Sound investments

don't happen alone

Find your crew, build teams, compete in VS MODE, and identify investment trends in our evergrowing investment ecosystem. You aren't on an island anymore, and our community is here to help you make informed decisions in a complex world.

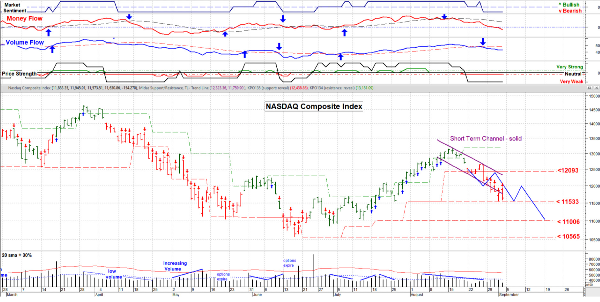

Sept. 2, 2022 - The past couple of weeks have been a big disappointment for Bullish investors. Many thought that “the low is in” and now they are beginning to question that. Much of the positive assumptions about interest rates plateauing are beginning to be challenged. But let’s step back a bit. Other than “Assumptions” and “Predictions” has anything materially changed? Not really. The economy moves, but moves slowly and everyone wants to ‘get the drop on the turn’.

Bear in mind that the US economy is still pretty good but Europe and China are not. With Russia cutting off nearly all of the natural gas supply to Europe that will cause major problems. And who buys the most stuff from China? The EU closely followed by the USA, plus China remains a COVID question mark with sporadic lock downs.

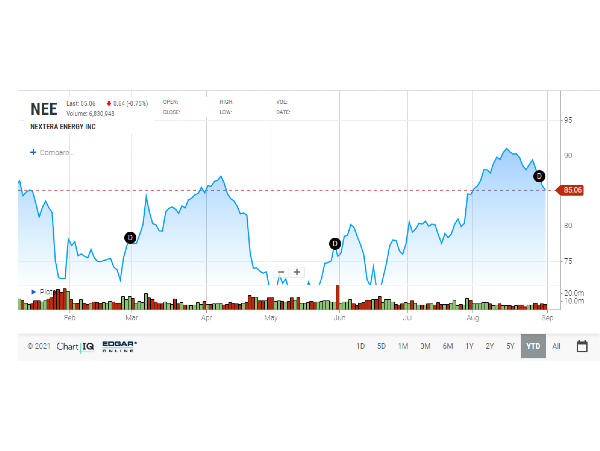

I think that the recent rally off the market lows was primarily driven by FOMO, Fear Of Missing Out, those trying to pick the bottom. If we begin to consolidate near current levels for a week or more that could be putting in a Bullish base. If we see renewed selling next week we’re likely to go down to at least the 11,066 ish level . . . or lower. I noted that the volume during the rally was pretty low. Not a sign of big investors wanting to jump back in.

The next big Consumer Price Index announcement is September 13 and that could be a news driver in either direction. Lastly, I continue to see a fair amount of Put options below the current market price. That amount is a sign that the ‘Big Guys & Gals’ are concerned and are hedging their portfolios. I’d like to see more optimism in option positioning. The markets in the US will be closed Monday but open everywhere else. Keeping my eyes open and trying to reduce ‘Assumptions’. (For those in the USA) Happy Labor Day. Have a good week. …. Tom ….

More information at: www.special-risk.net Price chart by MetaStock; table by www.HighGrowthStock.com. Used with permission.