Expertise provided by Kevin Matthews from buildingbread.com

The financial industry stands out as a sector, within the economy. Banks support activities by providing loans. They lend to both businesses and individuals. Insurance companies offer security against risks. Asset management firms aid in investing money for people and organizations. The well-being of the sector has an impact on the overall economy.

Like any stock, stocks related to finance are subject to the principles of supply and demand. When demand surpasses supply for a stock its price rises. Conversely, if there is a supply of stock compared to demand its price drops.

Financial stocks are greatly influenced by expectations. They are, like other stocks, not by blind optimism. It's about seeing improvements and growth. It's not about wishful thinking. Picture a scenario with low-interest rates and lots of cash for consumers. This fuel hopes of a thriving housing market. It could help companies linked to the sector, such as mortgage lenders. It could help card processors. They, for example, Mastercard and Visa. So, finding these outlooks in the realm is key. More spending might lead to more credit card use. This would benefit credit card companies.

You can connect these predictions to businesses. You can then validate them with research. This will help you assess which financial stocks could go up.

Several factors can affect the demand for financial stocks, including:

The overall health of the economy: In good economies, businesses and consumers are more likely to take out loans. This earns money for banks. As a result, investors may become more hopeful. This will lead to more demand and higher prices for stocks.

Interest rates: Interest rates refer to the charges imposed by banks on borrowers and the returns they offer to depositors. Higher interest rates let banks earn money from their loans. This can boost their profits. This may make financial stocks more appealing to investors. It will cause higher demand and prices.

Inflation: The rise, in prices of goods and services known as inflation can affect bank deposits by reducing their value over time. This may result in decreased profits for banks. Also, inflation could raise interest rates. This might help banks. The influence of inflation, on stocks is intricate and influenced by factors.

Government regulation: The government oversees the industry to safeguard consumers and uphold stability. Changes in rules can greatly affect share value. For example, if regulations on banks become less strict, banks might do ventures. These ventures could boost their earnings. This could make individuals like stocks more. But, if bank regulations become stricter, it could hinder their profit. Consequently, investors may opt to sell off their shares causing prices to decline.

The performance of individual companies: The financial performance of each company plays a role, in influencing the value of its stock. Investors evaluate a company's records. They look at earnings reports to see its profit and potential to grow. When a company performs well, investors become interested in its stock. This interest leads to a price increase.

What Causes Bank Stocks to Go Up?

Banks are places that take in money from clients. They lend out this money to borrowers. They earn money from the difference in interest rates. The variance, between what they charge for loans and what they offer for deposits.

Several factors can cause bank stocks to go up, including:

A strong economy: When the economy is thriving companies and individuals tend to take out loans resulting in higher earnings, for financial institutions.

Rising interest rates: When interest rates go up banks have the potential to make profits from their loans. As a result, this could increase the appeal of bank stocks, for investors.

A steep yield curve: The yield curve is, like a map that displays the interest rates offered on bonds with varying time frames. When the yield curve is steep it indicates that long-term bond rates exceed short-term bond rates. This situation can help banks. They can borrow money at short-term rates and lend it at long-term rates. This expands their profit margins.

An increase in loan demand: When there is a rise, in the need for loans banks have the opportunity to approve loan applications leading to an increase in their earnings. This upsurge can be attributed to factors. These include a growing economy and population. Also, increased business investments.

Cost-cutting measures: To enhance their profits banks can boost their performance through cost reduction. This may involve cutting employee wages and ad expenses. Or, it may involve improving efficiency.

Are small banks more attractive than large banks right now?

Choosing the bank for you is all, about what matters to you. Smaller banks provide a personal touch. They offer custom services. However, they may have fewer choices and less FDIC coverage. They tend to focus more on efficiency. They might have higher fees. You must pick the bank that fits your preferences. These are for service, security, and offerings.

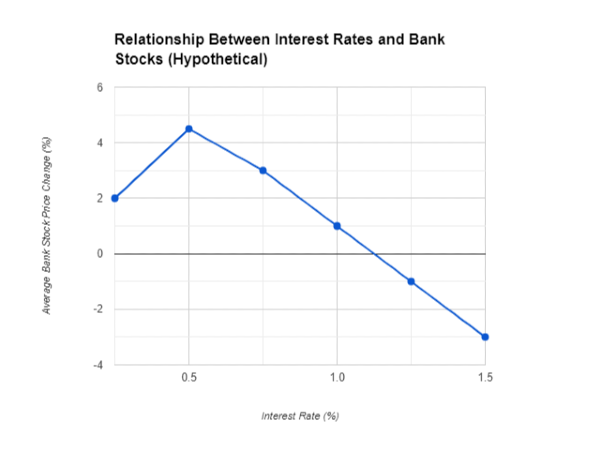

Relationship between interest rates and bank stocks

The chart shows how interest rates and bank stock prices may be related. On the axis, we have interest rates while bank stock prices are shown on the axis. Typically, there is a connection, between the two. As interest rates go up (move to the right). Bank stock prices usually rise too. This is because higher interest rates let banks earn more from loans. This boosts their profit potential. Nonetheless, this link isn't always flawless. Many factors can impact stock prices. Sudden interest rate spikes could cut loan demand.

What Drives Bank Stock Prices?

The value of a bank stock is influenced by factors, such, as;

The overall health of the economy: The state of the economy plays a role, in influencing the demand, for bank stocks. In times of prosperity, it is more probable for bank stocks to increase in value.

Interest rates: Changes, in interest rates, significantly impact the movement of bank stock prices. An increase in interest rates often results in a rise, in bank stocks well.

The bank's profitability: Investors often take into account a bank's profitability, as a factor when making decisions, about investing in its stock.

What causes bank stocks to go down?

A robust economy and increasing interest rates can boost the performance of bank stocks. Some factors could lead to a decline. Let us delve into the reasons, behind this trend;

Economic Downturn: When the economy is, in trouble it negatively impacts banks. As businesses and individuals cut back on spending the need for loans decreases. This results in a drop in the number of loans issued by banks, which is a source of their revenue. Moreover, during downturns, unemployment rates go up. This causes defaults on loans that are already in place. This poses a challenge, for banks. They face more loan defaults. This cuts their profits. It also dampens investor confidence.

Falling Interest Rates: When interest rates go up banks make money because the difference, between the rates widens. On the side when interest rates drop banks earn less from loans, which can squeeze their profits. This becomes an issue for banks with a lot of loans, at fixed rates since they can't change their rates to match the market rates.

Inverted Yield Curve: The yield curve shows how interest rates relate to bond maturities. In one case, the yield curve slopes upwards. This shows that long-term bonds offer higher interest rates than short-term ones. However, when the yield curve inverts it means that short-term rates are higher than long-term rates. This situation is often viewed as a sign of a recession because it deters banks from lending (why would they lend at rates for a longer period when they can earn more in the short term?). This reluctance to lend results in reduced profits for banks, which can have an impact, on stock prices.

Increased Loan Delinquencies and Defaults: As mentioned earlier, during economic downturns, more people tend to lose their jobs. This can cause borrowers to be unable to pay back their loans. When borrowers default on loans banks face losses in the amount lent. Also, have to spend money on trying to collect the debt. This increase, in missed payments and loan defaults impacts the profits of banks. It makes investors less interested. This causes stock prices to decrease.

Regulatory Changes: The financial industry is subject, to regulations to maintain stability. Nevertheless, the introduction of rules can lead to outcomes. For example, stricter capital requirements could force banks to keep more cash. This would limit their ability to lend and might block expansion. Also, regulations focus on protecting consumers. They might create obstacles for banks in granting loans. This would hurt their ability to make money.

Bank-Specific Issues: The performance of each bank is important too. Issues such as management choices, financial scandals, and losses can reduce investor trust in a bank. This causes it to sell its stock and results in a drop in its value.

Overall Market Sentiment: Market conditions can also impact the performance of bank shares. Caution in the market comes from events or political instability. Investors then avoid volatile investments, such as bank stocks. This causes their prices to drop.

Investing During Inflation

The connection, between bank shares and inflation is not just a straightforward yes or no situation. Let us delve into the effects;

Potential Benefits of Inflation for Bank Stocks:

Wider Interest Rate Spread: Inflation frequently leads banks to increase interest rates to control inflation. As interest rates go up, banks can raise loan rates. They can also offer better deposit rates. This makes the interest rate difference larger. The difference is crucial for banks. It reflects the gap between their earnings from loans and payouts for deposits. It is a source of profit for them.

Increased Loan Demand: In times of inflation companies might have to seek funds to sustain their operations because of the escalating expenses related to materials and workforce. As a result, there could be a surge, in the demand for loans, from banks ultimately enhancing their revenue streams.

Potential Drawbacks of Inflation for Bank Stocks:

Erosion of Deposit Value: When prices go up the value of money, in bank accounts decreases. If inflation increases more, the interest on deposits may not keep up. People may not want to keep their money in banks. This could reduce deposits. As a consequence, banks may have money to lend out making it harder for them to make profits.

Risk of Higher Loan Defaults: Excessive inflation may cause unpredictability affecting the capacity of businesses and individuals to repay debts. This could increase loan defaults. It is a threat to bank earnings.

Overall Impact:

The effect of inflation, on bank shares primarily hinges on how inflation rises compared to interest rate increases. When interest rates climb faster than inflation banks may see an impact due to an interest rate margin. If inflation surges before rates rise, it could devalue deposits. It would also raise default risks. This could overshadow any advantages for banks.

Additional Considerations:

Anticipated vs. Unexpected Inflation: The market typically responds positively to expected inflation taking into account interest rate increases. Still, sudden surges in inflation could disrupt the market. Resulting in fluctuations, in bank shares.

The Level of Inflation: Banks can handle inflation. High inflation greatly lowers deposit worth. It causes instability. This could harm bank stocks.

For more information watch this video.

https://youtu.be/FDuezr9tIEM

Expertise provided by Kevin Matthews from buildingbread.com

The financial industry stands out as a sector, within the economy. Banks support activities by providing loans. They lend to both businesses and individuals. Insurance companies offer security against risks. Asset management firms aid in investing money for people and organizations. The well-being of the sector has an impact on the overall economy.

Like any stock, stocks related to finance are subject to the principles of supply and demand. When demand surpasses supply for a stock its price rises. Conversely, if there is a supply of stock compared to demand its price drops.

Financial stocks are greatly influenced by expectations. They are, like other stocks, not by blind optimism. It's about seeing improvements and growth. It's not about wishful thinking. Picture a scenario with low-interest rates and lots of cash for consumers. This fuel hopes of a thriving housing market. It could help companies linked to the sector, such as mortgage lenders. It could help card processors. They, for example, Mastercard and Visa. So, finding these outlooks in the realm is key. More spending might lead to more credit card use. This would benefit credit card companies.

You can connect these predictions to businesses. You can then validate them with research. This will help you assess which financial stocks could go up. Several factors can affect the demand for financial stocks, including: The overall health of the economy: In good economies, businesses and consumers are more likely to take out loans. This earns money for banks. As a result, investors may become more hopeful. This will lead to more demand and higher prices for stocks.

Interest rates: Interest rates refer to the charges imposed by banks on borrowers and the returns they offer to depositors. Higher interest rates let banks earn money from their loans. This can boost their profits. This may make financial stocks more appealing to investors. It will cause higher demand and prices.

Inflation: The rise, in prices of goods and services known as inflation can affect bank deposits by reducing their value over time. This may result in decreased profits for banks. Also, inflation could raise interest rates. This might help banks. The influence of inflation, on stocks is intricate and influenced by factors.

Government regulation: The government oversees the industry to safeguard consumers and uphold stability. Changes in rules can greatly affect share value. For example, if regulations on banks become less strict, banks might do ventures. These ventures could boost their earnings. This could make individuals like stocks more. But, if bank regulations become stricter, it could hinder their profit. Consequently, investors may opt to sell off their shares causing prices to decline.

The performance of individual companies: The financial performance of each company plays a role, in influencing the value of its stock. Investors evaluate a company's records. They look at earnings reports to see its profit and potential to grow. When a company performs well, investors become interested in its stock. This interest leads to a price increase.

What Causes Bank Stocks to Go Up?

Banks are places that take in money from clients. They lend out this money to borrowers. They earn money from the difference in interest rates. The variance, between what they charge for loans and what they offer for deposits.

Several factors can cause bank stocks to go up, including:

A strong economy: When the economy is thriving companies and individuals tend to take out loans resulting in higher earnings, for financial institutions.

Rising interest rates: When interest rates go up banks have the potential to make profits from their loans. As a result, this could increase the appeal of bank stocks, for investors.

A steep yield curve: The yield curve is, like a map that displays the interest rates offered on bonds with varying time frames. When the yield curve is steep it indicates that long-term bond rates exceed short-term bond rates. This situation can help banks. They can borrow money at short-term rates and lend it at long-term rates. This expands their profit margins.

An increase in loan demand: When there is a rise, in the need for loans banks have the opportunity to approve loan applications leading to an increase in their earnings. This upsurge can be attributed to factors. These include a growing economy and population. Also, increased business investments.

Cost-cutting measures: To enhance their profits banks can boost their performance through cost reduction. This may involve cutting employee wages and ad expenses. Or, it may involve improving efficiency.

Are small banks more attractive than large banks right now?

Choosing the bank for you is all, about what matters to you. Smaller banks provide a personal touch. They offer custom services. However, they may have fewer choices and less FDIC coverage. They tend to focus more on efficiency. They might have higher fees. You must pick the bank that fits your preferences. These are for service, security, and offerings.

Relationship between interest rates and bank stocks

The chart shows how interest rates and bank stock prices may be related. On the axis, we have interest rates while bank stock prices are shown on the axis. Typically, there is a connection, between the two. As interest rates go up (move to the right). Bank stock prices usually rise too. This is because higher interest rates let banks earn more from loans. This boosts their profit potential. Nonetheless, this link isn't always flawless. Many factors can impact stock prices. Sudden interest rate spikes could cut loan demand.

What Drives Bank Stock Prices?

The value of a bank stock is influenced by factors, such, as; The overall health of the economy: The state of the economy plays a role, in influencing the demand, for bank stocks. In times of prosperity, it is more probable for bank stocks to increase in value.

Interest rates: Changes, in interest rates, significantly impact the movement of bank stock prices. An increase in interest rates often results in a rise, in bank stocks well.

The bank's profitability: Investors often take into account a bank's profitability, as a factor when making decisions, about investing in its stock.

What causes bank stocks to go down?

A robust economy and increasing interest rates can boost the performance of bank stocks. Some factors could lead to a decline. Let us delve into the reasons, behind this trend;

Economic Downturn: When the economy is, in trouble it negatively impacts banks. As businesses and individuals cut back on spending the need for loans decreases. This results in a drop in the number of loans issued by banks, which is a source of their revenue. Moreover, during downturns, unemployment rates go up. This causes defaults on loans that are already in place. This poses a challenge, for banks. They face more loan defaults. This cuts their profits. It also dampens investor confidence.

Falling Interest Rates: When interest rates go up banks make money because the difference, between the rates widens. On the side when interest rates drop banks earn less from loans, which can squeeze their profits. This becomes an issue for banks with a lot of loans, at fixed rates since they can't change their rates to match the market rates.

Inverted Yield Curve: The yield curve shows how interest rates relate to bond maturities. In one case, the yield curve slopes upwards. This shows that long-term bonds offer higher interest rates than short-term ones. However, when the yield curve inverts it means that short-term rates are higher than long-term rates. This situation is often viewed as a sign of a recession because it deters banks from lending (why would they lend at rates for a longer period when they can earn more in the short term?). This reluctance to lend results in reduced profits for banks, which can have an impact, on stock prices.

Increased Loan Delinquencies and Defaults: As mentioned earlier, during economic downturns, more people tend to lose their jobs. This can cause borrowers to be unable to pay back their loans. When borrowers default on loans banks face losses in the amount lent. Also, have to spend money on trying to collect the debt. This increase, in missed payments and loan defaults impacts the profits of banks. It makes investors less interested. This causes stock prices to decrease.

Regulatory Changes: The financial industry is subject, to regulations to maintain stability. Nevertheless, the introduction of rules can lead to outcomes. For example, stricter capital requirements could force banks to keep more cash. This would limit their ability to lend and might block expansion. Also, regulations focus on protecting consumers. They might create obstacles for banks in granting loans. This would hurt their ability to make money.

Bank-Specific Issues: The performance of each bank is important too. Issues such as management choices, financial scandals, and losses can reduce investor trust in a bank. This causes it to sell its stock and results in a drop in its value.

Overall Market Sentiment: Market conditions can also impact the performance of bank shares. Caution in the market comes from events or political instability. Investors then avoid volatile investments, such as bank stocks. This causes their prices to drop.

Investing During Inflation

The connection, between bank shares and inflation is not just a straightforward yes or no situation. Let us delve into the effects;

Potential Benefits of Inflation for Bank Stocks:

Wider Interest Rate Spread: Inflation frequently leads banks to increase interest rates to control inflation. As interest rates go up, banks can raise loan rates. They can also offer better deposit rates. This makes the interest rate difference larger. The difference is crucial for banks. It reflects the gap between their earnings from loans and payouts for deposits. It is a source of profit for them.

Increased Loan Demand: In times of inflation companies might have to seek funds to sustain their operations because of the escalating expenses related to materials and workforce. As a result, there could be a surge, in the demand for loans, from banks ultimately enhancing their revenue streams.

Potential Drawbacks of Inflation for Bank Stocks:

Erosion of Deposit Value: When prices go up the value of money, in bank accounts decreases. If inflation increases more, the interest on deposits may not keep up. People may not want to keep their money in banks. This could reduce deposits. As a consequence, banks may have money to lend out making it harder for them to make profits.

Risk of Higher Loan Defaults: Excessive inflation may cause unpredictability affecting the capacity of businesses and individuals to repay debts. This could increase loan defaults. It is a threat to bank earnings.

Overall Impact:

The effect of inflation, on bank shares primarily hinges on how inflation rises compared to interest rate increases. When interest rates climb faster than inflation banks may see an impact due to an interest rate margin. If inflation surges before rates rise, it could devalue deposits. It would also raise default risks. This could overshadow any advantages for banks.

Additional Considerations:

Anticipated vs. Unexpected Inflation: The market typically responds positively to expected inflation taking into account interest rate increases. Still, sudden surges in inflation could disrupt the market. Resulting in fluctuations, in bank shares.

The Level of Inflation: Banks can handle inflation. High inflation greatly lowers deposit worth. It causes instability. This could harm bank stocks.

For more information watch this video.

https://youtu.be/FDuezr9tIEM