Introduction

An American company GameStop Corp. (NYSE: GME), is involved in the business of consumer electronics, video games, and gaming merchandise retailers. The headquarters is in Grapevine, Texas, and among the video game retailer, this is the largest worldwide. As per the data available on January 29, 2022, under the GameStop, EB Game Australia, ThinkGeek, EB Games, Zing Pop Culture, and Micromania-Zing brands, the company operates 4,573 stores which consist of 3,018 in the USA, 907 all across Europe, 417 in Australia, and 231 in Canada. The company's current name was suggested in 1999; however, it was founded in 1984 by Babbage.

During the mid to late 2010s, the company's performance moves down as a paradigm shift in the video game industry. Video game sales switched to online shopping, but GameStop could not succeed in making an investment in smartphone retail. Due to a short squeeze that members of the online forum r/wallstreetbets engineered in 2021, the company's stock price soared.

Due to its stock price volatility and the GameStop short squeeze, the firm attracted much media attention in January and February 2021. On the Fortune 500, the company is now rated 521. GameStop owns and runs the video game magazine Game Informer in addition to its retail outlets.

Also read about AMC stock.

GME stock analysis: Technical views and value drivers

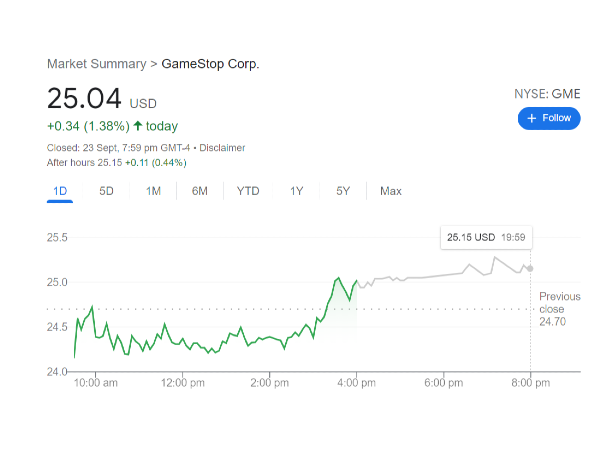

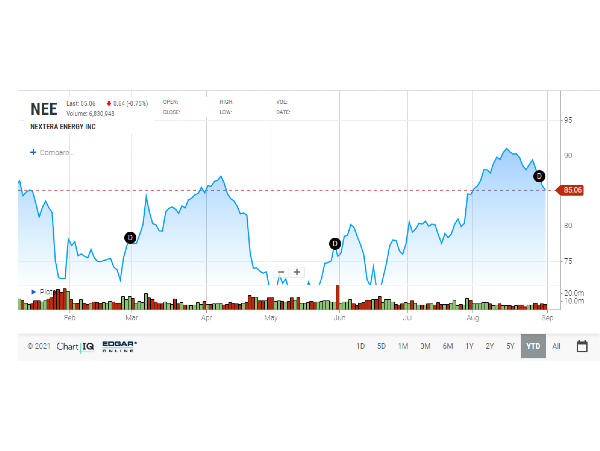

Though it has recently had some ups and downs, GME's performance has remained unfavorable this August 31. The company's valuation has suffered from worries about its ability to survive in the challenging macroeconomic environment of today.

The price of GME stock has dropped 22% since the beginning of 2022, which is a significant reduction compared to the S&P 500 Index US500's loss of 16% during the same period but less than the steep 24% collapse of the tech-heavy Nasdaq 100 Index US100.

Since its volatile peak in 2021, none of the transient increases in the value of the GME shares have resulted in a higher high. The stock's ongoing technical decline may support a bearish short-term GME stock prognosis.

The Relative Strength Index (RSI), which was getting close to oversold levels at 32.51 as of August, was another indication of a pessimistic outlook.

The Moving Average Convergence Divergence (MACD) was declining fast and had reached the negative zone while the gap between the indicator and the

signal line was growing.

GameStop fundamental analysis

GameStop released its financial data for the first quarter of the fiscal year 2022 on June 1.

Revenues came at $1.38 billion, exceeding market projections of $1.32 billion and rising significantly from the $1.27 billion reported in Q1 2021. However, the corporation also declared a net loss of $157.9 million, which was much worse than the $66 million net loss year over year.

GameStop reported that increasing customer demand and the potential for supply chain interruptions caused its Q1 inventory to grow to $917.6 million from $570.9 million a year earlier.

For the first time since Q3 2020, sales of software and collectibles accounted for more than 50% of overall quarterly revenue.

Could the increase in revenue result in a favorable stock outlook for GME? Take into account the most recent analyst stock estimates for GameStop.

GME stock forecast: Sentiments of Analyst

The GameStop (GME) stock outlook was discussed by Capital.com analyst Mikhail Karkhalev, who said:

"The main reason for GameStop stock soaring was the purchase of additional shares by GameStop's chair for around $10m. The sharp rise in GME's share price was picked up by retail traders, which helped the company avoid bankruptcy and now create new products, mainly in the crypto market, in the direction of NFT."

Karkhalev said a $30 million lawsuit from Boston Consulting Group would overshadow the company's solid development. GameStop has been ordered to pay Boston Consulting Group for consulting services rendered over the previous 2.5 years.

In response to the case, GameStop stated that they did not think it was in the "stockholders' best interests to pay the tens of millions of dollars demanded by BCG, especially considering their seemingly minimal impact on the company's bottom line."

"Despite strong revenue growth at the end of 2021, which reached $6bn, a 20% increase over 2020, the company's losses are still growing. At the end of 2021, the net loss was $381m, already 77% more than in 2020. Bottom line – despite the positive news, lawsuits and losses make investing in GME stock extremely risky," Karkalev deduced.

GameStop stock forecast: Wall Street ratings

As of August 31, both analysts surveyed gave the stock a "sell" recommendation, according to data provided by MarketBeat.

The typical price target for GameStop shares was $22 per share, which represents a possible loss of 25%. Analysts' estimates ranged from $7.50 to $36.50.

According to Wedbush Securities, the most recent earnings report was "underwhelmed" because of an unexpected turn to negative profitability and a lack of information about how the company intends to cut losses without diminishing its crucial cash balance.

Wedbush continued, "Without advice or clarity, it is difficult to ascertain whether any one of these three things will occur," alluding to the company's plans to either boost sales and gross margins or cut operational expenses.

Wedbush analysts recently reduced their price estimate for GME shares from $30 per share to $7.50 per share, which is less than their previous 12-month projection for GameStop's share price.

Is GameStop a Good Buy?

GameStop (GME) may or may not be a good asset depending on your trading goals. It's crucial to conduct independent research. Your risk tolerance, market knowledge, portfolio diversification, and comfort level with financial loss influence your decision to trade. Never trade with money you can't afford to lose.

Will GameStop Stock move Upward or Downward?

Nobody is aware. As of August 31, the two outside forecasting firms previously mentioned indicated a gloomy short-term outlook for GME stock. The two firms concur that the stock has a favorable view over the long run. However, analysts highlighted several significant risk factors before deciding whether to purchase or sell the company.

Should I invest in GameStop Stock?

Your risk tolerance, portfolio size and goals, and stock market experience should all be considered when deciding whether to buy GameStop stock. You should conduct your research to see whether the store is appropriate for you before making a decision.

It's essential to keep in mind that past results do not guarantee future success. Likewise, never trade or invest money you cannot afford to lose.

For more stock analysis: https://www.stockbossup.com/main/myProfile

Introduction

An American company GameStop Corp. (NYSE: GME), is involved in the business of consumer electronics, video games, and gaming merchandise retailers. The headquarters is in Grapevine, Texas, and among the video game retailer, this is the largest worldwide. As per the data available on January 29, 2022, under the GameStop, EB Game Australia, ThinkGeek, EB Games, Zing Pop Culture, and Micromania-Zing brands, the company operates 4,573 stores which consist of 3,018 in the USA, 907 all across Europe, 417 in Australia, and 231 in Canada. The company's current name was suggested in 1999; however, it was founded in 1984 by Babbage.

During the mid to late 2010s, the company's performance moves down as a paradigm shift in the video game industry. Video game sales switched to online shopping, but GameStop could not succeed in making an investment in smartphone retail. Due to a short squeeze that members of the online forum r/wallstreetbets engineered in 2021, the company's stock price soared.

Due to its stock price volatility and the GameStop short squeeze, the firm attracted much media attention in January and February 2021. On the Fortune 500, the company is now rated 521. GameStop owns and runs the video game magazine Game Informer in addition to its retail outlets.

Also read about AMC stock.

GME stock analysis: Technical views and value drivers

Though it has recently had some ups and downs, GME's performance has remained unfavorable this August 31. The company's valuation has suffered from worries about its ability to survive in the challenging macroeconomic environment of today. The price of GME stock has dropped 22% since the beginning of 2022, which is a significant reduction compared to the S&P 500 Index US500's loss of 16% during the same period but less than the steep 24% collapse of the tech-heavy Nasdaq 100 Index US100. Since its volatile peak in 2021, none of the transient increases in the value of the GME shares have resulted in a higher high. The stock's ongoing technical decline may support a bearish short-term GME stock prognosis.

The Relative Strength Index (RSI), which was getting close to oversold levels at 32.51 as of August, was another indication of a pessimistic outlook. The Moving Average Convergence Divergence (MACD) was declining fast and had reached the negative zone while the gap between the indicator and the signal line was growing.

GameStop fundamental analysis

GameStop released its financial data for the first quarter of the fiscal year 2022 on June 1. Revenues came at $1.38 billion, exceeding market projections of $1.32 billion and rising significantly from the $1.27 billion reported in Q1 2021. However, the corporation also declared a net loss of $157.9 million, which was much worse than the $66 million net loss year over year.

GameStop reported that increasing customer demand and the potential for supply chain interruptions caused its Q1 inventory to grow to $917.6 million from $570.9 million a year earlier.

For the first time since Q3 2020, sales of software and collectibles accounted for more than 50% of overall quarterly revenue. Could the increase in revenue result in a favorable stock outlook for GME? Take into account the most recent analyst stock estimates for GameStop.

GME stock forecast: Sentiments of Analyst

The GameStop (GME) stock outlook was discussed by Capital.com analyst Mikhail Karkhalev, who said: "The main reason for GameStop stock soaring was the purchase of additional shares by GameStop's chair for around $10m. The sharp rise in GME's share price was picked up by retail traders, which helped the company avoid bankruptcy and now create new products, mainly in the crypto market, in the direction of NFT."

Karkhalev said a $30 million lawsuit from Boston Consulting Group would overshadow the company's solid development. GameStop has been ordered to pay Boston Consulting Group for consulting services rendered over the previous 2.5 years.

In response to the case, GameStop stated that they did not think it was in the "stockholders' best interests to pay the tens of millions of dollars demanded by BCG, especially considering their seemingly minimal impact on the company's bottom line."

"Despite strong revenue growth at the end of 2021, which reached $6bn, a 20% increase over 2020, the company's losses are still growing. At the end of 2021, the net loss was $381m, already 77% more than in 2020. Bottom line – despite the positive news, lawsuits and losses make investing in GME stock extremely risky," Karkalev deduced.

GameStop stock forecast: Wall Street ratings

As of August 31, both analysts surveyed gave the stock a "sell" recommendation, according to data provided by MarketBeat. The typical price target for GameStop shares was $22 per share, which represents a possible loss of 25%. Analysts' estimates ranged from $7.50 to $36.50.

According to Wedbush Securities, the most recent earnings report was "underwhelmed" because of an unexpected turn to negative profitability and a lack of information about how the company intends to cut losses without diminishing its crucial cash balance. Wedbush continued, "Without advice or clarity, it is difficult to ascertain whether any one of these three things will occur," alluding to the company's plans to either boost sales and gross margins or cut operational expenses.

Wedbush analysts recently reduced their price estimate for GME shares from $30 per share to $7.50 per share, which is less than their previous 12-month projection for GameStop's share price.

Is GameStop a Good Buy?

GameStop (GME) may or may not be a good asset depending on your trading goals. It's crucial to conduct independent research. Your risk tolerance, market knowledge, portfolio diversification, and comfort level with financial loss influence your decision to trade. Never trade with money you can't afford to lose.

Will GameStop Stock move Upward or Downward?

Nobody is aware. As of August 31, the two outside forecasting firms previously mentioned indicated a gloomy short-term outlook for GME stock. The two firms concur that the stock has a favorable view over the long run. However, analysts highlighted several significant risk factors before deciding whether to purchase or sell the company.

Should I invest in GameStop Stock?

Your risk tolerance, portfolio size and goals, and stock market experience should all be considered when deciding whether to buy GameStop stock. You should conduct your research to see whether the store is appropriate for you before making a decision. It's essential to keep in mind that past results do not guarantee future success. Likewise, never trade or invest money you cannot afford to lose.

For more stock analysis: https://www.stockbossup.com/main/myProfile