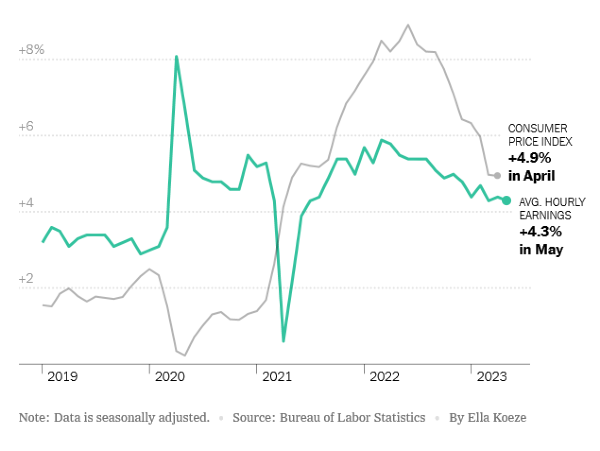

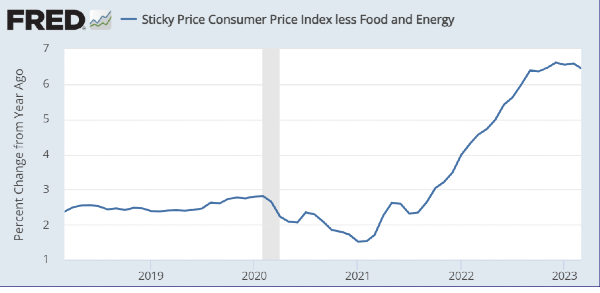

I remain Bullish in the long term but also remain expecting a pullback or at the least a pause. Last Wednesday morning we got the latest inflation data and it was pretty darn good. That’s all it took. ‘Up, Up and Away’ but on modest volume. Hence there are more buyers than sellers but there was not a lot of enthusiasm to buy . . . as many have already done so. We stay the course, not wanting to get shook out when the market does (eventually) takes a breather. For the time being let’s see what is doing best with the idea that it may fair better if we hit a bump in the market road in its quest to go higher. The Short Term Sector Strength table is shown above:

That’s it for now. The market reacts to economic news in a major way. Second quarter earnings reports have already started and of course the FED is up in less than 2 weeks. As always . . . expect the unexpected. Have a good week. …………. Tom …………