Overview of the Materials Sector

The materials sector encompasses industries involved in the discovery, development, and processing of raw materials. This sector includes companies that produce chemical products, metals, construction materials, packaging, and paper and forest products. The performance of the materials sector is closely tied to the economic cycle, often rising and falling with the overall state of economic growth.

In recent years, the sector has shown positive but sluggish returns due to concerns over recession risks. However, favorable supply-demand dynamics in certain segments, such as copper mining and chemical manufacturing, suggest potential long-term investment opportunities. The materials sector plays a crucial role in global markets, providing essential goods for various industries.

The top material stocks will be able to navigate the cyclical nature that comes with the material sectors. These stocks can manage the volatility that comes with the economic turndown and commodity price volatility.

Definition and examples of materials stocks

Materials stocks refer to shares of companies involved in extracting, processing, and selling raw materials, including base metals and industrial minerals. Examples of materials stocks include Rio Tinto (RIO), Nucor (NUE), and Air Products & Chemicals (APD). Materials companies provide building blocks for construction, manufacturing, and infrastructure development.

Cyclical Nature of the Materials Sector

During periods of economic growth, industries such as construction, manufacturing, and technology expand, leading to increased demand for raw materials like metals, chemicals, and construction materials. This heightened demand drives up the prices of these materials, boosting the revenues and stock prices of materials companies.

Conversely, during economic downturns, industrial activities slow down, leading to a decrease in demand for raw materials. As demand drops, the prices of these materials fall, negatively impacting the revenues and stock prices of materials companies.

Supply Constraints can also play a significant role. For example, geopolitical events, trade policies, and natural disasters can disrupt the supply of raw materials. When supply is limited and demand remains steady or increases, prices rise, benefiting materials stocks. However, if supply exceeds demand, prices fall, negatively affecting these stocks.

Consumer Behavior is linked closely to the demand for materials. When consumers are confident and spending increases, the demand for goods and, consequently, the raw materials needed to produce them, rises. During economic downturns, consumer spending declines, reducing demand for these materials.

Challenges of Material Stocks due to Cyclical Nature

The cyclical nature of material stocks can be particularly challenging for beginner investors. New investors might struggle with Market Timing. Knowing when to buy or sell material stocks requires an understanding of economic cycles and market trends, which can be difficult for those without experience.

The high volatility of material stocks can also be intimidating. Prices can fluctuate significantly due to changes in supply and demand, geopolitical events, and other factors. This can lead to substantial gains or losses, which might be overwhelming for new investors. Understanding the factors that influence material stocks, such as commodity prices, global economic conditions, and regulatory changes, can be complex. New investors might find it challenging to analyze these factors and make informed decisions.

Materials companies often require significant capital investments, which can impact their financial stability during economic downturns. New investors might find it difficult to assess the financial health and long-term viability of these companies. Many materials companies operate in international markets, exposing them to global economic conditions, currency fluctuations, and trade policies. New investors might find it challenging to navigate these complexities and understand their impact on stock performance.

Finally, the cyclical nature and volatility of material stocks can lead to emotional stress. New investors might react impulsively to market fluctuations, making decisions based on fear or greed rather than sound analysis.

Recent Material Stocks Impacted by Economic Cycles

Here are a few recent examples of traded material companies affected by economic trends. These examples illustrate how economic trends, such as commodity price fluctuations, inflation, and economic cycles, can significantly impact material companies.

Freeport-McMoRan is a leader in copper materials. Image by Image by Shelton Keys

Freeport-McMoRan Inc. (FCX) is a major copper producer that was impacted by fluctuations in copper prices, which are closely tied to global economic conditions. In 2023, concerns over a potential recession led to volatility in copper prices, affecting Freeport-McMoRan’s stock performance.

Dow Inc. (DOW), a leading chemical manufacturer, has faced challenges due to rising raw material costs and supply chain disruptions. Inflation and higher energy prices have increased production costs, impacting the company’s profitability.

Vulcan Materials Company (VMC), a construction materials company, has been influenced by the state of the construction industry, which is highly sensitive to economic cycles. During periods of economic growth, demand for construction materials like cement and aggregates increases, benefiting Vulcan Materials.

Emerging trends and opportunities in the sector

Industry trends present significant opportunities for innovation and growth in the material sector. Companies that can leverage these advancements are likely to gain a competitive edge in the market.

The material sector is experiencing several emerging mega-trends and opportunities driven by advancements in technology and a focus on sustainability. There is a growing demand for eco-friendly materials, such as biodegradable plastics and bio-based materials, which reduce environmental impact.

Nanomaterials are revolutionizing various industries, including healthcare, energy, and environmental remediation, due to their unique properties. Smart Materials can respond to external stimuli, such as temperature or pressure changes, making them ideal for applications in aerospace, automotive, and consumer electronics.

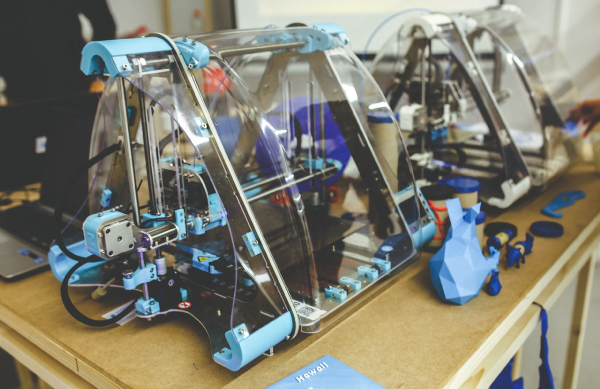

Additive Manufacturing (3D Printing) allows for the creation of complex structures with reduced material waste, leading to cost savings and increased design flexibility, while advanced Composites offer superior strength-to-weight ratios and are being used in industries like aerospace, automotive, and construction.

Final Thoughts

Investing in materials stocks can be challenging due to their cyclical nature and sensitivity to economic trends. However, for investors who understand the economic cycles and can navigate the volatility, there are significant opportunities for growth and profit. The materials sector plays a crucial role in global markets, providing essential goods for various industries, and is poised for innovation with emerging trends like sustainable materials, nanotechnology, and additive manufacturing.

While the sector’s performance is closely tied to the economic cycle, favorable supply-demand dynamics in certain segments suggest potential long-term investment opportunities. Companies that can leverage advancements in technology and sustainability are likely to gain a competitive edge in the market.

In conclusion, materials stocks may be cyclical, but with careful analysis and strategic investment, they can offer substantial returns. Investors should stay informed about economic trends and emerging opportunities to make well-informed decisions in this dynamic sector.

Cover Image by Si Platt

Overview of the Materials Sector

The materials sector encompasses industries involved in the discovery, development, and processing of raw materials. This sector includes companies that produce chemical products, metals, construction materials, packaging, and paper and forest products. The performance of the materials sector is closely tied to the economic cycle, often rising and falling with the overall state of economic growth.

In recent years, the sector has shown positive but sluggish returns due to concerns over recession risks. However, favorable supply-demand dynamics in certain segments, such as copper mining and chemical manufacturing, suggest potential long-term investment opportunities. The materials sector plays a crucial role in global markets, providing essential goods for various industries.

The top material stocks will be able to navigate the cyclical nature that comes with the material sectors. These stocks can manage the volatility that comes with the economic turndown and commodity price volatility.

Definition and examples of materials stocks

Materials stocks refer to shares of companies involved in extracting, processing, and selling raw materials, including base metals and industrial minerals. Examples of materials stocks include Rio Tinto (RIO), Nucor (NUE), and Air Products & Chemicals (APD). Materials companies provide building blocks for construction, manufacturing, and infrastructure development.

Cyclical Nature of the Materials Sector

During periods of economic growth, industries such as construction, manufacturing, and technology expand, leading to increased demand for raw materials like metals, chemicals, and construction materials. This heightened demand drives up the prices of these materials, boosting the revenues and stock prices of materials companies.

Conversely, during economic downturns, industrial activities slow down, leading to a decrease in demand for raw materials. As demand drops, the prices of these materials fall, negatively impacting the revenues and stock prices of materials companies.

Image by Markus Kammermann

Supply Constraints can also play a significant role. For example, geopolitical events, trade policies, and natural disasters can disrupt the supply of raw materials. When supply is limited and demand remains steady or increases, prices rise, benefiting materials stocks. However, if supply exceeds demand, prices fall, negatively affecting these stocks.

Consumer Behavior is linked closely to the demand for materials. When consumers are confident and spending increases, the demand for goods and, consequently, the raw materials needed to produce them, rises. During economic downturns, consumer spending declines, reducing demand for these materials.

Challenges of Material Stocks due to Cyclical Nature

The cyclical nature of material stocks can be particularly challenging for beginner investors. New investors might struggle with Market Timing. Knowing when to buy or sell material stocks requires an understanding of economic cycles and market trends, which can be difficult for those without experience.

The high volatility of material stocks can also be intimidating. Prices can fluctuate significantly due to changes in supply and demand, geopolitical events, and other factors. This can lead to substantial gains or losses, which might be overwhelming for new investors. Understanding the factors that influence material stocks, such as commodity prices, global economic conditions, and regulatory changes, can be complex. New investors might find it challenging to analyze these factors and make informed decisions.

Materials companies often require significant capital investments, which can impact their financial stability during economic downturns. New investors might find it difficult to assess the financial health and long-term viability of these companies. Many materials companies operate in international markets, exposing them to global economic conditions, currency fluctuations, and trade policies. New investors might find it challenging to navigate these complexities and understand their impact on stock performance.

Finally, the cyclical nature and volatility of material stocks can lead to emotional stress. New investors might react impulsively to market fluctuations, making decisions based on fear or greed rather than sound analysis.

Recent Material Stocks Impacted by Economic Cycles

Here are a few recent examples of traded material companies affected by economic trends. These examples illustrate how economic trends, such as commodity price fluctuations, inflation, and economic cycles, can significantly impact material companies.

Freeport-McMoRan is a leader in copper materials. Image by Image by Shelton Keys

Freeport-McMoRan Inc. (FCX) is a major copper producer that was impacted by fluctuations in copper prices, which are closely tied to global economic conditions. In 2023, concerns over a potential recession led to volatility in copper prices, affecting Freeport-McMoRan’s stock performance.

Dow Inc. (DOW), a leading chemical manufacturer, has faced challenges due to rising raw material costs and supply chain disruptions. Inflation and higher energy prices have increased production costs, impacting the company’s profitability.

Vulcan Materials Company (VMC), a construction materials company, has been influenced by the state of the construction industry, which is highly sensitive to economic cycles. During periods of economic growth, demand for construction materials like cement and aggregates increases, benefiting Vulcan Materials.

Emerging trends and opportunities in the sector

Industry trends present significant opportunities for innovation and growth in the material sector. Companies that can leverage these advancements are likely to gain a competitive edge in the market.

The material sector is experiencing several emerging mega-trends and opportunities driven by advancements in technology and a focus on sustainability. There is a growing demand for eco-friendly materials, such as biodegradable plastics and bio-based materials, which reduce environmental impact.

Nanomaterials are revolutionizing various industries, including healthcare, energy, and environmental remediation, due to their unique properties. Smart Materials can respond to external stimuli, such as temperature or pressure changes, making them ideal for applications in aerospace, automotive, and consumer electronics.

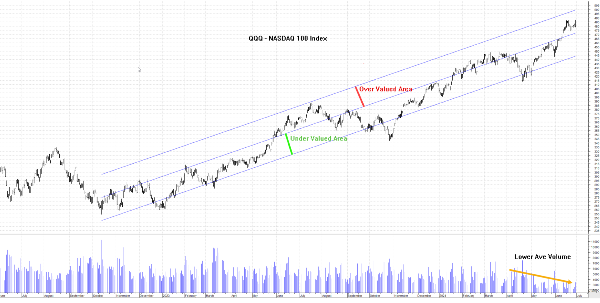

Image by Karolina Grabowska

Additive Manufacturing (3D Printing) allows for the creation of complex structures with reduced material waste, leading to cost savings and increased design flexibility, while advanced Composites offer superior strength-to-weight ratios and are being used in industries like aerospace, automotive, and construction.

Final Thoughts

Investing in materials stocks can be challenging due to their cyclical nature and sensitivity to economic trends. However, for investors who understand the economic cycles and can navigate the volatility, there are significant opportunities for growth and profit. The materials sector plays a crucial role in global markets, providing essential goods for various industries, and is poised for innovation with emerging trends like sustainable materials, nanotechnology, and additive manufacturing. While the sector’s performance is closely tied to the economic cycle, favorable supply-demand dynamics in certain segments suggest potential long-term investment opportunities. Companies that can leverage advancements in technology and sustainability are likely to gain a competitive edge in the market. In conclusion, materials stocks may be cyclical, but with careful analysis and strategic investment, they can offer substantial returns. Investors should stay informed about economic trends and emerging opportunities to make well-informed decisions in this dynamic sector.