Sound investments

don't happen alone

Find your crew, build teams, compete in VS MODE, and identify investment trends in our evergrowing investment ecosystem. You aren't on an island anymore, and our community is here to help you make informed decisions in a complex world.

June 23, 2023 - Not much new here folks. What will be interesting is if / how the markets react to the Russian “Issues” that unfolded over the weekend. My guess is not much and we’ll return to the usual concerns about interest rates, inflation and the economy. This market has been “climbing the wall of worry” and will likely continue after a small step backwards.

A pullback to the 13360 (blue line) level would be “normal”, and in a worse case, return to the 13090 level (red dashed line). Either of which would maintain the current trajectory of up. The traditional summer slowdown is now upon us so this rate of climb may likely slow down as many big investors are on vacation going into the 4th and afterwards.

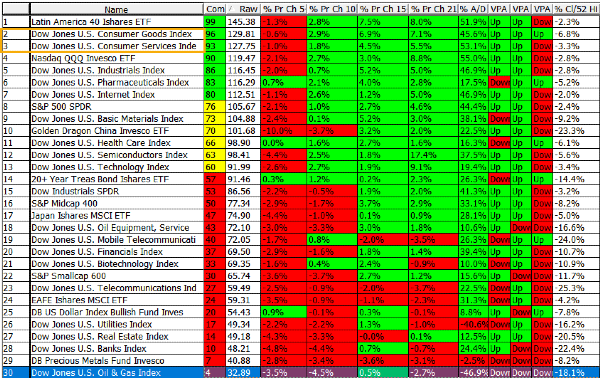

The Short Term Sector Strength table is shown above. I note that Brazil / Latin America is starting to look favorable and the strength in the consumer sectors remains good. Technology is over cooked and slowing but nothing major. For the time being . . . no recession in sight but manufacturing data shows a slowdown. That’s it for now. Have a good week. ………. Tom ………..

( chart of NASDAQ Composite, referred to) is shown at: www.Special-Risk.net ) Price chart by MetaStock; table by www.HighGrowthStock.com. Used with permission.