Aetna Inc. vs Cigna Group

CVS Health (Aetna Inc.) vs The Cigna Group: Which Insurance Company is a Better Buy?

Aetna Inc. and The Cigna Group are two of the largest health insurance companies in the sector right now. In this article, we will be taking a look at what sets them apart from one another, and which is the better buy right now.

Aetna Inc. is an American health care company that offers and sells health care insurance. They are based out of Hartford, Connecticut, and are a subsidiary of CVS Health Corporation. Cigna Group is also a healthcare company based out of Connecticut, headquartered in Bloomfield. The two companies are tied together by more than just geography, however.

In the 1800s, Aetna separated their annuity company and fire insurance companies. The fire insurance company that left the Aetna name eventually became a part of the Connecticut General Life Insurance Company. This company ended up becoming one of the two companies that combined to form Cigna as it is known today.

Since the CVS Health acquisition of Aetna Inc. in 2018, the CVS Health Corporation is the stock symbol that would be relevant to the Aetna Insurance.

The Case for Cigna Group: Working Hard For Their Investors

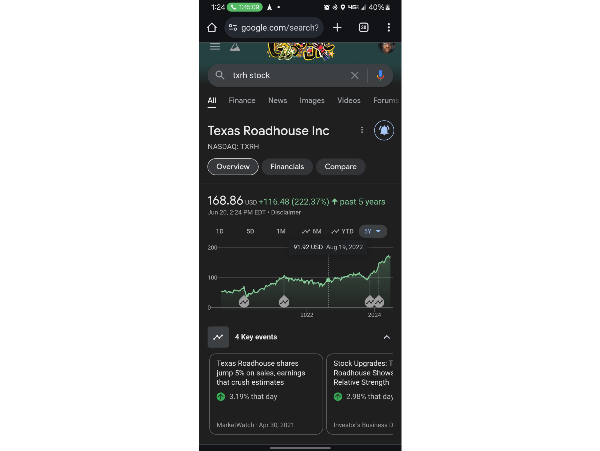

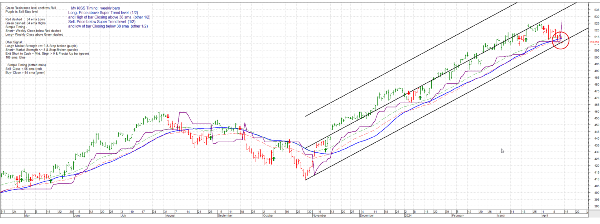

Cigna has for some time been one of the largest players in the healthcare sector. In fact, Cigna is ranked as the 27th largest insurance company in America. Their current stock price of $330.90 comes after a tremendous year for their stock. In the last full year, Cigna’s stock has increased 23.64%. This, along with their historically strong dividend performance has led to them being a major player for many years now.

Speaking of their dividend, Cigna currently has quarterly dividends of $1.4, which is a 1.6% dividend yield. They have routinely increased their dividend payouts, but did have a small bump in the road in the early 2000s. They have aggressively worked to improve share price, including recently a $11.3 billion stock buyback.

In addition to their work to improve their stock price, based on the GuruFocus FCF intrinsic value calculator, Cigna is actually considerably undervalued. The intrinsic value of Cigna Group based on their free cash flow is $522.69, considerably higher the current trading price of $333.90.

Is the Case for Aetna Inc. Stronger?

Aetna Inc. has been similarly successful to Cigna, though they are even larger in terms of their total health plan enrollment. In 2021, they were the 6th largest health insurance company in America. This success was reflected in the performance of their stock price leading to their acquisition by CVS Health Corporation.. Aetna Inc. was trading at $212.70, an all-time high for the company. Currently, CVS Health stock is trading at $60.99. This is an 11.18% decrease over the past full year.

The dividend performance for CVS Health is a lot stronger than the performance of their stock price. For the past 20 years, CVS has increased their dividend. Currently, the dividend yield stands at 4.35%, and quarterly dividends of $0.66. This is relatively strong, returning a far higher annual yield than Cigna.

The formula for intrinsic value for CVS indicates that similarly to Cigna, CVS Health stock may be undervalued. Currently based on that model, the intrinsic value of CVS stock is $146.56. This means the CVS Health stock is even more undervalued (based on this model) than that of Cigna Group!

Performance Comparison

Both Aetna Inc. and Cigna Group offer compelling reasons to consider them if you are looking into buying stock. While the stock performance of Cigna has been stronger recently, the CVS Health stock is also undervalued, and offers a stronger dividend yield. So how do we determine which is a better buy?

Trefis determines that while CVS has a higher P/S ratio, Cigna remains the stronger buy due to their greater return potential. Others point to the weaker stock performance of CVS Health, even with having greater revenue growth than Cigna as an indicator for potential future success. Both are valid strategies, and both stocks certainly have merit and have earned their consideration.

Over the past year, the debate of which is a better buy has heated up. While CVS Health’s stock has struggled, their revenue has steadily grown. However, when comparing to Cigna Group, especially in revenue per share, we can see that Cigna performs stronger there as well.

Conclusions

While both stocks warrant consideration from investors, I believe Cigna Group appears to be the stronger buy. While CVS Health operates one of the largest insurance companies in the world, and performs well by its own right, I believe it is not enough to match the opportunity of Cigna.

Cigna manages to maintain a stronger performance in terms of year-over-year revenue, despite CVS and Aetna increasing their revenue more last year. The difference in dividend yield could have been a deciding factor, if the recent performance for CVS gave me more optimism. While it is true they are undervalued, so is Cigna, who also has maintained strong stock performance and who have been active in increasing their stock price in recent years.

Aetna is one of the largest insurance companies in the world, and is only one component of what makes up CVS Health stock. I do believe that it does offer significant value to investors, and has maintained a strong dividend, but if I were able to choose only one, my choice would be Cigna Group.

Aetna Inc. vs Cigna Group

CVS Health (Aetna Inc.) vs The Cigna Group: Which Insurance Company is a Better Buy?

Aetna Inc. and The Cigna Group are two of the largest health insurance companies in the sector right now. In this article, we will be taking a look at what sets them apart from one another, and which is the better buy right now.

Aetna Inc. is an American health care company that offers and sells health care insurance. They are based out of Hartford, Connecticut, and are a subsidiary of CVS Health Corporation. Cigna Group is also a healthcare company based out of Connecticut, headquartered in Bloomfield. The two companies are tied together by more than just geography, however.

In the 1800s, Aetna separated their annuity company and fire insurance companies. The fire insurance company that left the Aetna name eventually became a part of the Connecticut General Life Insurance Company. This company ended up becoming one of the two companies that combined to form Cigna as it is known today.

Since the CVS Health acquisition of Aetna Inc. in 2018, the CVS Health Corporation is the stock symbol that would be relevant to the Aetna Insurance.

The Case for Cigna Group: Working Hard For Their Investors

Cigna has for some time been one of the largest players in the healthcare sector. In fact, Cigna is ranked as the 27th largest insurance company in America. Their current stock price of $330.90 comes after a tremendous year for their stock. In the last full year, Cigna’s stock has increased 23.64%. This, along with their historically strong dividend performance has led to them being a major player for many years now.

Speaking of their dividend, Cigna currently has quarterly dividends of $1.4, which is a 1.6% dividend yield. They have routinely increased their dividend payouts, but did have a small bump in the road in the early 2000s. They have aggressively worked to improve share price, including recently a $11.3 billion stock buyback.

In addition to their work to improve their stock price, based on the GuruFocus FCF intrinsic value calculator, Cigna is actually considerably undervalued. The intrinsic value of Cigna Group based on their free cash flow is $522.69, considerably higher the current trading price of $333.90.

Is the Case for Aetna Inc. Stronger?

Aetna Inc. has been similarly successful to Cigna, though they are even larger in terms of their total health plan enrollment. In 2021, they were the 6th largest health insurance company in America. This success was reflected in the performance of their stock price leading to their acquisition by CVS Health Corporation.. Aetna Inc. was trading at $212.70, an all-time high for the company. Currently, CVS Health stock is trading at $60.99. This is an 11.18% decrease over the past full year.

The dividend performance for CVS Health is a lot stronger than the performance of their stock price. For the past 20 years, CVS has increased their dividend. Currently, the dividend yield stands at 4.35%, and quarterly dividends of $0.66. This is relatively strong, returning a far higher annual yield than Cigna.

The formula for intrinsic value for CVS indicates that similarly to Cigna, CVS Health stock may be undervalued. Currently based on that model, the intrinsic value of CVS stock is $146.56. This means the CVS Health stock is even more undervalued (based on this model) than that of Cigna Group!

Performance Comparison

Both Aetna Inc. and Cigna Group offer compelling reasons to consider them if you are looking into buying stock. While the stock performance of Cigna has been stronger recently, the CVS Health stock is also undervalued, and offers a stronger dividend yield. So how do we determine which is a better buy?

Trefis determines that while CVS has a higher P/S ratio, Cigna remains the stronger buy due to their greater return potential. Others point to the weaker stock performance of CVS Health, even with having greater revenue growth than Cigna as an indicator for potential future success. Both are valid strategies, and both stocks certainly have merit and have earned their consideration.

Over the past year, the debate of which is a better buy has heated up. While CVS Health’s stock has struggled, their revenue has steadily grown. However, when comparing to Cigna Group, especially in revenue per share, we can see that Cigna performs stronger there as well.

Conclusions

While both stocks warrant consideration from investors, I believe Cigna Group appears to be the stronger buy. While CVS Health operates one of the largest insurance companies in the world, and performs well by its own right, I believe it is not enough to match the opportunity of Cigna.

Cigna manages to maintain a stronger performance in terms of year-over-year revenue, despite CVS and Aetna increasing their revenue more last year. The difference in dividend yield could have been a deciding factor, if the recent performance for CVS gave me more optimism. While it is true they are undervalued, so is Cigna, who also has maintained strong stock performance and who have been active in increasing their stock price in recent years.

Aetna is one of the largest insurance companies in the world, and is only one component of what makes up CVS Health stock. I do believe that it does offer significant value to investors, and has maintained a strong dividend, but if I were able to choose only one, my choice would be Cigna Group.