Linde plc (LIN) is a compelling buy for investors seeking a blend of growth and stability. As a leading industrial gas company, Linde is classified as a growth stock with a robust dividend growth track record. The company has consistently increased its dividend for over 25 years, showcasing its commitment to returning value to shareholders. Linde’s innovative technologies, such as advancements in cryogenics, play a crucial role in industries like healthcare, food preservation, and space exploration, giving it a competitive edge. Additionally, strategic acquisitions, including the 2018 merger with Praxair, have solidified its market position and expanded its global footprint.

Linde’s future earnings and sales outlook is promising. Analysts project double-digit EPS growth driven by robust price/volume dynamics, efficiency gains, and new projects.

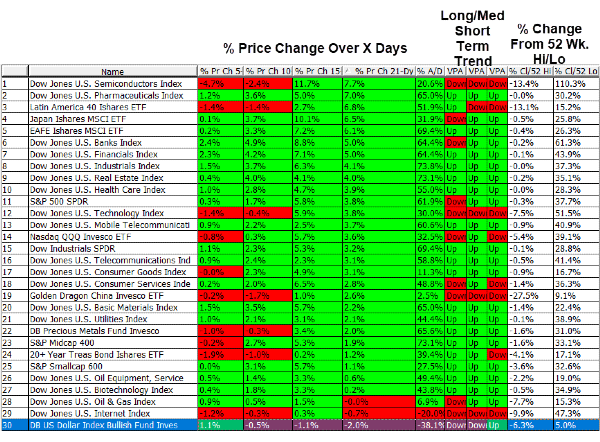

LIN Financials

The company’s EBITDA margins continue to improve, reflecting operational efficiency and strong market demand. With a forward PE ratio of 29.39, Linde is positioned for sustained growth. The company’s extensive global presence in over 100 countries allows it to capitalize on diverse market opportunities and mitigate regional economic risks.

In terms of debt, Linde maintains a healthy financial position with a debt-to-equity ratio of 0.54. The company’s interest coverage ratio of 16.35 indicates its ability to comfortably meet interest obligations. Linde’s strategic investments and acquisitions have been financed prudently, ensuring a balanced approach to growth and financial stability. Over the next two years, Linde is expected to continue its trajectory of growth, supported by its innovative technologies and expanding market presence.

Linde operates in the industrial gases sector, providing essential gases and services to various industries, including healthcare, manufacturing, and energy. The company’s expertise in cryogenics and other advanced technologies enables it to offer solutions that enhance efficiency and sustainability for its clients. Linde’s largest markets include North America, Europe, and Asia, where it serves a diverse customer base with tailored solutions.

Compared to its competitors, Linde stands out due to its scale, technological innovation, and strategic acquisitions. While companies like Air Liquide and Air Products and Chemicals also operate in the industrial gases sector, Linde’s merger with Praxair has created the world’s largest industrial gas company, providing it with unmatched market reach and product offerings. Linde’s focus on sustainability and innovation further differentiates it from its peers, positioning it as a leader in the industry.

Final Thoughts

Linde plc (LIN) is a strong buy for investors looking for a growth stock with a solid dividend track record. The company’s innovative technologies, strategic acquisitions, and global presence provide a robust foundation for future growth. With a healthy financial position and promising earnings outlook, Linde is well-positioned to capitalize on market opportunities and deliver value to shareholders. As the world’s largest industrial gas company, Linde’s competitive advantages make it a standout choice in the materials sector.

Linde plc (LIN) is a compelling buy for investors seeking a blend of growth and stability. As a leading industrial gas company, Linde is classified as a growth stock with a robust dividend growth track record. The company has consistently increased its dividend for over 25 years, showcasing its commitment to returning value to shareholders. Linde’s innovative technologies, such as advancements in cryogenics, play a crucial role in industries like healthcare, food preservation, and space exploration, giving it a competitive edge. Additionally, strategic acquisitions, including the 2018 merger with Praxair, have solidified its market position and expanded its global footprint. Linde’s future earnings and sales outlook is promising. Analysts project double-digit EPS growth driven by robust price/volume dynamics, efficiency gains, and new projects.

LIN Financials

The company’s EBITDA margins continue to improve, reflecting operational efficiency and strong market demand. With a forward PE ratio of 29.39, Linde is positioned for sustained growth. The company’s extensive global presence in over 100 countries allows it to capitalize on diverse market opportunities and mitigate regional economic risks.

In terms of debt, Linde maintains a healthy financial position with a debt-to-equity ratio of 0.54. The company’s interest coverage ratio of 16.35 indicates its ability to comfortably meet interest obligations. Linde’s strategic investments and acquisitions have been financed prudently, ensuring a balanced approach to growth and financial stability. Over the next two years, Linde is expected to continue its trajectory of growth, supported by its innovative technologies and expanding market presence.

Linde operates in the industrial gases sector, providing essential gases and services to various industries, including healthcare, manufacturing, and energy. The company’s expertise in cryogenics and other advanced technologies enables it to offer solutions that enhance efficiency and sustainability for its clients. Linde’s largest markets include North America, Europe, and Asia, where it serves a diverse customer base with tailored solutions.

Compared to its competitors, Linde stands out due to its scale, technological innovation, and strategic acquisitions. While companies like Air Liquide and Air Products and Chemicals also operate in the industrial gases sector, Linde’s merger with Praxair has created the world’s largest industrial gas company, providing it with unmatched market reach and product offerings. Linde’s focus on sustainability and innovation further differentiates it from its peers, positioning it as a leader in the industry.

Final Thoughts

Linde plc (LIN) is a strong buy for investors looking for a growth stock with a solid dividend track record. The company’s innovative technologies, strategic acquisitions, and global presence provide a robust foundation for future growth. With a healthy financial position and promising earnings outlook, Linde is well-positioned to capitalize on market opportunities and deliver value to shareholders. As the world’s largest industrial gas company, Linde’s competitive advantages make it a standout choice in the materials sector.