Sound investments

don't happen alone

Find your crew, build teams, compete in VS MODE, and identify investment trends in our evergrowing investment ecosystem. You aren't on an island anymore, and our community is here to help you make informed decisions in a complex world.

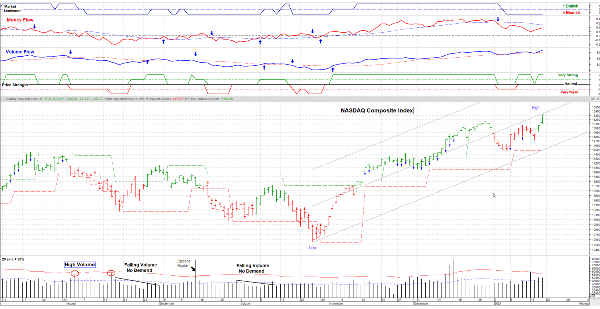

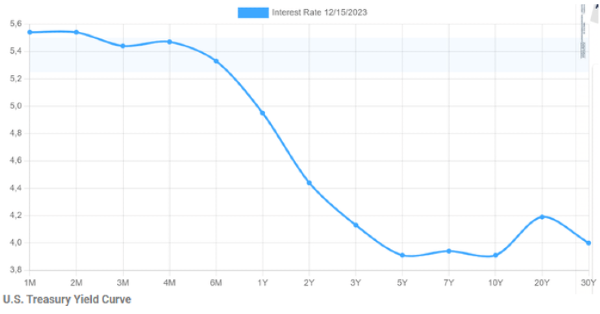

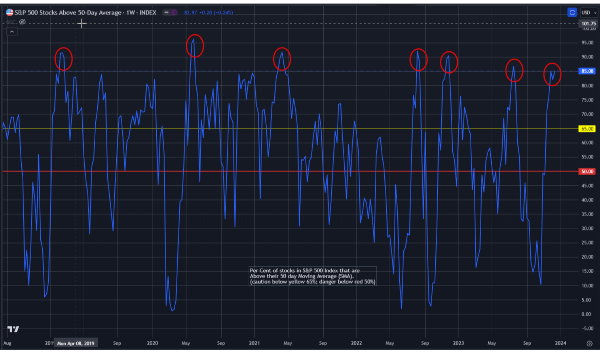

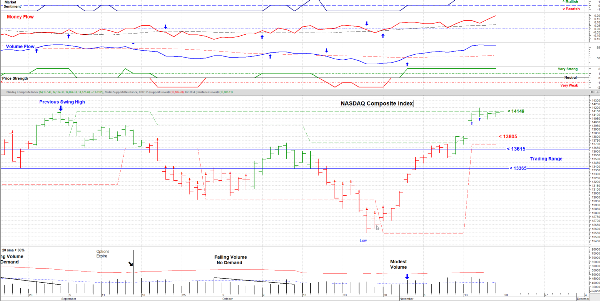

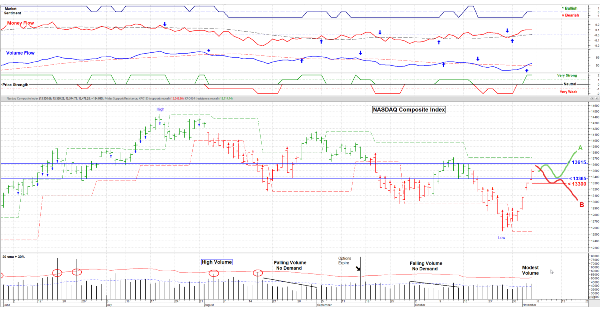

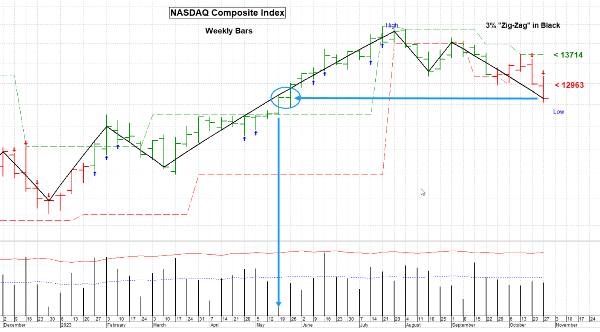

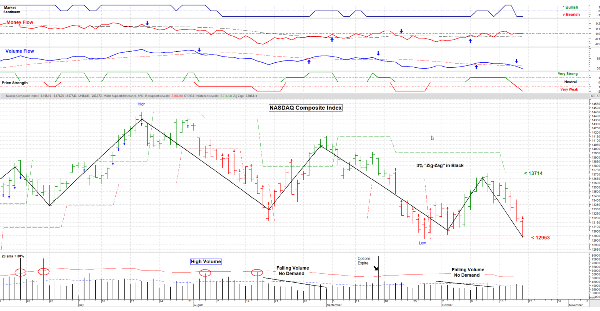

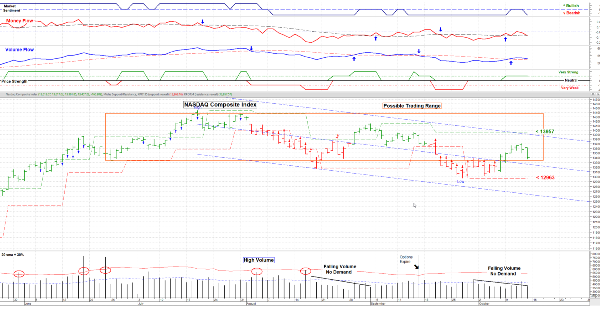

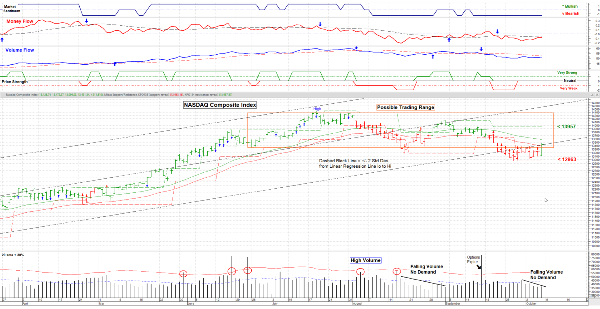

January 19,2024 - By now you’ve heard that the markets (in the US) are at all time highs. And that’s great, but keep in mind: “Where is the Risk? At the 52 week High or the 52 week Low?” Now, a new 52 week high doesn’t not mean that we are at the top and going lower, but as the market climbs / increases, so does the risk. Eventually it will catch up. (The goal of this last statement was to let some air out of our egos and keep things “real”.) Just to give you a “heads up”; the end of January has some pretty significant events: 1/30 Federal Reserve Meeting. All eyes & ears will be on this projecting event. 1/31 Treasury Department releases its funding goals for the quarter; the amount & maturities. 2/1 Apple earnings. A big part of the “magnificent 7” tech stocks and a bell weather. Make no mistake, this market is fixated on interest rates, earnings and consumer strength. So, these events will be carefully analyzed. Until then, I present the chart of the NASDAQ Composite Index:

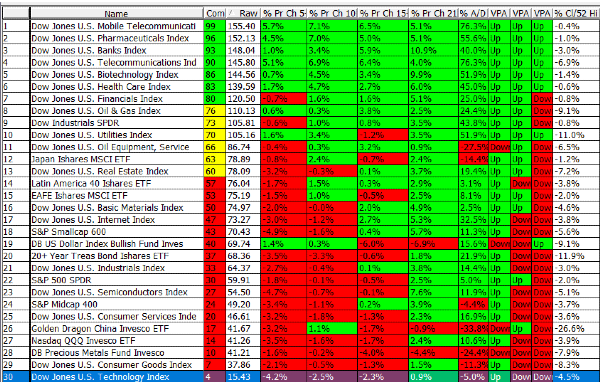

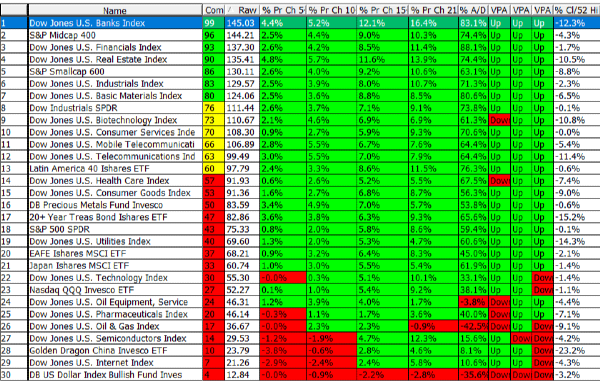

Not surprising, Technology stocks continue to lead the way higher. The red circle at the upper right column shows the relationship of Fridays Close to the indexes 52 week high. These stocks are “expensive” in relationship to their price and their current earnings (P/E ratio). As long as earnings growth is evident, there’s no problem, but if current or forward earnings are presented as slowing, that IS a problem.

The Short-Term Sector Strength table is shown at: www.Special-Risk.net .

Have a good week & Take Care. ……………. Tom ………………

Price chart by MetaStock; table by www.HighGrowthStock.com. Used with permission.