Should I buy Amazon stock now? Is this the question you are asking after Amazon announced somewhat satisfactory second-quarter results on July 28 after their disastrous Q1 earnings in March? If yes, you need to look at the Amazon stock price prediction.

This article will discuss the headwinds Amazon stock has been witnessing since the start of this financial year and post-pandemic. On the other hand, we will analyze where the stock price will be in the upcoming 5 to 10 years. So, let’s dive deep!

Read Also: Tesla (TSLA), Alphabet (GOOG), Apple (APPL) and Netflix (NFLX)

Amazon Profile

Amazon is the largest retail and e-commerce company, providing the best e-commerce services worldwide. Founded in 1995 by Jeff Bezos in 1994 as an e-commerce business, has thrived in artificial intelligence, cloud computing and digital streaming.

An American multinational corporation can lead the digital world space in the arena of e-commerce, artificial intelligence and cloud computing. Moreover, it has ventured into the Cryptocurrency and Automotive industry by making breakthroughs in its adventures and business ventures.

| Stock Metrics |

Values |

| Market Cap |

456.40 B |

| P/E Ratio |

13.92 |

| 52-week Range |

$ 154.25 - $384.33 |

| ROE (TTM) |

9.43% |

| Beta |

1.33 |

Amazon has also ventured into cryptocurrency by introducing its cryptocurrency of Amazon Coin. Although it does not accept any cryptocurrency as a part of its payments systems, it has shown interest in taking the Non-fungible Tokens (NFTs) and other cryptocurrencies in the near future.

The business is as strong as a rock, stood firm during the Covid-19 period, and showed robust earnings even when the stock market was engulfed in pessimism and was at its lowest level. It is too good to ignore right now.

Read Also: Visa (V), Bank of America (BAC) and Meta Platforms Inc. (META)

Amazon Stock Price

Amazon's stock price prediction is very optimistic and robust by most analysts due to the resilient earnings potential of this e-commerce giant and the massive success of its Amazon Web Service (AWS), which offers cloud-computing services to businesses. It is now leading the market in cloud computing and Amazon Web services.

Amazon Stock Splits

Amazon was listed on NASDAQ in 1997 and started trading its shares globally under the ticker symbol of AMZN. Since then, four Amazon stock splits have occurred. The first stock split happened in 1998 (2-for-1 stock split).

There was two stock splits just one year after the first stock split occurred. In 1998, the second stock split was 3-for-1 in January, followed by another 2-for-1 stock split in September.

It took Amazon more than two decades to get its fourth stock split in June 2022. It was the most extensive stock split by Amazon ever (20-for-1). The purpose of stock splitting was to make the stock affordable for small investors.

Amazon First-Quarter Earnings

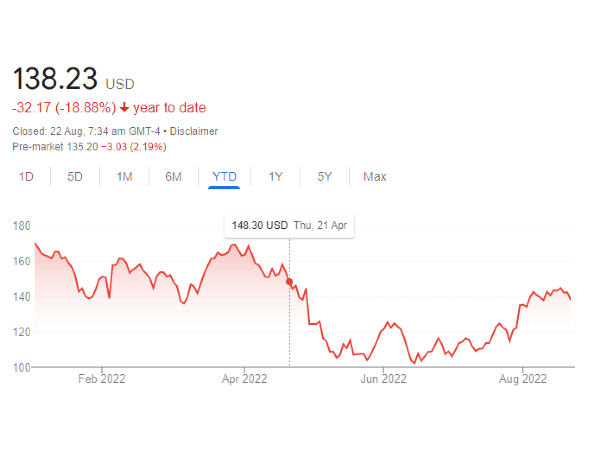

Currently, Amazon stock is being traded for $138.23. Due to the market uncertainty, Russia-Ukraine War, Inflation and Supply-chain disruptions, the stock has bottomed at 18.88% year to date.

Pandemic where proved a curse for many businesses bringing an end to some companies, Covid-19 ear proved a blessing for this e-commerce business when people were shut down to their homes, and they scrolled all day buying products at their doorsteps.

Amazon Second Quarter Earnings

Amazon made huge revenues during the isolation period, and its earnings reached as high as 220 %, reaching $108.5 billion in sales. During 2020. The net income was reported at $21.33B, higher in 2021. It was reported at $33.364 B. Until now, its year-over-year profit in 2022 has declined 60.57% for the second-quarter earnings ending June 30.

Amazon sales dropped 4% in the second quarter. The Rivian investment proved a poor decision by the Amazon and suffered a loss of 3.9 billion loss in the second-quarter.

| Stock Metrics |

Values |

YoY Change |

| Revenue |

121.23 B |

7,21% up |

| Net Income |

-2.03B |

126.07% down |

| Diluted EPS |

-0.2 |

126.32% down |

| Net Profit Margin |

-1.67% |

124.27% down |

Amazon Stock Price Prediction

Amazon's stock price is expected to reach $500 by the end of 2025. It will reach the three-digit number and cross the price of $2000 by 2030. Amazon estimates the third quarter as an excellent health care adventure. Moreover, the Rivian automation shows somewhat negative results.

Read Also: Sempra Energy Stock (SRE), Edison International Stock (EIX), NRG Energy Stock and Dominion Energy Stock (D)

The Bottom Line

The bottom line is a business model as innovative as Amazon and as resilient as it has proved until now is not a gamble. It is a strong buy if you have an investment outlook of at least ten years in your mind. In a resilient model, one bad year or a quarter does not make sense for the long-term investment. The Amazon stock price prediction is strong and is expected to reach $2000 by 2030. So, it is high time you buy Amazon stock now.

Read Aslo: What Will Microsoft (MSFT) be Worth in 10 Years?, NextEra Energy Stock (NEE) and Is BBY A Buy or Sell? Is Best Buy still the Best Buy For Investors?

Should I buy Amazon stock now? Is this the question you are asking after Amazon announced somewhat satisfactory second-quarter results on July 28 after their disastrous Q1 earnings in March? If yes, you need to look at the Amazon stock price prediction.

This article will discuss the headwinds Amazon stock has been witnessing since the start of this financial year and post-pandemic. On the other hand, we will analyze where the stock price will be in the upcoming 5 to 10 years. So, let’s dive deep!

Read Also: Tesla (TSLA), Alphabet (GOOG), Apple (APPL) and Netflix (NFLX)

Amazon Profile

Amazon is the largest retail and e-commerce company, providing the best e-commerce services worldwide. Founded in 1995 by Jeff Bezos in 1994 as an e-commerce business, has thrived in artificial intelligence, cloud computing and digital streaming.

An American multinational corporation can lead the digital world space in the arena of e-commerce, artificial intelligence and cloud computing. Moreover, it has ventured into the Cryptocurrency and Automotive industry by making breakthroughs in its adventures and business ventures.

Amazon has also ventured into cryptocurrency by introducing its cryptocurrency of Amazon Coin. Although it does not accept any cryptocurrency as a part of its payments systems, it has shown interest in taking the Non-fungible Tokens (NFTs) and other cryptocurrencies in the near future.

The business is as strong as a rock, stood firm during the Covid-19 period, and showed robust earnings even when the stock market was engulfed in pessimism and was at its lowest level. It is too good to ignore right now.

Read Also: Visa (V), Bank of America (BAC) and Meta Platforms Inc. (META)

Amazon Stock Price

Amazon's stock price prediction is very optimistic and robust by most analysts due to the resilient earnings potential of this e-commerce giant and the massive success of its Amazon Web Service (AWS), which offers cloud-computing services to businesses. It is now leading the market in cloud computing and Amazon Web services.

Amazon Stock Splits

Amazon was listed on NASDAQ in 1997 and started trading its shares globally under the ticker symbol of AMZN. Since then, four Amazon stock splits have occurred. The first stock split happened in 1998 (2-for-1 stock split).

There was two stock splits just one year after the first stock split occurred. In 1998, the second stock split was 3-for-1 in January, followed by another 2-for-1 stock split in September.

It took Amazon more than two decades to get its fourth stock split in June 2022. It was the most extensive stock split by Amazon ever (20-for-1). The purpose of stock splitting was to make the stock affordable for small investors.

Amazon First-Quarter Earnings

Currently, Amazon stock is being traded for $138.23. Due to the market uncertainty, Russia-Ukraine War, Inflation and Supply-chain disruptions, the stock has bottomed at 18.88% year to date.

Pandemic where proved a curse for many businesses bringing an end to some companies, Covid-19 ear proved a blessing for this e-commerce business when people were shut down to their homes, and they scrolled all day buying products at their doorsteps.

Amazon Second Quarter Earnings

Amazon made huge revenues during the isolation period, and its earnings reached as high as 220 %, reaching $108.5 billion in sales. During 2020. The net income was reported at $21.33B, higher in 2021. It was reported at $33.364 B. Until now, its year-over-year profit in 2022 has declined 60.57% for the second-quarter earnings ending June 30. Amazon sales dropped 4% in the second quarter. The Rivian investment proved a poor decision by the Amazon and suffered a loss of 3.9 billion loss in the second-quarter.

Amazon Stock Price Prediction

Amazon's stock price is expected to reach $500 by the end of 2025. It will reach the three-digit number and cross the price of $2000 by 2030. Amazon estimates the third quarter as an excellent health care adventure. Moreover, the Rivian automation shows somewhat negative results.

Read Also: Sempra Energy Stock (SRE), Edison International Stock (EIX), NRG Energy Stock and Dominion Energy Stock (D)

The Bottom Line

The bottom line is a business model as innovative as Amazon and as resilient as it has proved until now is not a gamble. It is a strong buy if you have an investment outlook of at least ten years in your mind. In a resilient model, one bad year or a quarter does not make sense for the long-term investment. The Amazon stock price prediction is strong and is expected to reach $2000 by 2030. So, it is high time you buy Amazon stock now.

Read Aslo: What Will Microsoft (MSFT) be Worth in 10 Years?, NextEra Energy Stock (NEE) and Is BBY A Buy or Sell? Is Best Buy still the Best Buy For Investors?