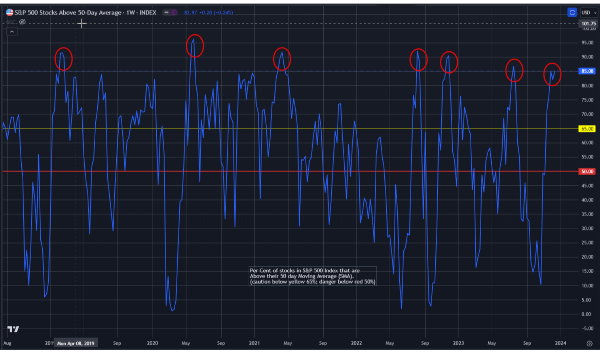

March 1, 2024 - I’ve been harping on the ‘Lack of Breath’ in this market for months. It basically means that a smaller number of stocks account for the majority of an index’s performance. I’m super business so I’ll get right to the point.

Above is a chart of the” Magnificent 7” stocks in comparison to the broad S&P 500 Index. Now, one of the major reasons for this is that the S&P Index is capital weighted, that is, the price of the stock times the number of shares = “capitalization”. The S&P gives weight or value to the stock’s price as a function of its capitalization. Thus large (number of shares) companies with high stock prices sway the index the most.

The “Mag 7” stocks are also the most “expensive” when viewed in comparison to the average stock P/E Ration (Price divided by Earnings).

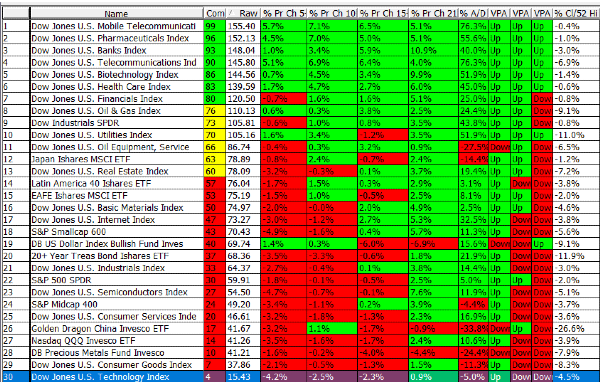

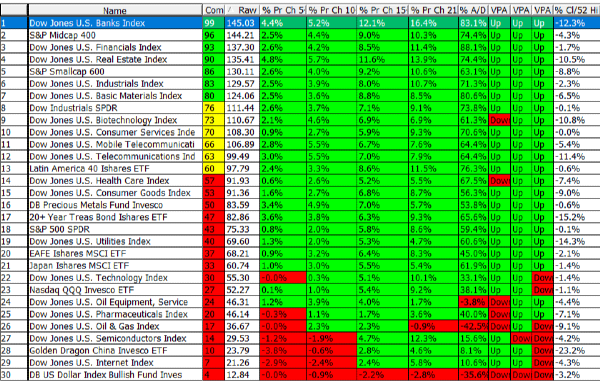

Here’s the most recent table of P/E evaluation –

* (shown at www.Special-Risk.net)*

Now folks will say that these stocks are “worth more” because of potential earnings growth. OK, but if (or when) that earnings report comes out that does not support that narrative . . . well, all Hell breaks loose. The bottom line is stocks, like real estate, are worth whatever the buyer is willing to pay . . . now.

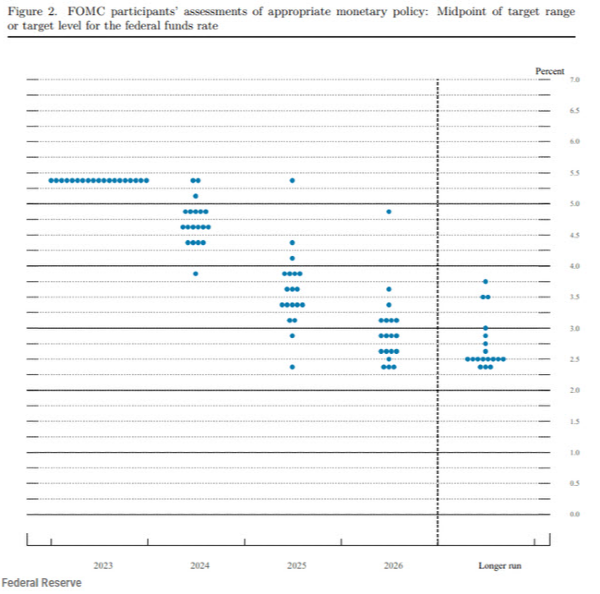

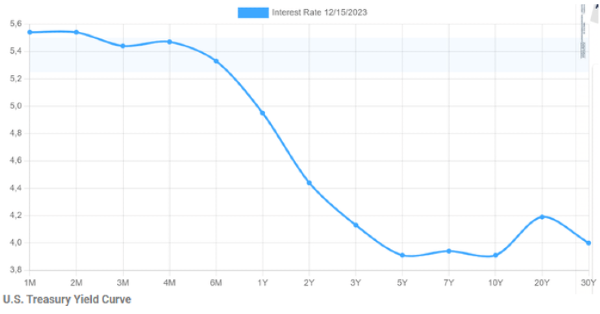

I’m not saying that the market will fall apart soon, no one can say that with a straight face, but we are far above “average value” and thus suitable to at least a correction. That’s the big reason why everyone is concerned about interest rates, and when they will be cut. The markets don’t like to be disappointed, and right now they are expecting 2 -3 cuts this year; preferably in a month or two. If not . . . that might cause a brief set back this summer.

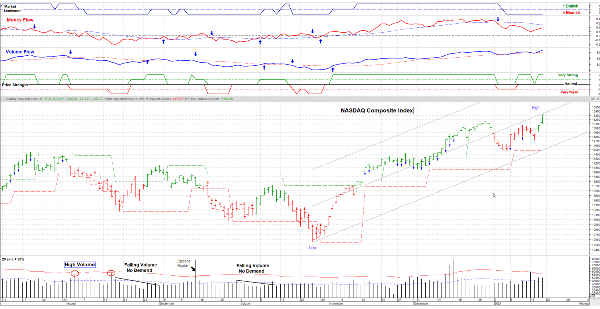

I remain invested but have raised some Cash recently. In the short term (about 2 weeks) we’re overbought, but in the long term (since early November, 2023) we’re about average within the trend.

Have a good week ! …………. Tom ………………

March 1, 2024 - I’ve been harping on the ‘Lack of Breath’ in this market for months. It basically means that a smaller number of stocks account for the majority of an index’s performance. I’m super business so I’ll get right to the point.

Above is a chart of the” Magnificent 7” stocks in comparison to the broad S&P 500 Index. Now, one of the major reasons for this is that the S&P Index is capital weighted, that is, the price of the stock times the number of shares = “capitalization”. The S&P gives weight or value to the stock’s price as a function of its capitalization. Thus large (number of shares) companies with high stock prices sway the index the most.

The “Mag 7” stocks are also the most “expensive” when viewed in comparison to the average stock P/E Ration (Price divided by Earnings).

Here’s the most recent table of P/E evaluation – * (shown at www.Special-Risk.net)*

Now folks will say that these stocks are “worth more” because of potential earnings growth. OK, but if (or when) that earnings report comes out that does not support that narrative . . . well, all Hell breaks loose. The bottom line is stocks, like real estate, are worth whatever the buyer is willing to pay . . . now.

I’m not saying that the market will fall apart soon, no one can say that with a straight face, but we are far above “average value” and thus suitable to at least a correction. That’s the big reason why everyone is concerned about interest rates, and when they will be cut. The markets don’t like to be disappointed, and right now they are expecting 2 -3 cuts this year; preferably in a month or two. If not . . . that might cause a brief set back this summer.

I remain invested but have raised some Cash recently. In the short term (about 2 weeks) we’re overbought, but in the long term (since early November, 2023) we’re about average within the trend. Have a good week ! …………. Tom ………………