The stock market's current turbulence has left retail investors searching for reliable indicators to guide them back into equities. Among these indicators, the price-to-earnings (P/E) ratio stands out as one of the most commonly discussed metrics, having been a cornerstone of investing for nearly a century. However, while the P/E ratio can be informative, relying solely on this metric is a flawed strategy for making sound investment decisions.

Understanding the Limitations of the P/E Ratio

The P/E ratio measures how much investors are willing to pay for a company's earnings. While it offers insight into valuation, it doesn't provide a complete picture. Here’s why: the P/E ratio fails to account for a company’s assets, cash reserves, or growth potential. Without considering these factors, investors risk making decisions based on incomplete data.

The Three Key Metrics for Valuing a Company

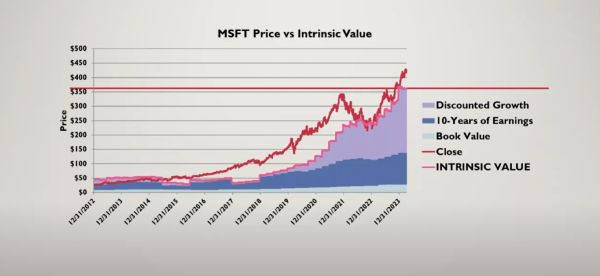

To obtain a more accurate intrinsic value of a company, investors should combine the P/E ratio with two other metrics: the book value per share and earnings growth. Here’s how these metrics work together:

- Price-to-Earnings (P/E) Ratio: Offers a snapshot of how much investors are paying for each dollar of a company’s earnings.

- Book Value per Share: Represents the net asset value per share of a company. This metric is particularly useful for understanding the baseline value of a company’s assets.

- Earnings Growth: Measures the company’s ability to increase profitability over time. While assessing earnings growth is challenging—especially for growth stocks—it’s a crucial factor in determining a company's future potential.

Book Value: A Crucial Yet Overlooked Metric

Consider the importance of book value through real-world examples. Apple, at one point, had so much cash on hand that $11 of its stock price per share was supported purely by cash reserves. This illustrates how valuable assets can significantly influence a stock's valuation.

On the flip side, Chevron's stock once traded at a price that matched its book value per share when oil prices were at historic lows. Investors essentially bought Chevron’s assets wholesale, as if the company had no future earnings potential—a gross underestimation of its intrinsic value.

Sector-Specific Insights: Why One Size Doesn't Fit All

Another critical limitation of the P/E ratio is that it varies significantly across sectors. For example:

- Banks: Tend to have more assets per share, requiring lower P/E ratios for fair valuation.

- Tech Companies: Often lack significant physical assets but exhibit higher growth potential, justifying higher P/E ratios.

Thus, applying a generic P/E ratio across all industries is impractical and can lead to misguided investment decisions.

Key Takeaway for New Investors

If you’re new to investing, start by focusing on the book value per share. This metric provides a solid foundation for understanding how much of a company’s stock price is backed by tangible assets. For instance, if a stock is trading at $20 per share and $5 is supported by assets, your task is to evaluate whether the remaining $15 is justified by the company's earnings and growth potential.

By combining the P/E ratio, book value per share, and earnings growth, investors can develop a more holistic approach to stock valuation.

For more in-depth stock analysis and ideas, check out our investor leaderboard, where only the best-performing stock tips trend.

Happy investing!

The stock market's current turbulence has left retail investors searching for reliable indicators to guide them back into equities. Among these indicators, the price-to-earnings (P/E) ratio stands out as one of the most commonly discussed metrics, having been a cornerstone of investing for nearly a century. However, while the P/E ratio can be informative, relying solely on this metric is a flawed strategy for making sound investment decisions.

Understanding the Limitations of the P/E Ratio

The P/E ratio measures how much investors are willing to pay for a company's earnings. While it offers insight into valuation, it doesn't provide a complete picture. Here’s why: the P/E ratio fails to account for a company’s assets, cash reserves, or growth potential. Without considering these factors, investors risk making decisions based on incomplete data.

The Three Key Metrics for Valuing a Company

To obtain a more accurate intrinsic value of a company, investors should combine the P/E ratio with two other metrics: the book value per share and earnings growth. Here’s how these metrics work together:

Book Value: A Crucial Yet Overlooked Metric

Consider the importance of book value through real-world examples. Apple, at one point, had so much cash on hand that $11 of its stock price per share was supported purely by cash reserves. This illustrates how valuable assets can significantly influence a stock's valuation.

On the flip side, Chevron's stock once traded at a price that matched its book value per share when oil prices were at historic lows. Investors essentially bought Chevron’s assets wholesale, as if the company had no future earnings potential—a gross underestimation of its intrinsic value.

Sector-Specific Insights: Why One Size Doesn't Fit All

Another critical limitation of the P/E ratio is that it varies significantly across sectors. For example:

Thus, applying a generic P/E ratio across all industries is impractical and can lead to misguided investment decisions.

Key Takeaway for New Investors

If you’re new to investing, start by focusing on the book value per share. This metric provides a solid foundation for understanding how much of a company’s stock price is backed by tangible assets. For instance, if a stock is trading at $20 per share and $5 is supported by assets, your task is to evaluate whether the remaining $15 is justified by the company's earnings and growth potential.

By combining the P/E ratio, book value per share, and earnings growth, investors can develop a more holistic approach to stock valuation.

For more in-depth stock analysis and ideas, check out our investor leaderboard, where only the best-performing stock tips trend.