Key Takeaways

- AGCO Group is a great company, but a bad investment in 2024

- The stock’s intrinsic value clearly shows the cyclicality of the farming industry, independent of AGCO’s own analysis. Agco’s analysis also takes into account the farming industry cyclicality.

- The stock is a neutral rating.

What is the intrinsic value of AGCO?

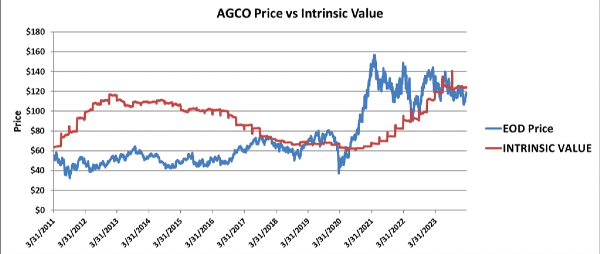

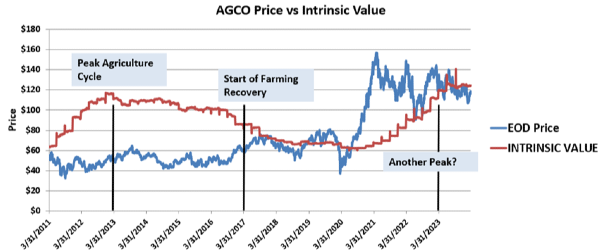

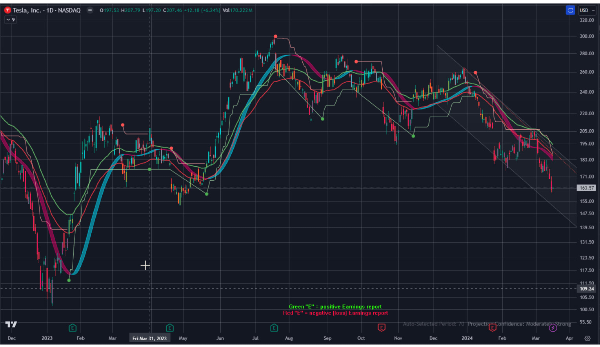

The numbers just don’t lie. Usually, I would say the intrinsic value of AGCO is a concrete number (it would be $123 in this case). But when you plot out the intrinsic value of Agco group, you notice something strange. You notice that the intrinsic value of the stock is cyclical?

This raised my suspicion. Why is AGCO’s intrinsic value cyclical? The answer comes straight from Agco’s recent annual report.

Our success depends in large part on the strength of the agricultural equipment industry. Historically, demand for agricultural equipment has been cyclical and generally reflected the economic health of the agricultural industry, which is impacted by a variety of economic and other factors such as commodity prices, farm income and government support.

The report further states that the farming cycle peaked in 2013, started falling, and then didn’t start recovering until 2017. This aligns very well with Agco’s intrinsic value cycles.

And now, Agco’s intrinsic value may be predicting another peak in the agriculture business cycle. If that is the case, then Agco’s price may stagnate for the remainder of the decade, regardless of how well managed the company is. This is because Agco Group is the Largest Pure-Play Farm Equipment manufacturer in the World (Agco 2023 annual report, page 2).

Is AGCO undervalued?

Agco group is currently trading right at the company’s intrinsic value. Unfortunately, our intrinsic value calculation does not account for the cyclical nature of the farming industry. When looking at the intrinsic value right now, it may have realistically peaked. This means that earnings may begin to fall as demand softens for agricultural equipment. This isn’t our theory, but again a forecast given by Agco’s management:

In 2023, industry conditions remained above mid-cycle levels, and even above the last peak, driven largely by increases in commodity prices and healthy farm income.

Agco Group may be hitting the peak of the farming cycle. Historical stock prices show that once a downturn occurs, price stagnation can occur for years. So even though Agco is near its intrinsic value, it currently is not undervalued and potentially overvalued.

The Farming Business Cycle

The farming business cycle that is influencing Agco’s stock occurs due to a variety of cycles that occur in the farming cycle.

The first influence is how farmers earn cash. Farmers must invest in their farms up front. They buy equipment from Agco Group to plant and harvest their crops. This cash flows out months before cash flows back to the farm. This time step between costs and revenue likely make farmers buy equipment with loans, creating a multiyear time period between equipment purchases.

Crop rotation can also have a cyclical effect on the farming business. To maintain soil health, farmers must rotate crops to rejuvenate the soil. These rotations occur over years.

Finally, the commodity and futures markets also play a role in the cyclicality of the farming industry. Commodity prices move cyclically, and in response, farmers may use futures to hedge against fluctuations in commodity prices. Since farmers won’t know the price of their commodity until they bring their product to market months after seeds are planted, farmers can use futures to lock in a price now that will ensure profitability in future, sacrificing any potential upswing in commodity prices.

Agco Group is well aware of the multiple cycles in farming, and have acquired companies like FarmFacts to help make the full crop cycle autonomous by using

Why Buy AGCO?

Agco group is a great buy if you want exposure to heavy equipment and agriculture. They provide a variety in equipment including tractors, engines, and even grain storage.

Well known brands like Agco Group’s Massey Ferguson provides seeding and tillage equipment, balers, and combine harvestors. The company is like an actively managed ETF in pure-play farming equipment, except that the subsidiaries are fully controlled companies instead of partial ownerships of a basket of companies. This gives the investor an opportunity to profit from an experienced executive leadership that is focused on the farming equipment market.

The team’s leadership is showing results. Overall sales in all regions across the world are increasing, and AGCO group is taking more market share over time.

Final Thoughts

If you want a consistent company that knows its lane and really want investment exposure to farming, Agco Group is a great choice. Agco group is diversified across different regions all over the world and have significant market share in large scale farming. Agco is a great company - just one that may be at its peak!

Key Takeaways

What is the intrinsic value of AGCO?

The numbers just don’t lie. Usually, I would say the intrinsic value of AGCO is a concrete number (it would be $123 in this case). But when you plot out the intrinsic value of Agco group, you notice something strange. You notice that the intrinsic value of the stock is cyclical?

This raised my suspicion. Why is AGCO’s intrinsic value cyclical? The answer comes straight from Agco’s recent annual report.

- AGCO 2023 Annual Report

The report further states that the farming cycle peaked in 2013, started falling, and then didn’t start recovering until 2017. This aligns very well with Agco’s intrinsic value cycles.

And now, Agco’s intrinsic value may be predicting another peak in the agriculture business cycle. If that is the case, then Agco’s price may stagnate for the remainder of the decade, regardless of how well managed the company is. This is because Agco Group is the Largest Pure-Play Farm Equipment manufacturer in the World (Agco 2023 annual report, page 2).

Is AGCO undervalued?

Agco group is currently trading right at the company’s intrinsic value. Unfortunately, our intrinsic value calculation does not account for the cyclical nature of the farming industry. When looking at the intrinsic value right now, it may have realistically peaked. This means that earnings may begin to fall as demand softens for agricultural equipment. This isn’t our theory, but again a forecast given by Agco’s management:

Agco 2023 annual report, page 37

Agco Group may be hitting the peak of the farming cycle. Historical stock prices show that once a downturn occurs, price stagnation can occur for years. So even though Agco is near its intrinsic value, it currently is not undervalued and potentially overvalued.

The Farming Business Cycle

The farming business cycle that is influencing Agco’s stock occurs due to a variety of cycles that occur in the farming cycle.

The first influence is how farmers earn cash. Farmers must invest in their farms up front. They buy equipment from Agco Group to plant and harvest their crops. This cash flows out months before cash flows back to the farm. This time step between costs and revenue likely make farmers buy equipment with loans, creating a multiyear time period between equipment purchases.

Crop rotation can also have a cyclical effect on the farming business. To maintain soil health, farmers must rotate crops to rejuvenate the soil. These rotations occur over years.

Finally, the commodity and futures markets also play a role in the cyclicality of the farming industry. Commodity prices move cyclically, and in response, farmers may use futures to hedge against fluctuations in commodity prices. Since farmers won’t know the price of their commodity until they bring their product to market months after seeds are planted, farmers can use futures to lock in a price now that will ensure profitability in future, sacrificing any potential upswing in commodity prices.

Agco Group is well aware of the multiple cycles in farming, and have acquired companies like FarmFacts to help make the full crop cycle autonomous by using

Why Buy AGCO?

Agco group is a great buy if you want exposure to heavy equipment and agriculture. They provide a variety in equipment including tractors, engines, and even grain storage.

Well known brands like Agco Group’s Massey Ferguson provides seeding and tillage equipment, balers, and combine harvestors. The company is like an actively managed ETF in pure-play farming equipment, except that the subsidiaries are fully controlled companies instead of partial ownerships of a basket of companies. This gives the investor an opportunity to profit from an experienced executive leadership that is focused on the farming equipment market.

The team’s leadership is showing results. Overall sales in all regions across the world are increasing, and AGCO group is taking more market share over time.

Final Thoughts

If you want a consistent company that knows its lane and really want investment exposure to farming, Agco Group is a great choice. Agco group is diversified across different regions all over the world and have significant market share in large scale farming. Agco is a great company - just one that may be at its peak!