Sound investments

don't happen alone

Find your crew, build teams, compete in VS MODE, and identify investment trends in our evergrowing investment ecosystem. You aren't on an island anymore, and our community is here to help you make informed decisions in a complex world.

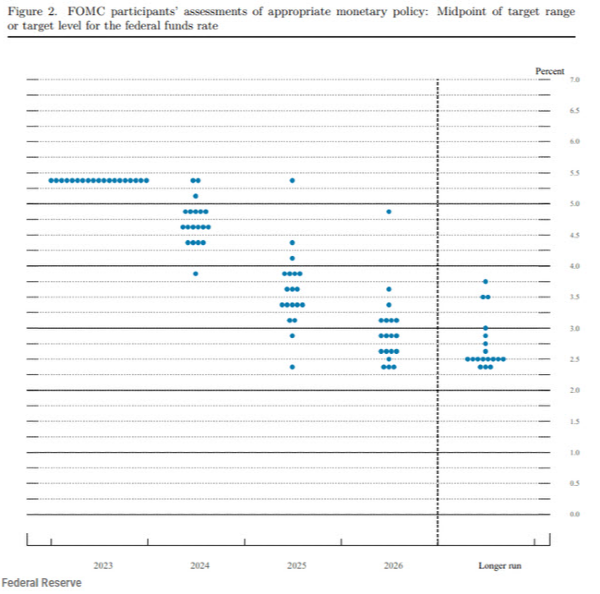

March 27, 2024 - The US economy is roughly 70% consumer based and the rest "other" (government and business to business direct). So . . . when the US consumer catches a cold, the economy gets the flu (so to speak).

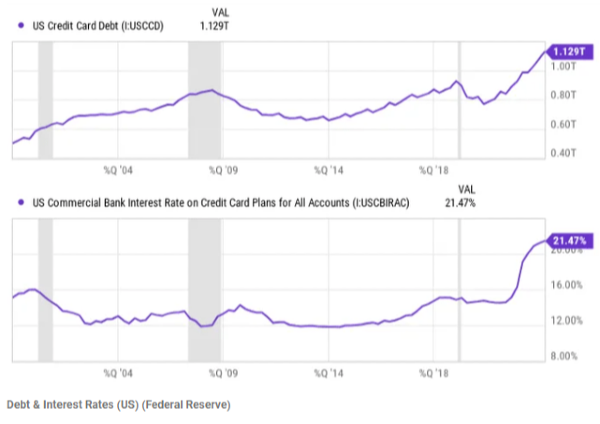

Up for your consideration is a couple of metrics about the US consumer. The top chart is the amount of debt consumers are holding and the lower chart the interest rates for short term debt, a.k.a. credit card debt. My thought is that this economy has certainly recovered and it's because of the consumer; not surprisingly. More than likely because of the pent up demand caused by COVID and the urge to "get back to normal", though it's more like catching up to normal.

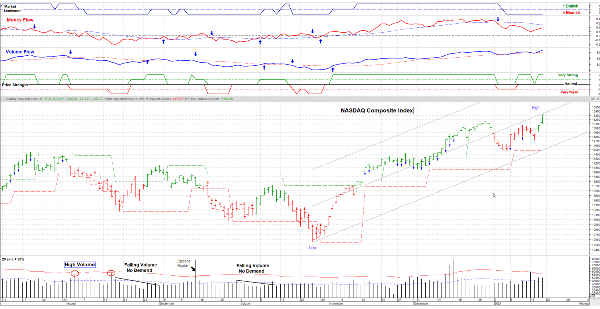

This does not mean that the economy or markets need to go down, but does likely mean they won't go up nearly as fast a rate as what we've seen. A sideway market or a minor (5-10%) correction would be entirely appropriate. The question is what event will trigger that?

Until then, I'm invested but with Cash available to add as a continuation of a market move high develops. ***Happy Easter to All ! *** ............. Tom ................