Check out our companion video to this article:

https://youtu.be/K2zbK3Ch7kE

Is American Electric Power (AEP) a Buy?

American Electric Company is rated as a buy with an estimated intrinsic value of $108.73 versus a much lower current price as of $94.95 (as of the end of December 30th, 2022). This price is below our undervalued price of $97.85. We estimate that AEP would be over-valued at $119.60. As of the time of writing, AEP is 13.25% below our estimated intrinsic value.

American Electric Power Forecast

Our two-year price forecast is $122.60 and our 4-yr price forecast is 137.37.

This forecast assumes continued earnings growth of 7% minimum and continued reinvestment by AEP. These predictions are in line with its continued price growth over the last 10 years.

AEP Earnings per Share Growth

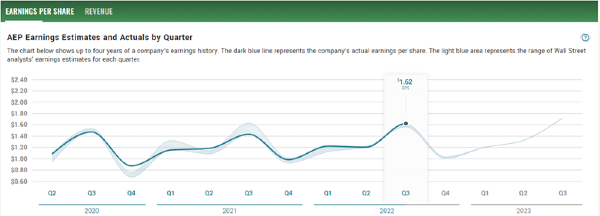

AEP has had phenomenal earnings growth for the last 10 years with a median EPS growth at a staggering 12%. For 2023, analyst consensus estimates EPS will jump to $5.26 per share, this is an estimated EPS growth of 9.13% and in line with AEP’s historical growth. AEP has proven it delivers what it promises, and this can be seen in the EPS forecast versus actual below. AEP has historically done a great job providing estimates for analysts. The difference between actuals and forecasts are minimal.

Hence, there doesn't seem to be any upcoming risks to earnings growth, even with the AEP executive team warning that economic activity slowdown will start to hit AEPs electrical demand in 2023.

AEP Economic Development Projects

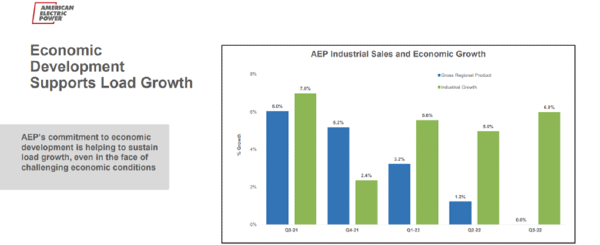

The executive noted that even though regional gross domestic product has been sharply sliding, their efforts for the past few years to build their economic development projects is starting to pay off.

Various projects like new chemical plants, steel mills, and other industrial facilities take years to prepare electrical transmission lines for. Julie Sloat, President and soon to be CEO starting January 2023, noted in the quarterly that these economic development projects had been planned years ago and the benefits are now being seen as AEP load is balanced out by this new economic activity.

AEP’s New Leadership

Julie Sloat will be AEP’s new CEO starting January 2023. She replaces Nick Akins who will stay as AEP’s chairman of the board. On the call, Nick noted how AEP has a proven track record of “exceeding our earnings projections and raising guidance”.

“[AEP continues to exceed] our earnings projections and raise guidance” – Nick Akins, Chair of AEP

Julie Sloat looks to be a great choice to continue this culture of increasing goals and meeting expectations. Her Q3 report was spot on in recognizing issues within certain numbers being reported and keen on breaking down the numbers in their transmission business further to better help analysts understand business performance. Julie looks to have been mentored by Nick; hence, there looks to be no risk in continued performance during this leadership transition.

Pure Play Regulated Utility

Per Nick Akins, AEP continues to be a “pure play, regulated utility”. AEP solely provides electricity to its customers from power generation to transmission and distribution. Unlike other utilities, AEP does not provide water or natural gas to its customers. By focusing on just electrical generation and transmission, AEP has significantly reduced the volatility of their business. The distribution of natural gas creates earnings volatility as the price of natural gas swings with the markets. Besides avoiding natural gas, another core reason for this reduced volatility is their transition into renewable energy.

“AEP is a pure play, regulated utility” – Nick Akins, Chair of AEP

While its admirable to reduce carbon emissions by renewable energy, I do not believe that is the only reason why AEP is pushing hard into renewable energy. Their push into renewable energy reduces their exposure to the volatile energy markets by not relying on natural gas, coal, and oil to produce energy. This allows them to reliably control their cost of revenue and ultimately their gross margins.

Read More: What is the Difference Between the Utility and Energy Sector

While focusing on just electricity reduces earnings volatility, by focusing on being a regulated utility, AEP reduces competition. This gives them further earnings consistency and improved margins. For investors, this is basically a moat.

Book Value Per Share

Book value per share is a critical component in assessing intrinsic value. As of Q3 2022, AEP’s book value per share was at $47.26. This gives a current price-to-book ratio of 2.01.

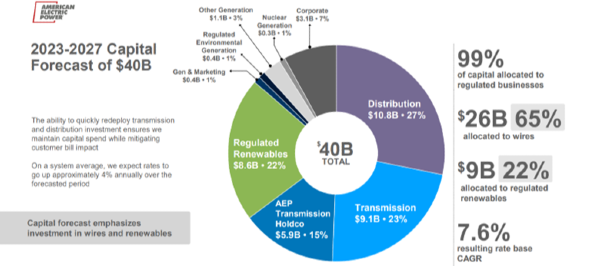

All indications point to book value per share increasing for the next few years. When comparing 2021 assets and liabilities to those of 2022, no particular issues are glaring. Net Property, Plant and equipment increased roughly $4 Billion in the last year. This is a good sign that the company is reinvesting earning into capital projects faster than their equipment is depreciating. AEP is dedicated to further investment in renewable energy. This will continue to grow the company’s reinvestment in its renewable energy power generation.

Source: AEP Q3 2022 Earnings Presentation. AEP is dedicated to investing in transition, distribution, and renewables

Other notes from AEPs balance sheet:

- Long term debt due in one year fell by ~$0.5 Billion. This was offset by long-term debt increasing by roughly $2 Billion

- Shareholder equity increased by roughly $2 Billion year-over-year

- Accounts receivables jumped by $0.5 Billion. This asset on the books is of interest as this may mean that more people are not paying their electric bills on time. This could also just be a normal delay in payment from industrial customers with longer payment terms.

AEP Dividend

As of the start of the new year, AEP’s dividend yield sat at around 3.5%. AEP has a really good dividend thanks to its consistent, decades long, dividend growth and their strong, consistent dividend policy. AEP’s dividend policy is a 60% to 70% dividend payout ratio. AEP is ranked as our top dividend utility stock thanks in part to a strong adherence to its dividend policy.

Is AEP a Good Income Stock?

AEP is ranked #1 as our top utility stock for income investors as of Q4 2022. AEP’s focus on its core business and its strong dedication to methodical earnings growth has allowed its stock price to consistently increase the last decade along with its dividend. Its low price volatility, strong price appreciation, and historical dividend growth also made AEP our top electric utility stock as of Q4 2022 and the top safest utility stock for income investors.

The leadership transition is bringing a new CEO with the same principals of methodical earnings growth and disciplined capital allocation. It would not be a surprise if AEP continues to be a top utility stock thru 2023.

The Bottom Line

AEP is poised to be a great stock pick to start 2023. AEP looks to be undervalued with a strong forecast to appreciate thru 2025. AEP's disciplined approach to growing guidance, meeting goals, and methodical earnings growth has helped AEP be our pick as the top electric utility stock and the top safest utility stock for income investors.

I/we have a position in an asset mentioned

Check out our companion video to this article:

https://youtu.be/K2zbK3Ch7kE

Check out our companion video to this article:

https://youtu.be/K2zbK3Ch7kE

Is American Electric Power (AEP) a Buy?

American Electric Company is rated as a buy with an estimated intrinsic value of $108.73 versus a much lower current price as of $94.95 (as of the end of December 30th, 2022). This price is below our undervalued price of $97.85. We estimate that AEP would be over-valued at $119.60. As of the time of writing, AEP is 13.25% below our estimated intrinsic value.

American Electric Power Forecast

Our two-year price forecast is $122.60 and our 4-yr price forecast is 137.37. This forecast assumes continued earnings growth of 7% minimum and continued reinvestment by AEP. These predictions are in line with its continued price growth over the last 10 years.

AEP Earnings per Share Growth

AEP has had phenomenal earnings growth for the last 10 years with a median EPS growth at a staggering 12%. For 2023, analyst consensus estimates EPS will jump to $5.26 per share, this is an estimated EPS growth of 9.13% and in line with AEP’s historical growth. AEP has proven it delivers what it promises, and this can be seen in the EPS forecast versus actual below. AEP has historically done a great job providing estimates for analysts. The difference between actuals and forecasts are minimal.

Source: marketbeat.com

Hence, there doesn't seem to be any upcoming risks to earnings growth, even with the AEP executive team warning that economic activity slowdown will start to hit AEPs electrical demand in 2023.

AEP Economic Development Projects

The executive noted that even though regional gross domestic product has been sharply sliding, their efforts for the past few years to build their economic development projects is starting to pay off.

Source: AEP Investor Presentation Q3 2022

Various projects like new chemical plants, steel mills, and other industrial facilities take years to prepare electrical transmission lines for. Julie Sloat, President and soon to be CEO starting January 2023, noted in the quarterly that these economic development projects had been planned years ago and the benefits are now being seen as AEP load is balanced out by this new economic activity.

AEP’s New Leadership

Julie Sloat will be AEP’s new CEO starting January 2023. She replaces Nick Akins who will stay as AEP’s chairman of the board. On the call, Nick noted how AEP has a proven track record of “exceeding our earnings projections and raising guidance”.

Julie Sloat looks to be a great choice to continue this culture of increasing goals and meeting expectations. Her Q3 report was spot on in recognizing issues within certain numbers being reported and keen on breaking down the numbers in their transmission business further to better help analysts understand business performance. Julie looks to have been mentored by Nick; hence, there looks to be no risk in continued performance during this leadership transition.

Pure Play Regulated Utility

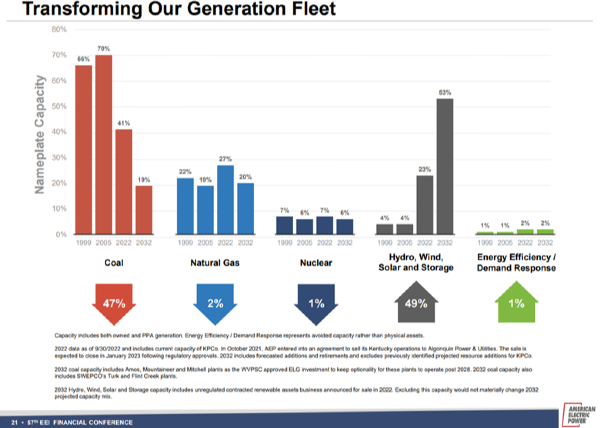

Per Nick Akins, AEP continues to be a “pure play, regulated utility”. AEP solely provides electricity to its customers from power generation to transmission and distribution. Unlike other utilities, AEP does not provide water or natural gas to its customers. By focusing on just electrical generation and transmission, AEP has significantly reduced the volatility of their business. The distribution of natural gas creates earnings volatility as the price of natural gas swings with the markets. Besides avoiding natural gas, another core reason for this reduced volatility is their transition into renewable energy.

While its admirable to reduce carbon emissions by renewable energy, I do not believe that is the only reason why AEP is pushing hard into renewable energy. Their push into renewable energy reduces their exposure to the volatile energy markets by not relying on natural gas, coal, and oil to produce energy. This allows them to reliably control their cost of revenue and ultimately their gross margins.

Source: AEP 2022 Investor Fact Book

While focusing on just electricity reduces earnings volatility, by focusing on being a regulated utility, AEP reduces competition. This gives them further earnings consistency and improved margins. For investors, this is basically a moat.

Image by Robert Owen-Wahl from Pixabay

Book Value Per Share

Book value per share is a critical component in assessing intrinsic value. As of Q3 2022, AEP’s book value per share was at $47.26. This gives a current price-to-book ratio of 2.01. All indications point to book value per share increasing for the next few years. When comparing 2021 assets and liabilities to those of 2022, no particular issues are glaring. Net Property, Plant and equipment increased roughly $4 Billion in the last year. This is a good sign that the company is reinvesting earning into capital projects faster than their equipment is depreciating. AEP is dedicated to further investment in renewable energy. This will continue to grow the company’s reinvestment in its renewable energy power generation.

Source: AEP Q3 2022 Earnings Presentation. AEP is dedicated to investing in transition, distribution, and renewables

Other notes from AEPs balance sheet:

AEP Dividend

As of the start of the new year, AEP’s dividend yield sat at around 3.5%. AEP has a really good dividend thanks to its consistent, decades long, dividend growth and their strong, consistent dividend policy. AEP’s dividend policy is a 60% to 70% dividend payout ratio. AEP is ranked as our top dividend utility stock thanks in part to a strong adherence to its dividend policy.

Is AEP a Good Income Stock?

AEP is ranked #1 as our top utility stock for income investors as of Q4 2022. AEP’s focus on its core business and its strong dedication to methodical earnings growth has allowed its stock price to consistently increase the last decade along with its dividend. Its low price volatility, strong price appreciation, and historical dividend growth also made AEP our top electric utility stock as of Q4 2022 and the top safest utility stock for income investors. The leadership transition is bringing a new CEO with the same principals of methodical earnings growth and disciplined capital allocation. It would not be a surprise if AEP continues to be a top utility stock thru 2023.

The Bottom Line

AEP is poised to be a great stock pick to start 2023. AEP looks to be undervalued with a strong forecast to appreciate thru 2025. AEP's disciplined approach to growing guidance, meeting goals, and methodical earnings growth has helped AEP be our pick as the top electric utility stock and the top safest utility stock for income investors.

I/we have a position in an asset mentioned

Check out our companion video to this article:

https://youtu.be/K2zbK3Ch7kE