Are consumer staples a good investment?

Consumer staples can be a strong investment choice due to their stability and resilience, even during economic downturns. These essentials, such as food, beverages, and household products, are consistently in demand, making companies in this sector less vulnerable to the whims of the market. This steady demand often results in more predictable revenue streams and dividends, which can be appealing for conservative investors looking for a dependable source of income.

Moreover, consumer staples companies frequently have well-established brands with loyal customer bases. This brand loyalty can provide a competitive advantage and help maintain market share, even in a crowded and highly competitive marketplace. Many of these companies also benefit from extensive distribution networks and economies of scale, which can enhance profitability and provide a cushion against market volatility. As a result, these businesses can often achieve consistent growth, which might translate into long-term value for investors.

However, it's essential to note that while consumer staples can offer stability, they may not deliver the high growth potential found in more volatile sectors, such as technology or biotechnology. Investors should consider their overall investment strategy and risk tolerance before committing heavily to this sector. By diversifying their portfolio to include a mix of asset classes, investors can balance stability with growth, potentially enhancing their long-term returns while minimizing risk.

Understanding Consumer Staple Stocks

Consumer staple stocks represent companies that produce essentials we frequently use, such as food, beverages, and household goods. These products tend to have consistent demand regardless of economic conditions, making consumer staple stocks a reliable investment option. They typically provide a steady revenue stream and are known for paying regular dividends, appealing to investors seeking stability and income.

Why are Consumer Staples Underperforming?

In recent times, consumer staples have been underperforming compared to other sectors of the stock market, raising concerns among investors. Despite their reputation for stability, several factors have contributed to this trend.

Inflation and Changing Consumer Behavior

One of the significant reasons consumer staples have been struggling is stubborn inflation. As inflation rates remain high, consumers are becoming more cost-conscious, opting for cheaper alternatives and store brands. This shift in purchasing behavior has put pressure on traditional consumer staples companies, leading to decreased revenue and slower growth. Major companies like PepsiCo and Kellanova have already reported challenging economic conditions and value-conscious consumers.

Interest Rates and Valuation Concerns

With rising interest rates, consumer staples companies are facing additional challenges. Historically, these stocks have been seen as bond proxies due to their stable dividends. However, as treasury yields increase, investors may prefer bonds over consumer staples stocks, leading to a decline in demand. Furthermore, some consumer staples companies have been overvalued in recent years, making them less attractive compared to other sectors like technology, which offer higher growth potential.

Global Market Dynamics

Consumer staples companies with significant international exposure are also dealing with the effects of a strong dollar, which has impacted their earnings. Additionally, as the global market experiences economic fluctuations, these companies must navigate through various challenges, including supply chain disruptions and changes in consumer preferences. With these hurdles in place, it's no surprise that consumer staples have underperformed in the stock market.

Costco: A Retail Giant

Costco Wholesale Corporation operates a chain of membership-only warehouse clubs, offering a wide range of products including groceries, electronics, clothing, and household items. The company's business model is built on offering quality products at lower prices, attracting a loyal customer base that values both savings and high-quality merchandise. With over 800 locations worldwide and millions of members, Costco is a dominant player in the retail industry.

Is Costco a Consumer Staple Stock?

While Costco sells many consumer staples, it is categorically part of the retail sector, specifically under the hypermarkets and supercenters industry. Traditional consumer staple stocks include manufacturers of essential goods, such as Procter & Gamble or Coca-Cola. However, Costco’s dominant position in the retail market, extensive product range, and consistent demand for its offerings give it a stable revenue stream similar to consumer staples companies.

Is the Consumer Staple Sector a Safe Investment?

When it comes to building a dependable investment portfolio, consumer staples stocks often find their way to the top of the list. These stocks represent companies that produce and sell essential goods such as food, beverages, and household products. Given the consistent demand for these products, consumer staples stocks are generally considered a safe investment. However, it's important to understand the factors that contribute to their stability and the potential risks involved.

Consistent Demand and Stability

Consumer staples companies benefit from the non-cyclical nature of their products. Regardless of economic conditions, people still need to purchase essentials, creating a steady demand that can safeguard these companies against market volatility. This reliability often translates into predictable revenue streams and regular dividends, making them attractive to conservative investors seeking stable returns. For instance, companies like Procter & Gamble and Nestle have maintained strong performance even during economic downturns, underscoring the resilient nature of this sector.

Diversified Portfolios and Brand Loyalty

Another reason consumer staples are considered safe investments is their diversified product portfolios and strong brand loyalty. Many companies in this sector have a wide range of products catering to different consumer needs, which helps mitigate risks associated with changing market trends. Additionally, established brands often enjoy a loyal customer base, ensuring consistent sales and further contributing to their stability. This brand loyalty can act as a buffer against competition and market disruptions, providing a sense of security for investors.

Potential Risks and Considerations

Despite their reputation for safety, consumer staples stocks are not without risks. One potential concern is the impact of inflation, which can increase production costs and squeeze profit margins. Moreover, rising interest rates can make bonds more attractive to investors, potentially decreasing demand for consumer staples stocks. Lastly, global market dynamics, such as currency fluctuations and geopolitical tensions, can also affect the performance of multinational consumer staples companies.

Consumer Staples Outlook for 2025

As we look ahead to 2025, the consumer staples sector presents a promising outlook despite recent challenges. After a period of relative underperformance, industry experts are anticipating a return to normalcy with several factors contributing to a positive forecast.

Economic Stability and Consumer Behavior

A stable economic backdrop is expected to support the consumer staples sector in 2025. With solid consumer balance sheets, healthy employment rates, and steady real wage growth, the sector is well positioned to benefit from sustained consumer demand. Even though high interest rates and inflation have posed challenges, the Federal Reserve's expected rate cuts could further bolster the sector's performance. Consumers are likely to continue prioritizing essential goods, ensuring consistent demand for products within this sector.

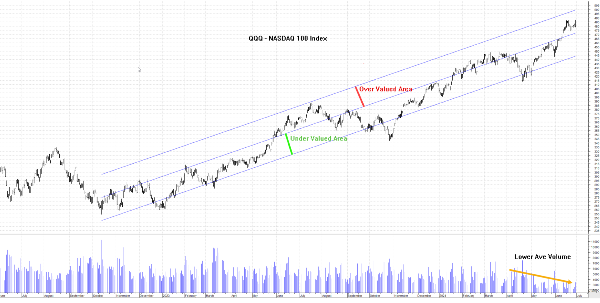

Opportunities in Undervalued Stocks

The consumer staples sector is also expected to offer opportunities in undervalued stocks, particularly in categories like soft drinks and spirits. Many companies within this sector may present turnaround stories or value investments, thanks to their robust product portfolios and loyal customer bases. Investors who are strategic in their stock selection could potentially reap significant benefits as the sector stabilizes and returns to growth.

Global Market Dynamics

The global market dynamics will play a critical role in shaping the outlook for consumer staples in 2025. While a strong dollar could impede international growth, companies with well-established global operations may still thrive. The sector's defensive nature, coupled with its ability to adapt to changing market conditions, will be key in navigating potential challenges and leveraging growth opportunities.

Conclusion

In summary, consumer staples stocks are generally considered a safe investment due to their consistent demand, stable revenue streams, and strong brand loyalty. However, investors should remain mindful of potential risks, such as inflation and global market dynamics. By considering these factors and diversifying their portfolios, investors can strike a balance between stability and growth, making informed decisions that align with their long-term financial goals.

Are consumer staples a good investment?

Consumer staples can be a strong investment choice due to their stability and resilience, even during economic downturns. These essentials, such as food, beverages, and household products, are consistently in demand, making companies in this sector less vulnerable to the whims of the market. This steady demand often results in more predictable revenue streams and dividends, which can be appealing for conservative investors looking for a dependable source of income.

Moreover, consumer staples companies frequently have well-established brands with loyal customer bases. This brand loyalty can provide a competitive advantage and help maintain market share, even in a crowded and highly competitive marketplace. Many of these companies also benefit from extensive distribution networks and economies of scale, which can enhance profitability and provide a cushion against market volatility. As a result, these businesses can often achieve consistent growth, which might translate into long-term value for investors.

However, it's essential to note that while consumer staples can offer stability, they may not deliver the high growth potential found in more volatile sectors, such as technology or biotechnology. Investors should consider their overall investment strategy and risk tolerance before committing heavily to this sector. By diversifying their portfolio to include a mix of asset classes, investors can balance stability with growth, potentially enhancing their long-term returns while minimizing risk.

Understanding Consumer Staple Stocks

Consumer staple stocks represent companies that produce essentials we frequently use, such as food, beverages, and household goods. These products tend to have consistent demand regardless of economic conditions, making consumer staple stocks a reliable investment option. They typically provide a steady revenue stream and are known for paying regular dividends, appealing to investors seeking stability and income.

Why are Consumer Staples Underperforming?

In recent times, consumer staples have been underperforming compared to other sectors of the stock market, raising concerns among investors. Despite their reputation for stability, several factors have contributed to this trend.

Inflation and Changing Consumer Behavior

One of the significant reasons consumer staples have been struggling is stubborn inflation. As inflation rates remain high, consumers are becoming more cost-conscious, opting for cheaper alternatives and store brands. This shift in purchasing behavior has put pressure on traditional consumer staples companies, leading to decreased revenue and slower growth. Major companies like PepsiCo and Kellanova have already reported challenging economic conditions and value-conscious consumers.

Interest Rates and Valuation Concerns

With rising interest rates, consumer staples companies are facing additional challenges. Historically, these stocks have been seen as bond proxies due to their stable dividends. However, as treasury yields increase, investors may prefer bonds over consumer staples stocks, leading to a decline in demand. Furthermore, some consumer staples companies have been overvalued in recent years, making them less attractive compared to other sectors like technology, which offer higher growth potential.

Global Market Dynamics

Consumer staples companies with significant international exposure are also dealing with the effects of a strong dollar, which has impacted their earnings. Additionally, as the global market experiences economic fluctuations, these companies must navigate through various challenges, including supply chain disruptions and changes in consumer preferences. With these hurdles in place, it's no surprise that consumer staples have underperformed in the stock market.

Costco: A Retail Giant

Image by: TastingTable

Costco Wholesale Corporation operates a chain of membership-only warehouse clubs, offering a wide range of products including groceries, electronics, clothing, and household items. The company's business model is built on offering quality products at lower prices, attracting a loyal customer base that values both savings and high-quality merchandise. With over 800 locations worldwide and millions of members, Costco is a dominant player in the retail industry.

Is Costco a Consumer Staple Stock?

While Costco sells many consumer staples, it is categorically part of the retail sector, specifically under the hypermarkets and supercenters industry. Traditional consumer staple stocks include manufacturers of essential goods, such as Procter & Gamble or Coca-Cola. However, Costco’s dominant position in the retail market, extensive product range, and consistent demand for its offerings give it a stable revenue stream similar to consumer staples companies.

Is the Consumer Staple Sector a Safe Investment?

When it comes to building a dependable investment portfolio, consumer staples stocks often find their way to the top of the list. These stocks represent companies that produce and sell essential goods such as food, beverages, and household products. Given the consistent demand for these products, consumer staples stocks are generally considered a safe investment. However, it's important to understand the factors that contribute to their stability and the potential risks involved.

Consistent Demand and Stability

Consumer staples companies benefit from the non-cyclical nature of their products. Regardless of economic conditions, people still need to purchase essentials, creating a steady demand that can safeguard these companies against market volatility. This reliability often translates into predictable revenue streams and regular dividends, making them attractive to conservative investors seeking stable returns. For instance, companies like Procter & Gamble and Nestle have maintained strong performance even during economic downturns, underscoring the resilient nature of this sector.

Diversified Portfolios and Brand Loyalty

Another reason consumer staples are considered safe investments is their diversified product portfolios and strong brand loyalty. Many companies in this sector have a wide range of products catering to different consumer needs, which helps mitigate risks associated with changing market trends. Additionally, established brands often enjoy a loyal customer base, ensuring consistent sales and further contributing to their stability. This brand loyalty can act as a buffer against competition and market disruptions, providing a sense of security for investors.

Potential Risks and Considerations

Despite their reputation for safety, consumer staples stocks are not without risks. One potential concern is the impact of inflation, which can increase production costs and squeeze profit margins. Moreover, rising interest rates can make bonds more attractive to investors, potentially decreasing demand for consumer staples stocks. Lastly, global market dynamics, such as currency fluctuations and geopolitical tensions, can also affect the performance of multinational consumer staples companies.

Consumer Staples Outlook for 2025

As we look ahead to 2025, the consumer staples sector presents a promising outlook despite recent challenges. After a period of relative underperformance, industry experts are anticipating a return to normalcy with several factors contributing to a positive forecast.

Economic Stability and Consumer Behavior

A stable economic backdrop is expected to support the consumer staples sector in 2025. With solid consumer balance sheets, healthy employment rates, and steady real wage growth, the sector is well positioned to benefit from sustained consumer demand. Even though high interest rates and inflation have posed challenges, the Federal Reserve's expected rate cuts could further bolster the sector's performance. Consumers are likely to continue prioritizing essential goods, ensuring consistent demand for products within this sector.

Opportunities in Undervalued Stocks

The consumer staples sector is also expected to offer opportunities in undervalued stocks, particularly in categories like soft drinks and spirits. Many companies within this sector may present turnaround stories or value investments, thanks to their robust product portfolios and loyal customer bases. Investors who are strategic in their stock selection could potentially reap significant benefits as the sector stabilizes and returns to growth.

Global Market Dynamics

The global market dynamics will play a critical role in shaping the outlook for consumer staples in 2025. While a strong dollar could impede international growth, companies with well-established global operations may still thrive. The sector's defensive nature, coupled with its ability to adapt to changing market conditions, will be key in navigating potential challenges and leveraging growth opportunities.

Conclusion

In summary, consumer staples stocks are generally considered a safe investment due to their consistent demand, stable revenue streams, and strong brand loyalty. However, investors should remain mindful of potential risks, such as inflation and global market dynamics. By considering these factors and diversifying their portfolios, investors can strike a balance between stability and growth, making informed decisions that align with their long-term financial goals.