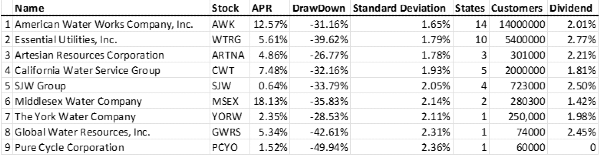

The Top Water Utilities in the U.S. and Their Dividend Yield

- 1). American Water Works Company, Inc. (AWK) – 2.01%

- 2). Essential Utilities, Inc. (WTRG) – 2.77%

- 3). Artesian Resources Corporation (ARTNA) – 2.21%

- 4). California Water Service Group (CWT) – 1.81%

- 5). SJW Group (SJW) – 2.50%

- 6). Middlesex Water Company (MSEX)– 1.42%

- 7). The York Water Company (YORW) – 1.98%

- 8). Global Water Resources, Inc. (GWRS) – 2.45%

- 9). Pure Cycle Corporation (PCYO) – 0.00%

What are Water Utility Stocks

Utilities prepare and safely transfer different resources to homes and businesses. These include electricity, gas, and water. Water utilities specialize in the treatment and delivery of water[1]. This infrastructure includes[2][3]:

- Surface water treatment plants (surface, ground, and wastewater)

- Transmission, distribution and collection mains and pipes

- Groundwater wells

- Water and wastewater pumping stations

- Storage Facilities

- Dams

- Reservoirs

Water treatment is a multi-step process that may include[3]:

- Screens

- Multiple chemical treatments including carbon, potassium, or sodium

- Disinfectors and pH adjustors like lime or caustic soda

Utilities are defensive plays during economic downturns

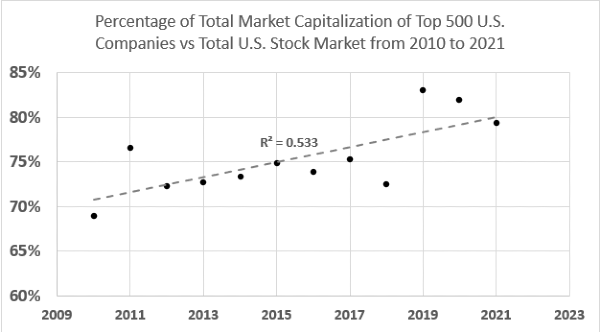

Utilities fall much less during market downturns. At times, these safe stocks may even rise in value. This is due to investors looking for a safe haven during market corrections.

This phenomenon is measured by a stock’s beta. Utility Select Sector SPDR Fund (XLU) is a fund of utility stocks and is a representative of the overall Utility sector. Its beta as of Q4 2022 is 0.54 (5Y Monthly). This means that utilities have fallen and risen about half as much as the general market.

How do we Determine the Top Water Utility Stocks?

We are using the same principles as the StockBossUp draft system by taking into account:

- Annual Percentage Return (last 5 years)

- Volatility (last 5 years, daily)

- Drawdown

- Diversity (Total markets, as defined in each company’s investor presentation)

- Dividend Yield

Utilities are typically useful for income strategies. Hence, we will also weigh the utility’s dividend. The diversity will be measured by the company’s total customer base and by the number of states the company operates in. For the customer base, we will take into consideration industrial customers if necessary. The number of states will be used as a secondary diversity measure due to the stricter regulations around water utilities. By operating in multiple states, a utility company won’t be detrimentally affected by significant regulatory changes at a state level.

What are the Top Water Utility Stocks

The data is tabulated as of Q4 2022. We gave a rank weight to each variable and then summed up the rankings for each water utility. This means that APR had a weight of 16%, volatility had a weight of 32%, diversity had a weight of 32%, and the dividend had a weight of 16%.

- 14 Million Customer

- Operating in 14 States

- Lowest Volatility

AWK is our top spot water utility pick for Q4 2022. AWK is the largest water utility in the country. It doesn’t have the largest dividend of the “water works” companies but it has the lowest volatility of all the utilities in the last 5 years. American Water supplies a variety of customers including Military sites in multiple states including California, Texas, and New York[4].

- Highest dividend yield as of Q4 2022 of all water utilities on this list

- Second largest company by customers served

- Poor drawdown in last 5 years of -39.62%

Essential Utilities is an infrastructure company with the highest dividend out of all the water utilities. However, its second-place finish is heavily due to its poor drawdown in the last 5 years. This is likely due to its exposure to natural gas, which is its other infrastructure service[9].

- The lowest drawdown in the last 5 years of -26.77%

- Low volatility with a daily price change standard deviation of 1.77%

Artesian Resources Corporation provides water in the Deleware and Maryland region[5]. The company has been consistently providing water for nearly 115 years[6]. ARTNA has also been the most consistent water utility stock. Artesian Resources had the smallest drawdown and lowest daily volatility of all the utilities on the list.

- At 7.48% APR CWT has the 3rd best APR

California Water Service Group sits in the middle of the list to start the mid-tier utilities. Its dividend, volatility, and diversification are all midrange. CWT is a big proponent of environmental, social and governance policies and is likely a great stock pick for those interested in sustainable investing[7][8].

- A top dividend provider at 2.5%

- Stock value has lowest appreciation at a 0.64% APR

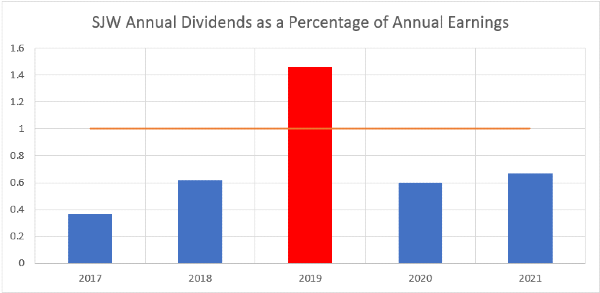

What a curious case SJW is. It is a top dividend provider at 2.5%, but its stock price hasn’t budged in 5 years. From looking at SJW Group’s investor presentation it looks like company earnings are being put into dividend increases. Between this and the multiple capital projects it looks like in the near term the companies growth is slowed as money goes out in dividends. Capital projects look promising but are adding risk to the utility which may be making income investors nervous.

SJW is raising their dividend consistently; however, earnings are not growing and are actually falling. This will hopefully start to turnaround as capital projects complete and new revenue streams open up[10].

- The largest stock APR at 18.13% in the last five years

- The lowest dividend given out at 1.42%

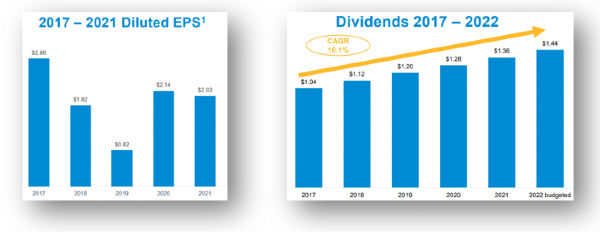

Its funny how things just work out sometimes. So Middlesex Water Company has appreciated the most in the last five years, but its dividend return rate lags behind some other companies in the space. Interestingly, Middlesex Water Company is cognizant of earnings vs dividends given out and highlight them on the same graph:

From the graph, you can see that the company is growing their dividend in conjunction with the earnings per share growth[11][12]. Compared to SJW, Middlesex Water Company is keeping their dividend to 40% to 50% of their earnings per share, compared to SJW’s 60% to 70% dividend to earnings per share.

- One of the smaller water utility companies, serving 250,000 customers in Pennsylvania

- The second lowest drawdown in 5yrs at -28.53%

The York Water Company may have a low drawdown due to a potentially loyal investor base that has helped to stabilize the stock’s price profile. Roughly 5600 retail investors own The York Water Company. Many of these investors live in the area supplied by the utility[3]. Its possible that these investors may have helped to minimize the drawdown as they may have held their shares, and possibly bought more, due to the local nature of the investment.

- Low number of customers at 74,000

- Running mainly out of Arizona

- Poor drawdown of -42.61%

GWRS comes in near the bottom of the list because of its high volatility and low diversity of customers. With a drawdown and high price volatility, GWRS doesn’t look like a strong choice for income investors. The low diversity may be a causation for their volatility, though this is most likely all correlated back to their status as a small-cap stock. They may also be struggling to pay their dividend as earnings per share is only $0.21 while their dividend is $0.29. This means that either earnings need to be increased, or more easily, dividends will need to be cut[11].

- Micro-cap water utility stock with a Market Cap of $195 Million

- Operates primarily in Colorado

- A high drawdown of -49.94%

- The lowest company in terms of diversity and volatility

- No dividend

- The second lowest APR at 1.52%

The Consolidated Water Company is hurt by our metrics because its more closely resembles a start-up. Its business supplies water for 60,000 residents and is diversified into other businesses like property management and oil and gas land portfolios[12]. For income investors, this is not the water utility company for you. However, for those interested in a business diversified in multiple resource management portfolios, this one may be of interest.

Consolidated Water was not included in our list because of their unique business plan. While CWCO is not an ideal candidate for income investors, the stock may be an interesting pick-up as an industrial stock.

Consolidated Water primarily works out of the Cayman Islands. They are building a niche as the provider of water in areas where natural freshwater is scarce[13]. They focus on the operations and manufacturing of seawater reverse osmosis desalination plants. Because of their niche, they not only are a Utility operator but also an equipment manufacturer. This is different from traditional utilities who have a stricter focus on Utilities operation.

Are Water Utilities a Good Investment?

For income portfolios, our data shows that water utility stocks can be a good investment. If the company has a diversified customer base and solid earnings versus their dividend, you can expect continued dividend growth.

Water Utilities provide investors lower volatility, but by no means are they immune to volatility. The lowest drawdown was still -26.77%, a far cry from stable. Unless you choose a Utility that is growing, expect your annual return to lag behind the S&P 500 as do other Utilities in electric and gas distribution

Resources

The Top Water Utilities in the U.S. and Their Dividend Yield

What are Water Utility Stocks

Utilities prepare and safely transfer different resources to homes and businesses. These include electricity, gas, and water. Water utilities specialize in the treatment and delivery of water[1]. This infrastructure includes[2][3]:

Water treatment is a multi-step process that may include[3]:

Utilities are defensive plays during economic downturns

Utilities fall much less during market downturns. At times, these safe stocks may even rise in value. This is due to investors looking for a safe haven during market corrections. This phenomenon is measured by a stock’s beta. Utility Select Sector SPDR Fund (XLU) is a fund of utility stocks and is a representative of the overall Utility sector. Its beta as of Q4 2022 is 0.54 (5Y Monthly). This means that utilities have fallen and risen about half as much as the general market.

How do we Determine the Top Water Utility Stocks?

We are using the same principles as the StockBossUp draft system by taking into account:

Utilities are typically useful for income strategies. Hence, we will also weigh the utility’s dividend. The diversity will be measured by the company’s total customer base and by the number of states the company operates in. For the customer base, we will take into consideration industrial customers if necessary. The number of states will be used as a secondary diversity measure due to the stricter regulations around water utilities. By operating in multiple states, a utility company won’t be detrimentally affected by significant regulatory changes at a state level.

What are the Top Water Utility Stocks

The data is tabulated as of Q4 2022. We gave a rank weight to each variable and then summed up the rankings for each water utility. This means that APR had a weight of 16%, volatility had a weight of 32%, diversity had a weight of 32%, and the dividend had a weight of 16%.

American Water (AWK)

AWK is our top spot water utility pick for Q4 2022. AWK is the largest water utility in the country. It doesn’t have the largest dividend of the “water works” companies but it has the lowest volatility of all the utilities in the last 5 years. American Water supplies a variety of customers including Military sites in multiple states including California, Texas, and New York[4].

Essential Utilities (WTRG)

Essential Utilities is an infrastructure company with the highest dividend out of all the water utilities. However, its second-place finish is heavily due to its poor drawdown in the last 5 years. This is likely due to its exposure to natural gas, which is its other infrastructure service[9].

Artesian Resources Corporation (ARTNA)

Artesian Resources Corporation provides water in the Deleware and Maryland region[5]. The company has been consistently providing water for nearly 115 years[6]. ARTNA has also been the most consistent water utility stock. Artesian Resources had the smallest drawdown and lowest daily volatility of all the utilities on the list.

California Water Service Group (CWT)

California Water Service Group sits in the middle of the list to start the mid-tier utilities. Its dividend, volatility, and diversification are all midrange. CWT is a big proponent of environmental, social and governance policies and is likely a great stock pick for those interested in sustainable investing[7][8].

SJW Group (SJW)

What a curious case SJW is. It is a top dividend provider at 2.5%, but its stock price hasn’t budged in 5 years. From looking at SJW Group’s investor presentation it looks like company earnings are being put into dividend increases. Between this and the multiple capital projects it looks like in the near term the companies growth is slowed as money goes out in dividends. Capital projects look promising but are adding risk to the utility which may be making income investors nervous.

SJW is raising their dividend consistently; however, earnings are not growing and are actually falling. This will hopefully start to turnaround as capital projects complete and new revenue streams open up[10].

Middlesex Water Company (MSEX)

Its funny how things just work out sometimes. So Middlesex Water Company has appreciated the most in the last five years, but its dividend return rate lags behind some other companies in the space. Interestingly, Middlesex Water Company is cognizant of earnings vs dividends given out and highlight them on the same graph:

From the graph, you can see that the company is growing their dividend in conjunction with the earnings per share growth[11][12]. Compared to SJW, Middlesex Water Company is keeping their dividend to 40% to 50% of their earnings per share, compared to SJW’s 60% to 70% dividend to earnings per share.

The York Water Company (YORW)

The York Water Company may have a low drawdown due to a potentially loyal investor base that has helped to stabilize the stock’s price profile. Roughly 5600 retail investors own The York Water Company. Many of these investors live in the area supplied by the utility[3]. Its possible that these investors may have helped to minimize the drawdown as they may have held their shares, and possibly bought more, due to the local nature of the investment.

Global Water Resources (GWRS)

GWRS comes in near the bottom of the list because of its high volatility and low diversity of customers. With a drawdown and high price volatility, GWRS doesn’t look like a strong choice for income investors. The low diversity may be a causation for their volatility, though this is most likely all correlated back to their status as a small-cap stock. They may also be struggling to pay their dividend as earnings per share is only $0.21 while their dividend is $0.29. This means that either earnings need to be increased, or more easily, dividends will need to be cut[11].

Pure Cycle Corporation (PCYO)

The Consolidated Water Company is hurt by our metrics because its more closely resembles a start-up. Its business supplies water for 60,000 residents and is diversified into other businesses like property management and oil and gas land portfolios[12]. For income investors, this is not the water utility company for you. However, for those interested in a business diversified in multiple resource management portfolios, this one may be of interest.

Honorable Mention – Consolidated Water (CWCO)

Consolidated Water was not included in our list because of their unique business plan. While CWCO is not an ideal candidate for income investors, the stock may be an interesting pick-up as an industrial stock. Consolidated Water primarily works out of the Cayman Islands. They are building a niche as the provider of water in areas where natural freshwater is scarce[13]. They focus on the operations and manufacturing of seawater reverse osmosis desalination plants. Because of their niche, they not only are a Utility operator but also an equipment manufacturer. This is different from traditional utilities who have a stricter focus on Utilities operation.

Are Water Utilities a Good Investment?

For income portfolios, our data shows that water utility stocks can be a good investment. If the company has a diversified customer base and solid earnings versus their dividend, you can expect continued dividend growth. Water Utilities provide investors lower volatility, but by no means are they immune to volatility. The lowest drawdown was still -26.77%, a far cry from stable. Unless you choose a Utility that is growing, expect your annual return to lag behind the S&P 500 as do other Utilities in electric and gas distribution

Resources

1). American Water Corporate Overview

2). amwater.com subsidiaries

3). York Water Processing

4). amwater.com

5). ARTNA Investor Fundamentals

6). Artesian Water About

7). California Water Group subsidiaries

8). About California Water Group

9). Essential Utilities 2021 Year in Review

10). About SJW Group

11). Global Water Resources Company Profile

12). Pure Cycle Water Operations

13). About Consolidated Water