Market musing from George Crawford @GeorgeCrawIN

Tuesday 9:45am - DNOWS Meetup

What Trades do you have?

How is your education going?

Market/Industry/Bitcoin Technicals

Stock, ETF, Crypto Alpha Boost Case Studies

Seabrook Investing Discussion 7pm Wednesday

New Age Traders Noon Thursday

- High Volatility: VIX > 32. SPX dropped on Monday to the 4000 level. Can SPX and Nasdaq drop for a 6th straight week? For now, can cash and commodities continue to outperform Stocks and Bonds. Watch Chris Rowe’s video below for answers on how long this can continue. For now, please keep you hedges on. Put Ghetto Spreads in SPX and Nasdaq are working. Expect markets to maintain this high volatility this week as CPI, Rate Hikes and Ukraine dominate the news cycle. Omicron, Vaccines and Treatments are eliminating Covid-19 domestically and globally. The new expected SPX range for this week: 4257 top and 3989 bottom.

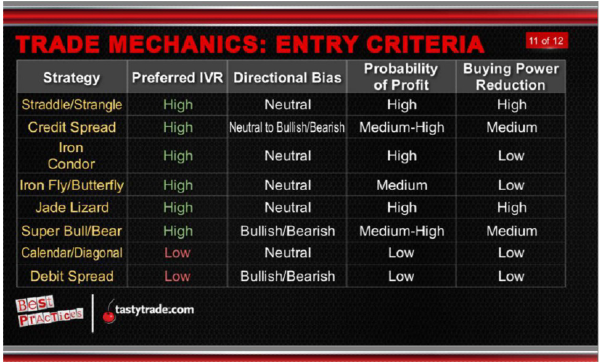

Sell Put Credit and Call Credit Spreads. Buy Put Calendars, Ghetto Spreads and Butterflies on overbought Stocks and ETFs.

US Dollar and 10 Year Interest Rate:

The US Dollar rise is pausing after breaching the Pandemic High of 104. For now, the US Dollar is a flight to safety as the US, China and Europe slip into recession. As a result, the 10Y Note Interest htit a high of 3.16% on Monday. 30 year fixed rate mortgages are at a 4 year high between 5-6%. This is not good for Tech Stocks and Real Estate. Commodities prices on Oil and Wheat remain elevated. Long Term the US Dollar decline is still intact with Fiscal and Monetary stimulus flooding the world with US Dollars.

Crypto Currency: Bitcoin collapsed on Monday dropping below $30,000. Is this a buy the dip moment? El Salavdor bought 500 more Bitcoin on Monday’s dip. Mass institutional adoption accelerates. Watch for other Corporations, Countries, Investors and Retail investors to jump in Globally. Please continue to Dollar Cost Average into Bitcoin and Ethereum. Start unloading when CBBI.INFO hits 90% to 100%.

The hottest application areas for Cryptos / Blockchain are Metaverse, Decentralized Finance (DEFI) and Non-Fungible Tokens (NFT). Besides Bitcoin and Ethereum, these momentum coins could represent scalping opportunities: Cardano (ADA), Vechain (VET), Hedera (HBAR), Solana (SOL), Chainlink (Link), Terra (LUNA), AXIE Polygon(Matic) and MANA.

https://support.tastyworks.com/support/solutions/articles/43000612831-available-cryptocurrencies

- Tasty Works Algo Trading System: James at Quiet Foundation

Alpha Boost ideas, sign up HERE:

https://issuu.com/luckbox/docs/2111-luckbox-site/56 Alph Boost Article

If you are new to options or this blog sounds like gibberish, please tryout Tasty Trade’s New 2020 Education. Includes 40 Videos, Testing and you get a certificate of completion at the end of the course.

https://tastytrade.thinkific.com/courses/beginner-options-course

- TRADE Log: VIX > 32

Jade Lizards

Put Broken Wing Butterflies -

Put and CallCredit Spreads -

Put Calendars -

Crypto -

- Video and Articles

https://theotrade.com/into-the-eye-of-the-volatility-storm/

How to Create Risk-Free Option Positions - Chris Butler, Former Tastytrade Researcher and Trader

https://youtu.be/EFEUbh2CLVI

https://pfnews.substack.com/p/how-to-create-risk-free-option-positions

Chris Rowe: 3 Things You Can Do Right Now to Protect Yourself and Profit from the Coming Bear Market

https://www.facebook.com/truemarketinsidersofficial/videos/500503595043092/

George Crawford's previous musings:

Market musing from George Crawford @GeorgeCrawIN

Tuesday 9:45am - DNOWS Meetup

Seabrook Investing Discussion 7pm Wednesday

New Age Traders Noon Thursday

Sell Put Credit and Call Credit Spreads. Buy Put Calendars, Ghetto Spreads and Butterflies on overbought Stocks and ETFs.

US Dollar and 10 Year Interest Rate:

The US Dollar rise is pausing after breaching the Pandemic High of 104. For now, the US Dollar is a flight to safety as the US, China and Europe slip into recession. As a result, the 10Y Note Interest htit a high of 3.16% on Monday. 30 year fixed rate mortgages are at a 4 year high between 5-6%. This is not good for Tech Stocks and Real Estate. Commodities prices on Oil and Wheat remain elevated. Long Term the US Dollar decline is still intact with Fiscal and Monetary stimulus flooding the world with US Dollars.

Crypto Currency: Bitcoin collapsed on Monday dropping below $30,000. Is this a buy the dip moment? El Salavdor bought 500 more Bitcoin on Monday’s dip. Mass institutional adoption accelerates. Watch for other Corporations, Countries, Investors and Retail investors to jump in Globally. Please continue to Dollar Cost Average into Bitcoin and Ethereum. Start unloading when CBBI.INFO hits 90% to 100%.

The hottest application areas for Cryptos / Blockchain are Metaverse, Decentralized Finance (DEFI) and Non-Fungible Tokens (NFT). Besides Bitcoin and Ethereum, these momentum coins could represent scalping opportunities: Cardano (ADA), Vechain (VET), Hedera (HBAR), Solana (SOL), Chainlink (Link), Terra (LUNA), AXIE Polygon(Matic) and MANA.

https://support.tastyworks.com/support/solutions/articles/43000612831-available-cryptocurrencies

Alpha Boost ideas, sign up HERE:

https://issuu.com/luckbox/docs/2111-luckbox-site/56 Alph Boost Article

If you are new to options or this blog sounds like gibberish, please tryout Tasty Trade’s New 2020 Education. Includes 40 Videos, Testing and you get a certificate of completion at the end of the course.

https://tastytrade.thinkific.com/courses/beginner-options-course

Jade Lizards

Put Broken Wing Butterflies -

Put and CallCredit Spreads -

Put Calendars -

Crypto -

https://theotrade.com/into-the-eye-of-the-volatility-storm/

How to Create Risk-Free Option Positions - Chris Butler, Former Tastytrade Researcher and Trader

https://youtu.be/EFEUbh2CLVI

https://pfnews.substack.com/p/how-to-create-risk-free-option-positions

Chris Rowe: 3 Things You Can Do Right Now to Protect Yourself and Profit from the Coming Bear Market

https://www.facebook.com/truemarketinsidersofficial/videos/500503595043092/

George Crawford's previous musings:

FED Watch

Big Tech Earnings, Prepping for a Bearish Market

Earnings Season, Higher Interest Rates

Inflation, Earnings, and Bond Sales oh my

2022 Inverted Yield Curve and Elon Musk Buys Twitter