Introduction

Hershey (HSY): Dividend Stock Review. As a dividend growth Investor, the best companies to invest in are quality companies with a history of growing revenues and cash flow to enable them to increase their dividends over time. In addition, dividend increases act as a hedge against inflation as investors are technically getting a raise each year the company grows its dividend.

A company like Hershey (HSY) is known worldwide and appears on the surface to be a quality company. Indeed a good start, but before parting with hard-earned cash, it is always wise to carry out your due diligence on a company.

This review will examine Hershey’s business units to see how the it makes money and potential future catalysts. As dividends come from cash to investors, the financial statements are critical to the due diligence process, with particular attention paid to the balance sheet and cash flow.

Hershey (HSY) – Dividend Stock Review

Affiliate

If you are interested in investing in stocks that pay dividends I recommend signing up for the Sure Dividend Newsletter*. It is a good value and one of the best dividend stock newsletters available. There is a 7-day free trial and grace period so it is risk free. The service provides top 10 stock picks each month with discussion of advantages, valuation, and risks. I highly recommend them and use their insights for my own stock research.

Brief Introduction About Hershey

In 1894, Milton Hershey introduced Hershey as a Lancaster caramel subsidiary under the Hershey Chocolate Company. The company has grown to be the largest producer of chocolate and confectionery products in the United States. The company is No. 1 in confection and No. 2 in snacking in the United States.

Besides chocolates, the company also bakes cakes and cookies and sells beverages such as milkshakes and other products. Popular brands include Hershey’s, Reese’s, Kisses, Cadbury, Ice Breakers, Kit Kat, Almond Joy, Jolly Rancher, Twizzlers, Good’ n’ Plenty, Heath, Whoppers, and Milk Duds.

Hershey’s company headquarters is located in Hershey, Pennsylvania, and it distributes its products all over the U.S. and in more than 60 countries globally. The company has massive distribution centers and uses modern technology and industry management systems to run its processes and product production.

According to Warren Buffett, a tycoon, investor, and Berkshire Hathaway’s CEO, two significant rules should govern your investment, and they are;

1). Don’t lose money

2). remember rule number one.

Here’s a detailed overview of the Hershey dividend to help me if it’s worth my investment.

Hershey (HSY) – A Dividend Stock Review

Hershey (HSY) Stock Price and Fundamentals

- Stock Price: $231.99

- Market Capitalization: $47.55 B

- PE Ratio: 28.64X

- Dividend Rate (FWD): $4.14

- Dividend Yield (FWD): 1.79%

- Payout Ratio (FWD): 47.4%

Hershey’s Recent Earnings and Growth

Hershey has been growing over the past years and is doing well in 2022. In Q3 2022, Hershey’s net sales improved by 15.6 %, amounting to $2,728.2 million. Over fiscal years 2017-2021, HSY has recorded a gross profit margin of 45.4% to 46.0%.

Acquisitions influence was a 4.1-point headwind, and foreign exchange was a 0.3-point headwind for net sales. But net income fell by 9.3%, to $1.94 per share-diluted or a $399.5 million net income.

Hershey’s marketing, selling, and administration expenses rose by 13.5% in the quarter, boosted by inflation, labor expenses, and technology investments. During their fourth quarter last year, HSY recorded a $556.6 million operating profit.

A company’s operating margin can tell you if it has problems because the margin usually declines before the revenue and profit. The operating margin is calculated by dividing a company’s operating income by its revenue. For example, in 2021, Hershey’s revenue and operating income were $8,971.3 million and $2,048.6 million, respectively.

Hence, their operating margin at that time was 22.8%, which isn’t a bad sign. This income has been progressively expanding. Over the past 5-years, HSY’s operating margin has been between 20.7% and 22.8% exceeding most Consumer Packaged Goods companies.

Revenue has grown from $7.515.4 million in 2017 to $8,971.3 million in 2021.

Hershey Payout Ratios

Companies usually pay out dividends from the profits it earns. However, a dividend may become unideal and unjustifiable if the company pays more than it makes. Therefore, it’s best to be stringent and careful when selecting a dividend growth company. Payout ratios can be calculated using earnings, net income, or free cash flow, as outlined here.

You can determine if the company can afford the dividends by analyzing its net income percentage after tax. For example, HSY paid slightly less than half of its profits or 45.7% as dividends over the trailing 12-month period. Payout ratios of more than 50% usually indicate that the company is almost reaching maturity. However, they can continue to increase their dividend. Payout ratios of more than 65% are riskier than the dividend.

Besides comparing HSY dividends against its profit, it’s also essential to know if it could create enough money to pay dividends. The free cash flow (FCF) payout ratio is around 43.3%, below our cutoff value of 70%.

Usually, Hershey’s dividends are covered by current FCF and profits, implying that their dividends are ideal and sustainable. Furthermore, with a low payout ratio, HSY has a significant safety margin to prevent cutting its dividend.

Growth of Dividends and Earnings for Hershey Stock

With a robust growth prospect, it’s easy for a business to provide the best dividend payment. Dividends tend to grow smoothly and immensely if a company’s earnings per share snowball. Conversely, a company with decreasing earnings per share usually cuts its dividends.

Therefore, Hershey’s investment in its dividend seems like a good prospect due to its rapidly growing earnings. For the last five years, HSY has recorded an EPS GAGR of more than 10%.

It’s rational payout ratio, earnings growth, and profits reinvestment indicate that the Hershey dividends have a higher growth probability due to the strong prospects.

Sometimes, relying on dividends as an income source can be risky, especially when the company starts struggling financially and decides to cut its dividends. Such an occurrence will not only impact your income flow but also make your investment decline.

Dividend volatility describes the measure of a dividend’s risk. This Hershey dividend review will analyze its dividend payment for the last ten years to help have a deeper look at its dividend volatility.

Statistics show that the Hershey’s dividends have been stable in the last decade, which is a great sign. This data indicates that the Hershey stock’s dividends and the company generally have a high resilience.

Compared to its first annual payment in 2012 of $1.56 with last year’s $3.41, Hershey’s dividends have shown significant growth, approximated to be 9.47% annually over this period.

In the past five years, HSY has attained an average dividend growth rate of about 7.26% annually. As a result, Hershey has consistently increased its dividends and earnings growth.

Growing earnings faster than dividends is a positive sign for dividend growth investors and a good sign for sustainability.

Future Growth

While HSY has performed well in the last decade, it’s often easy to wonder if this will be the trend in the upcoming years. Its 2022 outlook is provided considering the period of high inflation and geopolitical concerns following the volatility of the COVID-19 pandemic.

Hershey’s management board expects a 14 to 15% adjusted EPS growth rate and 14 to 15% net sales growth. In addition, the firm expects a 4-to-5-point benefit from Pretzels, Dot’s, and Lily’s Sweets acquisitions.

It also expects an approximately $135 to $140 million interest expense and a $600 million capital expenditure.

Debt Analysis

At the end of Q3 FY 2022, the company had short-term debt of $793.9 million, current long-term debt of $752.2 million, and long-term debt of $3,340.7 million. The cash and equivalents were $327.7.

Here’s a brief definition of some of the terms in the above paragraph: current debt refers to a part of an industry’s debt that’s due in a year, and long-term debts are due in more than a year. Cash and equivalents refer to the money and all liquid securities with three months or less maturity period. Total debt refers to the (long-term + current debt) – cash equivalents.

A company’s financial leverage can be estimated by comparing the debt ratio. For example, Hershey’s total assets are worth $10,832.9 million, and its total debt was $5,213.9 million, with a debt ratio of 0.48. Debt ratios above one usually mean that most of the debt is financed by assets, which can be risky.

The defaulting loan risk usually increases with the debt ratio if the interest rises too. Currently, Hershy has a debt-to-equity ratio of 169%, which has been declining in the past 5-years. However, the company has an interest coverage ratio of over 16X and a leverage ratio of 1.88X. As a result, the rating agencies give Hershey an A/A1 upper-medium investment grade credit rating.

Conclusion on Hershey – Dividend Stock Review

As a dividend growth investor, there is much to like about Hershy. Solid and reliable earnings have paved the way for free cash flow and dividend growth. As a Dividend Contender, the company has returned increasing dividends to shareholders for the past 13 years. Share buybacks were canceled during the worst part of the COVID-19 pandemic but were restarted.

The snacking business will most likely remain a focus. However, investment in innovation should drive sales higher over the long haul. However, we have seen trends that consumers are becoming more health-conscious, which could damage the companies’ expected growth rates in the future. In addition, the balance sheet is in reasonably good order and leaves plenty of room for the company to grow through bolt-on acquisitions.

For Investors purely focused on income and dividend safety, Hershy ticks many boxes, but valuation becomes essential from a total return point of view. As a result, investors may be disappointed that the current dividend yield of 1.78% is lower than the company’s historical 2.19% average. In addition, during the past ten years, shares of Hershey have traded with a P/E ratio between 22.88X and 26.84X earnings. However, the current P/E ratio of 28.24X suggests the company is overvalued, limiting future upside from stock price appreciation.

That said, the company trade at a premium price for a reason. The company managed to increase its profits and sales during the Great Recession. It did so again during the COVID-19 pandemic.

Thanks for reading Hershey (HSY) – A Dividend Stock Review.

Disclosure: None

Introduction

Hershey (HSY): Dividend Stock Review. As a dividend growth Investor, the best companies to invest in are quality companies with a history of growing revenues and cash flow to enable them to increase their dividends over time. In addition, dividend increases act as a hedge against inflation as investors are technically getting a raise each year the company grows its dividend.

A company like Hershey (HSY) is known worldwide and appears on the surface to be a quality company. Indeed a good start, but before parting with hard-earned cash, it is always wise to carry out your due diligence on a company.

This review will examine Hershey’s business units to see how the it makes money and potential future catalysts. As dividends come from cash to investors, the financial statements are critical to the due diligence process, with particular attention paid to the balance sheet and cash flow.

Hershey (HSY) – Dividend Stock Review

Affiliate

If you are interested in investing in stocks that pay dividends I recommend signing up for the Sure Dividend Newsletter*. It is a good value and one of the best dividend stock newsletters available. There is a 7-day free trial and grace period so it is risk free. The service provides top 10 stock picks each month with discussion of advantages, valuation, and risks. I highly recommend them and use their insights for my own stock research.

Brief Introduction About Hershey

In 1894, Milton Hershey introduced Hershey as a Lancaster caramel subsidiary under the Hershey Chocolate Company. The company has grown to be the largest producer of chocolate and confectionery products in the United States. The company is No. 1 in confection and No. 2 in snacking in the United States.

Besides chocolates, the company also bakes cakes and cookies and sells beverages such as milkshakes and other products. Popular brands include Hershey’s, Reese’s, Kisses, Cadbury, Ice Breakers, Kit Kat, Almond Joy, Jolly Rancher, Twizzlers, Good’ n’ Plenty, Heath, Whoppers, and Milk Duds.

Hershey’s company headquarters is located in Hershey, Pennsylvania, and it distributes its products all over the U.S. and in more than 60 countries globally. The company has massive distribution centers and uses modern technology and industry management systems to run its processes and product production.

According to Warren Buffett, a tycoon, investor, and Berkshire Hathaway’s CEO, two significant rules should govern your investment, and they are;

1). Don’t lose money 2). remember rule number one.

Here’s a detailed overview of the Hershey dividend to help me if it’s worth my investment.

Hershey (HSY) – A Dividend Stock Review

Hershey (HSY) Stock Price and Fundamentals

Source: Portfolio Insight* (as of December 2, 2022)

Source: Stock Rover*

Hershey’s Recent Earnings and Growth

Hershey has been growing over the past years and is doing well in 2022. In Q3 2022, Hershey’s net sales improved by 15.6 %, amounting to $2,728.2 million. Over fiscal years 2017-2021, HSY has recorded a gross profit margin of 45.4% to 46.0%.

Acquisitions influence was a 4.1-point headwind, and foreign exchange was a 0.3-point headwind for net sales. But net income fell by 9.3%, to $1.94 per share-diluted or a $399.5 million net income.

Hershey’s marketing, selling, and administration expenses rose by 13.5% in the quarter, boosted by inflation, labor expenses, and technology investments. During their fourth quarter last year, HSY recorded a $556.6 million operating profit.

A company’s operating margin can tell you if it has problems because the margin usually declines before the revenue and profit. The operating margin is calculated by dividing a company’s operating income by its revenue. For example, in 2021, Hershey’s revenue and operating income were $8,971.3 million and $2,048.6 million, respectively.

Hence, their operating margin at that time was 22.8%, which isn’t a bad sign. This income has been progressively expanding. Over the past 5-years, HSY’s operating margin has been between 20.7% and 22.8% exceeding most Consumer Packaged Goods companies.

Revenue has grown from $7.515.4 million in 2017 to $8,971.3 million in 2021.

Hershey Payout Ratios

Companies usually pay out dividends from the profits it earns. However, a dividend may become unideal and unjustifiable if the company pays more than it makes. Therefore, it’s best to be stringent and careful when selecting a dividend growth company. Payout ratios can be calculated using earnings, net income, or free cash flow, as outlined here.

You can determine if the company can afford the dividends by analyzing its net income percentage after tax. For example, HSY paid slightly less than half of its profits or 45.7% as dividends over the trailing 12-month period. Payout ratios of more than 50% usually indicate that the company is almost reaching maturity. However, they can continue to increase their dividend. Payout ratios of more than 65% are riskier than the dividend.

Besides comparing HSY dividends against its profit, it’s also essential to know if it could create enough money to pay dividends. The free cash flow (FCF) payout ratio is around 43.3%, below our cutoff value of 70%.

Usually, Hershey’s dividends are covered by current FCF and profits, implying that their dividends are ideal and sustainable. Furthermore, with a low payout ratio, HSY has a significant safety margin to prevent cutting its dividend.

Growth of Dividends and Earnings for Hershey Stock

With a robust growth prospect, it’s easy for a business to provide the best dividend payment. Dividends tend to grow smoothly and immensely if a company’s earnings per share snowball. Conversely, a company with decreasing earnings per share usually cuts its dividends.

Therefore, Hershey’s investment in its dividend seems like a good prospect due to its rapidly growing earnings. For the last five years, HSY has recorded an EPS GAGR of more than 10%.

Source: Portfolio Insight*

It’s rational payout ratio, earnings growth, and profits reinvestment indicate that the Hershey dividends have a higher growth probability due to the strong prospects.

Sometimes, relying on dividends as an income source can be risky, especially when the company starts struggling financially and decides to cut its dividends. Such an occurrence will not only impact your income flow but also make your investment decline.

Dividend volatility describes the measure of a dividend’s risk. This Hershey dividend review will analyze its dividend payment for the last ten years to help have a deeper look at its dividend volatility.

Statistics show that the Hershey’s dividends have been stable in the last decade, which is a great sign. This data indicates that the Hershey stock’s dividends and the company generally have a high resilience.

Compared to its first annual payment in 2012 of $1.56 with last year’s $3.41, Hershey’s dividends have shown significant growth, approximated to be 9.47% annually over this period.

In the past five years, HSY has attained an average dividend growth rate of about 7.26% annually. As a result, Hershey has consistently increased its dividends and earnings growth.

Growing earnings faster than dividends is a positive sign for dividend growth investors and a good sign for sustainability.

Source: Portfolio Insight*

Future Growth

While HSY has performed well in the last decade, it’s often easy to wonder if this will be the trend in the upcoming years. Its 2022 outlook is provided considering the period of high inflation and geopolitical concerns following the volatility of the COVID-19 pandemic.

Hershey’s management board expects a 14 to 15% adjusted EPS growth rate and 14 to 15% net sales growth. In addition, the firm expects a 4-to-5-point benefit from Pretzels, Dot’s, and Lily’s Sweets acquisitions.

It also expects an approximately $135 to $140 million interest expense and a $600 million capital expenditure.

Debt Analysis

At the end of Q3 FY 2022, the company had short-term debt of $793.9 million, current long-term debt of $752.2 million, and long-term debt of $3,340.7 million. The cash and equivalents were $327.7.

Here’s a brief definition of some of the terms in the above paragraph: current debt refers to a part of an industry’s debt that’s due in a year, and long-term debts are due in more than a year. Cash and equivalents refer to the money and all liquid securities with three months or less maturity period. Total debt refers to the (long-term + current debt) – cash equivalents.

A company’s financial leverage can be estimated by comparing the debt ratio. For example, Hershey’s total assets are worth $10,832.9 million, and its total debt was $5,213.9 million, with a debt ratio of 0.48. Debt ratios above one usually mean that most of the debt is financed by assets, which can be risky.

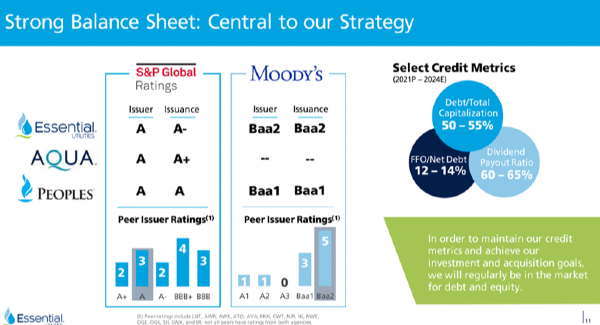

The defaulting loan risk usually increases with the debt ratio if the interest rises too. Currently, Hershy has a debt-to-equity ratio of 169%, which has been declining in the past 5-years. However, the company has an interest coverage ratio of over 16X and a leverage ratio of 1.88X. As a result, the rating agencies give Hershey an A/A1 upper-medium investment grade credit rating.

Conclusion on Hershey – Dividend Stock Review

As a dividend growth investor, there is much to like about Hershy. Solid and reliable earnings have paved the way for free cash flow and dividend growth. As a Dividend Contender, the company has returned increasing dividends to shareholders for the past 13 years. Share buybacks were canceled during the worst part of the COVID-19 pandemic but were restarted.

The snacking business will most likely remain a focus. However, investment in innovation should drive sales higher over the long haul. However, we have seen trends that consumers are becoming more health-conscious, which could damage the companies’ expected growth rates in the future. In addition, the balance sheet is in reasonably good order and leaves plenty of room for the company to grow through bolt-on acquisitions.

For Investors purely focused on income and dividend safety, Hershy ticks many boxes, but valuation becomes essential from a total return point of view. As a result, investors may be disappointed that the current dividend yield of 1.78% is lower than the company’s historical 2.19% average. In addition, during the past ten years, shares of Hershey have traded with a P/E ratio between 22.88X and 26.84X earnings. However, the current P/E ratio of 28.24X suggests the company is overvalued, limiting future upside from stock price appreciation.

That said, the company trade at a premium price for a reason. The company managed to increase its profits and sales during the Great Recession. It did so again during the COVID-19 pandemic.

Thanks for reading Hershey (HSY) – A Dividend Stock Review.

Disclosure: None

Originally Posted in dividendpower.org