The Trade Desk (Ticker: TTD): A Look at Explosive Growth and Unique Offerings

Ticker symbol TTD has skyrocketed over 80% in the past year, making The Trade Desk a standout performer in the stock market. With a remarkable 102% year-over-year net income growth and consistent margin expansion, this digital advertising powerhouse is revolutionizing the way businesses approach marketing campaigns. Let’s dive into what sets The Trade Desk apart, their financial performance, and the challenges that lie ahead.

What is The Trade Desk?

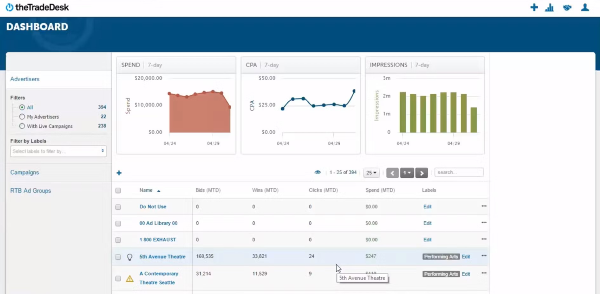

The Trade Desk is a self-service, cloud-based ad-buying platform that empowers businesses to optimize and measure data-driven digital advertising campaigns. Their platform supports multiple ad formats and channels—such as video, audio, display, and digital out-of-home—allowing companies to maximize the impact of their campaigns. The key selling point? Flexibility. Businesses can define desirable outcomes like impressions or clicks, enabling precise strategies for better campaign results.

Revenue Model and Growth Opportunities

The Trade Desk primarily generates revenue by charging a percentage of clients' total advertising spend. Their client base includes both advertisers and advertising agencies. To fuel growth, the company has two main strategies:

- Increasing share of client spending: By encouraging existing clients to use more services and ad formats, they aim to grow their revenue share.

- Innovating technology: By continuously refining their platform, they ensure an improved user experience, attracting new clients and retaining existing ones.

Financial Performance: Breaking Down the Numbers

From a financial perspective, The Trade Desk boasts several impressive metrics:

- Return on Capital Employed (ROCE): A solid 133%, nearing the 15% threshold for excellence.

- Interest Coverage Ratio: Strong, indicating no immediate debt concerns.

- Cash Conversion: At 90%, showcasing their efficiency in generating free cash flow.

- Profit Margin: 81%, paired with a rapidly approaching 15% net margin target.

Predictable revenue and gross profit growth are key strengths. Since September 2022, net margins have improved every quarter, signaling robust financial health.

Balance Sheet and Fundamental Analysis

The Trade Desk’s balance sheet is equally impressive:

- Current Ratio: Above 1.6, ensuring short-term liabilities are well-covered.

- Efficient Free Cash Flow Generation: Driven organically through their core operations, eliminating reliance on acquisitions for growth.

The company scores 7 out of 8 in fundamental analysis, reflecting low liability risk, organic growth, and a consistent cash flow profile.

Competitive Advantage and Risks

The Trade Desk benefits from significant competitive advantages:

- Pricing Power: They charge a fee based on clients' advertising spend, with opportunities to grow revenue by offering additional services or targeting new ad channels.

- Switching Costs: Their platform’s user-friendly nature, combined with high client satisfaction, creates barriers for competitors to lure clients away.

However, challenges persist. The company’s valuation is high, trading at approximately 200x earnings with a free cash flow yield of 0.83%, raising concerns about overvaluation. Additionally, increasing competition in the advertising technology space and cyclical risks from downturns in ad spending could pressure growth in the future.

Conclusion: A Promising but Pricey Investment

The Trade Desk exemplifies a company with strong fundamentals, consistent cash flows, and a growing competitive moat. While it faces challenges such as rising competition and cyclical risks, its ability to innovate and retain clients positions it well for future growth. However, potential investors should be cautious of its high valuation, as even minor slowdowns in growth could result in significant stock price declines.

What’s your outlook on The Trade Desk? Share your thoughts in the comments below!

https://youtu.be/Wzw77eJ9KF0?si=ejMHWQt85vAT5MiP

The Trade Desk (Ticker: TTD): A Look at Explosive Growth and Unique Offerings

Ticker symbol TTD has skyrocketed over 80% in the past year, making The Trade Desk a standout performer in the stock market. With a remarkable 102% year-over-year net income growth and consistent margin expansion, this digital advertising powerhouse is revolutionizing the way businesses approach marketing campaigns. Let’s dive into what sets The Trade Desk apart, their financial performance, and the challenges that lie ahead.

What is The Trade Desk?

The Trade Desk is a self-service, cloud-based ad-buying platform that empowers businesses to optimize and measure data-driven digital advertising campaigns. Their platform supports multiple ad formats and channels—such as video, audio, display, and digital out-of-home—allowing companies to maximize the impact of their campaigns. The key selling point? Flexibility. Businesses can define desirable outcomes like impressions or clicks, enabling precise strategies for better campaign results.

Revenue Model and Growth Opportunities

The Trade Desk primarily generates revenue by charging a percentage of clients' total advertising spend. Their client base includes both advertisers and advertising agencies. To fuel growth, the company has two main strategies:

Financial Performance: Breaking Down the Numbers

From a financial perspective, The Trade Desk boasts several impressive metrics:

Predictable revenue and gross profit growth are key strengths. Since September 2022, net margins have improved every quarter, signaling robust financial health.

Balance Sheet and Fundamental Analysis

The Trade Desk’s balance sheet is equally impressive:

The company scores 7 out of 8 in fundamental analysis, reflecting low liability risk, organic growth, and a consistent cash flow profile.

Competitive Advantage and Risks

The Trade Desk benefits from significant competitive advantages:

However, challenges persist. The company’s valuation is high, trading at approximately 200x earnings with a free cash flow yield of 0.83%, raising concerns about overvaluation. Additionally, increasing competition in the advertising technology space and cyclical risks from downturns in ad spending could pressure growth in the future.

Conclusion: A Promising but Pricey Investment

The Trade Desk exemplifies a company with strong fundamentals, consistent cash flows, and a growing competitive moat. While it faces challenges such as rising competition and cyclical risks, its ability to innovate and retain clients positions it well for future growth. However, potential investors should be cautious of its high valuation, as even minor slowdowns in growth could result in significant stock price declines.

What’s your outlook on The Trade Desk? Share your thoughts in the comments below!

https://youtu.be/Wzw77eJ9KF0?si=ejMHWQt85vAT5MiP