Getting Started on StockBossUp

Investing can feel overwhelming, but StockBossUp keeps it simple and approachable. Getting started is easy, and each step helps you grow into a more confident investor. Once you join, we guide you through the platform, explain why each step matters, and highlight the tools that will support your investing journey.

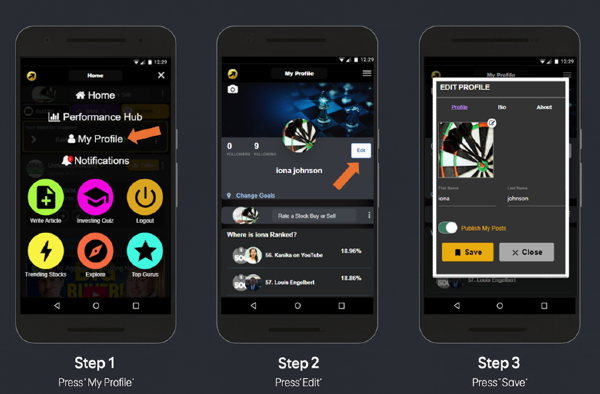

Create a Profile

Let the community see who you are as an investor. Add a profile picture and share a bit about your investing background. Whether you use a real photo or an avatar, your standout stock picks will shine even brighter when people can connect them to your all star profile.

Note: Completing your profile unlocks your investor ranking!

Rate Ten Stocks

Rate ten stocks as a buy or sell to qualify for ranking. Not sure which ones to choose? No worries — the platform gives you several tools to quickly discover ten great stock ideas.

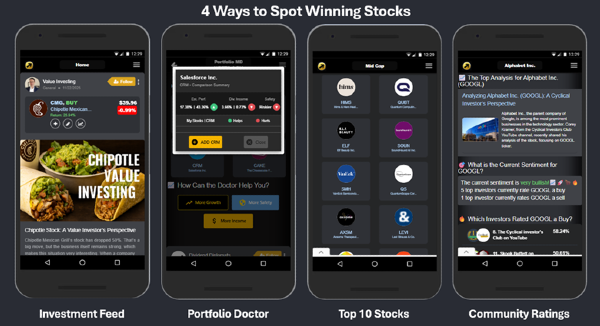

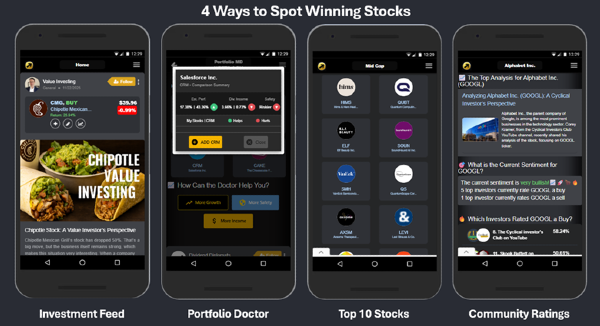

Investment Feed

Your investment feed sits right on your homepage, just below your watchlist snapshot. Explore stock analysis from investors across the community—through posts or videos. When something catches your eye, tap the “plus” button to add it to your 10 stock picks.

Note: As you browse your investment feed, follow the investors who inspire you. Once you do, you’ll be able to see all their stock picks and rankings in the “Friends” tab.

Portfolio Doctor

Do you know your investment goals? Maybe you’re focused on growth, looking for monthly income, or aiming for something more stable.

That’s where the Portfolio Doctor comes in. It serves up four community backed stock ideas tailored to your objectives. Keep rolling through suggestions until you find the perfect picks to add to your watchlist.

Top Ten Stock Picks

Discover the top ten stocks for any market cap, sector, or theme on the Explore page (side panel on desktop, or scroll down in the app).

These lists highlight the stocks most frequently rated a buy by the community’s top investors — or, in the case of the bearish list, the ones most often rated a sell — all organized by category to help you find strong ideas fast.

Community Stock Rating

When you click on any stock infographic in StockBossUp, you’ll jump straight to that stock’s community rating — a score driven by the sentiment of the platform’s top investors.

Because transparency matters, you can see exactly who rated the stock a buy or sell, along with their ranking. Tap any investor’s profile picture to explore their full analysis and learn from their perspective.

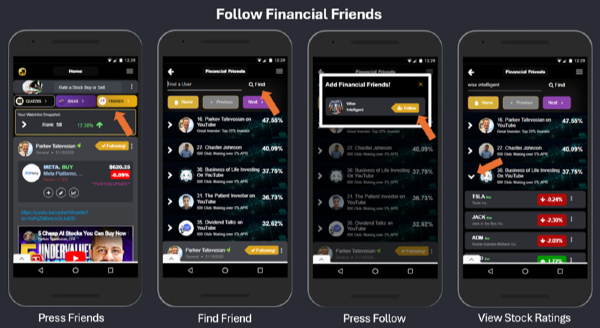

Follow Financial Friends

While your ranking is being calculated, take a moment to follow some financial friends on the platform. It’s especially useful for investment groups who want to track how their ideas stack up.

When you follow someone, you’ll be able to see all their stock ratings, how their ranking compares to your other financial friends, and their latest analysis.

You can view everyone you follow anytime by heading to the “Friends” tab.

Share your Investment Ideas

Feel strongly about a stock? Turn that conviction into an article. StockBossUp articles from top investors often rank high in web searches and even surface in AI results, giving your analysis the power to reach far beyond the platform.

If you’ve created a YouTube video, just paste the link and it will appear instantly in your post or article. And if you only have a quick insight to share, a short post is all it takes to help the community discover a new investment opportunity.

Earn Bragging Rights

Here’s a more energetic, professional, and easy to read version:

What comes after getting started? Leveling up your investment performance. Climb the ranks by uncovering stronger stock ideas and learning directly from the community’s best.

As you rise, you’ll earn serious bragging rights and gain more visibility across the platform. You can track your growing influence and watch your views climb inside the “Performance Hub.”

Conclusion

Getting started on StockBossUp is more than an introduction to a platform — it’s the beginning of a smarter, more connected investing journey. Every feature you explore, from rating stocks to following financial friends, is designed to help you grow your skills, sharpen your ideas, and make more informed decisions.

As you engage with the community, share your insights, and climb the rankings, you’re not just tracking performance — you’re building your reputation as an investor. And with powerful tools like the Portfolio Doctor, Top Ten lists, and transparent community ratings, you’ll always have fresh ideas and trusted perspectives at your fingertips.

Whether you’re here to learn, to lead, or to level up, StockBossUp gives you the support and visibility to make your mark. Your investing journey starts here — and the community is ready to rise with you.

Getting Started on StockBossUp

Investing can feel overwhelming, but StockBossUp keeps it simple and approachable. Getting started is easy, and each step helps you grow into a more confident investor. Once you join, we guide you through the platform, explain why each step matters, and highlight the tools that will support your investing journey.

Create a Profile

Let the community see who you are as an investor. Add a profile picture and share a bit about your investing background. Whether you use a real photo or an avatar, your standout stock picks will shine even brighter when people can connect them to your all star profile.

Rate Ten Stocks

Rate ten stocks as a buy or sell to qualify for ranking. Not sure which ones to choose? No worries — the platform gives you several tools to quickly discover ten great stock ideas.

Investment Feed

Your investment feed sits right on your homepage, just below your watchlist snapshot. Explore stock analysis from investors across the community—through posts or videos. When something catches your eye, tap the “plus” button to add it to your 10 stock picks.

Portfolio Doctor

Do you know your investment goals? Maybe you’re focused on growth, looking for monthly income, or aiming for something more stable. That’s where the Portfolio Doctor comes in. It serves up four community backed stock ideas tailored to your objectives. Keep rolling through suggestions until you find the perfect picks to add to your watchlist.

Top Ten Stock Picks

Discover the top ten stocks for any market cap, sector, or theme on the Explore page (side panel on desktop, or scroll down in the app). These lists highlight the stocks most frequently rated a buy by the community’s top investors — or, in the case of the bearish list, the ones most often rated a sell — all organized by category to help you find strong ideas fast.

Community Stock Rating

When you click on any stock infographic in StockBossUp, you’ll jump straight to that stock’s community rating — a score driven by the sentiment of the platform’s top investors. Because transparency matters, you can see exactly who rated the stock a buy or sell, along with their ranking. Tap any investor’s profile picture to explore their full analysis and learn from their perspective.

Follow Financial Friends

While your ranking is being calculated, take a moment to follow some financial friends on the platform. It’s especially useful for investment groups who want to track how their ideas stack up. When you follow someone, you’ll be able to see all their stock ratings, how their ranking compares to your other financial friends, and their latest analysis. You can view everyone you follow anytime by heading to the “Friends” tab.

Share your Investment Ideas

Feel strongly about a stock? Turn that conviction into an article. StockBossUp articles from top investors often rank high in web searches and even surface in AI results, giving your analysis the power to reach far beyond the platform. If you’ve created a YouTube video, just paste the link and it will appear instantly in your post or article. And if you only have a quick insight to share, a short post is all it takes to help the community discover a new investment opportunity.

Earn Bragging Rights

Here’s a more energetic, professional, and easy to read version: What comes after getting started? Leveling up your investment performance. Climb the ranks by uncovering stronger stock ideas and learning directly from the community’s best. As you rise, you’ll earn serious bragging rights and gain more visibility across the platform. You can track your growing influence and watch your views climb inside the “Performance Hub.”

Conclusion

Getting started on StockBossUp is more than an introduction to a platform — it’s the beginning of a smarter, more connected investing journey. Every feature you explore, from rating stocks to following financial friends, is designed to help you grow your skills, sharpen your ideas, and make more informed decisions. As you engage with the community, share your insights, and climb the rankings, you’re not just tracking performance — you’re building your reputation as an investor. And with powerful tools like the Portfolio Doctor, Top Ten lists, and transparent community ratings, you’ll always have fresh ideas and trusted perspectives at your fingertips. Whether you’re here to learn, to lead, or to level up, StockBossUp gives you the support and visibility to make your mark. Your investing journey starts here — and the community is ready to rise with you.