Business Overview

Atmos Energy can trace its beginnings back to 1906, when it was formed in Texas. Since then, it has grown organically and through mergers to a $16.5 billion market capitalization.

The company distributes and stores natural gas in eight states, serves over 3 million customers, and should generate about $3.7 billion in revenue this year. Atmos Energy manages proprietary pipeline and storage assets, including one of Texas’s largest intrastate natural gas pipeline systems. Atmos has a 38-year history of raising dividends, putting it in a rare company among dividend stocks.

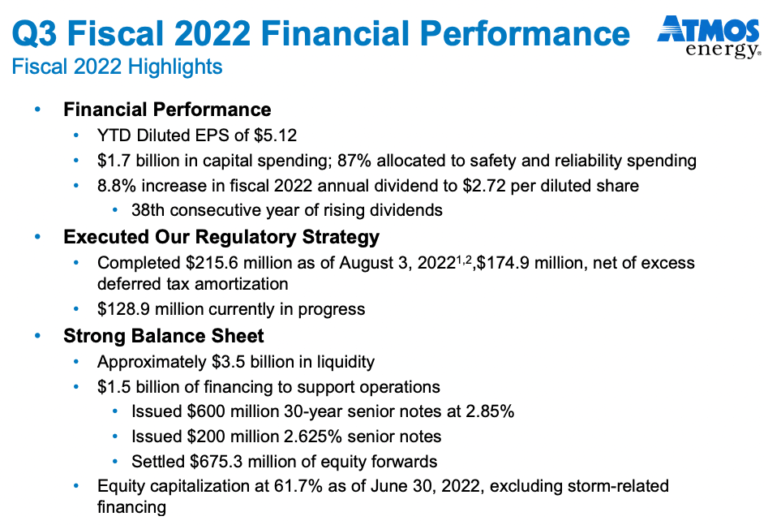

Atmos reported third-quarter earnings on August 3rd, 2022, and results were better than expected on both the top and bottom lines. Earnings-per-share came to $0.92, which was seven cents ahead of estimates. Total investment income soared 34.8% to $816.4 million, beating expectations by $128.67 million.

Consolidated operating income increased by $21.2 million to $154.6 million for the third quarter from $133.4 million in the third quarter of 2021.

Distribution operating income decreased to $66.1 million for the quarter compared to $68.1 million in the third quarter of 2021. Key operating drivers for this segment include a net $30.5 million increase in rates, a $2.6 million increase due to net customer growth, a $3.3 million increase in consumption, net of the company weather normalization adjustments (WNA), and a $1.8 million decrease in other operation and maintenance expense primarily due to lower bad debt expense in the current-year quarter, partially offset by a $13.7 million increase in depreciation and property tax expenses and a $5.0 million increase in system maintenance expense.

Pipeline and storage operating income increased from $23.3 million to $88.5 million compared to $65.3 million for the same period of 2021. Key drivers for this segment were a $21.0 million increase in rate due to GRIP filings approved in 20211 and 2022. Also, a $6.1 million decrease in system maintenance expenses.

Growth Prospects

Earnings growth across the utility industry typically mimics GDP growth. However, we expect Atmos Energy to continue outperforming this trend due to its focus on capital investment in its regulated operations, a constructive regulatory environment in Texas, and population growth.

As a result, the company should benefit from solid rate base growth, which will generate annual earnings per share growth in accordance with management’s 6% – 8% guidance. For example, the company was approved to increase its rates last year.

The growth drivers for Atmos Energy are new customers, rate increases, and aggressive capital expenditures. One benefit of operating in a regulated industry is that utilities are permitted to raise rates on a regular basis, which virtually assures a steady level of growth.

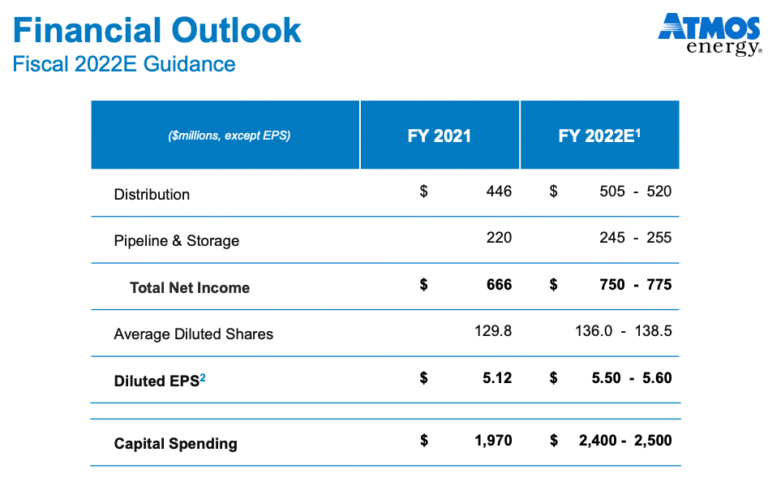

The company provided a 2022 outlook. The company expects an increase in distribution and total net income for the year. They also expect earnings growth from $5.12 per share in 2021 to $5.55 per share in 2022.

Competitive Advantages & Recession Performance

Atmos Energy’s main competitive advantage is the high regulatory hurdles of the utility industry. Gas service is necessary and vital to society. As a result, the industry is highly regulated, making it virtually impossible for a new competitor to enter the market. This provides great certainty to Atmos Energy and its annual earnings.

Another competitive advantage is the company’s stable business model and sound balance sheet, giving it an attractive cost of capital. This enables it to fund accretive acquisitions and growth capital expenditures, driving outsized earnings per share growth.

In addition, the utility business model is highly recession-resistant. While many companies experienced large earnings declines in 2008 and 2009, Atmos Energy’s earnings per share kept growing. Earnings-per-share during the Great Recession are shown below:

- 2007 earnings-per-share of $1.91

- 2008 earnings-per-share of $1.99 (4% growth)

- 2009 earnings-per-share of $2.07 (4% growth)

- 2010 earnings-per-share of $2.20 (6% growth)

The company still generated healthy growth even during the worst economic downturn. This resilience allowed Atmos Energy to continue increasing its dividend each year.

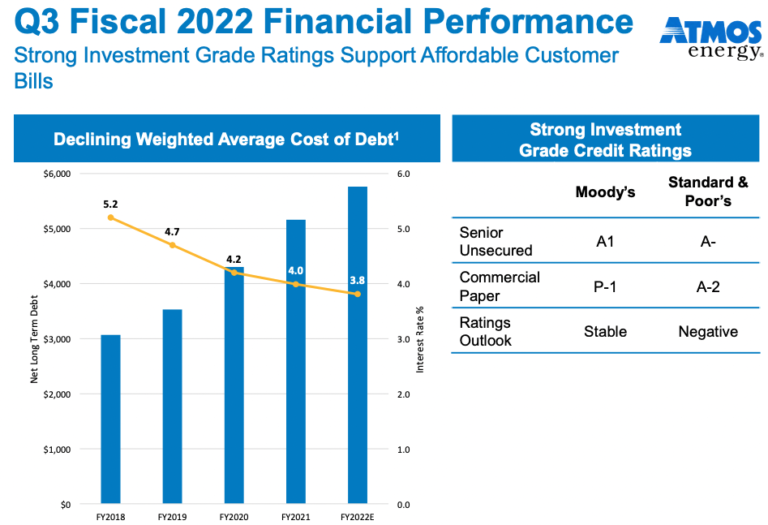

The company has a robust balance sheet. The company sports a debt-to-equity ratio of 0.9 and a long-term debt-to-capital ratio of 33.4. Also, the interest coverage ratio is 10.3, which is an admirable ratio, meaning that the company covers the interest on its debt well. The company also has an A- S&P credit rating. This is an investment grade rating.

Valuation & Expected Returns

Atmos Energy is expected to earn $5.55 this year. Based on this, the stock trades with a price-to-earnings ratio of 21.4. This is above our fair value estimate of 19X. The current ratio is also above the company’s ten-year average ratio of 19.6x earnings. However, it is below the five-year average of 22.3x earnings.

Thus, Atmos Energy shares appear to be overvalued. If the stock valuation retraces to the fair value estimate over the next five years, the corresponding multiple contractions will reduce annual returns by 1.9%. This could be a slight headwind for future returns.

The stock could still provide positive returns to shareholders through earnings growth and dividends. We expect the company to grow earnings by 6% per year over the next five years.

In addition, the stock has a current dividend yield of 2.3%. Atmos Energy last raised its dividend by 8.8% in November 2021. This marked the 38th year of dividend growth for Atmos Energy. We expect the company to grow its dividend this November at a high single-digit rate.

Overall, if we add all this together, we can expect the company to have a 6.4% annual rate of return for the next five years.

Final Thoughts

Atmos has strong fundamentals and a long track record of solid performance, but the valuation has risen of late. We are forecasting total annual returns of 6.4%, consisting of the current 2.3% yield, 6% earnings-per-share growth, and a slight potential headwind from the valuation. Thus, the stock earns a hold rating.

Thanks for reading this article. Please send any feedback, corrections, or questions to support@suredividend.com.

Business Overview

Atmos Energy can trace its beginnings back to 1906, when it was formed in Texas. Since then, it has grown organically and through mergers to a $16.5 billion market capitalization.

The company distributes and stores natural gas in eight states, serves over 3 million customers, and should generate about $3.7 billion in revenue this year. Atmos Energy manages proprietary pipeline and storage assets, including one of Texas’s largest intrastate natural gas pipeline systems. Atmos has a 38-year history of raising dividends, putting it in a rare company among dividend stocks.

Atmos reported third-quarter earnings on August 3rd, 2022, and results were better than expected on both the top and bottom lines. Earnings-per-share came to $0.92, which was seven cents ahead of estimates. Total investment income soared 34.8% to $816.4 million, beating expectations by $128.67 million.

Consolidated operating income increased by $21.2 million to $154.6 million for the third quarter from $133.4 million in the third quarter of 2021.

Distribution operating income decreased to $66.1 million for the quarter compared to $68.1 million in the third quarter of 2021. Key operating drivers for this segment include a net $30.5 million increase in rates, a $2.6 million increase due to net customer growth, a $3.3 million increase in consumption, net of the company weather normalization adjustments (WNA), and a $1.8 million decrease in other operation and maintenance expense primarily due to lower bad debt expense in the current-year quarter, partially offset by a $13.7 million increase in depreciation and property tax expenses and a $5.0 million increase in system maintenance expense.

Pipeline and storage operating income increased from $23.3 million to $88.5 million compared to $65.3 million for the same period of 2021. Key drivers for this segment were a $21.0 million increase in rate due to GRIP filings approved in 20211 and 2022. Also, a $6.1 million decrease in system maintenance expenses.

Source: Investor Presentation

Growth Prospects

Earnings growth across the utility industry typically mimics GDP growth. However, we expect Atmos Energy to continue outperforming this trend due to its focus on capital investment in its regulated operations, a constructive regulatory environment in Texas, and population growth.

As a result, the company should benefit from solid rate base growth, which will generate annual earnings per share growth in accordance with management’s 6% – 8% guidance. For example, the company was approved to increase its rates last year.

The growth drivers for Atmos Energy are new customers, rate increases, and aggressive capital expenditures. One benefit of operating in a regulated industry is that utilities are permitted to raise rates on a regular basis, which virtually assures a steady level of growth.

The company provided a 2022 outlook. The company expects an increase in distribution and total net income for the year. They also expect earnings growth from $5.12 per share in 2021 to $5.55 per share in 2022.

Source: Investor Presentation

Competitive Advantages & Recession Performance

Atmos Energy’s main competitive advantage is the high regulatory hurdles of the utility industry. Gas service is necessary and vital to society. As a result, the industry is highly regulated, making it virtually impossible for a new competitor to enter the market. This provides great certainty to Atmos Energy and its annual earnings.

Another competitive advantage is the company’s stable business model and sound balance sheet, giving it an attractive cost of capital. This enables it to fund accretive acquisitions and growth capital expenditures, driving outsized earnings per share growth.

In addition, the utility business model is highly recession-resistant. While many companies experienced large earnings declines in 2008 and 2009, Atmos Energy’s earnings per share kept growing. Earnings-per-share during the Great Recession are shown below:

The company still generated healthy growth even during the worst economic downturn. This resilience allowed Atmos Energy to continue increasing its dividend each year.

The company has a robust balance sheet. The company sports a debt-to-equity ratio of 0.9 and a long-term debt-to-capital ratio of 33.4. Also, the interest coverage ratio is 10.3, which is an admirable ratio, meaning that the company covers the interest on its debt well. The company also has an A- S&P credit rating. This is an investment grade rating.

Source Investor Presentation

Valuation & Expected Returns

Atmos Energy is expected to earn $5.55 this year. Based on this, the stock trades with a price-to-earnings ratio of 21.4. This is above our fair value estimate of 19X. The current ratio is also above the company’s ten-year average ratio of 19.6x earnings. However, it is below the five-year average of 22.3x earnings.

Thus, Atmos Energy shares appear to be overvalued. If the stock valuation retraces to the fair value estimate over the next five years, the corresponding multiple contractions will reduce annual returns by 1.9%. This could be a slight headwind for future returns.

The stock could still provide positive returns to shareholders through earnings growth and dividends. We expect the company to grow earnings by 6% per year over the next five years.

In addition, the stock has a current dividend yield of 2.3%. Atmos Energy last raised its dividend by 8.8% in November 2021. This marked the 38th year of dividend growth for Atmos Energy. We expect the company to grow its dividend this November at a high single-digit rate.

Overall, if we add all this together, we can expect the company to have a 6.4% annual rate of return for the next five years.

Final Thoughts

Atmos has strong fundamentals and a long track record of solid performance, but the valuation has risen of late. We are forecasting total annual returns of 6.4%, consisting of the current 2.3% yield, 6% earnings-per-share growth, and a slight potential headwind from the valuation. Thus, the stock earns a hold rating.

Thanks for reading this article. Please send any feedback, corrections, or questions to support@suredividend.com.

Originally Posted on suredividend.com