Sound investments

don't happen alone

Find your crew, build teams, compete in VS MODE, and identify investment trends in our evergrowing investment ecosystem. You aren't on an island anymore, and our community is here to help you make informed decisions in a complex world.

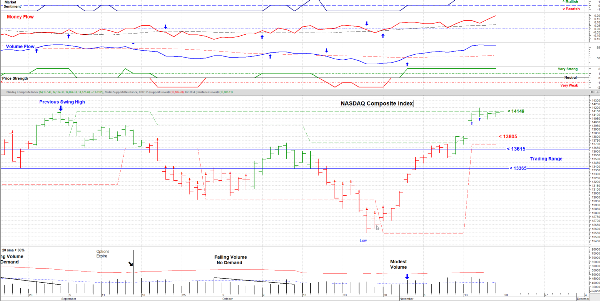

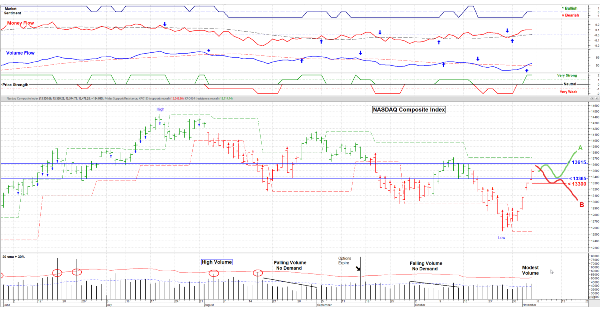

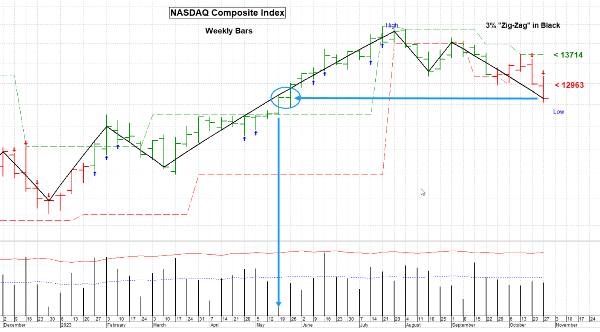

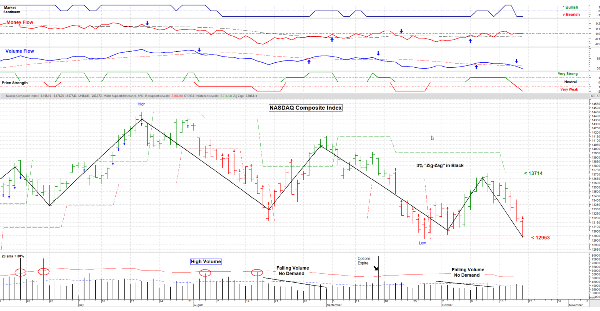

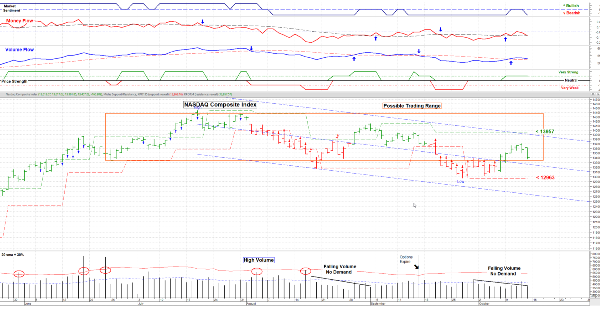

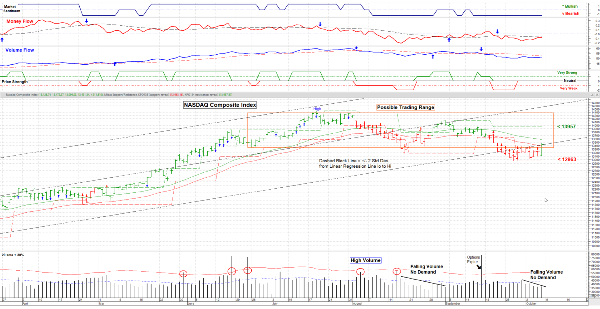

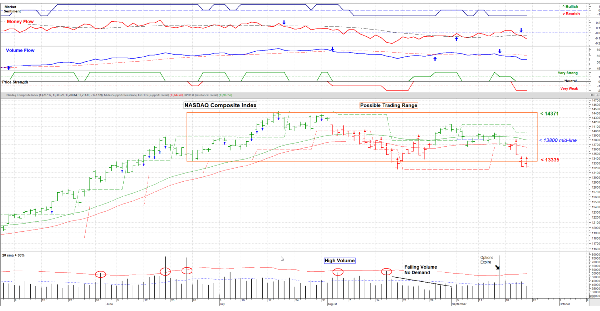

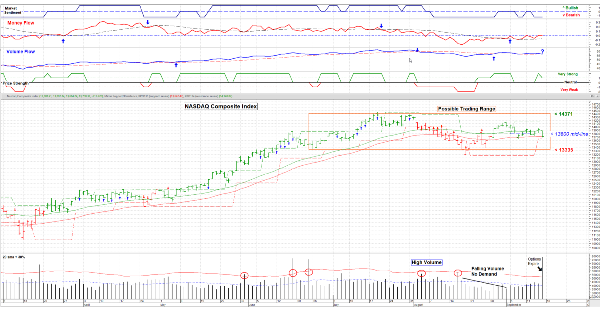

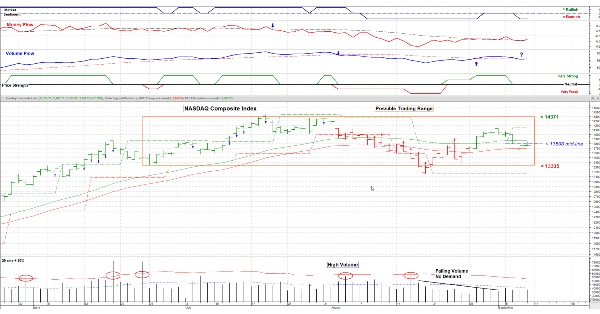

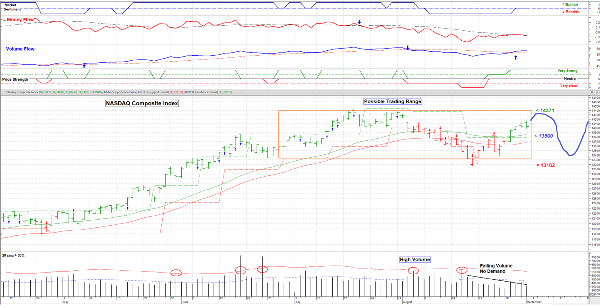

December 1, 2023 – The market has done pretty well lately. I’m expecting a pause or a minor pullback, then a resume upward. I see buying returning to Small and Mid-Cap stocks which is bullish for the market overall.

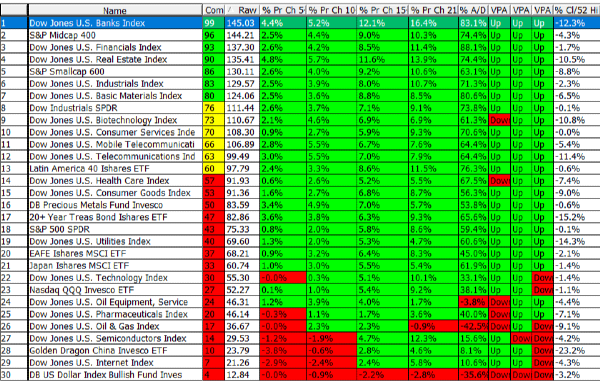

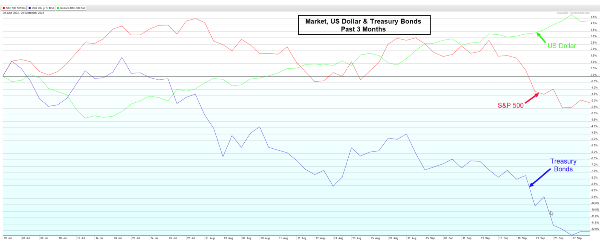

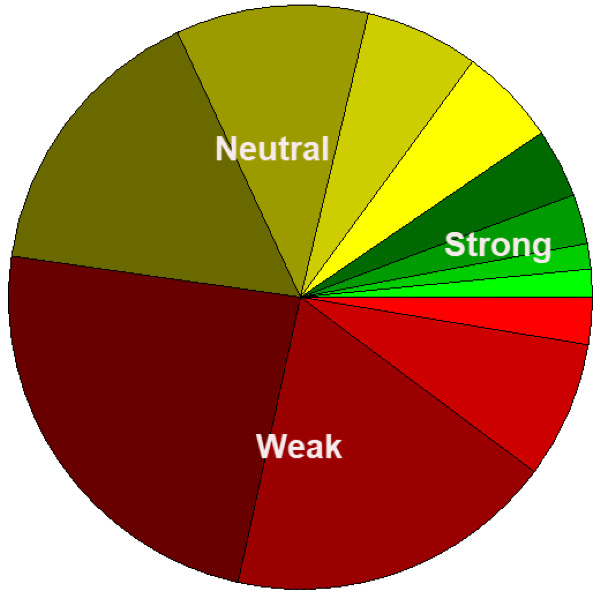

What’s driving this is very positive economic news and indications that interest rates will not go higher, at least not much in worse case terms. Then anticipation of rates falling in the first half of 2024; after all, it’s a Presidential Election year. The Short-Term Sector Strength table is shown –

I have been “scaling into” this market and will continue to do so. The global issues don’t seem to matter right now and investors don’t want to miss the boat. The “Santa Clause Rally” looks like a real thing this year. Take Care and have a wonderful Holiday Season ! …………. Tom …………...