If you want to invest in the best ESG compliance company, there is no option except the NRG stock. NRG stock forecast regarding Return on Equity (ROE) is very bright and optimistic due to its solid income statement, robust balance sheet and rosy ESG outlook.

Read also: Utility Stocks in a Recession- Are Utility Stocks a Good Buy Now?

About NRG

NRG Energy Company provides an array of energy solutions to their customers. Based in North America, this public company generates, supplies and distributes electricity to millions of customers in different states of America and Canada.

This American energy corporation offers the main sources of power generation, coal, wind, natural gas, oil, nuclear, utility-scale, and distributed solar generation. This consumer-centric energy company has been shifting towards clean energy solutions since 2009.

Starting as a subsidiary of the North States Power Company (NSP) in 1992, it owns many other subsidiaries now. Example include Reliant Energy, Xoom Energy, Green Mountain Energy and eight other energy companies.

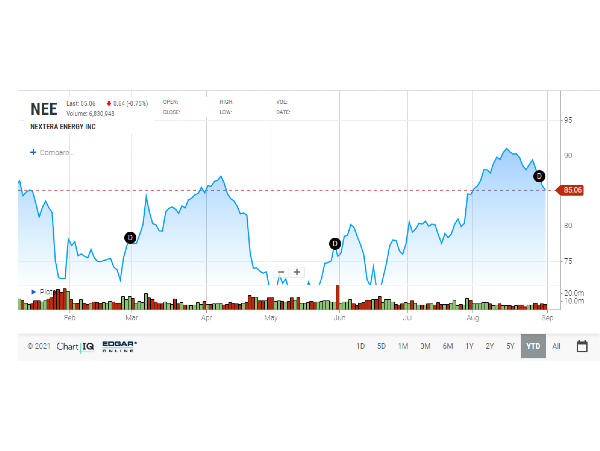

Read Also: Next Era Energy (NEE) Stock, Sempra Energy Stock (SRE), SRE Stock Forecast, Edison International Stock (EIX) and Dominion Energy Stock (D).

NRG Energy Stock

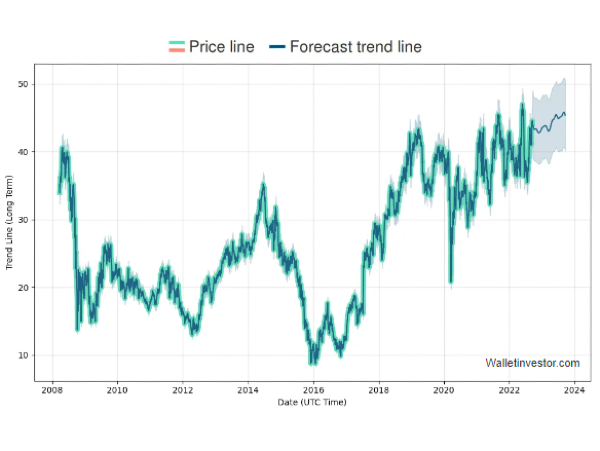

NRG Energy stock is currently trading at a stock price of $40.63. It has dropped by 5.42% year to date. The NRG Energy stock price is estimated to be around the median price of $43.50. The highest price estimation is set at $47.00 and that of the lowest is at $38.00.

| Stock Metrics |

Stock Values |

| Market Cap |

$9.55 B |

| 52-week price range |

$34.70 - $47.82 |

| P/E Ratio |

2.86 |

| Dividend Yield |

3.45% |

| SDP Climate Change Score |

B |

| EPS |

8.93 |

| Beta |

0.90 |

The second quarter report of NRG was very impressive, with a revenue of $7.28 billion, an increase of 38.89% year-over-year. However, the net income had seen a decline of 52.41% YoY. The EPS was $0.33 against the forecast of $0.31. Net profit margin also witnessed a sluggish increase of only 7.04% due to market volatility and slow economic growth.

On the other hand, the NRG stock dividend is stable yet lower. With a low payout ratio, its dividend payment is well covered by its earnings.

Similarly, the debt level is high. But NRG Energy Stock remained successful in covering its debt payments over the last five years. Consequently, it has reduced its debt level from 479% to 151.3% during the same period.

| Metrics |

Jun 2022 |

Mar 2022 |

Dec 2022 |

Sep 2022 |

| Revenues |

T7.28 B |

$7.9 B |

$7.05 B |

$6.61 B |

| Net Income |

513 m |

1,74 Billion |

-427 million |

1.62 Billion |

| Diluted EPS |

---- |

7.17 |

-1.74 |

6.6 |

| Net Profit Margin |

7.04% |

21.99% |

-6.06% |

24.48% |

| Operating Income |

887 m |

2.44 B |

-459 m |

2.34 B |

| Net Change in Cash |

1.6 B |

1.89 B |

-911 m |

1.11 B |

| Cost of Revenue |

5.89 B |

4.95 B |

6.99 B |

3.69 B |

NRG Energy Stock Forecast

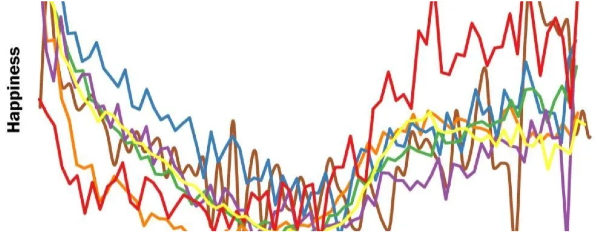

Let's compare the energy sector with the equity market of the USA. We can observe that EPS is ten, much higher than the 3-year average of 5.4. Moreover, investors are optimistic about the future of the energy sector, expecting the earnings to grow by 54.4%.

Analysts are expecting to see a growth in earnings of the energy sector of 54% for the next five years. But, the situation is the opposite for the NRG stock earnings. The analysts have predicted that NRG earnings may drop during the next three years by 17.5% on average.

The ROE for the next three years is expected to grow by 38.2% against the industry ROE of 8.9%.

Although the company has become profitable over the past five years, its earnings are expected to fall in the upcoming three years. The reasons for this low growth may be the high-level debt, the switching toward renewable energy sources and volatile oil and gas prices.

NRG stock forecast for the third quarter has an estimated EPS of $1.63. The EPS is expected to remain volatile due to the most likely recession and the continued Russia-Ukraine War.

Read also about Tesla (TSLA) Alphabet (GOOG), and Netflix (NFLX) stocks

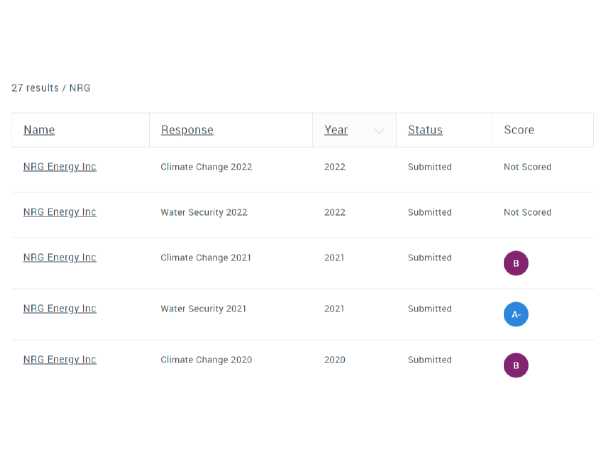

NRG and ESG Award

In July, NRG received an ESG Integration Award in the category of best board oversight of ESG. It is a piece of good news for the current and prospective stakeholders who aspire to invest in the best ESG corporations.

NRG was also appreciated for Excellence in Greenhouse Gas Management at the 2021 Climate Leadership Award.

It was a great achievement of NRG, which has always desired to provide energy-efficient and clean energy solutions by fostering innovation and strategic policies

.

NRG is committed to achieving its goal of net zero by the end of 2050. NRG Energy Company takes special care of all three parameters of ESG: Environmental, Social and Governance.

ESG award recognizes the efforts of the corporations in terms of their contributions toward social inclusion, diversity, environmental safety and governance. ESG Awards bring them to the fore for keeping the investors and stakeholders abreast of the ESG performance of their interested company.

ESG compliance is one of the major factors that investors are looking forward along with the solid balance sheet and investment returns. So, NRG is the best choice for investing in an ESG company. It is a company where diversity, inclusion and sustainability represent this corporate culture and values.

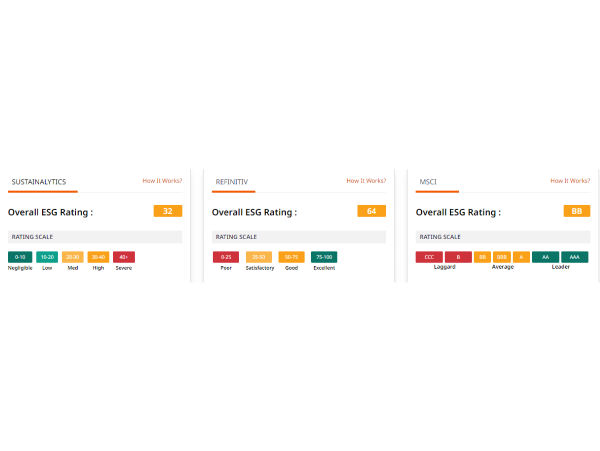

However, NRG is still struggling to achieve excellence in its commitment to a net-zero future. Its MSCI ESG rating is currently average, with a rating of BB.

Read Also: Visa (V) and Bank of America (BAC)

IS NRG A Good Stock To Buy?

Stock NRG is currently undervalued by 68.2%, much below the fair value of $127.66. On the other hand, the corporation is striving to align its goals of innovations and development with those of the United Nation's Sustainable Development Goals (SDGs).

Read Also: Why is Apple Dividend So Low? and Amazon Stock Price Prediction.

This is why it is a good time to invest in this stock. The EPS is expected to be lower, but Returns on Equity (ROE) are most likely to rise. As a result, the NRG stock forecast price will probably increase during the next three years. Most analysts have rated this stock as a hold. If you wish to earn higher returns, you can also invest in this stock of net zero by 2050.

Final Thoughts

Lastly, we conclude by saying that ESG investment requires the stocks to get a higher score on ESG Investing Categories. And, NRG Energy Stock is doing really well on it.

On the other hand, this energy stock has performed impressively over the last five years. Besides, the half-year performance is also outperforming the market analyst's expectations.

Although this stock has not been successful in getting the attention it requires due to the high level of debt. This is why its Return on Investment is somewhat higher. In my opinion, if you already holding this stock, you must maintain the 'Hold' position as the upcoming three years are very crucial and if the company pays back its debt, then you can really enjoy higher returns in the future.

Read Also: Is BBY A Buy or Sell? Is Best Buy still the Best Buy For Investors?

If you want to invest in the best ESG compliance company, there is no option except the NRG stock. NRG stock forecast regarding Return on Equity (ROE) is very bright and optimistic due to its solid income statement, robust balance sheet and rosy ESG outlook.

Read also: Utility Stocks in a Recession- Are Utility Stocks a Good Buy Now?

About NRG

NRG Energy Company provides an array of energy solutions to their customers. Based in North America, this public company generates, supplies and distributes electricity to millions of customers in different states of America and Canada.

This American energy corporation offers the main sources of power generation, coal, wind, natural gas, oil, nuclear, utility-scale, and distributed solar generation. This consumer-centric energy company has been shifting towards clean energy solutions since 2009.

Starting as a subsidiary of the North States Power Company (NSP) in 1992, it owns many other subsidiaries now. Example include Reliant Energy, Xoom Energy, Green Mountain Energy and eight other energy companies.

Read Also: Next Era Energy (NEE) Stock, Sempra Energy Stock (SRE), SRE Stock Forecast, Edison International Stock (EIX) and Dominion Energy Stock (D).

NRG Energy Stock

NRG Energy stock is currently trading at a stock price of $40.63. It has dropped by 5.42% year to date. The NRG Energy stock price is estimated to be around the median price of $43.50. The highest price estimation is set at $47.00 and that of the lowest is at $38.00.

The second quarter report of NRG was very impressive, with a revenue of $7.28 billion, an increase of 38.89% year-over-year. However, the net income had seen a decline of 52.41% YoY. The EPS was $0.33 against the forecast of $0.31. Net profit margin also witnessed a sluggish increase of only 7.04% due to market volatility and slow economic growth.

On the other hand, the NRG stock dividend is stable yet lower. With a low payout ratio, its dividend payment is well covered by its earnings.

Similarly, the debt level is high. But NRG Energy Stock remained successful in covering its debt payments over the last five years. Consequently, it has reduced its debt level from 479% to 151.3% during the same period.

NRG Energy Stock Forecast

Let's compare the energy sector with the equity market of the USA. We can observe that EPS is ten, much higher than the 3-year average of 5.4. Moreover, investors are optimistic about the future of the energy sector, expecting the earnings to grow by 54.4%.

Analysts are expecting to see a growth in earnings of the energy sector of 54% for the next five years. But, the situation is the opposite for the NRG stock earnings. The analysts have predicted that NRG earnings may drop during the next three years by 17.5% on average.

The ROE for the next three years is expected to grow by 38.2% against the industry ROE of 8.9%.

Although the company has become profitable over the past five years, its earnings are expected to fall in the upcoming three years. The reasons for this low growth may be the high-level debt, the switching toward renewable energy sources and volatile oil and gas prices.

NRG stock forecast for the third quarter has an estimated EPS of $1.63. The EPS is expected to remain volatile due to the most likely recession and the continued Russia-Ukraine War.

Read also about Tesla (TSLA) Alphabet (GOOG), and Netflix (NFLX) stocks

NRG and ESG Award

In July, NRG received an ESG Integration Award in the category of best board oversight of ESG. It is a piece of good news for the current and prospective stakeholders who aspire to invest in the best ESG corporations. NRG was also appreciated for Excellence in Greenhouse Gas Management at the 2021 Climate Leadership Award.

It was a great achievement of NRG, which has always desired to provide energy-efficient and clean energy solutions by fostering innovation and strategic policies . NRG is committed to achieving its goal of net zero by the end of 2050. NRG Energy Company takes special care of all three parameters of ESG: Environmental, Social and Governance.

ESG award recognizes the efforts of the corporations in terms of their contributions toward social inclusion, diversity, environmental safety and governance. ESG Awards bring them to the fore for keeping the investors and stakeholders abreast of the ESG performance of their interested company.

ESG compliance is one of the major factors that investors are looking forward along with the solid balance sheet and investment returns. So, NRG is the best choice for investing in an ESG company. It is a company where diversity, inclusion and sustainability represent this corporate culture and values.

However, NRG is still struggling to achieve excellence in its commitment to a net-zero future. Its MSCI ESG rating is currently average, with a rating of BB.

Read Also: Visa (V) and Bank of America (BAC)

IS NRG A Good Stock To Buy?

Stock NRG is currently undervalued by 68.2%, much below the fair value of $127.66. On the other hand, the corporation is striving to align its goals of innovations and development with those of the United Nation's Sustainable Development Goals (SDGs).

Read Also: Why is Apple Dividend So Low? and Amazon Stock Price Prediction.

This is why it is a good time to invest in this stock. The EPS is expected to be lower, but Returns on Equity (ROE) are most likely to rise. As a result, the NRG stock forecast price will probably increase during the next three years. Most analysts have rated this stock as a hold. If you wish to earn higher returns, you can also invest in this stock of net zero by 2050.

Final Thoughts

Lastly, we conclude by saying that ESG investment requires the stocks to get a higher score on ESG Investing Categories. And, NRG Energy Stock is doing really well on it.

On the other hand, this energy stock has performed impressively over the last five years. Besides, the half-year performance is also outperforming the market analyst's expectations.

Although this stock has not been successful in getting the attention it requires due to the high level of debt. This is why its Return on Investment is somewhat higher. In my opinion, if you already holding this stock, you must maintain the 'Hold' position as the upcoming three years are very crucial and if the company pays back its debt, then you can really enjoy higher returns in the future.

Read Also: Is BBY A Buy or Sell? Is Best Buy still the Best Buy For Investors?