What are Building Material Stocks?

Building material companies are involved in the production and distribution of materials used in construction and infrastructure projects. These materials include concrete, cement, steel, lumber, and other essential components for building structures. Investing in building material stocks can be a way to gain exposure to the construction industry and benefit from economic growth and infrastructure development.

Building material stocks often include companies that produce aggregates such as crushed stone, sand, and gravel, which are essential for various construction activities. Some companies also manufacture precast concrete products, fiber cement siding, and industrial gases used in construction.

Investing in these stocks can provide diversification within the materials sector, as they encompass a wide range of products and services. Moreover, these stocks tend to perform well during periods of economic expansion, when there is increased demand for construction and infrastructure projects.

Overall, building material stocks offer a unique opportunity to capitalize on the growth and development of the construction industry, making them an attractive option for investors seeking long-term gains.

What do you mean by building materials?

Building materials are substances used in the construction of buildings and other structures. These materials can be naturally occurring, such as clay, rocks, sand, and wood, or they can be man-made, like concrete, steel, and glass.

These materials are chosen based on their properties, availability, cost, and the specific requirements of the construction project. Advances in technology and materials science continue to expand the range of building materials available, leading to more efficient, sustainable, and innovative construction practices.

Some common building materials include:

- Wood used for framing, flooring, and finishing.

- Concrete made from cement, aggregates, and water, used in foundations and structural elements.

- Steel which is known for its strength and flexibility, used in structural frames and roofing.

- Brick made from clay and fired in a kiln, used in wall construction.

- Glass which is used in windows, doors, and facades for its transparency and light transmission.

- Stone: which is durable and strong, often used in foundations, walls, and decorative elements.

- Gypsum: which is used in drywall and plaster for interior walls and ceilings.

- Insulation materials: such as fiberglass, foam, and cellulose, used to reduce heat transfer and improve energy efficiency.

- Asphalt: which is commonly used in roofing and road construction for its waterproofing properties.

- Plastic: which is versatile and lightweight. It is used in piping, insulation, and as a component in composite materials.

- Ceramics: used in tiles, sanitary ware, and as a component in advanced building materials for their durability and aesthetic appeal.

- Bamboo: which is a sustainable and renewable material used in flooring, paneling, and structural elements in some regions.

What are Examples of Building Material Stock?

Building material stocks include companies that produce essential materials for construction and infrastructure projects. Some notable building material stocks include the following stocks.

Sherwin-Williams (SHW)

Sherwin-Williams (SHW) is known for its paints and coatings The company offers a wide range of residential materials, including. They provide high-quality interior paints, primers, wood stains, wood sealants, topcoats, aerosols, and cement paints. The company also offers various regional exterior color schemes, such as America’s Heritage, Desert and Southwest Style, Northern Shores and Seaports, Southern Shores and Beaches, Suburban Modern, and Suburban Traditional.

Vulcan Materials (VMC)

Vulcan Materials (VMC) specializes in aggregates like crushed stone, sand, and gravel. The Company is the largest producer of construction aggregates in the United States. Their primary products include Crushed Stone, Sand, and Gravel

In addition to these aggregates, Vulcan also produces aggregates-based construction materials such as Asphalt and Ready-Mixed Concrete. These materials are essential for various construction projects, including roads, buildings, and infrastructure.

Nucor (NUE)

Nucor (NUE) is a leading steel producer. The company provides a variety of building materials, primarily focusing on steel products. Their offerings include Steel Framing Systems, Roof Panel Systems, Wall Panel Systems, Insulated Metal Panels, Joists and Decking, Rebar, Pipe & Tube, and Fasteners and Grating.

Nucor also offers custom-engineered metal building systems through Nucor Building Systems, which are designed to be energy-efficient and environmentally friendly.

Who is the target market for building materials?

The target market for building materials can be broadly categorized into several segments. Each of these segments has unique needs and preferences, making it essential for building materials providers to tailor their products and marketing strategies accordingly.

Residential Segment includes homeowners, builders, and contractors involved in the construction, renovation, or remodeling of residential properties. There is a high demand for quality and affordable building materials, as well as a growing interest in energy-efficient and sustainable products.

Commercial Segment comprises of businesses, institutions, and organizations that require building materials for their commercial properties. The demand here is for durable, functional, and aesthetically pleasing materials that can withstand heavy use and traffic.

Industrial Segment which caters to heavy industries such as manufacturing, mining, and energy. The materials needed are strong, durable, and resistant to harsh environmental conditions like high temperatures and corrosive chemicals.

Infrastructure Segment which is a critical market that provides materials for public infrastructure projects such as roads, bridges, airports, and water treatment plants. The materials must be safe, reliable, and long-lasting.

DIY Market which is a fast-growing consumer market where individuals undertake home renovation projects themselves to save on labor costs. Consumers look for high-quality materials that are easy to install and targeted to their needs2.

What is the outlook for the building materials industry?

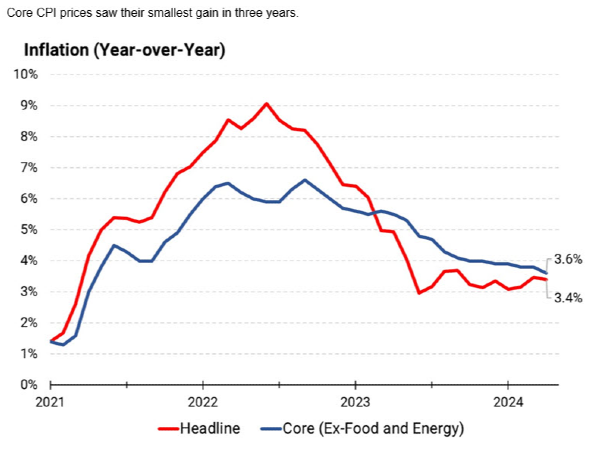

The outlook for the building materials industry in 2024 presents a mixed picture. The national economy shows signs of slowing down, with consumer spending holding steady but driven by reduced savings and increased credit card usage, Real disposable income is not keeping pace with core inflation, which may impact consumer spending power. High inflation and low unemployment may delay any reduction in interest rates until mid-2024. This could affect consumer credit spending as credit card interest rates rise.

Single-family housing starts and resale forecasts for 2024 are expected to be influenced by these economic factors as the industry is increasingly testing and implementing new building materials driven by decarbonization efforts and changing consumer preferences. These innovations include significant investments in companies and emerging startups focused on sustainability, efficiency, and resilience.

Building materials companies with a sizable share of revenues derived from public construction are expected to outperform building products manufacturers. However, they could see lower volumes in the second half of 2024 as nonresidential activity falls.

Overall, while there are challenges, there are also opportunities for innovation and growth, particularly in sustainability and public construction sectors.

What is the future of the building materials industry?

The future of the building materials industry is poised for significant transformation, driven by several key trends and innovations:

Sustainability: The industry is increasingly focusing on reducing carbon emissions and adopting sustainable practices. This includes the use of low-carbon materials, recycling, and energy-efficient construction methods

Technological Advancements: Innovations such as 3D printing, AI, and IoT are revolutionizing the way buildings are designed and constructed. These technologies enhance efficiency, reduce costs, and improve the overall quality of construction

New Materials: Researchers are developing new materials that are stronger, lighter, and more environmentally friendly. Examples include carbon-fiber reinforced concrete, super-strong plastics, and 3D-printed mycelium

Public and Private Investment: Significant investments from both public and private sectors are expected to boost the industry. This includes funding for infrastructure projects and clean energy initiatives.

Labor and Workforce: Addressing the ongoing shortage of skilled labor is crucial. New workforce norms and strategies are being implemented to bridge the talent gap and ensure a steady supply of skilled workers

Overall, the building materials industry is set to become more sustainable, technologically advanced, and innovative, paving the way for a more efficient and eco-friendly construction landscape.

Final Thoughts

Building material stocks represent a vital segment of the construction industry, offering investors a unique opportunity to benefit from economic growth and infrastructure development. These stocks encompass a diverse range of products and services, from aggregates and precast concrete to steel and industrial gases, providing significant diversification within the materials sector.

Investing in building material stocks can be particularly rewarding during periods of economic expansion, as increased demand for construction and infrastructure projects drives growth. Companies like Sherwin-Williams, Vulcan Materials, and Nucor exemplify the potential for long-term gains in this sector.

Overall, building material stocks are an attractive option for investors seeking to capitalize on the ongoing growth and development of the construction industry, making them a valuable addition to a diversified investment portfolio.

What are Building Material Stocks?

Building material companies are involved in the production and distribution of materials used in construction and infrastructure projects. These materials include concrete, cement, steel, lumber, and other essential components for building structures. Investing in building material stocks can be a way to gain exposure to the construction industry and benefit from economic growth and infrastructure development.

Building material stocks often include companies that produce aggregates such as crushed stone, sand, and gravel, which are essential for various construction activities. Some companies also manufacture precast concrete products, fiber cement siding, and industrial gases used in construction.

Investing in these stocks can provide diversification within the materials sector, as they encompass a wide range of products and services. Moreover, these stocks tend to perform well during periods of economic expansion, when there is increased demand for construction and infrastructure projects.

Overall, building material stocks offer a unique opportunity to capitalize on the growth and development of the construction industry, making them an attractive option for investors seeking long-term gains.

What do you mean by building materials?

Building materials are substances used in the construction of buildings and other structures. These materials can be naturally occurring, such as clay, rocks, sand, and wood, or they can be man-made, like concrete, steel, and glass.

These materials are chosen based on their properties, availability, cost, and the specific requirements of the construction project. Advances in technology and materials science continue to expand the range of building materials available, leading to more efficient, sustainable, and innovative construction practices.

Some common building materials include:

What are Examples of Building Material Stock?

Building material stocks include companies that produce essential materials for construction and infrastructure projects. Some notable building material stocks include the following stocks.

Sherwin-Williams (SHW)

Image by StockSnap from Pixabay

Sherwin-Williams (SHW) is known for its paints and coatings The company offers a wide range of residential materials, including. They provide high-quality interior paints, primers, wood stains, wood sealants, topcoats, aerosols, and cement paints. The company also offers various regional exterior color schemes, such as America’s Heritage, Desert and Southwest Style, Northern Shores and Seaports, Southern Shores and Beaches, Suburban Modern, and Suburban Traditional.

Vulcan Materials (VMC)

Image by Igor2008 from Pixabay

Vulcan Materials (VMC) specializes in aggregates like crushed stone, sand, and gravel. The Company is the largest producer of construction aggregates in the United States. Their primary products include Crushed Stone, Sand, and Gravel

In addition to these aggregates, Vulcan also produces aggregates-based construction materials such as Asphalt and Ready-Mixed Concrete. These materials are essential for various construction projects, including roads, buildings, and infrastructure.

Nucor (NUE)

Nucor (NUE) is a leading steel producer. The company provides a variety of building materials, primarily focusing on steel products. Their offerings include Steel Framing Systems, Roof Panel Systems, Wall Panel Systems, Insulated Metal Panels, Joists and Decking, Rebar, Pipe & Tube, and Fasteners and Grating.

Nucor also offers custom-engineered metal building systems through Nucor Building Systems, which are designed to be energy-efficient and environmentally friendly.

Who is the target market for building materials?

The target market for building materials can be broadly categorized into several segments. Each of these segments has unique needs and preferences, making it essential for building materials providers to tailor their products and marketing strategies accordingly.

Residential Segment includes homeowners, builders, and contractors involved in the construction, renovation, or remodeling of residential properties. There is a high demand for quality and affordable building materials, as well as a growing interest in energy-efficient and sustainable products.

Commercial Segment comprises of businesses, institutions, and organizations that require building materials for their commercial properties. The demand here is for durable, functional, and aesthetically pleasing materials that can withstand heavy use and traffic.

Industrial Segment which caters to heavy industries such as manufacturing, mining, and energy. The materials needed are strong, durable, and resistant to harsh environmental conditions like high temperatures and corrosive chemicals.

Infrastructure Segment which is a critical market that provides materials for public infrastructure projects such as roads, bridges, airports, and water treatment plants. The materials must be safe, reliable, and long-lasting.

DIY Market which is a fast-growing consumer market where individuals undertake home renovation projects themselves to save on labor costs. Consumers look for high-quality materials that are easy to install and targeted to their needs2.

What is the outlook for the building materials industry?

The outlook for the building materials industry in 2024 presents a mixed picture. The national economy shows signs of slowing down, with consumer spending holding steady but driven by reduced savings and increased credit card usage, Real disposable income is not keeping pace with core inflation, which may impact consumer spending power. High inflation and low unemployment may delay any reduction in interest rates until mid-2024. This could affect consumer credit spending as credit card interest rates rise.

Single-family housing starts and resale forecasts for 2024 are expected to be influenced by these economic factors as the industry is increasingly testing and implementing new building materials driven by decarbonization efforts and changing consumer preferences. These innovations include significant investments in companies and emerging startups focused on sustainability, efficiency, and resilience.

Building materials companies with a sizable share of revenues derived from public construction are expected to outperform building products manufacturers. However, they could see lower volumes in the second half of 2024 as nonresidential activity falls.

Overall, while there are challenges, there are also opportunities for innovation and growth, particularly in sustainability and public construction sectors.

What is the future of the building materials industry?

The future of the building materials industry is poised for significant transformation, driven by several key trends and innovations:

Sustainability: The industry is increasingly focusing on reducing carbon emissions and adopting sustainable practices. This includes the use of low-carbon materials, recycling, and energy-efficient construction methods

Technological Advancements: Innovations such as 3D printing, AI, and IoT are revolutionizing the way buildings are designed and constructed. These technologies enhance efficiency, reduce costs, and improve the overall quality of construction

New Materials: Researchers are developing new materials that are stronger, lighter, and more environmentally friendly. Examples include carbon-fiber reinforced concrete, super-strong plastics, and 3D-printed mycelium

Public and Private Investment: Significant investments from both public and private sectors are expected to boost the industry. This includes funding for infrastructure projects and clean energy initiatives.

Labor and Workforce: Addressing the ongoing shortage of skilled labor is crucial. New workforce norms and strategies are being implemented to bridge the talent gap and ensure a steady supply of skilled workers

Overall, the building materials industry is set to become more sustainable, technologically advanced, and innovative, paving the way for a more efficient and eco-friendly construction landscape.

Final Thoughts

Building material stocks represent a vital segment of the construction industry, offering investors a unique opportunity to benefit from economic growth and infrastructure development. These stocks encompass a diverse range of products and services, from aggregates and precast concrete to steel and industrial gases, providing significant diversification within the materials sector. Investing in building material stocks can be particularly rewarding during periods of economic expansion, as increased demand for construction and infrastructure projects drives growth. Companies like Sherwin-Williams, Vulcan Materials, and Nucor exemplify the potential for long-term gains in this sector. Overall, building material stocks are an attractive option for investors seeking to capitalize on the ongoing growth and development of the construction industry, making them a valuable addition to a diversified investment portfolio.