What are ESG Stocks?

ESG stocks represent companies that prioritize Environmental, Social, and Governance (ESG) criteria in their business practices. These criteria include a wide range of activities, such as reducing carbon emissions, ensuring fair labor practices, maintaining transparent corporate governance, and fostering community engagement. By integrating these principles into their operations, ESG-focused companies aim to create long-term sustainable value for their stakeholders, including investors, employees, customers, and the broader society. This approach not only helps mitigate risks associated with environmental and social issues but also drives innovation and efficiency, making these companies more resilient and attractive to conscious investors.

Investing in ESG stocks allows investors to align their financial goals with their values. By supporting companies that are committed to ethical and sustainable business practices, investors can contribute to positive environmental and social outcomes while potentially achieving competitive returns. The growing demand for ESG investments reflects a broader shift towards responsible investing, as more individuals and institutions recognize the importance of sustainability in driving long-term economic prosperity. As a result, ESG stocks have become an integral part of many investment portfolios, offering a way to promote positive change while pursuing financial growth.

Why are ESG Stocks a Good Investment?

ESG stocks are a good investment because they represent companies that prioritize environmental sustainability, social responsibility, and strong governance practices. This triple focus not only helps them avoid significant risks like regulatory penalties and reputational damage but also positions them for long-term growth and stability. As more investors and consumers seek ethical and sustainable options, demand for ESG stocks increases, driving up their value. Additionally, companies with robust ESG practices tend to be more resilient during market fluctuations, providing investors with more stable returns and the satisfaction of contributing to positive societal change.

ESG Stocks Have Sustainable Growth Potential

ESG stocks represent companies that prioritize sustainable and ethical practices, positioning themselves for long-term growth. These companies actively work to reduce their environmental footprint, foster positive social impact, and maintain strong governance standards. This commitment not only helps them to avoid significant regulatory fines and reputational damage but also makes them more attractive to consumers who increasingly prefer to support businesses with strong ethical values. By investing in ESG stocks, investors can benefit from the sustainable growth potential driven by these responsible business practices.

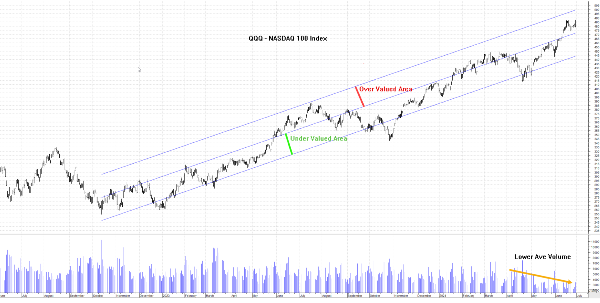

ESG Stocks have Resilience During Market Volatility

One of the key advantages of investing in ESG stocks is their resilience during market downturns. Companies with robust ESG practices tend to have strong risk management strategies in place, which allows them to navigate economic challenges more effectively. For example, companies that prioritize environmental sustainability are less likely to face significant operational disruptions due to environmental regulations or climate-related events. This resilience can lead to more stable returns for investors, even during periods of market volatility.

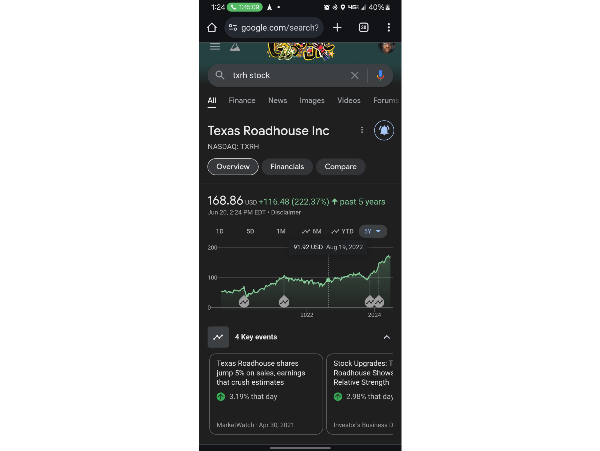

Attraction of Long-term Investors to ESG Stock

ESG stocks appeal to long-term investors who are interested in sustainable and reliable returns. These investors often prioritize companies that demonstrate a commitment to social responsibility. As more institutional investors and asset managers incorporate ESG criteria into their investment decisions, the demand for ESG stocks continues to grow. This increased demand can drive up stock prices and provide investors with the potential for capital appreciation. Additionally, companies with strong ESG performance are likely to be better managed and more transparent, further increasing their attractiveness to discerning investors.

ESG Stocks may have a Positive Impact on Society and the Environment

Investing in ESG stocks allows investors to contribute positively to society and the environment. By supporting companies that prioritize ethical business practices, investors can help drive change and promote a more sustainable future. This not only aligns with the growing trend of socially responsible investing but also allows investors to feel good about where their money is going. The emphasis on environmental sustainability, social equity, and good governance can lead to a better world, making ESG stocks a compelling choice for those who want their investments to reflect their values.

Why are ESG Stocks Criticized?

One major criticism of ESG investing is the lack of standardized metrics and rankings. Different rating agencies often assess companies based on varying criteria, leading to inconsistent evaluations of ESG performance. This inconsistency makes it challenging for investors to accurately compare companies and make informed investment decisions. Critics argue that without a universal standard for ESG metrics, it's difficult to ensure that investments are truly aligned with ethical and sustainable practices, raising concerns about the credibility and reliability of ESG ratings.

Another significant criticism of ESG investing is the potential for "greenwashing," where companies project a false image of being environmentally friendly or socially responsible without making substantive changes to their operations. Some companies may adopt minimal or superficial ESG practices solely to attract investors, without committing to meaningful sustainability efforts. This deceptive practice undermines the integrity of ESG investing and can mislead investors who genuinely want to support companies with strong ethical values. Critics stress the importance of rigorous scrutiny and transparency to prevent greenwashing and ensure that ESG investments truly reflect responsible business practices.

https://youtu.be/2RFzPDYX8kA

See how ESG investing can get murky in the video above

Critics of ESG investing also argue that prioritizing environmental, social, and governance criteria can sometimes come at the expense of financial performance. They believe that companies focused on ESG may incur higher costs, such as investing in eco-friendly technologies or implementing fair labor practices, which could impact their profitability. Additionally, there's a concern that ESG-focused companies might face regulatory uncertainties or public backlash linked to their sustainability initiatives. Critics claim that these potential drawbacks may result in lower returns for investors, questioning whether the trade-off between sustainability and financial gains is worth it.

Image by Dorothe from Pixabay

What are ESG Stocks?

ESG stocks represent companies that prioritize Environmental, Social, and Governance (ESG) criteria in their business practices. These criteria include a wide range of activities, such as reducing carbon emissions, ensuring fair labor practices, maintaining transparent corporate governance, and fostering community engagement. By integrating these principles into their operations, ESG-focused companies aim to create long-term sustainable value for their stakeholders, including investors, employees, customers, and the broader society. This approach not only helps mitigate risks associated with environmental and social issues but also drives innovation and efficiency, making these companies more resilient and attractive to conscious investors.

Investing in ESG stocks allows investors to align their financial goals with their values. By supporting companies that are committed to ethical and sustainable business practices, investors can contribute to positive environmental and social outcomes while potentially achieving competitive returns. The growing demand for ESG investments reflects a broader shift towards responsible investing, as more individuals and institutions recognize the importance of sustainability in driving long-term economic prosperity. As a result, ESG stocks have become an integral part of many investment portfolios, offering a way to promote positive change while pursuing financial growth.

Why are ESG Stocks a Good Investment?

ESG stocks are a good investment because they represent companies that prioritize environmental sustainability, social responsibility, and strong governance practices. This triple focus not only helps them avoid significant risks like regulatory penalties and reputational damage but also positions them for long-term growth and stability. As more investors and consumers seek ethical and sustainable options, demand for ESG stocks increases, driving up their value. Additionally, companies with robust ESG practices tend to be more resilient during market fluctuations, providing investors with more stable returns and the satisfaction of contributing to positive societal change.

ESG Stocks Have Sustainable Growth Potential

ESG stocks represent companies that prioritize sustainable and ethical practices, positioning themselves for long-term growth. These companies actively work to reduce their environmental footprint, foster positive social impact, and maintain strong governance standards. This commitment not only helps them to avoid significant regulatory fines and reputational damage but also makes them more attractive to consumers who increasingly prefer to support businesses with strong ethical values. By investing in ESG stocks, investors can benefit from the sustainable growth potential driven by these responsible business practices.

ESG Stocks have Resilience During Market Volatility

One of the key advantages of investing in ESG stocks is their resilience during market downturns. Companies with robust ESG practices tend to have strong risk management strategies in place, which allows them to navigate economic challenges more effectively. For example, companies that prioritize environmental sustainability are less likely to face significant operational disruptions due to environmental regulations or climate-related events. This resilience can lead to more stable returns for investors, even during periods of market volatility.

Attraction of Long-term Investors to ESG Stock

ESG stocks appeal to long-term investors who are interested in sustainable and reliable returns. These investors often prioritize companies that demonstrate a commitment to social responsibility. As more institutional investors and asset managers incorporate ESG criteria into their investment decisions, the demand for ESG stocks continues to grow. This increased demand can drive up stock prices and provide investors with the potential for capital appreciation. Additionally, companies with strong ESG performance are likely to be better managed and more transparent, further increasing their attractiveness to discerning investors.

ESG Stocks may have a Positive Impact on Society and the Environment

Investing in ESG stocks allows investors to contribute positively to society and the environment. By supporting companies that prioritize ethical business practices, investors can help drive change and promote a more sustainable future. This not only aligns with the growing trend of socially responsible investing but also allows investors to feel good about where their money is going. The emphasis on environmental sustainability, social equity, and good governance can lead to a better world, making ESG stocks a compelling choice for those who want their investments to reflect their values.

Why are ESG Stocks Criticized?

One major criticism of ESG investing is the lack of standardized metrics and rankings. Different rating agencies often assess companies based on varying criteria, leading to inconsistent evaluations of ESG performance. This inconsistency makes it challenging for investors to accurately compare companies and make informed investment decisions. Critics argue that without a universal standard for ESG metrics, it's difficult to ensure that investments are truly aligned with ethical and sustainable practices, raising concerns about the credibility and reliability of ESG ratings.

Another significant criticism of ESG investing is the potential for "greenwashing," where companies project a false image of being environmentally friendly or socially responsible without making substantive changes to their operations. Some companies may adopt minimal or superficial ESG practices solely to attract investors, without committing to meaningful sustainability efforts. This deceptive practice undermines the integrity of ESG investing and can mislead investors who genuinely want to support companies with strong ethical values. Critics stress the importance of rigorous scrutiny and transparency to prevent greenwashing and ensure that ESG investments truly reflect responsible business practices.

https://youtu.be/2RFzPDYX8kA

Critics of ESG investing also argue that prioritizing environmental, social, and governance criteria can sometimes come at the expense of financial performance. They believe that companies focused on ESG may incur higher costs, such as investing in eco-friendly technologies or implementing fair labor practices, which could impact their profitability. Additionally, there's a concern that ESG-focused companies might face regulatory uncertainties or public backlash linked to their sustainability initiatives. Critics claim that these potential drawbacks may result in lower returns for investors, questioning whether the trade-off between sustainability and financial gains is worth it.