OneOK Inc. (NYSE: OKE) is a major player in the oil and gas midstream sector, with a market capitalization of approximately $60 billion. As an established company, founded in 1906 and headquartered in Tulsa, Oklahoma, OneOK specializes in gathering, processing, fractionation, transportation, and storage of oil. Let’s delve into the financial metrics to determine whether OneOK is a buy or a sell.

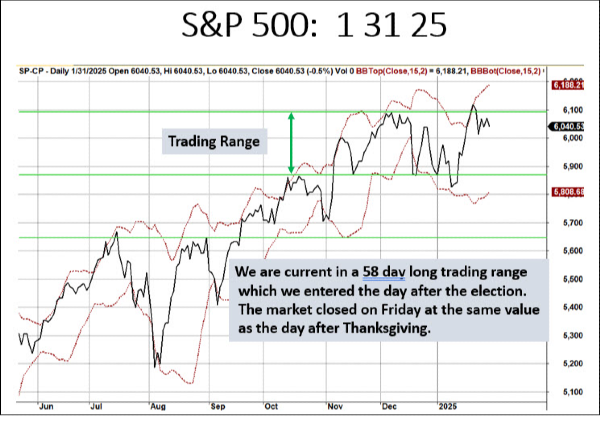

Stock Performance and Market Cap

OneOK is currently trading at $102 per share, with 584 million shares outstanding, placing its market cap at around $60 billion.

Financial Overview

The primary method for valuing OneOK, like any other company, involves estimating future free cash flows (FCF) and discounting them back to their present value. Here’s a snapshot of OneOK’s recent financial performance:

Free Cash Flow (FCF):

- 2022: $1.7 billion (a decline from $1.8 billion)

- 2023: $2.8 billion (up 66%)

- Trailing 12 months (TTM): $2.7 billion (down 4%)

- TTM Margin: 14%

Net Income:

- Increased steadily from $1.5 billion to $2.8 billion

- TTM Margin: 14%

Revenue:

- Peaked at $22 billion in 2022

- 2023: $18 billion (a 21% decline)

- TTM: Nearly $20 billion

OneOK’s dividend yield stands at 4%, lower than the industry average for midstream companies, costing the company $2.4 billion to pay.

Valuation and Discount Analysis

By estimating four years of future free cash flows and a terminal value, OneOK’s total valuation is calculated at $75 billion. Dividing this by 580 million shares gives a stock price of $128, which indicates that the stock is trading at a 20% discount at its current price of $102. According to our model, this makes OneOK a buy.

Industry Comparison

Comparing OneOK to its 45 industry peers:

- Capex: $2.1 billion (double the industry average)

- Debt to Equity: 1.7 (close to industry median)

- Dividend Yield: 4% (lower than the industry average of 7%)

- Free Cash Flow: $2.7 billion (double the industry average)

Financial Metrics

- Price to Book: 3.5

- Price to Earnings: 21

- Price to Free Cash Flow: 22

- Price to Revenue: 3

Despite trading closer to their 52-week high, OneOK's 5-year annual revenue growth rate is an impressive 133%, much higher than the industry average of 11%.

Historical Performance

An investment of $10,000 in OneOK 10 years ago, with dividends reinvested, would now be worth approximately $38,000, marking a 280% total return and an annual return of 4%.

Final Verdict

Our model shows OneOK trading at a 20% discount, earning a 7/10 rating overall, a 7/10 for short-term investments, and a 9/10 for long-term investments. Its strong revenue growth and robust financial health make it an attractive long-term buy despite the current trading price being close to its 52-week high.

https://youtu.be/265hGScdckc?si=H5_BLrPKTDNVEK8p

OneOK Inc. (NYSE: OKE) is a major player in the oil and gas midstream sector, with a market capitalization of approximately $60 billion. As an established company, founded in 1906 and headquartered in Tulsa, Oklahoma, OneOK specializes in gathering, processing, fractionation, transportation, and storage of oil. Let’s delve into the financial metrics to determine whether OneOK is a buy or a sell.

Stock Performance and Market Cap

OneOK is currently trading at $102 per share, with 584 million shares outstanding, placing its market cap at around $60 billion.

Financial Overview

The primary method for valuing OneOK, like any other company, involves estimating future free cash flows (FCF) and discounting them back to their present value. Here’s a snapshot of OneOK’s recent financial performance:

Free Cash Flow (FCF):

Net Income:

Revenue:

OneOK’s dividend yield stands at 4%, lower than the industry average for midstream companies, costing the company $2.4 billion to pay.

Valuation and Discount Analysis

By estimating four years of future free cash flows and a terminal value, OneOK’s total valuation is calculated at $75 billion. Dividing this by 580 million shares gives a stock price of $128, which indicates that the stock is trading at a 20% discount at its current price of $102. According to our model, this makes OneOK a buy.

Industry Comparison

Comparing OneOK to its 45 industry peers:

Financial Metrics

Despite trading closer to their 52-week high, OneOK's 5-year annual revenue growth rate is an impressive 133%, much higher than the industry average of 11%.

Historical Performance

An investment of $10,000 in OneOK 10 years ago, with dividends reinvested, would now be worth approximately $38,000, marking a 280% total return and an annual return of 4%.

Final Verdict

Our model shows OneOK trading at a 20% discount, earning a 7/10 rating overall, a 7/10 for short-term investments, and a 9/10 for long-term investments. Its strong revenue growth and robust financial health make it an attractive long-term buy despite the current trading price being close to its 52-week high.

https://youtu.be/265hGScdckc?si=H5_BLrPKTDNVEK8p