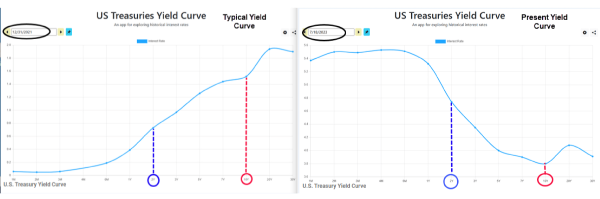

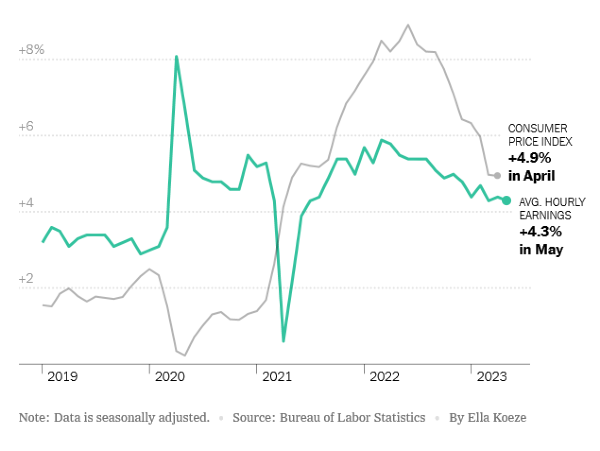

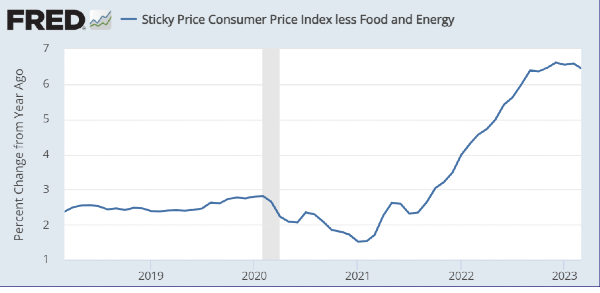

July 21, 2023 - With the markets in a pause state I thought it would be good to talk about what an “Inverted Yield Curve” is, since many throw that term around when interest rates get dicey. A ‘Normal’ chart of government bond interest rates looks like the chart on the left.

The logic is that when rates are stable and not likely to change much, buyers of longer dated bonds have higher interest rates. Stands to reason since if you’re holding a bond that matures in 10 years you should be paid more for an uncertain future than someone holding say a 2 year bond. It’s all about future risk and how to compensate for it.

When the interest rate curve is inverted (i.e. turned upside down) the shorter term (2 year) bond pays more interest that a 10 year bond. Why is that? Well it’s because the market demands a higher interest rate, which is typically because interest rates are rising and nobody knows just how far they are likely to rise; also the perspective that rate may actually fall in the near future. An inverted yield curve then looks like what we have now and is shown on the right.

Why do folks think this “Yield Curve Inversion” is important? The point would be made that no economic recession has started without an inversion, but . . . there has been inversions without a recession. Thus, just because there is a yield curve inversion does not mean there must be a recession coming; could be, but maybe not too.

One last point with bonds and interest rates: With any bond, if current interest rates rise, the bond value (what buyers are willing to pay for it) falls. If one holds the bond to maturity that is of little consequence, but if you want / need to sell before maturity it all depends on what interest rate of your bond vs. what the current rate is. (Yes, there are other factors such as the bond rating, liquidly, etc.) The bottom line is the value of bonds, like stocks, depend on supply and demand. Who wants to buy a bond at face value that pays 2% when you can buy an equivalent bond at 5%? (only at a discount) I rest my case.

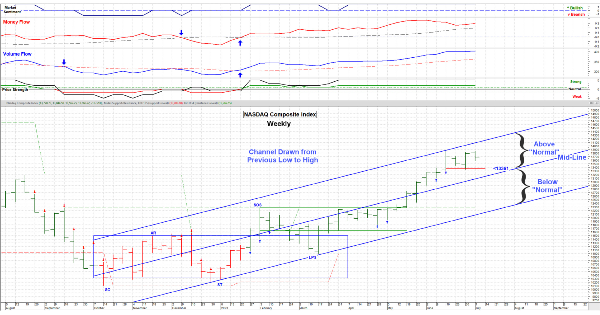

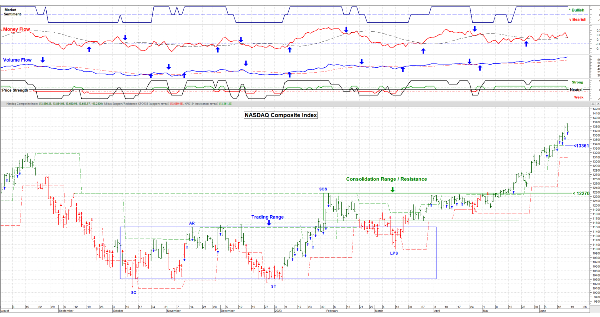

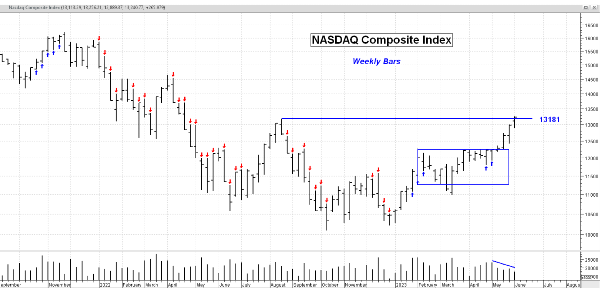

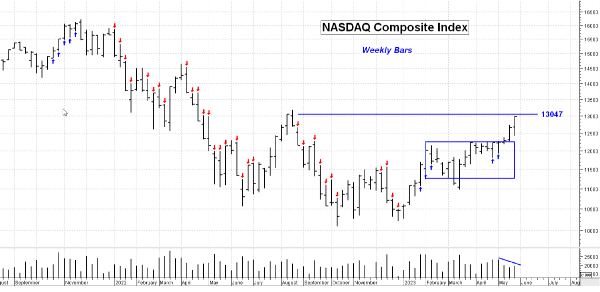

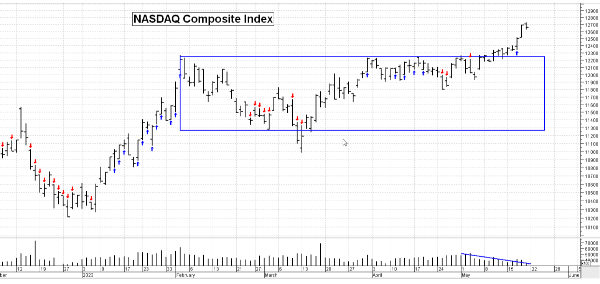

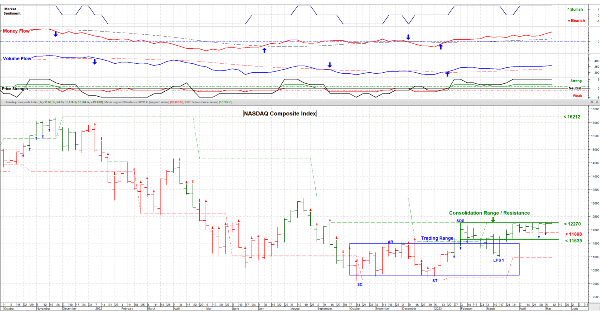

I’m still expecting a minor pullback or at the least a pause in this market; it’s due. Have a good week.

… Tom …

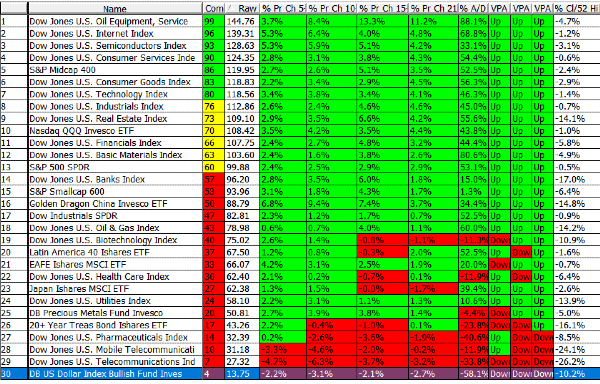

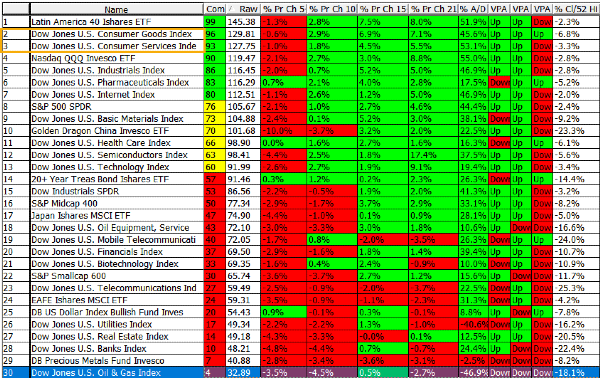

Sector Strength table at: www.Special-Risk.net

July 21, 2023 - With the markets in a pause state I thought it would be good to talk about what an “Inverted Yield Curve” is, since many throw that term around when interest rates get dicey. A ‘Normal’ chart of government bond interest rates looks like the chart on the left.

The logic is that when rates are stable and not likely to change much, buyers of longer dated bonds have higher interest rates. Stands to reason since if you’re holding a bond that matures in 10 years you should be paid more for an uncertain future than someone holding say a 2 year bond. It’s all about future risk and how to compensate for it.

When the interest rate curve is inverted (i.e. turned upside down) the shorter term (2 year) bond pays more interest that a 10 year bond. Why is that? Well it’s because the market demands a higher interest rate, which is typically because interest rates are rising and nobody knows just how far they are likely to rise; also the perspective that rate may actually fall in the near future. An inverted yield curve then looks like what we have now and is shown on the right. Why do folks think this “Yield Curve Inversion” is important? The point would be made that no economic recession has started without an inversion, but . . . there has been inversions without a recession. Thus, just because there is a yield curve inversion does not mean there must be a recession coming; could be, but maybe not too.

One last point with bonds and interest rates: With any bond, if current interest rates rise, the bond value (what buyers are willing to pay for it) falls. If one holds the bond to maturity that is of little consequence, but if you want / need to sell before maturity it all depends on what interest rate of your bond vs. what the current rate is. (Yes, there are other factors such as the bond rating, liquidly, etc.) The bottom line is the value of bonds, like stocks, depend on supply and demand. Who wants to buy a bond at face value that pays 2% when you can buy an equivalent bond at 5%? (only at a discount) I rest my case.

I’m still expecting a minor pullback or at the least a pause in this market; it’s due. Have a good week. … Tom …

Sector Strength table at: www.Special-Risk.net