2025 Stock Market Outlook: Will the Juggernaut Finally Slow Down?

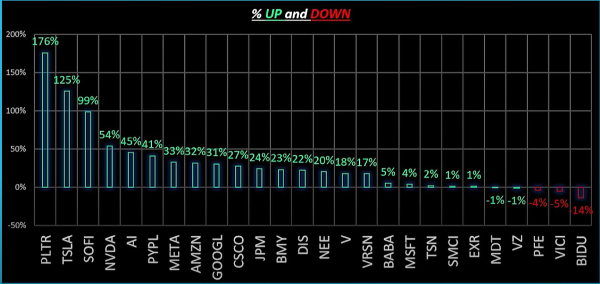

As we move into 2025, market analysts are divided on what the year will bring for the stock market. Following Blockbuster returns in both 2023 and 2024, some analysts predict a significant shift, with the stock market potentially losing its juggernaut status. Others foresee a substantial correction, possibly around 10%, looming on the horizon.

Historical Performance and Predictions

Over the last two years, the S&P 500 has delivered impressive returns of 20-30%. However, a potentially poor year in 2025 is prompting analysts to identify stocks they believe will outperform. Today, we examine five stocks that are projected to deliver more than a 35% return in the coming year.

1. Uber Technologies, Inc. (UBER)

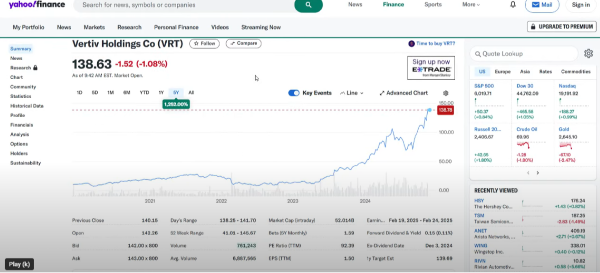

Uber Technologies is a stock we've been bullish on since it hovered around the $60 mark. In the past year, it has seen a 7% increase, and over the last five years, it has surged by approximately 92%. Currently trading in the mid to lower end of its 52-week range, both Seeking Alpha and Wall Street analysts have rated it a buy.

Earnings and Expectations

Uber has beaten earnings expectations in three of the last four quarters, with an estimated forward P/E of 29.1 for 2025. The company's year-on-year growth is anticipated to be 177%, significantly higher than the sector's 4.2%. Uber's earnings per share are projected to grow by 42% annually over the next 3-5 years, compared to a sector average of 11.5%.

Profitability and Valuation

Uber's profitability looks strong with an A+ rating, a gross margin of around 32%, and a bottom line of 10.5%. The company's cash from operations is a standout at $6.21 billion versus the sector's average of $347 million. Institutions currently hold 80% ownership, with notable buying activity observed throughout 2024.

Intrinsic Value and Analyst Targets

Using a Discounted Cash Flow (DCF) model, our intrinsic value calculation for Uber is $93, indicating a 38% upside. Conservative estimates value it at $82, while bullish projections see it at $116. Wall Street's price target of $92 suggests a 36% upside by year-end.

Conclusion

The potential for a 10% market correction in 2025 highlights the importance of identifying bullish stocks. Uber Technologies stands out with its strong financial metrics, robust growth prospects, and institutional backing. As always, we advise conducting your own due diligence before making investment decisions.

https://youtu.be/DCe75TA2CZE?si=Mn1zezkwZz0_Zg0b&t=43

2025 Stock Market Outlook: Will the Juggernaut Finally Slow Down?

As we move into 2025, market analysts are divided on what the year will bring for the stock market. Following Blockbuster returns in both 2023 and 2024, some analysts predict a significant shift, with the stock market potentially losing its juggernaut status. Others foresee a substantial correction, possibly around 10%, looming on the horizon.

Historical Performance and Predictions

Over the last two years, the S&P 500 has delivered impressive returns of 20-30%. However, a potentially poor year in 2025 is prompting analysts to identify stocks they believe will outperform. Today, we examine five stocks that are projected to deliver more than a 35% return in the coming year.

1. Uber Technologies, Inc. (UBER)

Uber Technologies is a stock we've been bullish on since it hovered around the $60 mark. In the past year, it has seen a 7% increase, and over the last five years, it has surged by approximately 92%. Currently trading in the mid to lower end of its 52-week range, both Seeking Alpha and Wall Street analysts have rated it a buy.

Earnings and Expectations

Uber has beaten earnings expectations in three of the last four quarters, with an estimated forward P/E of 29.1 for 2025. The company's year-on-year growth is anticipated to be 177%, significantly higher than the sector's 4.2%. Uber's earnings per share are projected to grow by 42% annually over the next 3-5 years, compared to a sector average of 11.5%.

Profitability and Valuation

Uber's profitability looks strong with an A+ rating, a gross margin of around 32%, and a bottom line of 10.5%. The company's cash from operations is a standout at $6.21 billion versus the sector's average of $347 million. Institutions currently hold 80% ownership, with notable buying activity observed throughout 2024.

Intrinsic Value and Analyst Targets

Using a Discounted Cash Flow (DCF) model, our intrinsic value calculation for Uber is $93, indicating a 38% upside. Conservative estimates value it at $82, while bullish projections see it at $116. Wall Street's price target of $92 suggests a 36% upside by year-end.

Conclusion

The potential for a 10% market correction in 2025 highlights the importance of identifying bullish stocks. Uber Technologies stands out with its strong financial metrics, robust growth prospects, and institutional backing. As always, we advise conducting your own due diligence before making investment decisions.

https://youtu.be/DCe75TA2CZE?si=Mn1zezkwZz0_Zg0b&t=43