https://youtu.be/nldxFI2k0KM?si=4m9lwdNeoT3irlWB

Investing in Micron: Timing the Cyclical Nature of the AI Boom

1. Business Improvement Amid AI Boom

Micron Technology stands to benefit significantly from the AI boom. The first key question to consider is whether the business has improved, and the answer is a resounding yes. For Q1 2025, Micron's revenue nearly doubled from $4.7 billion in Q1 2024 to $8.7 billion. Additionally, the company swung from a net loss of $1 billion last year to a net profit of $2 billion this quarter.

2. Key Product Offerings

Understanding Micron's primary products is essential for assessing future revenue. The company's revenue is majorly driven by DRAM (Dynamic Random Access Memory), which is widely used in laptops, data centers, and other devices. DRAM accounts for a significant portion of Micron's revenue, along with NAND products used in SSDs.

3. Major Competitors

To gauge Micron's market position, it's crucial to know its competitors. The major players in the DRAM market include Samsung with a 40% market share, SK Hynix with 25%, and Micron holding around 20-25%. Understanding these competitors is vital for assessing Micron's future growth potential.

4. Future Demand for DRAM

The future demand for DRAM is driven by the AI boom. Projections suggest that by 2032, the market size could reach approximately $300 billion. Various reports estimate the market size to be between $200 billion and $300 billion, with a compound annual growth rate of about 7%.

5. Future Demand for NAND

The demand for NAND products is also expected to grow significantly, with estimates suggesting a market size of $91 billion by 2025 and potentially reaching over $100 billion by 2030. This demand is primarily driven by the increasing adoption of AI and data centers.

6. Valuing Micron's Business

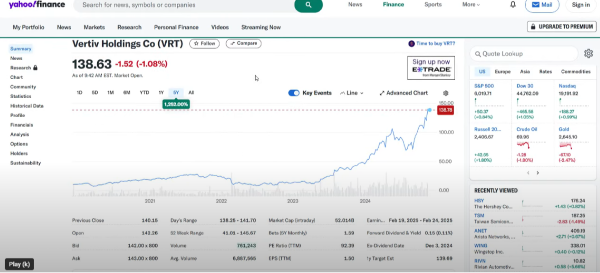

Valuing Micron involves understanding its cyclical nature. The company's revenue is expected to grow, with estimates suggesting it could reach $60 billion by 2030. However, due to the cyclical nature of the business, this growth will not be linear. The market cap could range between $60 billion and $120 billion, depending on demand and competition.

7. Investment Timing

The key to investing in Micron lies in understanding its cyclical nature. Investors should consider buying during periods of low demand to maximize returns. With the current market cap around $100 billion, the potential for growth to $120 billion or more exists if demand surpasses expectations.

8. Strategic Opportunities

Micron could explore other product categories and industries, potentially increasing revenue beyond current projections. While the primary focus remains on DRAM and NAND, diversification could enhance future growth prospects.

Conclusion

Micron Technology's growth amid the AI boom presents a compelling investment opportunity. With substantial improvements in revenue and profitability, and a promising future demand for DRAM and NAND products, the company is well-positioned for long-term success. However, investors must consider the cyclical nature of the business and strategically time their investments to maximize returns.

https://youtu.be/nldxFI2k0KM?si=4m9lwdNeoT3irlWB

https://youtu.be/nldxFI2k0KM?si=4m9lwdNeoT3irlWB

Investing in Micron: Timing the Cyclical Nature of the AI Boom

1. Business Improvement Amid AI Boom

Micron Technology stands to benefit significantly from the AI boom. The first key question to consider is whether the business has improved, and the answer is a resounding yes. For Q1 2025, Micron's revenue nearly doubled from $4.7 billion in Q1 2024 to $8.7 billion. Additionally, the company swung from a net loss of $1 billion last year to a net profit of $2 billion this quarter.

2. Key Product Offerings

Understanding Micron's primary products is essential for assessing future revenue. The company's revenue is majorly driven by DRAM (Dynamic Random Access Memory), which is widely used in laptops, data centers, and other devices. DRAM accounts for a significant portion of Micron's revenue, along with NAND products used in SSDs.

3. Major Competitors

To gauge Micron's market position, it's crucial to know its competitors. The major players in the DRAM market include Samsung with a 40% market share, SK Hynix with 25%, and Micron holding around 20-25%. Understanding these competitors is vital for assessing Micron's future growth potential.

4. Future Demand for DRAM

The future demand for DRAM is driven by the AI boom. Projections suggest that by 2032, the market size could reach approximately $300 billion. Various reports estimate the market size to be between $200 billion and $300 billion, with a compound annual growth rate of about 7%.

5. Future Demand for NAND

The demand for NAND products is also expected to grow significantly, with estimates suggesting a market size of $91 billion by 2025 and potentially reaching over $100 billion by 2030. This demand is primarily driven by the increasing adoption of AI and data centers.

6. Valuing Micron's Business

Valuing Micron involves understanding its cyclical nature. The company's revenue is expected to grow, with estimates suggesting it could reach $60 billion by 2030. However, due to the cyclical nature of the business, this growth will not be linear. The market cap could range between $60 billion and $120 billion, depending on demand and competition.

7. Investment Timing

The key to investing in Micron lies in understanding its cyclical nature. Investors should consider buying during periods of low demand to maximize returns. With the current market cap around $100 billion, the potential for growth to $120 billion or more exists if demand surpasses expectations.

8. Strategic Opportunities

Micron could explore other product categories and industries, potentially increasing revenue beyond current projections. While the primary focus remains on DRAM and NAND, diversification could enhance future growth prospects.

Conclusion

Micron Technology's growth amid the AI boom presents a compelling investment opportunity. With substantial improvements in revenue and profitability, and a promising future demand for DRAM and NAND products, the company is well-positioned for long-term success. However, investors must consider the cyclical nature of the business and strategically time their investments to maximize returns.

https://youtu.be/nldxFI2k0KM?si=4m9lwdNeoT3irlWB