The Top Utility Stocks to Buy Now

🔥 Top Investors with Buy Ratings in Utility Stocks

Read More

The Top Utility Stocks

The top utility stocks on this list were proposed by our leading investors on the platform. These investors provide not only an investment idea but they back up their proposal with analysis and research. The top investors are drafted by other community members on the platform based on their insights, performance, and risk management.

What Makes a Good Utility Stock?

A good utility stock typically adds additionally stability and income to dividend strategies, income strategies, and even balanced growth strategies. Good utilities will pay a dividend to investors. The utility will also make responsible investments back into its company, which gets reflected with a stable appreciation in stock price. The price of a good utility will typically be stable and will not see a lot of volatility while the market is falling.

For more information on how to find a good utility stock, see How to Screen for Utility Stocks

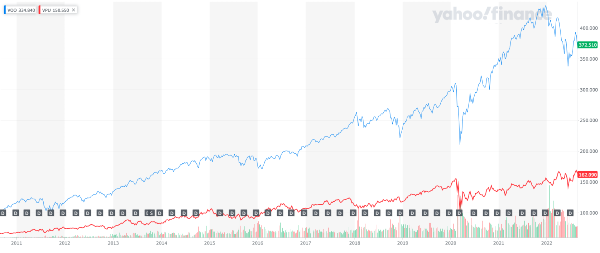

A good utility stock may not always match or outperform the overall market. Utility stocks have underperformed the overall market since the downturn in 2009. During this decade period, the Vanguard S&P 500 ETF VOO (representing the overall market)) climbed 266% while the Vanguard utility Index Fund VPU (representing utilities) climbed 148% in the same period.

Source: Yahoo! Finance

Utility ETF VPU (in red) vs. S&P 500 ETF VOO (in blue) from 2011 to 2022

During the same period, you can see that during significant downturns in the market, utilities didn’t feel significant downward pressure.

What is Considered a Utility Stock?

Per Fidelity Research[6], the Utility sector consists of companies who provide:

- Electric power – this could be coal, nuclear, natural gas, wind or even hydro-electric power. To learn more, check out our picks for the top electric company stocks for income investors

- Gas – For example, natural gas supplied into houses for heating and cooking

- Water – This is the clean water coming in but also waste water that leaves your house. Check out our picks for the top water utility stocks for income investors

- And power distributors – These companies manage the power lines, power transformers, and distribution sub-stations that bring electricity to your home or business.

Energy stocks are not utility stocks. Energy stocks consist of the oil and gas industry, while utility stocks provide energy and water to businesses and households. These two sectors have different performance opportunities and risk profiles.

Investing in Utility Stocks

Utility stocks are great assets to help reduced the volatility of your portfolio. Dividend reinvestment plans (DRIPS) may be utilized to reinvest income earned from utility dividends. Many brokerages like Fidelity allow you to reinvest dividends from fractional shares. This allows you to build a diversified portfolio that includes dividends for only $10.

Utility Stocks for Income Investors

Utilities stocks provide low volatility and stable dividends. Both qualities help income investors with their strategy. Using Vanguard’s Utility ETF again as an example, we can see how Utilities provide significant benefits to an income strategy.

- Dividend rate for VPU is 2.81% as of Q3 2022

- The stocks beta is 0.45, meaning that if the market falls, Utilities will fall at roughly half the rate and potentially even rise.

- The dividend for VPU has steadily increased year over year[1], representing a consistent growth rate across the Utility sector

Are Utility Stocks Safe?

Utility stocks are a safe long term investment; however, they have proven to be very volatile in the short term. Utility stocks have had a drawdown of 35% to 55% in the last five years. This drawdown percentage is worse than a bear market which is a 20% fall in the overall market. You can learn more about this volatility in our article, The Safest Utility Stocks to Invest in Q4 2022.

Are Utility Stocks Good During Inflation?

Utility stocks are a neutral option when inflation rises. When inflation occurs, multiple economic machinations take place that will interfere with each other:

During inflation, a utilities dividend rate will be eroded by rising prices

Simultaneously, inflation may erode the rate of short-term notes so low as to show a negative real interest rate[2]. This will add pressure to income investors to find a higher dividend return, which may turn them to utility dividends

When inflation becomes untenable, the Federal Reserve will raise interest rates. If this shocks the broader market, investors may move out of riskier assets into dividends. There is no clear factor that decides when inflation is untenable and is determined by government policy[3]. Hence, the timing of interest rate hikes is not reliably predictable.

Once inflation starts to fall again, investors may flee utility stocks to gain exposure to beaten down stocks.

The takeaway is that Utility stocks should be assessed on the merits of the company, their dividend, and their price vs. their valuation. Though inflation can effect these assessments, inflation itself isn’t a good consideration when determining to buy a utility stock.

What Makes a Utility Stock Fall?

Some of the main reasons a utility stock falls:

- A dividend is cut to preserve money for capital projects or to shore up operational costs

- A major capital project (for example, a new Nuclear Plant)[4]) is delayed and over budget

- Investors fleeing safer assets if momentum is moving towards riskier assets

- A Utility Company is being mis-managed, producing poor results or even safety risks. This occurred catastrophically with PG&E as they are blamed for causing California’s largest wild fire in 2022

- Utility stocks can have large drawdowns during a market correction. Utility stocks are safe long-term investments, but can be risky in the short-term.

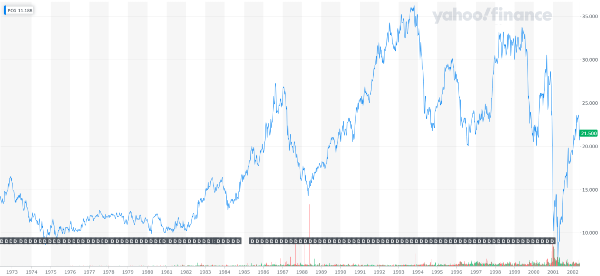

Source: Yahoo! Finance

Shares of PG&E collapsed in 2021 as the company was sued for allegedly causing major fires in California due to incompetency and negligence

How do you Value a Utility Stock?

The best way to value a utility stock is using a "discounted earnings model". Discount earnings by the current interest rate and be sure to add in the utility's book value per share into your calculated intrinsic value. Utilities tend to revert back to their intrinsic value in roughly 2-year intervals.

Executives at different utilities use the same tools and metrics to present the value of their utility company. Investors need to interpret these metrics to help decide upon a valuation of the utility. The key metrics utilities use are:

- Earnings Bridge Charts - These charts guide investors on why earnings grew or fell

- Price to Earnings Ratio - The P/E ratio of utilities are typically lower than other sectors

- Dividend Policy - A policy set by the board that defines how dividends are paid. Dividend policies give guidance to the company's key stakeholders on how earnings are used.

How do you Buy Utility Stocks?

Utility stocks can be bought at any Brokerage firm. For new investors, we suggest Fidelity or Robinhood due to their cost as you can build a diverse portfolio for only $10 using fractional shares.

Top Utility Stocks: The Complete Guide for 2026

If you’re searching for the top Utility stocks, this guide gives you a clearer picture than traditional rankings based on market cap or last year’s earnings. Instead of backward‑looking metrics, our list is powered by the real‑world performance of StockBossUp’s highest‑achieving investors. These investors must consistently perform well to stay ranked, which adds accountability and depth to every stock they choose.

This means the stocks you see here aren’t just popular. They reflect conviction backed by results. If you want to compete with top investors and share your own ideas, join StockBossUp and make your mark.

The Top 5 Utility Stocks

These five companies represent the top Utility stocks chosen by our highest‑performing community members. The list updates daily, giving you a real‑time look at where experienced investors see opportunity in this stock category.

There may be less than 5 stocks when top investors are not rating Utility a buy.

Why These Stocks Stand Out

Each stock earns its place through:

Strong long‑term investor sentiment

Consistent performance from top‑ranked users

Analysis focused on durable growth, not short‑term hype

The Top 16 Utility Stocks

This expanded list gives you a broader view of the best Utility stocks for long‑term investors. These stocks are ranked by sentiment from our highest‑performing long‑term investors, offering a snapshot of where experienced stock pickers see opportunity today.