Sound investments

don't happen alone

Find your crew, build teams, compete in VS MODE, and identify investment trends in our evergrowing investment ecosystem. You aren't on an island anymore, and our community is here to help you make informed decisions in a complex world.

February 1, 2025 OK, some folks have labeled the market action after the election in November as “The Trump Bump”. But really? Businesses may be euphoric wishing for everything from “No Regulations” to “Tax Cuts”. But if the current rate of changes, purges and marginal (I’m charitable here) cabinet secretaries are any indication, the effects on the economy are just beginning. A.K.A. Tariffs, trade wars, dare I go on? Gone are the comments about “Lowering the Cost of Groceries” and in with “I am your Retribution”.

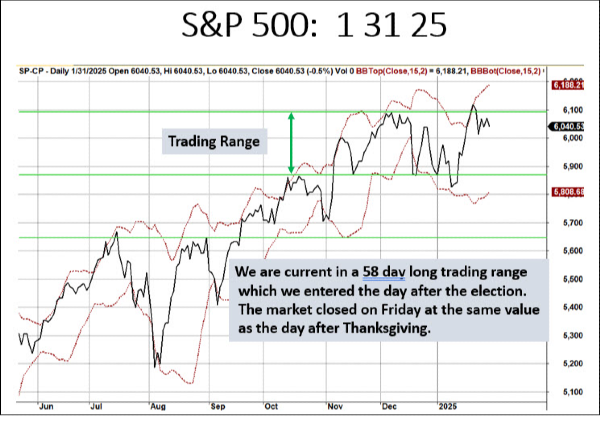

The US economy is 70% consumer based, and that is based on consumption. High prices, stagnate wages = not much consumption. Econ 101, supply is greater than demand. Thus, prices may fall. But profits take a hit. Profits go down, tariffs kick in and all of a sudden, the stock market “looks expensive”. The chart shows that in reality, we’re in a trading range since late November. Are investors getting concerned and want to wait to see what happens next? It sure does seem like it.

I’m treading lightly here, invested yes, but lightly so. Where is the market leadership? Technology? Well . . . not really. Financials, yeah kind of but . . . What’s the next shoe to drop? And, will it help or hurt the US consumer? That’s the question and we likely won’t have to wait very long for an answer. Have a good week + and be careful out there. …………… Tom ………………