Microsoft and the Growth Explosion

Microsoft is an amazing stock for new investors to try. The company has evolved, acquired, and developed a multifaceted set of businesses that are fundamentally driving growth. But for new investors, the barrier to entry is mindset:

“Microsoft is too expensive!”

“Microsoft is overvalued!”

“Microsoft is overhyped. AI is a trend!”

For us millennials and boomers out there, Microsoft’s price explosion feels like a bubble, possibly a technology bubble. It feels like something we have gone through before. But this feeling is wrong because Microsoft is bringing the goods. It has the cashflow, growth and innovation plan that backs up its price tag.

And for those concerned about Microsoft being too risky, we’re going to prove it’s worth the current market price using value investing principles! Let’s deep dive into Microsoft’s intrinsic value and show why Microsoft is an amazing opportunity even after its amazing growth.

What is Microsoft’s intrinsic value

As of Q2 2024, MSFT has an intrinsic value of $360, just below it’s current price range around $420. At first, this may look like it proves Microsoft is overvalued, but what a new investor may not know is that, just like Microsoft’s actual price, Microsoft’s intrinsic value has been increasing rapidly for years now. Just like how Warren Buffett’s Berkshire Hathaway bought Apple, I believe the same fundamental value analysis can be used on Microsoft to calculate its intrinsic value.

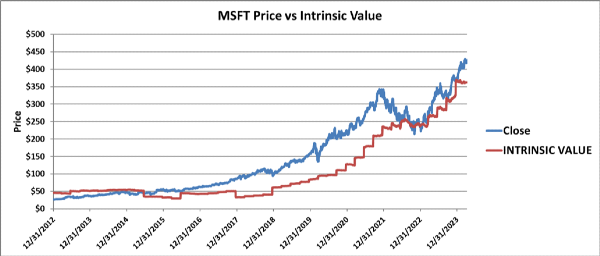

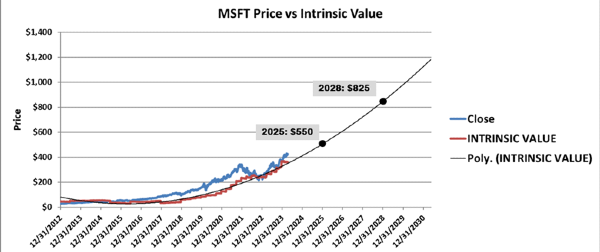

Below is a chart of Microsoft’s historical price for the last decade compared to its intrinsic value:

Here are some interesting takeaways looking at this chart:

Microsoft was punished for years by Wall Street. Wall Street would not pay a premium for Microsoft’s stock.

Microsoft has been consistent for two decades. They make smart technology acquisitions so that they can continue to grow their technology portfolio.

Over time, investors started to pay a premium for Microsoft. Covid-19 brought the market back to reality.

Covid-19 drove the stock price right back to the intrinsic value of the stock (this happened a lot during Covid-19. Stocks didn’t get undervalued, they returned to their intrinsic value).

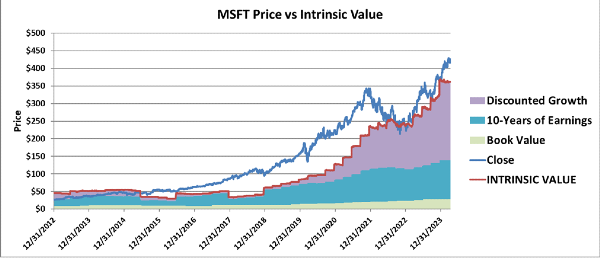

What’s interesting is what is driving the intrinsic value of Microsoft. The intrinsic value of Microsoft is being driven by the earnings growth expectations of Microsoft. The market is pricing in Microsoft’s earnings growth. You can see this when we break down intrinsic value by its different components:

Analyzing Microsoft’s Book Value

Unlike stock’s like JP Morgan or Markel Group whose book value makes a significant portion of the intrinsic value of their respective stocks, Microsoft’s intrinsic value, and ultimately its price, is driven by its earnings and earnings growth potential. But Microsoft’s book value continues to grow.

From their 2023 annual report, their book value of $32.06 per share amounts to $200 Billion. $100 Billion is in cash and cash equivalents, $100 Billion is property and equipment, $100 Billion is goodwill, intangibles, and other assets, with the last $100 Billion tied up in inventories and account receivables. When we subtract roughly $200 Billion in debt we get back to $200 Billion (yes investor equity roughly equals debt).

When you break it down, roughly $15 per share is made up of just the cash Microsoft has on hand. Again, just for the beginner to comprehend what you’re buying, the other $15 per share is made up of property and equipment.

Goodwill only makes up roughly $7 per share and is likely reasonably estimated per standard GAAP procedures. This goodwill isn’t as consequential for Microsoft as it is for a company like Dover Corporation’s goodwill. Dover Corporation’s goodwill is consequential because it makes up a larger portion of Dover’s assets. Hence, any goodwill surprises can significantly affect the stock price.

Microsoft’s Earnings, because it’s about Making Money

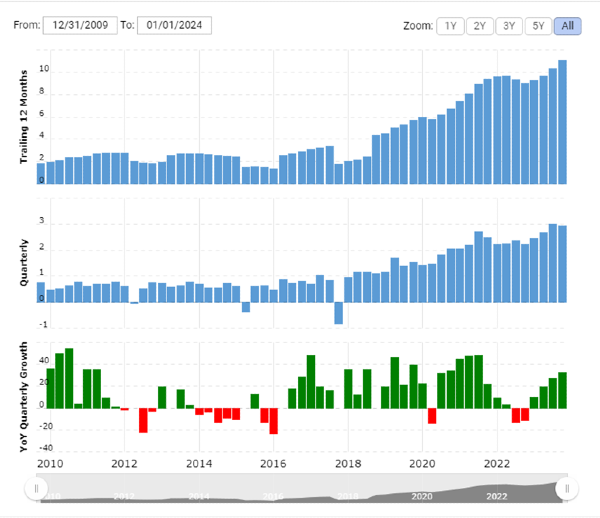

Microsoft’s diluted trailing twelve-month earnings per share (EPS) stands at $11.08 per share. Microsoft has proven that they rarely have earnings fall over time, so you can expect earnings to continue growing throughout the decade. That means, if Microsoft’s growth is flat, you’ll be earning $110 per share over the next decade.

But analysts agree that earnings will likely continue growing, with Nasdaq.com expecting MSFT earnings to nearly double by 2027!

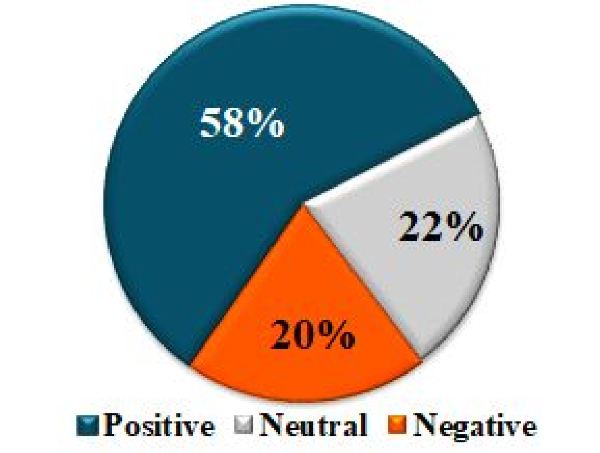

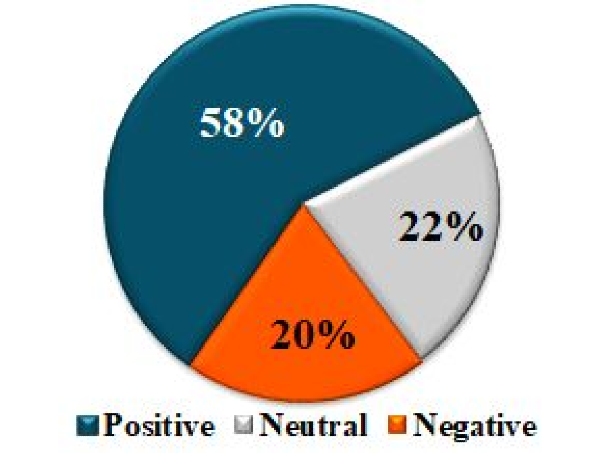

Analysts are very bullish on continued earnings growth.

So, book value per share and earnings are looking solid; however, they aren’t what make up the bulk of Microsoft’s intrinsic value. We now need to deep dive into the dangerous part of our analysis: earnings growth.

Microsoft’s Earnings Growth Potential

This big estimate that dominates our intrinsic value is the discounted growth potential. Let’s break down what this means, why it’s important, and why it dominates Microsoft’s intrinsic value. We’ll also touch on why the stock price follows this estimate so closely.

Look again at the analyst’s earnings predictions. They are going up. In fact, earnings have been going up for decades. Year after year, Microsoft continues to increase earnings.

Not to get into too much math, but Microsoft’s earnings increases are accelerating. This is the hallmark of a growth stock. Microsoft’s earnings don’t go up like a line.

Microsoft earnings grow 6% to 20% a year! That is incredible growth that is diversified across multiple businesses we will discuss next.

“Microsoft earnings aren’t just growing, their earnings growth is accelerating.”

Why is Microsoft’s Earnings Growing so Rapidly?

Microsoft has transformed from a software company to a multi-business technology conglomerate. Microsoft has significantly diversified away from operating systems and office suite software. They compete in multiple technology arenas.

Microsoft’s Heavy into Social Media?

Microsoft competes heavily in social media. But how? The answer is Linkedin, which the company acquired in 2016. Linkedin continues to dominate as the world’s largest professional network. But with Microsoft’s focus towards businesses and organizations, Linkedin has thrived under Microsoft and dominated this social media “niche” while other tech companies compete under consumer brands Facebook, Twitter, Snapchat, and Reddit. While these latter companies compete for consumer retention, Linkedin has expanded its suite of tools to focus on the business professional.

Microsoft is the Backbone of the Internet

If you’re not a software developer, you would be forgiven for never hearing of Github or Azure. But these two products from Microsoft dominate select portions of the software implementation lifecycle.

If you want to maintain a code base, the dominant solution is Github. Github allows you to collaborate with others on a coding project big or small. Back in the 2000’s, Github provided a niche as a collaborative open platform to work on code together. For those who do not code, think about writing a large novel with 30 writers. Github allows you to collaborate with those writers on one novel by resolving writing conflicts (like if both authors wanted to make changes to chapter 5) and has a standard review process to turn drafts into the final novel script.

As more developers wanted to collaborate on open source code, Github began to monopolize the code collaboration market.

In 2018, Github was acquired by Microsoft for $7.5 billion. It may have seemed like a strange acquisition, especially as Microsoft paid 30x annual revenue for the company, and it may have been even stranger for a company like Microsoft that for years fought to protect their software from being used by open source communities. But Microsoft realized that Github dominated a process flow that has become integral to software development.

And if you want consumers to use that code? You can host and manage your web or mobile app using Azure. The cloud computing market is dominated by AWS, Azure and Google, with each having the following market share value:

- Amazon Web Services: 32%

- Microsoft Azure: 23%

- Google Cloud: 10%

Microsoft is still in Gaming?

Microsoft had mixed success with the Xbox release in the early 2000’s, but since then they have continued to build a catalog of software games that have been synonymous with gaming culture. The acquisition of Minecraft in 2014 was a huge success that continues to print money for Microsoft. The recent acquisition of Activision-Blizzard for $68 Billion looks to be a very good investment that can integrate with their other businesses.

And there are more potential acquisitions out there. Could Nintendo be acquired? Possibly Roblox? The joint power of Roblox, Minecraft, and Activision-Blizzard would be a death nail for Facebook’s Metaverse vision, as these three company’s control a staggeringly high portion of “metaverse” content.

Microsoft’s Price Forecast

Could Microsoft double in 5 years?

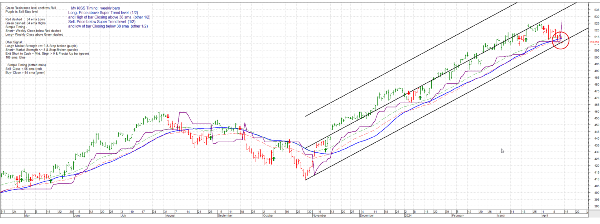

Microsoft is tracking to double by 2028. When we extrapolate our intrinsic value calculations, we find that Microsoft is heading towards $550 by 2025, and $825 by 2028. This is backed up by NASDAQ’s earnings estimates with earnings estimated to also double by 2028.

But does this feel right? Will Microsoft (MSFT) really double from a $3 Trillion company to a $6 Trillion company in 5 years?

Yes, it can double in the next five years just like it did in the previous five years. Microsoft has a proven investment strategy. There top investment strategy, make smart technology acquisitions to compliment one the their three operating segments: business processes, intelligent cloud, and personal computing. Their next strategy, stock buy backs and dividends. They have finetuned their strategy to maximize investor returns.

Is Artificial Intelligence Overvaluing Microsoft in 2024?

Wall Street is not overvaluing Microsoft at all. In fact, Wall Street is valuing Microsoft more as a value stock than as a speculative technology stock. The stock price of Microsoft is almost perfectly following the intrinsic value of the company. And this intrinsic value isn’t based on the hopes of A.I. Microsoft’s intrinsic value is based on its impressive earnings and earnings growth.

In fact, it looks like Wall Street hasn’t even priced in A.I.’s potential. As ChatGPT is integrated further into Bing, Bing may take up more market share of search over Google’s search engine. Just small chunks taken from Google’s market share could have significant ramifications for Microsoft’s earnings.

And this is just one aspect of A.I. that could help Microsoft. Already, A.I. is being incorporated into each of Microsoft’s divisions. Need design help on your PowerPoint slides? Yeah, those suggestions are A.I. generated.

Final Thoughts on Investing in Microsoft

For new investors, don’t let the price of $400 per share scare you away. Use the intrinsic value calculations we showcased to help you measure the stock’s value. And with fractional shares you can buy Microsoft stock for just $1.

Unless you’ve never seen a computer, you’ve used Microsoft’s products. These products are ubiquitous in our digital world. If you’re a new investor, do your own research and look into Microsoft.

I/we have a position in an asset mentioned

Microsoft and the Growth Explosion

Microsoft is an amazing stock for new investors to try. The company has evolved, acquired, and developed a multifaceted set of businesses that are fundamentally driving growth. But for new investors, the barrier to entry is mindset:

For us millennials and boomers out there, Microsoft’s price explosion feels like a bubble, possibly a technology bubble. It feels like something we have gone through before. But this feeling is wrong because Microsoft is bringing the goods. It has the cashflow, growth and innovation plan that backs up its price tag.

And for those concerned about Microsoft being too risky, we’re going to prove it’s worth the current market price using value investing principles! Let’s deep dive into Microsoft’s intrinsic value and show why Microsoft is an amazing opportunity even after its amazing growth.

What is Microsoft’s intrinsic value

As of Q2 2024, MSFT has an intrinsic value of $360, just below it’s current price range around $420. At first, this may look like it proves Microsoft is overvalued, but what a new investor may not know is that, just like Microsoft’s actual price, Microsoft’s intrinsic value has been increasing rapidly for years now. Just like how Warren Buffett’s Berkshire Hathaway bought Apple, I believe the same fundamental value analysis can be used on Microsoft to calculate its intrinsic value.

Below is a chart of Microsoft’s historical price for the last decade compared to its intrinsic value:

Here are some interesting takeaways looking at this chart:

Microsoft was punished for years by Wall Street. Wall Street would not pay a premium for Microsoft’s stock.

Microsoft has been consistent for two decades. They make smart technology acquisitions so that they can continue to grow their technology portfolio.

Over time, investors started to pay a premium for Microsoft. Covid-19 brought the market back to reality.

Covid-19 drove the stock price right back to the intrinsic value of the stock (this happened a lot during Covid-19. Stocks didn’t get undervalued, they returned to their intrinsic value).

What’s interesting is what is driving the intrinsic value of Microsoft. The intrinsic value of Microsoft is being driven by the earnings growth expectations of Microsoft. The market is pricing in Microsoft’s earnings growth. You can see this when we break down intrinsic value by its different components:

Analyzing Microsoft’s Book Value

Unlike stock’s like JP Morgan or Markel Group whose book value makes a significant portion of the intrinsic value of their respective stocks, Microsoft’s intrinsic value, and ultimately its price, is driven by its earnings and earnings growth potential. But Microsoft’s book value continues to grow.

From their 2023 annual report, their book value of $32.06 per share amounts to $200 Billion. $100 Billion is in cash and cash equivalents, $100 Billion is property and equipment, $100 Billion is goodwill, intangibles, and other assets, with the last $100 Billion tied up in inventories and account receivables. When we subtract roughly $200 Billion in debt we get back to $200 Billion (yes investor equity roughly equals debt).

When you break it down, roughly $15 per share is made up of just the cash Microsoft has on hand. Again, just for the beginner to comprehend what you’re buying, the other $15 per share is made up of property and equipment.

Goodwill only makes up roughly $7 per share and is likely reasonably estimated per standard GAAP procedures. This goodwill isn’t as consequential for Microsoft as it is for a company like Dover Corporation’s goodwill. Dover Corporation’s goodwill is consequential because it makes up a larger portion of Dover’s assets. Hence, any goodwill surprises can significantly affect the stock price.

Microsoft’s Earnings, because it’s about Making Money

Microsoft’s diluted trailing twelve-month earnings per share (EPS) stands at $11.08 per share. Microsoft has proven that they rarely have earnings fall over time, so you can expect earnings to continue growing throughout the decade. That means, if Microsoft’s growth is flat, you’ll be earning $110 per share over the next decade.

But analysts agree that earnings will likely continue growing, with Nasdaq.com expecting MSFT earnings to nearly double by 2027!

Analysts are very bullish on continued earnings growth.

So, book value per share and earnings are looking solid; however, they aren’t what make up the bulk of Microsoft’s intrinsic value. We now need to deep dive into the dangerous part of our analysis: earnings growth.

Microsoft’s Earnings Growth Potential

This big estimate that dominates our intrinsic value is the discounted growth potential. Let’s break down what this means, why it’s important, and why it dominates Microsoft’s intrinsic value. We’ll also touch on why the stock price follows this estimate so closely. Look again at the analyst’s earnings predictions. They are going up. In fact, earnings have been going up for decades. Year after year, Microsoft continues to increase earnings.

Source: macrotrends.net

Not to get into too much math, but Microsoft’s earnings increases are accelerating. This is the hallmark of a growth stock. Microsoft’s earnings don’t go up like a line. Microsoft earnings grow 6% to 20% a year! That is incredible growth that is diversified across multiple businesses we will discuss next.

Why is Microsoft’s Earnings Growing so Rapidly?

Microsoft has transformed from a software company to a multi-business technology conglomerate. Microsoft has significantly diversified away from operating systems and office suite software. They compete in multiple technology arenas.

Microsoft’s Heavy into Social Media?

Microsoft competes heavily in social media. But how? The answer is Linkedin, which the company acquired in 2016. Linkedin continues to dominate as the world’s largest professional network. But with Microsoft’s focus towards businesses and organizations, Linkedin has thrived under Microsoft and dominated this social media “niche” while other tech companies compete under consumer brands Facebook, Twitter, Snapchat, and Reddit. While these latter companies compete for consumer retention, Linkedin has expanded its suite of tools to focus on the business professional.

Microsoft is the Backbone of the Internet

If you’re not a software developer, you would be forgiven for never hearing of Github or Azure. But these two products from Microsoft dominate select portions of the software implementation lifecycle.

If you want to maintain a code base, the dominant solution is Github. Github allows you to collaborate with others on a coding project big or small. Back in the 2000’s, Github provided a niche as a collaborative open platform to work on code together. For those who do not code, think about writing a large novel with 30 writers. Github allows you to collaborate with those writers on one novel by resolving writing conflicts (like if both authors wanted to make changes to chapter 5) and has a standard review process to turn drafts into the final novel script. As more developers wanted to collaborate on open source code, Github began to monopolize the code collaboration market.

In 2018, Github was acquired by Microsoft for $7.5 billion. It may have seemed like a strange acquisition, especially as Microsoft paid 30x annual revenue for the company, and it may have been even stranger for a company like Microsoft that for years fought to protect their software from being used by open source communities. But Microsoft realized that Github dominated a process flow that has become integral to software development.

And if you want consumers to use that code? You can host and manage your web or mobile app using Azure. The cloud computing market is dominated by AWS, Azure and Google, with each having the following market share value:

Microsoft is still in Gaming?

Microsoft had mixed success with the Xbox release in the early 2000’s, but since then they have continued to build a catalog of software games that have been synonymous with gaming culture. The acquisition of Minecraft in 2014 was a huge success that continues to print money for Microsoft. The recent acquisition of Activision-Blizzard for $68 Billion looks to be a very good investment that can integrate with their other businesses.

And there are more potential acquisitions out there. Could Nintendo be acquired? Possibly Roblox? The joint power of Roblox, Minecraft, and Activision-Blizzard would be a death nail for Facebook’s Metaverse vision, as these three company’s control a staggeringly high portion of “metaverse” content.

Microsoft’s Price Forecast

Could Microsoft double in 5 years?

Microsoft is tracking to double by 2028. When we extrapolate our intrinsic value calculations, we find that Microsoft is heading towards $550 by 2025, and $825 by 2028. This is backed up by NASDAQ’s earnings estimates with earnings estimated to also double by 2028.

But does this feel right? Will Microsoft (MSFT) really double from a $3 Trillion company to a $6 Trillion company in 5 years?

Yes, it can double in the next five years just like it did in the previous five years. Microsoft has a proven investment strategy. There top investment strategy, make smart technology acquisitions to compliment one the their three operating segments: business processes, intelligent cloud, and personal computing. Their next strategy, stock buy backs and dividends. They have finetuned their strategy to maximize investor returns.

Is Artificial Intelligence Overvaluing Microsoft in 2024?

Wall Street is not overvaluing Microsoft at all. In fact, Wall Street is valuing Microsoft more as a value stock than as a speculative technology stock. The stock price of Microsoft is almost perfectly following the intrinsic value of the company. And this intrinsic value isn’t based on the hopes of A.I. Microsoft’s intrinsic value is based on its impressive earnings and earnings growth.

In fact, it looks like Wall Street hasn’t even priced in A.I.’s potential. As ChatGPT is integrated further into Bing, Bing may take up more market share of search over Google’s search engine. Just small chunks taken from Google’s market share could have significant ramifications for Microsoft’s earnings.

And this is just one aspect of A.I. that could help Microsoft. Already, A.I. is being incorporated into each of Microsoft’s divisions. Need design help on your PowerPoint slides? Yeah, those suggestions are A.I. generated.

Final Thoughts on Investing in Microsoft

For new investors, don’t let the price of $400 per share scare you away. Use the intrinsic value calculations we showcased to help you measure the stock’s value. And with fractional shares you can buy Microsoft stock for just $1.

Unless you’ve never seen a computer, you’ve used Microsoft’s products. These products are ubiquitous in our digital world. If you’re a new investor, do your own research and look into Microsoft.

I/we have a position in an asset mentioned