This Chevron Corporation (CVX) post is my third in a series of posts in which I cover an integrated oil and gas producer as well as summarize the overblown expectations of the demise of the oil and gas industry.

In July, I wrote Imperial Oil (IMO.to) and Exxon Mobil (XOM) posts; links are provided at the end of this post. I suggest you read them in advance of reading this post because I share my ‘big picture’ thoughts on the integrated oil and gas industry. These thoughts include a look at:

- the law of supply and demand and why oil and gas prices are likely to be higher in the future;

- the advent of electric vehicles may impact the demand for oil and gas but the mining industry is in no position to supply the quantities of minerals required to produce all the batteries that will be required for electric vehicles;

- why third-world countries are not on the same wavelength as advanced economies when it comes to the environment; and

- how the major integrated oil and gas producers are diversifying into more environmentally friendly sources of energy.

CVX was my 3rd largest holding when I completed my Mid-2022 Investment Holdings Review.

Affiliate

If you are interested in investing in stocks that pay dividends I recommend signing up for the Sure Dividend Newsletter* . It is a good value and one of the best dividend stock newsletters available. There is a 7-day free trial and grace period so it is risk free. The service provides top 10 stock picks each month with discussion of advantages, valuation, and risks. I highly recommend them and use their insights for my own stock research.

Oil and Gas Demise is Overblown and Chevron Should Benefit

Investors in integrated oil and gas companies, like Chevron, have experienced years of sub-par investment returns but the fears of being supplanted by renewables are overblown. However, in this August 17, 2019 post, I disclose my decision to add to my CVX exposure.

I followed up with a September 3, 2019 post confirming the purchase of additional shares. I also indicated that I expected my September 2019 $135 covered call contracts to expire worthless in a matter of days thus resulting in me retaining 100% of the option premium and the underlying shares; they did expire worthless.

In my November 29, 2019 post, I wrote that I considered CVX to have attractive long-term investment return potential.

During 2020 and 2021, I wrote several additional CVX posts that are accessible through the Archives of my Financial Freedom Is A Journey blog. In one particular post, Zig When Others Zag, I wrote:

In keeping with my plan to acquire shares that are reasonably valued and/or out of favour with the broad investment community, I have acquired additional shares in CVX; shares are held in two different ‘Core’ accounts within the FFJ Portfolio,

Some investors undoubtedly disagreed with my outlook.

Fast forward to the summer of 2021 at which time the broad investment community realized the law of supply and demand suggested that companies, such as CVX, stood to generate significant earnings and Free Cash Flow (FCF).

Oil and gas prices have exhibited weakness of late because inflationary pressures may lead to demand destruction. The long-term outlook, however, suggests that major oil and gas producers, like Chevron, stand to generate significant earnings and FCF going forward, and their demise is overblown.

Do Not Fixate On Short-Term Stock Price Gyrations

Benjamin Graham, the father of value investing, aptly stated that:

In the short term the stock market behaves like a voting machine, but in the long term it acts as a weighing machine.

Trying to capitalize on short-term stock price gyrations is akin to gambling. Nobody can consistently predict the direction of a company’s share price in the short term.

The behaviour of CVX’s stock price of late is a perfect example of why we should not fixate on short-term stock price gyrations. There is no rational explanation as to why CVX’s share price should have been:

- in the low $130s in February 2022;

- in the low $180s in early June 2022;

- once again in the $130s in mid-July;

- in the $160s in late July; and

- in the $150s in early August.

It is far better to look at the company’s underlying fundamentals and to try and determine a reasonable valuation. In addition, it is extremely important we also look at an investment’s potential risk.

Since Executives and Board members view a company through a long-term lens, it is critically important investors do the same. Fixating on intra-day share price fluctuations is unwise.

The Inflation Reduction Act of 2022 (IRA)

The Inflation Reduction Act (IRA) of 2022 signed into law by President Biden on August 16, 2022 is designed to reduce the federal deficit. It, however, includes billions in spending which is a factor that can contribute to higher inflation.

The following are some of the features of the IRA:

- encourage the production of renewable energy products that can not only reduce energy costs but increase supply;

- allocate $0.5B to the expansion of biofuel infrastructure;

- require the Department of the Interior to set aside at least 2 million acres per year for onshore oil and gas lease sales;

- provide drillers access to federal waters in Alaska and the Gulf of Mexico; and

- ease some federal rules the oil and gas industry has argued limit fossil fuel production.

The IRA also provides substantial tax credits for carbon capture and direct air capture technologies. These technologies enable carbon dioxide to be captured and stored underground and even extracted from the atmosphere.

Estimates suggest this could be a $4T industry by 2050!

Two measures in the IRA sound like bad news for the fossil fuel industry.

- a 15% minimum tax on companies earning over $1B

- a new fee on methane emissions.

Many companies such as CVX, however, already meet this tax threshold and they have been taking steps to limit their methane emissions. Furthermore, the fee would only apply to companies emitting at least 25,000 metric tons of carbon dioxide equivalent annually; this would account for only 40% of the industry’s total emissions based on a Congressional Research Service analysis.

While the IRA is being widely regarded as a significant step toward a clean energy future, this is ultimately bad news for the fossil fuel industry and in particular smaller independent oil producers.

Smaller independent oil producers when compared to their larger counterparts, are less invested in renewables and carbon capture. These are the industry participants that will be more exposed to the new methane fee. If there is going to be any demise in the oil and gas industry, the demise is likely to be the many independent oil producers that do not have the resources to navigate their rapidly evolving business environment.

Given that CVX has made significant investments to adapt to the rapidly evolving business environment, it could reap the rewards and benefit from the demise of many independent oil producers. This is another reason why I think the oil and gas demise is overblown and Chevron should benefit.

Company Overview

Some investors might associate CVX solely with oil and gas. The CVX of today, however, is not the same as at the turn of the century.

Senior management is well aware of the headwinds CVX faces. While they pay attention to short and medium-term performance, there is a heavy focus on CVX’s long-term success. This is why CVX is advancing technology for lower carbon businesses.

Having said this, you are undoubtedly familiar with CVX to some extent. There is, therefore, little point in me providing an overview of the company.

If you wish to learn more about the company, however, please review the most current Investor Presentation and Part 1 of the FY2021 Form 10-K.

Financial Review of CVX

Q2 and YTD2022 Results

On July 29, 2022, CVX released very strong Q2 and YTD results and announced an increase in its intended share repurchases.

CVX’s strong YTD earnings and FCF have further improved its debt ratio to 14.6%. In contrast, CVX’s debt ratio at FYE 2015 – 2021 was 20.2%, 24.1%, 20.7%, 18.2%, 15.8%, 25.2% and 18.4%.

Its net debt ratio as of June 30, 2022 is 8.3%. In contrast, this ratio at FYE 2017 – 2021 was 18.6%, 13.5%, 12.8%, 22.7%, and 15.6%.

Source: CVX – Q2 2022 Earnings Presentation

CVX’s Net Debt Ratio for June 30, 2022 is short-term debt of $3.2B plus long-term debt of $23.0B less cash and cash equivalents of $12.0B and marketable securities of $0.341B as a percentage of total debt less cash and cash equivalents and marketable securities, plus CVX’s Stockholders’ Equity of $153.6B.

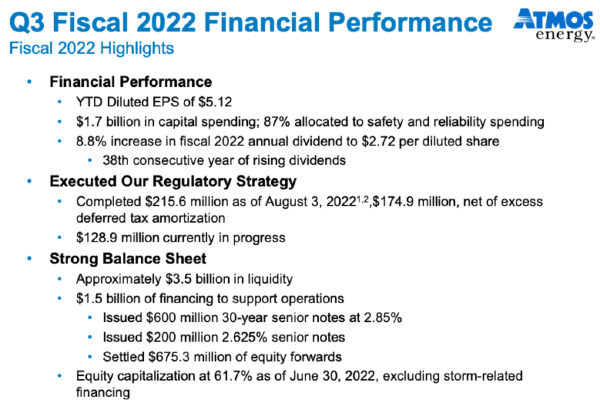

The following is a quarterly reconciliation of non-GAAP measures for 2021 and YTD2022.

Source: CVX – Q2 2022 Earnings Presentation

This image explains CVX’s calculation of FCF and Net Debt Ratio.

Source: CVX – Q2 2022 Earnings Presentation

Credit Ratings

As noted earlier, any investment requires a risk assessment.

When a company is rated by the major rating agencies I look at the ratings assigned to the domestic long-term unsecured debt. This form of debt carries more risk than secured debt but is less risky than owning common shares. It is, therefore, important, that equity investors account for this higher risk. Suppose a company’s domestic long-term unsecured debt is rated at the lowest tier of the lower medium-grade investment-grade category, for example. In that case, a common shareholder’s risk is a non-investment grade (speculative).

CVX’s current domestic long-term unsecured debt ratings and outlook are:

- Moody’s: Aa2 (stable)

- S&P Global: AA- (stable)

The rating assigned by Moody’s is the middle tier of the high-grade investment grade category. It is one tier above the rating assigned by S&P Global.

Both ratings define CVX as having a very strong capacity to meet its financial commitments. It differs from the highest-rated obligors only to a small degree.

Dividends and Share Repurchases

Dividends and Dividend Yield

Unlike XOM’s recent dividend history which reflects an $0.87 dividend distribution for 10 consecutive quarters and a $0.88 dividend for 4 consecutive quarters, CVX’s dividend history is superior.

Investors who seek dividend income can take comfort that CVX has been very consistent in demonstrating that in a cyclical business, it is prepared for the downside. In 2020 and when oil prices briefly turned negative, there was never a question as to whether the dividend would be cut. In fact,

CVX grew its dividend during the pandemic and the dividend has grown from $1.29 in 2020 to the current $1.42. This stands out as unique from several of CVX’s peers.

Even in a downside price scenario (ie. $50 Brent), CVX can still increase the dividend.

Source: CVX – Bernstein’s 38th Annual Strategic Decisions Conference – June 1, 2022

Having said this, investing in a company primarily for its dividend and dividend yield is a fundamentally flawed way in which to invest. Nevertheless, I understand we have our respective objectives and goal when it comes to investment decisions. Some investors might want dividend income hence their focus on dividend metrics.

I, however, think that investing based on an investment’s total potential return (capital gains and dividend income) is a far superior approach.

Dividends from shares in taxable accounts carry tax implications. Depending on your tax bracket, this could depress your investment returns.

If the retention of profits can be used to generate above-average long-term investment returns then an investor can postpone a tax obligation until well into the future.

Naturally, if a company has a track record of increasing dividend distributions, then there is a certain expectation this will continue. If CVX were to decide not to distribute a dividend and to use the earnings to repurchase shares or to reinvest in the company, the stock price would likely take a beating because it would go against investor expectations. However, Chevron continues to increase its dividend despite periods of low oil and gas prices and overblown expectations of the dividend’s demise.

Since CVX rewards investors with a consistently growing dividend, investors can expect the 4th consecutive $1.42 quarterly dividend to be declared in October for distribution in mid-December; the 3rd was declared at the end of July for distribution in mid-October.

With CVX shares currently trading at ~$154, the dividend yield is ~3.7%.

Since CVX’s FY2022 performance has been exceptional and expectations are for strong earnings and FCF for the remainder of the current fiscal year, I expect CVX will increase its quarterly dividend by $0.08 to $1.50 when it declares a quarterly dividend in January.

Share Repurchases

Unlike XOM’s weak share repurchase track record since FY2015, CVX’s track record has fared better.

The weighted average number of issued and outstanding shares (in millions) in FY2011 – FY2021 is 2,001, 1,965, 1,932, 1,884, 1,875, 1,873, 1,898, 1,914, 1,895, 1,870, and 1,920. For the 3 months and 6 months ending June 30, 2022, this has increased to 1,957 and 1,951. The reason for the increase is that in the first half of FY2022, $5.452B in shares were issued for share-based compensation plans and $3.755B of shares were purchased under share repurchase and deferred compensation plans. The net effect is $1.697B of YTD shares issued.

In Q1 alone, for example, CVX issued $4.6B for share-based compensation. CVX typically pays out long-term incentive compensation in Q1 of which a portion is in the form of restricted stock and performance shares. This happens annually, but this year CVX received over $4B in cash when about 3,000 current and former employees exercised stock options; the Q1 2022 proceeds from option exercises were over 4 times the historical annual average of around $1B per year. This is because of CVX’s higher stock price.

Roughly two-thirds of the vested options at FYE2021 were exercised during Q1 2022 thus lowering the potential future dilution rate. Over time, CVX expects share buybacks to more than offset the Q1 dilutive effect.

At its Investor Day in March 2022, CVX increased its share buyback guidance from ~$3B annually to ~$5B – ~$10B. Now, CVX has increased the top end of its share buyback guidance to $15B/year. Management expects to be at this level in Q3 2022.

Buybacks can change quarterly and the goal is not to maximize the buyback rate in any individual quarter. Rather, CVX sets a buyback range at a rate it can maintain across the commodity cycle.

Even in a downside price scenario (ie. $50 Brent), CVX will continue to have the capacity to buy back shares for five years with Brent at $50. Management states that with Brent at this level, CVX can buy back more than 20% of its outstanding shares over just 5 years.

CVX has also indicated it is considering the acceleration of share repurchases by leveraging the balance sheet closer to the 20% – 25% net debt ratio range. Given that the net debt ratio at the end of Q2 2022 is 8.3%, CVX can raise substantial debt!

Valuation

When I wrote my July 22, 2021 post, I indicated that I expected the 27 brokers who provided FY2021 and FY2022 adjusted diluted EPS guidance would revise their figures upwards following the release of Q2 results. At the time of that post, CVX’s valuation based on adjusted diluted EPS estimates and a ~$99 share price was:

FY2021: mean of $6.32 and a low/high range of $4.95 – $8.50. The forward adjusted diluted PE using the mean estimate is ~15.66 and ~14 if I use $7.

FY2022: mean of $7.23 and a low/high range of $5.05 – $10.44. The forward adjusted diluted PE using the mean estimate is ~13.7 and ~11 if I use $9.

At the time of my November 1, 2021 post, CVX was trading at ~$114.50. Based on the wide-ranging estimates, CVX’s forward adjusted diluted PE valuations were:

FY2021: mean of $7.39 and a low/high range of $5.19 – $9.42 from 30 brokers. The forward adjusted diluted PE using the mean estimate is ~15.5 and ~12.2 if I use $9.42.

FY2022: mean of $8.97 and a low/high range of $6.25 – $12.19 from 31 brokers. The forward adjusted diluted PE using the mean estimate is ~12.8 and ~9.4 if I use $12.19.

When I wrote my January 29, 2022 post, the adjusted earnings estimates and forward adjusted diluted PE valuations using the current ~$130.50 share price were:

- FY2022: mean of $10.05 and a low/high range of $7.57 – $16.49 from 28 brokers. The forward adjusted diluted PE using the mean estimate is ~13.

- FY2023: mean of $9.19 and a low/high range of $5.15 – $14.42 from 21 brokers. The forward adjusted diluted PE using the mean estimate is ~14.

- FY2024: mean of $9.16 and a low/high range of $7.67 – $12.65 from 6 brokers. The forward adjusted diluted PE using the mean estimate is ~14.

CVX shares were trading at ~$160 when I wrote my May 3, 2022 post. Using this share price and the current adjusted earnings estimates, forward adjusted diluted PE valuations were:

- FY2022: mean of $14.72 and a low/high range of $8.85 – $21.52 from 28 brokers. The forward adjusted diluted PE using the mean estimate is ~10.9.

- FY2023: mean of $13.16 and a low/high range of $6.68 – $24.55 from 25 brokers. The forward adjusted diluted PE using the mean estimate is ~12.2.

- FY2024: mean of $11.74 and a low/high range of $6.70 – $15.87 from 17 brokers. The forward adjusted diluted PE using the mean estimate is ~13.6.

CVX shares are now trading at ~$154. The current adjusted earnings estimates from the brokers which cover CVX are, once again, all ‘over the map’.

- FY2022: mean of $18.05 and a low/high range of $12.04 – $21.18 from 27 brokers. The forward adjusted diluted PE using the mean estimate is ~8.53.

- FY2023: mean of $16.33 and a low/high range of $8.64 – $25.22 from 27 brokers. The forward adjusted diluted PE using the mean estimate is ~9.43.

- FY2024: mean of $13.61 and a low/high range of $7.38 – $18.90 from 16 brokers. The forward adjusted diluted PE using the mean estimate is ~11.3.

It is readily apparent the brokers who cover CVX continue to have a huge difference in opinion about the company’s outlook!

I think the low end of each year’s earnings estimates is unrealistic and should be higher. I am also very reluctant to rely on earnings estimates beyond FY2022. Furthermore, if CVX significantly increases its debt load to repurchase shares, the forward EPS estimates could radically change.

We know that CVX has generated $9.17 and $9.18 in YTD2022 GAAP earnings and adjusted earnings. If it generates a similar bottom line over the remainder of FY2022 then we are looking at FY2022 earnings of ~$18.35. Using the current share price, the forward adjusted diluted PE is ~8.40.

Should the second half of FY2022 be weaker than the first half and CVX generates $15.00 in FY2022 adjusted diluted EPS, then we are looking at a forward adjusted diluted PE of ~10.3.

This seems like a fair valuation from my perspective.

Looking at CVX’s valuation from an FCF perspective, CVX generated ~$6.1B in Q1 and ~$10.6B in Q2 for a YTD FCF of ~$16.7. Should the second half of FY2022 be weaker than the first half and CVX only generates ~$10B in FCF, FY2022’s FCF would be $26.7B. The diluted weighted average number of shares outstanding for the 3 months ending June 30 is 1.957B. CVX intends to repurchase shares in the second half of FY2022 so suppose the weighted average declines to 1.94B. On this basis, CVX’s FCF per share is ~$13.76. Divide the current ~$154 share price by ~13.76 and CVX’s forward P/FCF is ~11.2.

While not an exact science, we now have PE and P/FCF ratios upon which to gauge CVX’s valuation.

In my opinion, CVX’s valuation is reasonable despite the recent run-up in its share price.

Chevron (CVX) – Oil and Gas Demise Is Overblown – Final Thoughts

Long-term CVX shareholders have endured several years of subpar investment returns. The world, however, has changed and I expect superior returns going forward. Fear about the demise of the oil and gas industry is probably overblown, and Chevron should benefit from higher future demand.

Historically, integrated oil and gas producers would spend billions of dollars on exploration and development. Massive projects, especially those offshore, would take years to develop before investors would see a dime in earnings and cash flow. Oftentimes, the projects would make sense when started. By the time they were completed several years later, however, industry conditions could have dramatically changed; the profitability of some of these projects was not as projected.

In recent years, the focus has changed from exploration and development to profitability and FCF. As a result, companies have significantly scaled back their capital expenditures. Earnings and FCF are now being returned to shareholders in the form of dividend increases, special dividends, and significant share repurchases.

While this is great from an investor’s perspective, scaling back on exploration and development is likely to lead to a long-term supply/demand imbalance. Green energy might replace oil and gas to some extent. However, the global population is growing and many regions in the world cannot afford to transition to green energy. Think for a moment just how many people in densely populated countries, such as India, can afford electric vehicles.

Next, we have mining industry executives warning us that the current exploration and development of mines from which the minerals are extracted for batteries in electric vehicles is insufficient to meet future demand. Exploration and development in the mining industry are not much different than that in the oil and gas space. It costs a lot of money and it takes years before a mine comes into production.

We should also consider that many of the mines rich in the minerals the world will require are in regions that are rife with corruption. Furthermore, if you think there are environmental hazards with oil and gas exploration you had better believe that mining also has its fair share of environmental hazards.

I like that CVX has a very strong balance sheet, very strong cash flow, and the ability to continue to

return cash to shareholders in any environment (even when Brent is at $50). For these reasons AND the ‘big picture’ reasons, I was acquiring CVX shares when they were out of favour. These acquisitions ultimately led to CVX being my third largest holding when I completed my Mid-2022 Investment Holdings Review.

Despite the recent run-up in CVX’s share price, shares appear to still be reasonably valued. I periodically add to my CVX exposure and acquired:

- 50 shares on July 8;

- 25 shares on July 12;

- 20 shares on July 20; and

- 100 shares on August 15

in two different ‘Core’ accounts in the FFJ Portfolio. I also reinvest the quarterly dividend income from my existing CVX holdings which, based on the current dividend and the number of shares owned minus the 15% dividend withholding tax, adds 16 – 20 shares/quarter.

Thanks for reading Chevron (CVX) – Oil and Gas Demise Is Overblown.

Other articles by Charles Fournier are:

Imperial Oil (IMO) Is Gushing Free Cash Flow

Exxon Mobil (XOM) Shareholders Are Finally Being Rewarded

Author Bio: I am a self-taught investor and run the Financial Freedom is a Journey blog. I have invested in the North American equities markets for over 34 years. I retired from a career in banking and continue to invest as this is something about which I am passionate.

Author Disclosure: I am long CVX and XOM. I disclose holdings held in the FFJ Portfolio and the dividend income generated from these holdings. I do not disclose details of holdings held in various tax-advantaged accounts for confidentiality reasons.

Author Disclaimer: I do not know your circumstances and do not provide individualized advice or recommendations. I encourage you to make investment decisions by conducting your research and due diligence. Consult your financial advisor about your specific situation.

This Chevron Corporation (CVX) post is my third in a series of posts in which I cover an integrated oil and gas producer as well as summarize the overblown expectations of the demise of the oil and gas industry.

In July, I wrote Imperial Oil (IMO.to) and Exxon Mobil (XOM) posts; links are provided at the end of this post. I suggest you read them in advance of reading this post because I share my ‘big picture’ thoughts on the integrated oil and gas industry. These thoughts include a look at:

CVX was my 3rd largest holding when I completed my Mid-2022 Investment Holdings Review.

Affiliate

If you are interested in investing in stocks that pay dividends I recommend signing up for the Sure Dividend Newsletter* . It is a good value and one of the best dividend stock newsletters available. There is a 7-day free trial and grace period so it is risk free. The service provides top 10 stock picks each month with discussion of advantages, valuation, and risks. I highly recommend them and use their insights for my own stock research.

Oil and Gas Demise is Overblown and Chevron Should Benefit

Investors in integrated oil and gas companies, like Chevron, have experienced years of sub-par investment returns but the fears of being supplanted by renewables are overblown. However, in this August 17, 2019 post, I disclose my decision to add to my CVX exposure.

I followed up with a September 3, 2019 post confirming the purchase of additional shares. I also indicated that I expected my September 2019 $135 covered call contracts to expire worthless in a matter of days thus resulting in me retaining 100% of the option premium and the underlying shares; they did expire worthless.

In my November 29, 2019 post, I wrote that I considered CVX to have attractive long-term investment return potential.

During 2020 and 2021, I wrote several additional CVX posts that are accessible through the Archives of my Financial Freedom Is A Journey blog. In one particular post, Zig When Others Zag, I wrote:

In keeping with my plan to acquire shares that are reasonably valued and/or out of favour with the broad investment community, I have acquired additional shares in CVX; shares are held in two different ‘Core’ accounts within the FFJ Portfolio,

Some investors undoubtedly disagreed with my outlook.

Fast forward to the summer of 2021 at which time the broad investment community realized the law of supply and demand suggested that companies, such as CVX, stood to generate significant earnings and Free Cash Flow (FCF).

Oil and gas prices have exhibited weakness of late because inflationary pressures may lead to demand destruction. The long-term outlook, however, suggests that major oil and gas producers, like Chevron, stand to generate significant earnings and FCF going forward, and their demise is overblown.

Do Not Fixate On Short-Term Stock Price Gyrations

Benjamin Graham, the father of value investing, aptly stated that:

In the short term the stock market behaves like a voting machine, but in the long term it acts as a weighing machine.

Trying to capitalize on short-term stock price gyrations is akin to gambling. Nobody can consistently predict the direction of a company’s share price in the short term.

The behaviour of CVX’s stock price of late is a perfect example of why we should not fixate on short-term stock price gyrations. There is no rational explanation as to why CVX’s share price should have been:

It is far better to look at the company’s underlying fundamentals and to try and determine a reasonable valuation. In addition, it is extremely important we also look at an investment’s potential risk.

Since Executives and Board members view a company through a long-term lens, it is critically important investors do the same. Fixating on intra-day share price fluctuations is unwise.

The Inflation Reduction Act of 2022 (IRA)

The Inflation Reduction Act (IRA) of 2022 signed into law by President Biden on August 16, 2022 is designed to reduce the federal deficit. It, however, includes billions in spending which is a factor that can contribute to higher inflation.

The following are some of the features of the IRA:

The IRA also provides substantial tax credits for carbon capture and direct air capture technologies. These technologies enable carbon dioxide to be captured and stored underground and even extracted from the atmosphere.

Estimates suggest this could be a $4T industry by 2050!

Two measures in the IRA sound like bad news for the fossil fuel industry.

Many companies such as CVX, however, already meet this tax threshold and they have been taking steps to limit their methane emissions. Furthermore, the fee would only apply to companies emitting at least 25,000 metric tons of carbon dioxide equivalent annually; this would account for only 40% of the industry’s total emissions based on a Congressional Research Service analysis.

While the IRA is being widely regarded as a significant step toward a clean energy future, this is ultimately bad news for the fossil fuel industry and in particular smaller independent oil producers.

Smaller independent oil producers when compared to their larger counterparts, are less invested in renewables and carbon capture. These are the industry participants that will be more exposed to the new methane fee. If there is going to be any demise in the oil and gas industry, the demise is likely to be the many independent oil producers that do not have the resources to navigate their rapidly evolving business environment.

Given that CVX has made significant investments to adapt to the rapidly evolving business environment, it could reap the rewards and benefit from the demise of many independent oil producers. This is another reason why I think the oil and gas demise is overblown and Chevron should benefit.

Company Overview

Some investors might associate CVX solely with oil and gas. The CVX of today, however, is not the same as at the turn of the century.

Senior management is well aware of the headwinds CVX faces. While they pay attention to short and medium-term performance, there is a heavy focus on CVX’s long-term success. This is why CVX is advancing technology for lower carbon businesses.

Having said this, you are undoubtedly familiar with CVX to some extent. There is, therefore, little point in me providing an overview of the company.

If you wish to learn more about the company, however, please review the most current Investor Presentation and Part 1 of the FY2021 Form 10-K.

Financial Review of CVX

Q2 and YTD2022 Results

On July 29, 2022, CVX released very strong Q2 and YTD results and announced an increase in its intended share repurchases.

Source: CVX – Q2 2022 Earnings Presentation

CVX’s strong YTD earnings and FCF have further improved its debt ratio to 14.6%. In contrast, CVX’s debt ratio at FYE 2015 – 2021 was 20.2%, 24.1%, 20.7%, 18.2%, 15.8%, 25.2% and 18.4%.

Its net debt ratio as of June 30, 2022 is 8.3%. In contrast, this ratio at FYE 2017 – 2021 was 18.6%, 13.5%, 12.8%, 22.7%, and 15.6%.

Source: CVX – Q2 2022 Earnings Presentation

CVX’s Net Debt Ratio for June 30, 2022 is short-term debt of $3.2B plus long-term debt of $23.0B less cash and cash equivalents of $12.0B and marketable securities of $0.341B as a percentage of total debt less cash and cash equivalents and marketable securities, plus CVX’s Stockholders’ Equity of $153.6B.

The following is a quarterly reconciliation of non-GAAP measures for 2021 and YTD2022.

Source: CVX – Q2 2022 Earnings Presentation

This image explains CVX’s calculation of FCF and Net Debt Ratio.

Source: CVX – Q2 2022 Earnings Presentation

Credit Ratings

As noted earlier, any investment requires a risk assessment.

When a company is rated by the major rating agencies I look at the ratings assigned to the domestic long-term unsecured debt. This form of debt carries more risk than secured debt but is less risky than owning common shares. It is, therefore, important, that equity investors account for this higher risk. Suppose a company’s domestic long-term unsecured debt is rated at the lowest tier of the lower medium-grade investment-grade category, for example. In that case, a common shareholder’s risk is a non-investment grade (speculative).

CVX’s current domestic long-term unsecured debt ratings and outlook are:

The rating assigned by Moody’s is the middle tier of the high-grade investment grade category. It is one tier above the rating assigned by S&P Global.

Both ratings define CVX as having a very strong capacity to meet its financial commitments. It differs from the highest-rated obligors only to a small degree.

Dividends and Share Repurchases

Dividends and Dividend Yield

Unlike XOM’s recent dividend history which reflects an $0.87 dividend distribution for 10 consecutive quarters and a $0.88 dividend for 4 consecutive quarters, CVX’s dividend history is superior.

Investors who seek dividend income can take comfort that CVX has been very consistent in demonstrating that in a cyclical business, it is prepared for the downside. In 2020 and when oil prices briefly turned negative, there was never a question as to whether the dividend would be cut. In fact, CVX grew its dividend during the pandemic and the dividend has grown from $1.29 in 2020 to the current $1.42. This stands out as unique from several of CVX’s peers.

Even in a downside price scenario (ie. $50 Brent), CVX can still increase the dividend.

Source: CVX – Bernstein’s 38th Annual Strategic Decisions Conference – June 1, 2022

Having said this, investing in a company primarily for its dividend and dividend yield is a fundamentally flawed way in which to invest. Nevertheless, I understand we have our respective objectives and goal when it comes to investment decisions. Some investors might want dividend income hence their focus on dividend metrics.

I, however, think that investing based on an investment’s total potential return (capital gains and dividend income) is a far superior approach.

Dividends from shares in taxable accounts carry tax implications. Depending on your tax bracket, this could depress your investment returns.

If the retention of profits can be used to generate above-average long-term investment returns then an investor can postpone a tax obligation until well into the future.

Naturally, if a company has a track record of increasing dividend distributions, then there is a certain expectation this will continue. If CVX were to decide not to distribute a dividend and to use the earnings to repurchase shares or to reinvest in the company, the stock price would likely take a beating because it would go against investor expectations. However, Chevron continues to increase its dividend despite periods of low oil and gas prices and overblown expectations of the dividend’s demise.

Source: Portfolio Insight*

Since CVX rewards investors with a consistently growing dividend, investors can expect the 4th consecutive $1.42 quarterly dividend to be declared in October for distribution in mid-December; the 3rd was declared at the end of July for distribution in mid-October.

With CVX shares currently trading at ~$154, the dividend yield is ~3.7%.

Source: Portfolio Insight*

Since CVX’s FY2022 performance has been exceptional and expectations are for strong earnings and FCF for the remainder of the current fiscal year, I expect CVX will increase its quarterly dividend by $0.08 to $1.50 when it declares a quarterly dividend in January.

Share Repurchases

Unlike XOM’s weak share repurchase track record since FY2015, CVX’s track record has fared better.

The weighted average number of issued and outstanding shares (in millions) in FY2011 – FY2021 is 2,001, 1,965, 1,932, 1,884, 1,875, 1,873, 1,898, 1,914, 1,895, 1,870, and 1,920. For the 3 months and 6 months ending June 30, 2022, this has increased to 1,957 and 1,951. The reason for the increase is that in the first half of FY2022, $5.452B in shares were issued for share-based compensation plans and $3.755B of shares were purchased under share repurchase and deferred compensation plans. The net effect is $1.697B of YTD shares issued.

In Q1 alone, for example, CVX issued $4.6B for share-based compensation. CVX typically pays out long-term incentive compensation in Q1 of which a portion is in the form of restricted stock and performance shares. This happens annually, but this year CVX received over $4B in cash when about 3,000 current and former employees exercised stock options; the Q1 2022 proceeds from option exercises were over 4 times the historical annual average of around $1B per year. This is because of CVX’s higher stock price.

Roughly two-thirds of the vested options at FYE2021 were exercised during Q1 2022 thus lowering the potential future dilution rate. Over time, CVX expects share buybacks to more than offset the Q1 dilutive effect.

At its Investor Day in March 2022, CVX increased its share buyback guidance from ~$3B annually to ~$5B – ~$10B. Now, CVX has increased the top end of its share buyback guidance to $15B/year. Management expects to be at this level in Q3 2022.

Buybacks can change quarterly and the goal is not to maximize the buyback rate in any individual quarter. Rather, CVX sets a buyback range at a rate it can maintain across the commodity cycle.

Even in a downside price scenario (ie. $50 Brent), CVX will continue to have the capacity to buy back shares for five years with Brent at $50. Management states that with Brent at this level, CVX can buy back more than 20% of its outstanding shares over just 5 years.

CVX has also indicated it is considering the acceleration of share repurchases by leveraging the balance sheet closer to the 20% – 25% net debt ratio range. Given that the net debt ratio at the end of Q2 2022 is 8.3%, CVX can raise substantial debt!

Valuation

When I wrote my July 22, 2021 post, I indicated that I expected the 27 brokers who provided FY2021 and FY2022 adjusted diluted EPS guidance would revise their figures upwards following the release of Q2 results. At the time of that post, CVX’s valuation based on adjusted diluted EPS estimates and a ~$99 share price was:

FY2021: mean of $6.32 and a low/high range of $4.95 – $8.50. The forward adjusted diluted PE using the mean estimate is ~15.66 and ~14 if I use $7.

FY2022: mean of $7.23 and a low/high range of $5.05 – $10.44. The forward adjusted diluted PE using the mean estimate is ~13.7 and ~11 if I use $9. At the time of my November 1, 2021 post, CVX was trading at ~$114.50. Based on the wide-ranging estimates, CVX’s forward adjusted diluted PE valuations were:

FY2021: mean of $7.39 and a low/high range of $5.19 – $9.42 from 30 brokers. The forward adjusted diluted PE using the mean estimate is ~15.5 and ~12.2 if I use $9.42.

FY2022: mean of $8.97 and a low/high range of $6.25 – $12.19 from 31 brokers. The forward adjusted diluted PE using the mean estimate is ~12.8 and ~9.4 if I use $12.19.

When I wrote my January 29, 2022 post, the adjusted earnings estimates and forward adjusted diluted PE valuations using the current ~$130.50 share price were:

CVX shares were trading at ~$160 when I wrote my May 3, 2022 post. Using this share price and the current adjusted earnings estimates, forward adjusted diluted PE valuations were:

CVX shares are now trading at ~$154. The current adjusted earnings estimates from the brokers which cover CVX are, once again, all ‘over the map’.

It is readily apparent the brokers who cover CVX continue to have a huge difference in opinion about the company’s outlook!

I think the low end of each year’s earnings estimates is unrealistic and should be higher. I am also very reluctant to rely on earnings estimates beyond FY2022. Furthermore, if CVX significantly increases its debt load to repurchase shares, the forward EPS estimates could radically change.

We know that CVX has generated $9.17 and $9.18 in YTD2022 GAAP earnings and adjusted earnings. If it generates a similar bottom line over the remainder of FY2022 then we are looking at FY2022 earnings of ~$18.35. Using the current share price, the forward adjusted diluted PE is ~8.40.

Should the second half of FY2022 be weaker than the first half and CVX generates $15.00 in FY2022 adjusted diluted EPS, then we are looking at a forward adjusted diluted PE of ~10.3.

This seems like a fair valuation from my perspective.

Looking at CVX’s valuation from an FCF perspective, CVX generated ~$6.1B in Q1 and ~$10.6B in Q2 for a YTD FCF of ~$16.7. Should the second half of FY2022 be weaker than the first half and CVX only generates ~$10B in FCF, FY2022’s FCF would be $26.7B. The diluted weighted average number of shares outstanding for the 3 months ending June 30 is 1.957B. CVX intends to repurchase shares in the second half of FY2022 so suppose the weighted average declines to 1.94B. On this basis, CVX’s FCF per share is ~$13.76. Divide the current ~$154 share price by ~13.76 and CVX’s forward P/FCF is ~11.2.

While not an exact science, we now have PE and P/FCF ratios upon which to gauge CVX’s valuation.

In my opinion, CVX’s valuation is reasonable despite the recent run-up in its share price.

Chevron (CVX) – Oil and Gas Demise Is Overblown – Final Thoughts

Long-term CVX shareholders have endured several years of subpar investment returns. The world, however, has changed and I expect superior returns going forward. Fear about the demise of the oil and gas industry is probably overblown, and Chevron should benefit from higher future demand.

Historically, integrated oil and gas producers would spend billions of dollars on exploration and development. Massive projects, especially those offshore, would take years to develop before investors would see a dime in earnings and cash flow. Oftentimes, the projects would make sense when started. By the time they were completed several years later, however, industry conditions could have dramatically changed; the profitability of some of these projects was not as projected.

In recent years, the focus has changed from exploration and development to profitability and FCF. As a result, companies have significantly scaled back their capital expenditures. Earnings and FCF are now being returned to shareholders in the form of dividend increases, special dividends, and significant share repurchases.

While this is great from an investor’s perspective, scaling back on exploration and development is likely to lead to a long-term supply/demand imbalance. Green energy might replace oil and gas to some extent. However, the global population is growing and many regions in the world cannot afford to transition to green energy. Think for a moment just how many people in densely populated countries, such as India, can afford electric vehicles.

Next, we have mining industry executives warning us that the current exploration and development of mines from which the minerals are extracted for batteries in electric vehicles is insufficient to meet future demand. Exploration and development in the mining industry are not much different than that in the oil and gas space. It costs a lot of money and it takes years before a mine comes into production.

We should also consider that many of the mines rich in the minerals the world will require are in regions that are rife with corruption. Furthermore, if you think there are environmental hazards with oil and gas exploration you had better believe that mining also has its fair share of environmental hazards.

I like that CVX has a very strong balance sheet, very strong cash flow, and the ability to continue to return cash to shareholders in any environment (even when Brent is at $50). For these reasons AND the ‘big picture’ reasons, I was acquiring CVX shares when they were out of favour. These acquisitions ultimately led to CVX being my third largest holding when I completed my Mid-2022 Investment Holdings Review.

Despite the recent run-up in CVX’s share price, shares appear to still be reasonably valued. I periodically add to my CVX exposure and acquired:

in two different ‘Core’ accounts in the FFJ Portfolio. I also reinvest the quarterly dividend income from my existing CVX holdings which, based on the current dividend and the number of shares owned minus the 15% dividend withholding tax, adds 16 – 20 shares/quarter.

Thanks for reading Chevron (CVX) – Oil and Gas Demise Is Overblown.

Other articles by Charles Fournier are:

Imperial Oil (IMO) Is Gushing Free Cash Flow

Exxon Mobil (XOM) Shareholders Are Finally Being Rewarded

Author Bio: I am a self-taught investor and run the Financial Freedom is a Journey blog. I have invested in the North American equities markets for over 34 years. I retired from a career in banking and continue to invest as this is something about which I am passionate.

Author Disclosure: I am long CVX and XOM. I disclose holdings held in the FFJ Portfolio and the dividend income generated from these holdings. I do not disclose details of holdings held in various tax-advantaged accounts for confidentiality reasons.

Author Disclaimer: I do not know your circumstances and do not provide individualized advice or recommendations. I encourage you to make investment decisions by conducting your research and due diligence. Consult your financial advisor about your specific situation.

Originally Posted on dividendpower.org