Littelfuse (LFUS) is a component manufacturer currently near a $6 Billion market capitalization. This makes it a small-cap stock, with the potential for further growth in its market segments or to be bought out by a competitor. The company has a strong focus on conducting its own acquisitions, which has translated into a portion of its assets logged as goodwill.

I found the company thanks to the research by Manifest Investing. The company has potential upside based on the stock selection guide and value investing analysis.

Is Littelfuse (LFUS) a Buy?

Littelfuse is a buy at $230 with an estimated two-year return of 40%. Littelfuse’s recent EPS of $10.34 (ttm) was lackluster compared to previous years, but the company is building on its merger and acquisitions strategy to refine its core business segments. Expect the company’s earnings per share to return to growth in the next few years, even as 2024 is forecasted by Littelfuse’s executive team to be soft.

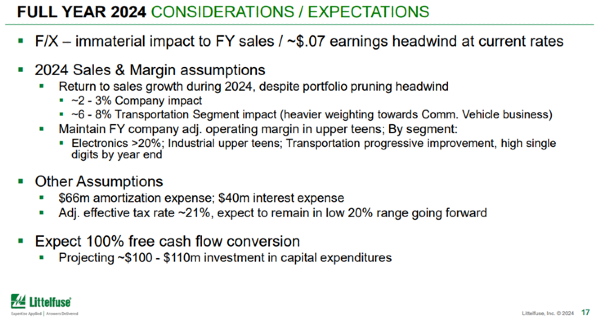

Unfortunately, Littelfuse is expecting further headwinds going into 2024. Littelfuse is forecasting an EPS in Q1 2024 to be $1.65 to $1.85. This is a drop of 8.4% from a Q4 2023 adjusted EPS of $2.02.

LFUS Segment Performance

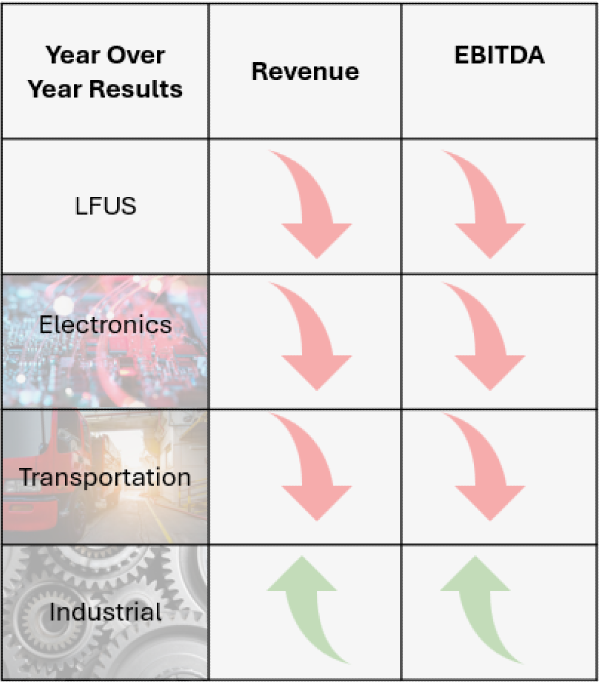

Littelfuse had a weaker FY2023 thanks to their electronic segment and transportation segments. The weakness in the electronics market was shrugged off by the executive team as they noted the culprit was destocking and they expect growth to return to the electronics segment in 2024.

The industrial segment was all over the place. Littelfuse has exposure to energy storage, industrial drives, and power supplies. This includes components for energy storage systems created by companies like Tesla.

The company is also seeing strength in renewables, infrastructure, and power supplies. The executive team connected this growth to secular megatrends which are supporting growth for Littelfuse industrial products.

On the other side, the growth in Littelfuse’s industrial segment was dampened by near term softness in HVAC and construction. This softness wasn’t enough to keep the industrial segment from growing in 2023.

The transportation segment seemed to have done well in 2023, but organic growth in commercial vehicles fell 14% due to inventory rebalancing. The team notes that margins should improve throughout 2024.

What is Littelfuse’s Price Target?

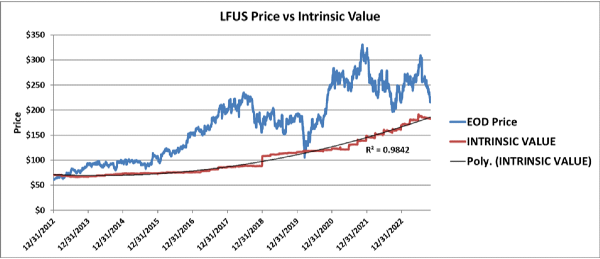

Littelfuse is currently bought by the market at a premium. The intrinsic value we estimated was touched during Covid-19 before jumping back up. This touch-off from the calculated intrinsic value is not a coincidence, but occurs for numerous industrial stocks we’ve analyzed including:

Healthy, growing stocks are trading currently at a premium by institutional investors. We theorize that this phenomenon is currently occurring due to bullishness in the industrial sector and a lack of opportunities for institutional investors to invest cash.

This may be why these companies were conducting stock buybacks in the early 2020s but have now softened their rate of buybacks as their own stock price exceeds reasonable valuations.

In the end, a reasonable buy point is $200, but a price of $230 still offers a potential two-year return of 40%. With Littelfuse forecasting softness in the near term for its eps growth, we rate LFUS a hold at its current prices, a buy at $200, and a sell at $260.

What is Littelfuse’s 2025 Stock Forecast?

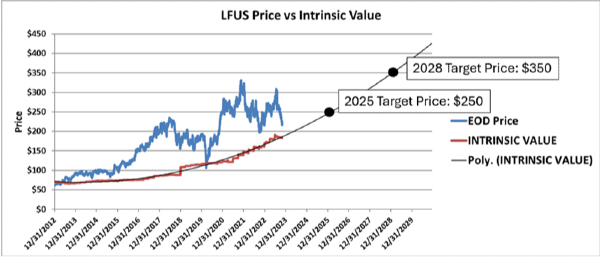

Littelfuse has a 2025 price target of $250 based on its potential intrinsic value growth. The company must continue to grow its earnings and book value and be weary of potential threats.

What is Littelfuse’s 2028 Stock Forecast?

Littelfuse has a 2028 price forecast with an extrapolated trajectory set upon $350. This should be the low-end potential of the stock. The market seems to be buying LFUS at a premium thanks to its potential growth opportunity in different megatrend segments.

Risk Factors to Forecast

A special note in Littelfuse’s 2022 annual report (page 13) was that Arrow Electronics (ARW) accounted for more than 10% of Littelfuse’s revenue. Arrow Electronics sales can have adverse effects on Littelfuse's results. Arrow Electronics has had steady growth the last few years and the risk of Arrow Electronics on Littelfuse’s results is minimal.

Goodwill Impairment

Goodwill is another risk factor that is summarized in Littelfuse’s Annual Report, page 25. In short, a miss in earnings or cash could have a triple negative effect on the stock price.

Less cash for capital investments. An earnings miss will mean less capital was earned to either conduct acquisitions, reinvest in capital projects, or conduct share repurchases. All possibilities result in less assets and a lower book value per share.

Reduced Earnings Growth Projection. Regardless of future potential, an earnings miss will mean a reduction in earnings projections across market analyst firms and funds. This results in a significant swing in stock price as analysts reassess their earnings projections.

Goodwill Impairment Reduces Book Value per Share. The consequence of an earnings miss has a negative multiplier effect on the company’s total assets. Goodwill is a non-trivial intangible asset propping up the company’s assets. Goodwill is the difference between the price of an acquired company and the value of its assets. In short, it’s the premium Littelfuse paid to acquire the company. This goodwill is calculated using projected discounted cash flow analysis along with revenue forecasts. These models also use a sensitivity test to check if small changes to these assumptions have large impacts on the goodwill amounts modeled.

If Littelfuse reports a miss in earnings, an individual acquisition Littelfuse purchased may be the cause of this miss. This means the goodwill amount Littelfuse estimated must now be adjusted, as it is once a year, to accommodate the miss and lower cash flow projections of the acquisition. Hence an earnings miss could have a triple effect on the company’s stock and create an outsized price movement.

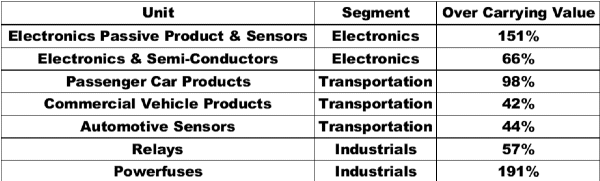

The good news – all seven units passed the goodwill impairment test. This means that the fair values expected exceed the carrying values.

This also means that the actual value of Littelfuse’s assets may be higher than reported. The following chart shows how much fair value exceeds carrying values for each of the company’s seven units.

Littelfuse Competitive Landscape

In Littelfuse’s 2022 annual report, page 9, the company describes their main competition in each business segment. As a note, Eaton Corporation competes with Littelfuse in all three business segments.

LFUS Competition in the Electronics Segment

1). Eaton Corporation (ETN): A multinational power management company that provides electrical, hydraulic, and mechanical power solutions.

2). Bourns Inc.: Bourns is a privately held company specializing in electronic components such as resistors, capacitors, and sensors.

3). TDK: A privately held Japanese electronics company known for its magnetic and electronic components.

4). ON Semiconductor Corporation (ON): A semiconductor manufacturer that produces power management and sensor solutions.

5). Infineon Technologies (IFNNY): A German semiconductor company focusing on automotive, industrial, and power management solutions.

6). STMicroelectronics NV(STM): A global semiconductor company involved in various applications, including automotive, IoT, and industrial.

7). Semtech Corporation (SMTC): A supplier of analog and mixed-signal semiconductors, particularly known for its work in wireless communication and sensing.

8). Vishay Intertechnology Inc. (VSH): A manufacturer of discrete semiconductors and passive electronic components.

LFUS Competition in the Transportation Segment

1). Pacific Engineering: Pacific Engineering, Inc. (PEI), is an one stop, engineering, design, modeling and simulation, and manufacturing company headquartered in Roca, NE. PEI has been performing engineering design services, product development, prototyping and manufacturing complex, high strength, light weight, composite and metal components since 1998. PEI is a privately held company.

2). MTA (Meccanotecnica Codognese): MTA is a privately held multinational company operating in the automotive sector through 3 Business Units: Electrical, Electronic and Power Electronic. From design to industrialization, MTA produces a wide portfolio of components for the primary manufacturers of cars, motorcycles, trucks, agricultural and earth moving machines.

3). Amphenol Corporation (APH): A global provider of interconnect solutions for various industries.

4). Sensata Technologies Holding NV (ST): A manufacturer of sensors and controls for automotive, industrial, and aerospace applications.

5). TE Connectivity Ltd. (TEL): A company specializing in connectivity and sensor solutions.

LFUS Competition in the Industrial Segment

1). GE Multilin: GE Multilin has been around since 1995. This part of General Electric focuses on industrial controls and manufacturing relays. This includes flexible process bus solutions and dual and multi-feeder protection for industrial applications. It also includes integrated motor protection for medium/large induction and synchronous motors. The company is under the General Electric Company

2). Mersen: Mersen is a global expert in electrical power and advanced materials. Mersen designs innovative solutions to address its clients specific needs to enable them to optimize their manufacturing process in sectors such as energy, transportation, electronics, chemical, pharmaceutical and process industries.

Conclusion

Littelfuse has huge potential this decade to double or even triple its company size in the next ten years. The company’s focus on electrical components helps to keep them competitive while their diversified customer base in different business segments smooths out revenue over the long term.

Littelfuse is valued heavily by institutional investors and has been purchased at a premium for most of its existence. However, there are times when the stock is undervalued, like in this current quarter, which could give investors a chance to buy Littelfuse near its intrinsic value.

I/we have a position in an asset mentioned

Littelfuse (LFUS) is a component manufacturer currently near a $6 Billion market capitalization. This makes it a small-cap stock, with the potential for further growth in its market segments or to be bought out by a competitor. The company has a strong focus on conducting its own acquisitions, which has translated into a portion of its assets logged as goodwill.

I found the company thanks to the research by Manifest Investing. The company has potential upside based on the stock selection guide and value investing analysis.

Is Littelfuse (LFUS) a Buy?

Littelfuse is a buy at $230 with an estimated two-year return of 40%. Littelfuse’s recent EPS of $10.34 (ttm) was lackluster compared to previous years, but the company is building on its merger and acquisitions strategy to refine its core business segments. Expect the company’s earnings per share to return to growth in the next few years, even as 2024 is forecasted by Littelfuse’s executive team to be soft.

Q4 2023 earnings release, page 17

Unfortunately, Littelfuse is expecting further headwinds going into 2024. Littelfuse is forecasting an EPS in Q1 2024 to be $1.65 to $1.85. This is a drop of 8.4% from a Q4 2023 adjusted EPS of $2.02.

LFUS Segment Performance

Littelfuse had a weaker FY2023 thanks to their electronic segment and transportation segments. The weakness in the electronics market was shrugged off by the executive team as they noted the culprit was destocking and they expect growth to return to the electronics segment in 2024.

The industrial segment was all over the place. Littelfuse has exposure to energy storage, industrial drives, and power supplies. This includes components for energy storage systems created by companies like Tesla.

The company is also seeing strength in renewables, infrastructure, and power supplies. The executive team connected this growth to secular megatrends which are supporting growth for Littelfuse industrial products.

On the other side, the growth in Littelfuse’s industrial segment was dampened by near term softness in HVAC and construction. This softness wasn’t enough to keep the industrial segment from growing in 2023.

The transportation segment seemed to have done well in 2023, but organic growth in commercial vehicles fell 14% due to inventory rebalancing. The team notes that margins should improve throughout 2024.

What is Littelfuse’s Price Target?

Littelfuse is currently bought by the market at a premium. The intrinsic value we estimated was touched during Covid-19 before jumping back up. This touch-off from the calculated intrinsic value is not a coincidence, but occurs for numerous industrial stocks we’ve analyzed including:

Healthy, growing stocks are trading currently at a premium by institutional investors. We theorize that this phenomenon is currently occurring due to bullishness in the industrial sector and a lack of opportunities for institutional investors to invest cash.

This may be why these companies were conducting stock buybacks in the early 2020s but have now softened their rate of buybacks as their own stock price exceeds reasonable valuations.

In the end, a reasonable buy point is $200, but a price of $230 still offers a potential two-year return of 40%. With Littelfuse forecasting softness in the near term for its eps growth, we rate LFUS a hold at its current prices, a buy at $200, and a sell at $260.

What is Littelfuse’s 2025 Stock Forecast?

Littelfuse has a 2025 price target of $250 based on its potential intrinsic value growth. The company must continue to grow its earnings and book value and be weary of potential threats.

What is Littelfuse’s 2028 Stock Forecast?

Littelfuse has a 2028 price forecast with an extrapolated trajectory set upon $350. This should be the low-end potential of the stock. The market seems to be buying LFUS at a premium thanks to its potential growth opportunity in different megatrend segments.

Risk Factors to Forecast

A special note in Littelfuse’s 2022 annual report (page 13) was that Arrow Electronics (ARW) accounted for more than 10% of Littelfuse’s revenue. Arrow Electronics sales can have adverse effects on Littelfuse's results. Arrow Electronics has had steady growth the last few years and the risk of Arrow Electronics on Littelfuse’s results is minimal.

Goodwill Impairment

Goodwill is another risk factor that is summarized in Littelfuse’s Annual Report, page 25. In short, a miss in earnings or cash could have a triple negative effect on the stock price.

Less cash for capital investments. An earnings miss will mean less capital was earned to either conduct acquisitions, reinvest in capital projects, or conduct share repurchases. All possibilities result in less assets and a lower book value per share.

Reduced Earnings Growth Projection. Regardless of future potential, an earnings miss will mean a reduction in earnings projections across market analyst firms and funds. This results in a significant swing in stock price as analysts reassess their earnings projections.

Goodwill Impairment Reduces Book Value per Share. The consequence of an earnings miss has a negative multiplier effect on the company’s total assets. Goodwill is a non-trivial intangible asset propping up the company’s assets. Goodwill is the difference between the price of an acquired company and the value of its assets. In short, it’s the premium Littelfuse paid to acquire the company. This goodwill is calculated using projected discounted cash flow analysis along with revenue forecasts. These models also use a sensitivity test to check if small changes to these assumptions have large impacts on the goodwill amounts modeled.

If Littelfuse reports a miss in earnings, an individual acquisition Littelfuse purchased may be the cause of this miss. This means the goodwill amount Littelfuse estimated must now be adjusted, as it is once a year, to accommodate the miss and lower cash flow projections of the acquisition. Hence an earnings miss could have a triple effect on the company’s stock and create an outsized price movement.

The good news – all seven units passed the goodwill impairment test. This means that the fair values expected exceed the carrying values.

This also means that the actual value of Littelfuse’s assets may be higher than reported. The following chart shows how much fair value exceeds carrying values for each of the company’s seven units.

Littelfuse Competitive Landscape

In Littelfuse’s 2022 annual report, page 9, the company describes their main competition in each business segment. As a note, Eaton Corporation competes with Littelfuse in all three business segments.

LFUS Competition in the Electronics Segment

1). Eaton Corporation (ETN): A multinational power management company that provides electrical, hydraulic, and mechanical power solutions.

2). Bourns Inc.: Bourns is a privately held company specializing in electronic components such as resistors, capacitors, and sensors.

3). TDK: A privately held Japanese electronics company known for its magnetic and electronic components.

4). ON Semiconductor Corporation (ON): A semiconductor manufacturer that produces power management and sensor solutions.

5). Infineon Technologies (IFNNY): A German semiconductor company focusing on automotive, industrial, and power management solutions.

6). STMicroelectronics NV(STM): A global semiconductor company involved in various applications, including automotive, IoT, and industrial.

7). Semtech Corporation (SMTC): A supplier of analog and mixed-signal semiconductors, particularly known for its work in wireless communication and sensing.

8). Vishay Intertechnology Inc. (VSH): A manufacturer of discrete semiconductors and passive electronic components.

LFUS Competition in the Transportation Segment

1). Pacific Engineering: Pacific Engineering, Inc. (PEI), is an one stop, engineering, design, modeling and simulation, and manufacturing company headquartered in Roca, NE. PEI has been performing engineering design services, product development, prototyping and manufacturing complex, high strength, light weight, composite and metal components since 1998. PEI is a privately held company.

2). MTA (Meccanotecnica Codognese): MTA is a privately held multinational company operating in the automotive sector through 3 Business Units: Electrical, Electronic and Power Electronic. From design to industrialization, MTA produces a wide portfolio of components for the primary manufacturers of cars, motorcycles, trucks, agricultural and earth moving machines.

3). Amphenol Corporation (APH): A global provider of interconnect solutions for various industries.

4). Sensata Technologies Holding NV (ST): A manufacturer of sensors and controls for automotive, industrial, and aerospace applications.

5). TE Connectivity Ltd. (TEL): A company specializing in connectivity and sensor solutions.

LFUS Competition in the Industrial Segment

1). GE Multilin: GE Multilin has been around since 1995. This part of General Electric focuses on industrial controls and manufacturing relays. This includes flexible process bus solutions and dual and multi-feeder protection for industrial applications. It also includes integrated motor protection for medium/large induction and synchronous motors. The company is under the General Electric Company

2). Mersen: Mersen is a global expert in electrical power and advanced materials. Mersen designs innovative solutions to address its clients specific needs to enable them to optimize their manufacturing process in sectors such as energy, transportation, electronics, chemical, pharmaceutical and process industries.

Conclusion

Littelfuse has huge potential this decade to double or even triple its company size in the next ten years. The company’s focus on electrical components helps to keep them competitive while their diversified customer base in different business segments smooths out revenue over the long term.

Littelfuse is valued heavily by institutional investors and has been purchased at a premium for most of its existence. However, there are times when the stock is undervalued, like in this current quarter, which could give investors a chance to buy Littelfuse near its intrinsic value.

I/we have a position in an asset mentioned