Guest Contribution by Tom Hutchinson, Chief Analyst, Cabot Dividend Investor

The Fed has raised the Fed Funds rate six times this year to combat inflation and the last four times at a 0.75% clip. The current 4% rate is the highest in well over a decade. But the Central Bank has indicated that it will take more pain to get that inflation genie back in the bottle.

At the November meeting, the Fed Chairman stated that the previous 4.5% to 5.0% Fed Funds target no longer applies. It will have to go higher. How much higher? He didn’t say. He only alluded that it will have to rise sufficiently to tame this inflation, which so far six rate hikes, a contracting economy, and a bear market has yet to even slow.

The U.S. economy is resilient. GDP managed to grow more than 2% last quarter, employment remains strong, and earnings have been better than feared. But the economy will eventually give way to the forces aligned against it. It is almost a certainty that there will be a recession in 2023.

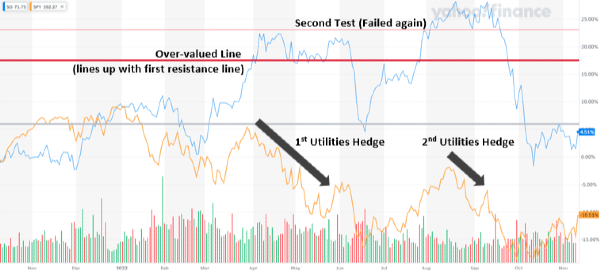

The late-summer selloff that drove the market to new lows didn’t account for recession. It focused instead on the current rising longer-term interest rates and inflation, which the inevitable recession should subdue. Some of the very best recession stocks were crushed. Therein lies the opportunity.

As the benchmark 10-year Treasury spiked to 4.25% from 2.5% at the beginning of August and 1.5% in January, conservative dividend stocks took a beating. Higher rates mean that fixed-rate investments become more competitive and dividend stocks pay the price. But a recession pressures interest rates lower and some of the most defensive stocks fell near the 52-week lows.

The best recession stocks got dirt cheap ahead of an inevitable recession. While the market indexes probably haven’t bottomed out yet, interest rate-sensitive stocks probably have. It’s premature to invest for recovery overall, but the recovery has likely already begun in certain utility stocks.

Here are two of the very best utility stocks to own. These stocks have long track records of vastly outperforming their peers and the overall market. The stocks got cheap ahead of a period where their relative performance thrives.

NextEra Energy, Inc. (NEE)

NextEra Energy provides all the advantages of a defensive utility plus exposure to the fast-growing and highly sought-after alternative energy market. It’s the world’s largest utility. It’s a monster with about $20 billion in annual revenue and a $152 billion market capitalization.

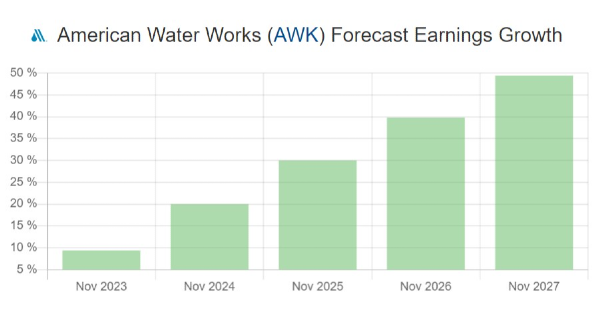

Ordinarily, when you think of a huge utility you probably think it has lackluster growth and a stable dividend. But that’s not true in this case. Earnings growth and stock returns have well exceeded what is normally expected of a utility.

For the last 10-, five-, and three-year periods, NEE has not only vastly outperformed the Utility Index but has also blown away the returns of the overall market. NEE stock has returned more than double that of the S&P 500 over the last ten years (480% with dividends reinvested). It has also significantly outperformed the S&P 500 index return over the last five years and three years.

How can that be? It’s because it isn’t a regular utility. NEE is two companies in one. It owns Florida Power and Light Company, which is one of the very best regulated utilities in the country, accounting for about 55% of revenues. It also owns NextEra Energy Resources, the world’s largest generator of renewable energy from wind and solar and a world leader in battery storage. It accounts for about 45% or earnings and provides a higher level of growth.

Investors love it because they get the safety and income of a utility and still get great growth and capital appreciation. It’s the best of both worlds.

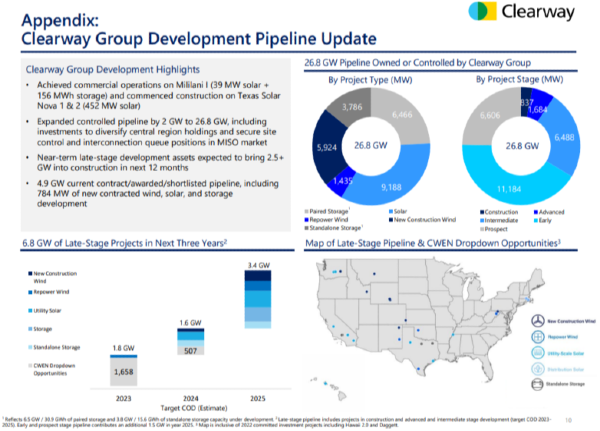

There is also a huge runway for growth projects. NextEra has deployed $50 to $55 billion in the last few years on growth expansions and acquisitions.

Since 2006, NextEra grew earnings by an average annual rate of 8.4% and grew the dividend at an average rate of 9.8% per year. That propelled the market returns stated above. The company is targeting 10% earnings growth from 2021-2025 and 10% annual dividend growth through at least 2024. NextEra has a long track record of meeting or exceeding goals.

NEE has restarted an uptrend after a drubbing that crashed the stock near the 52-week low for reasons that are likely to prove very temporary. Everything that propelled the stock higher in the past is still firmly in place. In fact, things might be better in the future than they were in the past.

Xcel Energy (XEL)

Xcel Energy provides all the defensive and recession-resistant advantages of most utilities plus exposure to the fast-growing and highly sought-after alternative energy market. It has the reliability of a utility plus much more growth than average from its sizable clean energy business.

Xcel is a regulated electric and natural gas utility serving 3.7 million electric customers and 2.1 million natural gas customers in eight states, primarily in the northern and southwestern U.S. It is also one of the largest renewable energy providers in the U.S. with about 30% of electricity sales generated from alternative energy sources.

Alternative energy is what separates XEL from the utility pack and makes it a much better investment. It enables investors to play defense and offense at the same time. You get stable earnings and low volatility along with exposure to one of the most exciting and fast-growing areas of the market.

Here are some other things to like about the stock.

- Long-term EPS growth 5% – 7%

- Annual dividend growth 5% – 7%

- Dividend payout ratio 60% – 70%

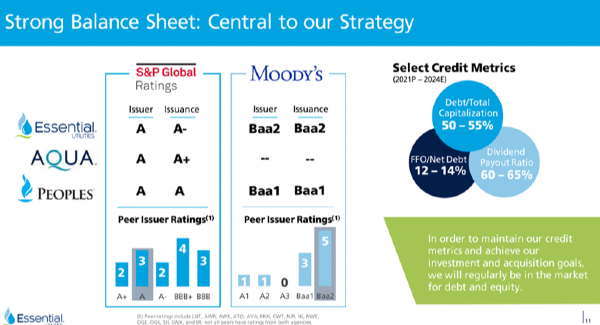

- Credit ratings in the A range

Results support the fact that Xcel is an excellent utility stock. XEL produced average annual returns of about 12% for the last ten years. That’s far better than its peer group over the same time. But that number is after the stock had a steep plunge recently.

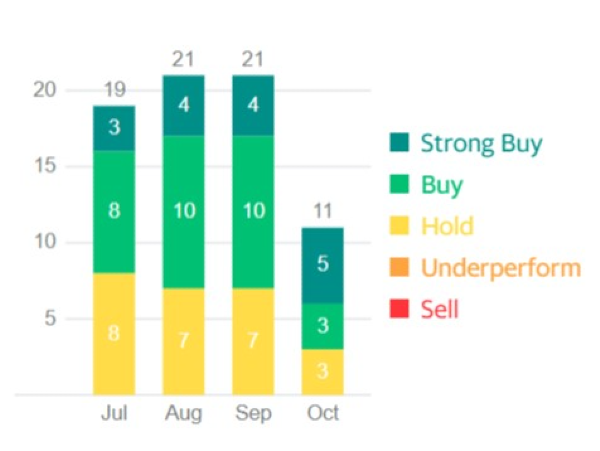

While the longer-term trajectory looks excellent, it’s really the recent market action that prompts the recommendation. The stock has gotten very cheap because of near-term circumstances and market gyrations that are unlikely to last.

Thanks for reading this article. Please send any feedback, corrections, or questions to support@suredividend.com.

Image by Oimheidi from Pixabay

Guest Contribution by Tom Hutchinson, Chief Analyst, Cabot Dividend Investor

The Fed has raised the Fed Funds rate six times this year to combat inflation and the last four times at a 0.75% clip. The current 4% rate is the highest in well over a decade. But the Central Bank has indicated that it will take more pain to get that inflation genie back in the bottle.

At the November meeting, the Fed Chairman stated that the previous 4.5% to 5.0% Fed Funds target no longer applies. It will have to go higher. How much higher? He didn’t say. He only alluded that it will have to rise sufficiently to tame this inflation, which so far six rate hikes, a contracting economy, and a bear market has yet to even slow.

The U.S. economy is resilient. GDP managed to grow more than 2% last quarter, employment remains strong, and earnings have been better than feared. But the economy will eventually give way to the forces aligned against it. It is almost a certainty that there will be a recession in 2023.

The late-summer selloff that drove the market to new lows didn’t account for recession. It focused instead on the current rising longer-term interest rates and inflation, which the inevitable recession should subdue. Some of the very best recession stocks were crushed. Therein lies the opportunity.

As the benchmark 10-year Treasury spiked to 4.25% from 2.5% at the beginning of August and 1.5% in January, conservative dividend stocks took a beating. Higher rates mean that fixed-rate investments become more competitive and dividend stocks pay the price. But a recession pressures interest rates lower and some of the most defensive stocks fell near the 52-week lows.

The best recession stocks got dirt cheap ahead of an inevitable recession. While the market indexes probably haven’t bottomed out yet, interest rate-sensitive stocks probably have. It’s premature to invest for recovery overall, but the recovery has likely already begun in certain utility stocks.

Here are two of the very best utility stocks to own. These stocks have long track records of vastly outperforming their peers and the overall market. The stocks got cheap ahead of a period where their relative performance thrives.

NextEra Energy, Inc. (NEE)

NextEra Energy provides all the advantages of a defensive utility plus exposure to the fast-growing and highly sought-after alternative energy market. It’s the world’s largest utility. It’s a monster with about $20 billion in annual revenue and a $152 billion market capitalization.

Ordinarily, when you think of a huge utility you probably think it has lackluster growth and a stable dividend. But that’s not true in this case. Earnings growth and stock returns have well exceeded what is normally expected of a utility.

For the last 10-, five-, and three-year periods, NEE has not only vastly outperformed the Utility Index but has also blown away the returns of the overall market. NEE stock has returned more than double that of the S&P 500 over the last ten years (480% with dividends reinvested). It has also significantly outperformed the S&P 500 index return over the last five years and three years.

How can that be? It’s because it isn’t a regular utility. NEE is two companies in one. It owns Florida Power and Light Company, which is one of the very best regulated utilities in the country, accounting for about 55% of revenues. It also owns NextEra Energy Resources, the world’s largest generator of renewable energy from wind and solar and a world leader in battery storage. It accounts for about 45% or earnings and provides a higher level of growth.

Investors love it because they get the safety and income of a utility and still get great growth and capital appreciation. It’s the best of both worlds.

There is also a huge runway for growth projects. NextEra has deployed $50 to $55 billion in the last few years on growth expansions and acquisitions.

Since 2006, NextEra grew earnings by an average annual rate of 8.4% and grew the dividend at an average rate of 9.8% per year. That propelled the market returns stated above. The company is targeting 10% earnings growth from 2021-2025 and 10% annual dividend growth through at least 2024. NextEra has a long track record of meeting or exceeding goals.

NEE has restarted an uptrend after a drubbing that crashed the stock near the 52-week low for reasons that are likely to prove very temporary. Everything that propelled the stock higher in the past is still firmly in place. In fact, things might be better in the future than they were in the past.

Xcel Energy (XEL)

Xcel Energy provides all the defensive and recession-resistant advantages of most utilities plus exposure to the fast-growing and highly sought-after alternative energy market. It has the reliability of a utility plus much more growth than average from its sizable clean energy business.

Xcel is a regulated electric and natural gas utility serving 3.7 million electric customers and 2.1 million natural gas customers in eight states, primarily in the northern and southwestern U.S. It is also one of the largest renewable energy providers in the U.S. with about 30% of electricity sales generated from alternative energy sources.

Alternative energy is what separates XEL from the utility pack and makes it a much better investment. It enables investors to play defense and offense at the same time. You get stable earnings and low volatility along with exposure to one of the most exciting and fast-growing areas of the market.

Here are some other things to like about the stock.

Results support the fact that Xcel is an excellent utility stock. XEL produced average annual returns of about 12% for the last ten years. That’s far better than its peer group over the same time. But that number is after the stock had a steep plunge recently.

While the longer-term trajectory looks excellent, it’s really the recent market action that prompts the recommendation. The stock has gotten very cheap because of near-term circumstances and market gyrations that are unlikely to last.

Thanks for reading this article. Please send any feedback, corrections, or questions to support@suredividend.com.

Originally Posted on suredividend.com