Why You Should Invest in Energy Stocks

Investing in energy stocks is a strategic move for diversifying portfolios, as the energy sector boasts resilience and long-term growth prospects. As the global demand for energy continues to rise, driven by population growth and industrialization, energy companies are positioned for sustained revenue generation. Additionally, the transition to renewable energy sources presents significant opportunities for investors to align with eco-conscious trends while benefiting from government incentives and technological advancements. With the dual advantage of stability from traditional energy investments and the innovative edge of renewables, energy stocks offer a promising balance of risk and reward.

Risks of Investing in Energy Stocks

Investing in energy stocks comes with its share of risks, which investors need to carefully consider. Market volatility is a significant concern, as energy prices can be unpredictable due to geopolitical events, natural disasters, and changes in supply and demand. Additionally, regulatory changes and environmental policies can impact the profitability of energy companies, especially those heavily reliant on fossil fuels. Technological advancements in alternative energy sources could render existing infrastructures obsolete, posing another risk. Lastly, the capital-intensive nature of the energy sector means that companies often carry substantial debt, which can be risky if not managed properly. Balancing these risks against potential rewards is crucial for any energy stock investor.

Energy vs Utility Stocks: What’s the Difference?

Jumping into the stock market as a new investor can be motivated by various reasons, such as high monthly electric bills impacting your budget. However, it can be confusing when you search for energy stocks and find oil and gas companies dominating the sector. Many investors might initially think their local electric company falls under the energy sector, but surprise – it’s in the utility sector. The misalignment arises because the energy process involves two distinct steps: extraction and production of raw materials (oil, gas, coal), and generation, distribution, and billing of electricity. While energy stocks represent companies drilling for and producing raw materials, utility stocks encompass those managing plants, transmission lines, and the final delivery of electricity to homes.

Understanding this distinction is crucial because energy and utility stocks present varied investment opportunities and risks. Energy stocks, highly influenced by geopolitical events and market speculations, offer potential for significant returns but come with higher volatility. Conversely, utility stocks provide a stable, income-focused investment that tends to grow steadily. Heavily regulated and capital-intensive, these companies pass on the cost variations to consumers, ensuring steady returns. As investors assess their portfolios, recognizing these differences can help in making informed decisions that align with risk tolerance and financial goals.

https://youtu.be/M6RfFWNdbV4?si=5-FBiFwyXdKe5V__

What are the Top Energy ETFs?

Investors looking to diversify their portfolios with energy exposure have several excellent options among exchange-traded funds (ETFs). One standout is the Energy Select Sector SPDR Fund (XLE), managing over $35 billion in assets. This ETF tracks 22 of the largest energy companies in the S&P 500, including Exxon Mobil and Chevron, offering a concentrated but highly liquid portfolio. With a low expense ratio of 0.09%, it's a cost-effective way to gain extensive energy sector coverage.

Another top pick is the Vanguard Energy ETF (VDE), known for its broad exposure to the energy sector with a focus on diversification. Managing approximately $8 billion in assets, VDE covers stocks across various energy sub-sectors, including oil, gas, and renewable energy. Its expense ratio stands at 0.10%, making it a slightly higher-cost option than XLE but still competitive. Both XLE and VDE are excellent choices for investors seeking stable, long-term growth in the energy sector.

Do oil stocks do well in a recession?

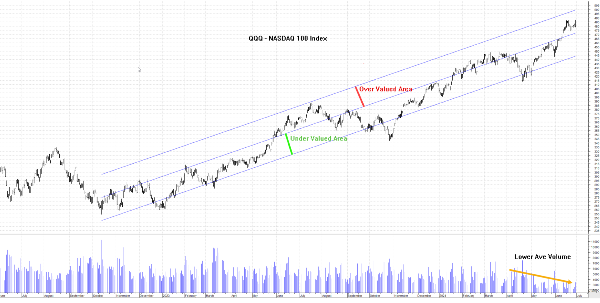

The performance of oil stocks during a recession can be unpredictable and often depends on various factors. Historically, oil stocks have shown significant volatility in times of economic downturns. For instance, during the 2008 recession, oil prices surged initially but then collapsed by around 80%, deeply affecting oil stocks. The high cost of extraction and geopolitical factors can further exacerbate these fluctuations. As a result, investing in oil stocks during a recession can be risky, with potential for both significant gains and losses.

However, not all oil stocks perform poorly during recessions. Some major companies with diversified operations, like Chevron and Kinder Morgan, are better positioned to weather economic downturns. These companies' integrated business models, covering upstream, midstream, and downstream operations, provide them with a certain level of resilience. Additionally, continuous demand for energy, even during recessions, can help sustain the performance of robust oil stocks. It's crucial, though, for investors to assess the specific factors impacting each stock and proceed with caution.

So, are Energy Stocks Worth it?

Energy stocks can offer substantial rewards, but they come with their share of risks. This sector encompasses both traditional fossil fuels and renewable energy sources, providing a diverse range of opportunities. Investing in energy stocks is particularly appealing due to the global reliance on energy, which ensures sustained demand. Major companies like Chevron and Brookfield Renewable are industry leaders known for their strong balance sheets and strategic growth, making them reliable choices for investors.

However, with great potential gains also come significant risks. The energy sector is highly susceptible to market volatility. Geopolitical events, environmental regulations, and technological advancements in alternative energy sources can profoundly impact profitability. Additionally, the capital-intensive nature of energy projects, particularly in oil and gas, often involves high levels of debt that can pose risks if not managed effectively. Investors must carefully evaluate these factors and diversify their portfolios to mitigate risks.

Despite the risks, the transition towards renewable energy presents new growth opportunities. Companies involved in renewables, like Vanguard Energy ETF (VDE) and Energy Select Sector SPDR Fund (XLE), are well-positioned to benefit from the increasing emphasis on sustainable energy. By balancing investments between traditional and renewable energy stocks, investors can potentially achieve a more stable and resilient portfolio.

Why You Should Invest in Energy Stocks

Investing in energy stocks is a strategic move for diversifying portfolios, as the energy sector boasts resilience and long-term growth prospects. As the global demand for energy continues to rise, driven by population growth and industrialization, energy companies are positioned for sustained revenue generation. Additionally, the transition to renewable energy sources presents significant opportunities for investors to align with eco-conscious trends while benefiting from government incentives and technological advancements. With the dual advantage of stability from traditional energy investments and the innovative edge of renewables, energy stocks offer a promising balance of risk and reward.

Risks of Investing in Energy Stocks

Investing in energy stocks comes with its share of risks, which investors need to carefully consider. Market volatility is a significant concern, as energy prices can be unpredictable due to geopolitical events, natural disasters, and changes in supply and demand. Additionally, regulatory changes and environmental policies can impact the profitability of energy companies, especially those heavily reliant on fossil fuels. Technological advancements in alternative energy sources could render existing infrastructures obsolete, posing another risk. Lastly, the capital-intensive nature of the energy sector means that companies often carry substantial debt, which can be risky if not managed properly. Balancing these risks against potential rewards is crucial for any energy stock investor.

Energy vs Utility Stocks: What’s the Difference?

Jumping into the stock market as a new investor can be motivated by various reasons, such as high monthly electric bills impacting your budget. However, it can be confusing when you search for energy stocks and find oil and gas companies dominating the sector. Many investors might initially think their local electric company falls under the energy sector, but surprise – it’s in the utility sector. The misalignment arises because the energy process involves two distinct steps: extraction and production of raw materials (oil, gas, coal), and generation, distribution, and billing of electricity. While energy stocks represent companies drilling for and producing raw materials, utility stocks encompass those managing plants, transmission lines, and the final delivery of electricity to homes.

Understanding this distinction is crucial because energy and utility stocks present varied investment opportunities and risks. Energy stocks, highly influenced by geopolitical events and market speculations, offer potential for significant returns but come with higher volatility. Conversely, utility stocks provide a stable, income-focused investment that tends to grow steadily. Heavily regulated and capital-intensive, these companies pass on the cost variations to consumers, ensuring steady returns. As investors assess their portfolios, recognizing these differences can help in making informed decisions that align with risk tolerance and financial goals.

https://youtu.be/M6RfFWNdbV4?si=5-FBiFwyXdKe5V__

What are the Top Energy ETFs?

Investors looking to diversify their portfolios with energy exposure have several excellent options among exchange-traded funds (ETFs). One standout is the Energy Select Sector SPDR Fund (XLE), managing over $35 billion in assets. This ETF tracks 22 of the largest energy companies in the S&P 500, including Exxon Mobil and Chevron, offering a concentrated but highly liquid portfolio. With a low expense ratio of 0.09%, it's a cost-effective way to gain extensive energy sector coverage.

Another top pick is the Vanguard Energy ETF (VDE), known for its broad exposure to the energy sector with a focus on diversification. Managing approximately $8 billion in assets, VDE covers stocks across various energy sub-sectors, including oil, gas, and renewable energy. Its expense ratio stands at 0.10%, making it a slightly higher-cost option than XLE but still competitive. Both XLE and VDE are excellent choices for investors seeking stable, long-term growth in the energy sector.

Do oil stocks do well in a recession?

The performance of oil stocks during a recession can be unpredictable and often depends on various factors. Historically, oil stocks have shown significant volatility in times of economic downturns. For instance, during the 2008 recession, oil prices surged initially but then collapsed by around 80%, deeply affecting oil stocks. The high cost of extraction and geopolitical factors can further exacerbate these fluctuations. As a result, investing in oil stocks during a recession can be risky, with potential for both significant gains and losses.

However, not all oil stocks perform poorly during recessions. Some major companies with diversified operations, like Chevron and Kinder Morgan, are better positioned to weather economic downturns. These companies' integrated business models, covering upstream, midstream, and downstream operations, provide them with a certain level of resilience. Additionally, continuous demand for energy, even during recessions, can help sustain the performance of robust oil stocks. It's crucial, though, for investors to assess the specific factors impacting each stock and proceed with caution.

So, are Energy Stocks Worth it?

Energy stocks can offer substantial rewards, but they come with their share of risks. This sector encompasses both traditional fossil fuels and renewable energy sources, providing a diverse range of opportunities. Investing in energy stocks is particularly appealing due to the global reliance on energy, which ensures sustained demand. Major companies like Chevron and Brookfield Renewable are industry leaders known for their strong balance sheets and strategic growth, making them reliable choices for investors.

However, with great potential gains also come significant risks. The energy sector is highly susceptible to market volatility. Geopolitical events, environmental regulations, and technological advancements in alternative energy sources can profoundly impact profitability. Additionally, the capital-intensive nature of energy projects, particularly in oil and gas, often involves high levels of debt that can pose risks if not managed effectively. Investors must carefully evaluate these factors and diversify their portfolios to mitigate risks.

Despite the risks, the transition towards renewable energy presents new growth opportunities. Companies involved in renewables, like Vanguard Energy ETF (VDE) and Energy Select Sector SPDR Fund (XLE), are well-positioned to benefit from the increasing emphasis on sustainable energy. By balancing investments between traditional and renewable energy stocks, investors can potentially achieve a more stable and resilient portfolio.